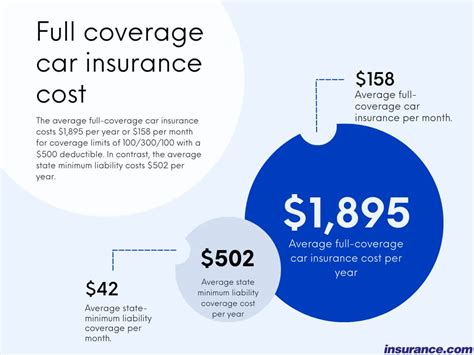

Full Coverage Auto Insurance Prices

Welcome to our comprehensive guide on full coverage auto insurance prices. Understanding the costs associated with full coverage insurance is crucial for anyone looking to protect their vehicles and ensure financial security in the event of accidents or unforeseen circumstances. In this article, we delve into the factors influencing full coverage insurance rates, provide real-world examples, and offer expert insights to help you make informed decisions about your automotive insurance coverage.

Understanding Full Coverage Auto Insurance

Full coverage auto insurance is a comprehensive insurance policy that offers a range of benefits to policyholders. It typically includes liability coverage, collision coverage, and comprehensive coverage, providing a safety net for various automotive risks. Liability coverage protects you financially if you cause damage to others or their property. Collision coverage assists with repairs or replacements if your vehicle is damaged in an accident, regardless of fault. Comprehensive coverage handles non-collision incidents like theft, vandalism, or natural disasters.

Key Components of Full Coverage Insurance

- Liability Coverage: This component is essential, as it covers the costs of injuries or damages caused to others by your vehicle. It includes bodily injury liability and property damage liability.

- Collision Coverage: Collision insurance pays for repairs or the replacement value of your vehicle if it’s damaged in an accident. It typically covers instances where you’re at fault or when the at-fault driver is uninsured or underinsured.

- Comprehensive Coverage: This coverage protects your vehicle against non-collision incidents, including theft, vandalism, fire, and natural disasters. It provides peace of mind for unexpected events that can damage your vehicle.

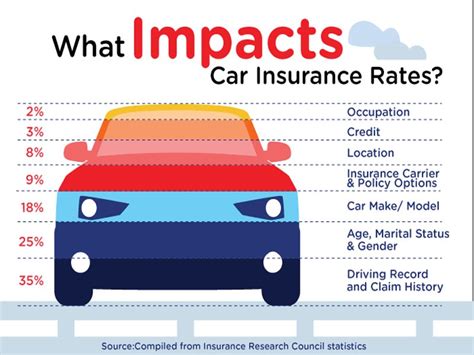

Factors Influencing Full Coverage Auto Insurance Prices

The cost of full coverage auto insurance can vary significantly based on several key factors. Understanding these influences can help you anticipate and manage your insurance expenses effectively. Here are the primary factors that impact insurance rates:

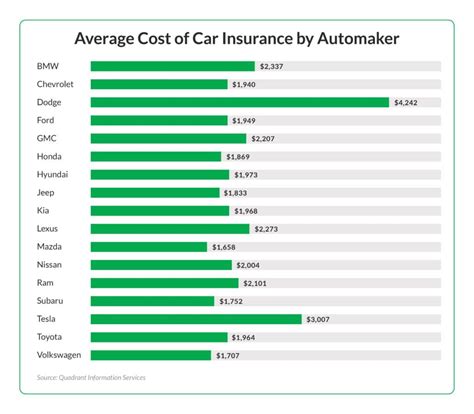

Vehicle Type and Value

The make, model, and year of your vehicle play a significant role in determining insurance prices. High-end, luxury vehicles, sports cars, and SUVs often command higher insurance premiums due to their higher replacement and repair costs. On the other hand, older, less valuable vehicles may have lower insurance rates.

| Vehicle Type | Average Annual Premium |

|---|---|

| Luxury Sedan | $2,200 |

| Sports Car | $2,500 |

| Compact SUV | $1,800 |

| Sedan (2005 model) | $1,400 |

Location and Usage

Where you live and how you use your vehicle can also affect insurance prices. Urban areas with higher traffic and crime rates often result in increased insurance premiums. Additionally, if you use your vehicle for business purposes or drive long distances, your insurance rates may be higher.

Driver Profile

Your personal driving record and demographics are crucial factors. Young drivers and those with a history of accidents or traffic violations may face higher insurance rates. Conversely, experienced drivers with clean records often enjoy lower premiums. Gender, age, and marital status can also impact insurance costs.

Coverage Options and Deductibles

The level of coverage you choose and your deductible amount significantly influence your insurance prices. Opting for higher coverage limits and lower deductibles can increase your premium, while selecting lower coverage and higher deductibles may reduce your costs. It’s essential to find a balance that suits your needs and budget.

Real-World Examples of Full Coverage Insurance Prices

To provide a clearer picture, let’s explore some real-world examples of full coverage auto insurance prices for different scenarios. These examples will illustrate how the factors we’ve discussed can impact insurance costs.

Scenario 1: Young Urban Driver

Consider a 22-year-old driver living in a busy city like New York City. They own a luxury sedan and use their vehicle for commuting and occasional long-distance travel. With a few minor traffic violations on their record, they opt for full coverage insurance with a 500 deductible.</p> <p><strong>Estimated Annual Premium:</strong> 3,200

Scenario 2: Middle-Aged Suburban Driver

A 45-year-old driver residing in a suburban area with low crime rates owns a compact SUV. They have a clean driving record and choose full coverage insurance with a 1,000 deductible. Their primary use of the vehicle is for commuting to work and occasional family trips.</p> <p><strong>Estimated Annual Premium:</strong> 1,600

Scenario 3: Senior Rural Driver

An elderly driver, aged 65, lives in a rural area with minimal traffic. They own a 2005 model sedan and use it primarily for local errands. With a spotless driving record, they opt for full coverage insurance with a 250 deductible.</p> <p><strong>Estimated Annual Premium:</strong> 1,200

Expert Insights and Tips for Managing Costs

Managing the costs of full coverage auto insurance is essential for maintaining financial stability. Here are some expert tips to help you navigate insurance pricing and potentially reduce your premiums:

- Bundle Policies: Consider bundling your auto insurance with other policies, such as homeowners or renters insurance. Many insurance companies offer discounts for customers who bundle their policies.

- Safe Driving Record: Maintain a clean driving record by avoiding accidents and traffic violations. Insurance companies reward safe drivers with lower premiums.

- Choose Higher Deductibles: Opting for higher deductibles can lower your insurance premiums. However, ensure you can afford the deductible amount in case of an accident.

- Discounts and Rewards: Take advantage of insurance discounts for safe driving, good student status, and safety features in your vehicle. These discounts can significantly reduce your insurance costs.

- Consider Usage-Based Insurance: Some insurance providers offer usage-based insurance programs that track your driving habits. If you drive safely and responsibly, you may qualify for lower rates.

Future Implications and Industry Trends

The auto insurance industry is continuously evolving, and several trends are shaping the future of full coverage insurance prices. Here are some key developments to watch:

Telematics and Usage-Based Insurance

Telematics technology is gaining traction, allowing insurance companies to track driving behavior and offer more personalized insurance rates. Usage-based insurance programs reward safe drivers with lower premiums, creating a more fair and accurate pricing system.

Automated Vehicles and Safety Features

The rise of automated and semi-automated vehicles, along with advanced safety features, is expected to reduce accident rates. As these technologies become more prevalent, insurance companies may adjust their pricing models to reflect the reduced risk.

Climate Change and Natural Disasters

Climate change is leading to more frequent and severe natural disasters, which can impact insurance rates. Insurance companies are adapting their risk assessments and pricing strategies to account for these changing environmental conditions.

Conclusion

Understanding the factors that influence full coverage auto insurance prices is essential for making informed decisions about your automotive insurance coverage. By considering vehicle type, location, usage, and driver profile, you can anticipate and manage your insurance costs effectively. Additionally, staying informed about industry trends and exploring cost-saving strategies can help you secure the best insurance rates for your unique circumstances.

How often should I review my auto insurance policy and rates?

+It’s recommended to review your auto insurance policy and rates annually or whenever you experience significant life changes, such as buying a new vehicle, moving to a different location, or getting married. Regular reviews ensure you’re getting the best coverage and rates for your current situation.

Can I negotiate my auto insurance rates with the provider?

+While insurance rates are largely determined by factors beyond your control, you can negotiate with your provider to explore potential discounts or adjustments based on your specific circumstances. Don’t hesitate to ask for a review of your policy to see if you’re eligible for any savings.

What should I do if I’m unhappy with my current auto insurance provider and rates?

+If you’re dissatisfied with your current auto insurance provider or feel that you’re paying excessive rates, it’s advisable to shop around and compare quotes from multiple providers. Obtaining multiple quotes will give you a better understanding of the market rates and help you find a more affordable and suitable option.