Bcbs Ppo Insurance

BCBS PPO Insurance, offered by Blue Cross Blue Shield (BCBS), is a preferred provider organization (PPO) plan that provides policyholders with a wide range of healthcare options and flexibility. With a long-standing reputation in the health insurance industry, BCBS aims to deliver comprehensive coverage and ensure access to quality healthcare services. In this article, we will delve into the specifics of BCBS PPO Insurance, exploring its features, benefits, and how it caters to the diverse healthcare needs of individuals and families.

Understanding BCBS PPO Insurance

BCBS PPO Insurance is designed to offer policyholders the freedom to choose their healthcare providers while enjoying the benefits of a comprehensive health plan. The PPO network of BCBS consists of a large number of medical professionals, hospitals, and specialists, giving individuals the flexibility to seek treatment from their preferred healthcare providers.

One of the key advantages of BCBS PPO Insurance is the ability to access healthcare services without requiring a referral. Policyholders can directly visit in-network providers and facilities, streamlining the process of obtaining necessary medical care. This feature is particularly beneficial for individuals who require ongoing specialized treatment or have established relationships with specific healthcare providers.

Network Coverage and Provider Access

The BCBS PPO network is extensive, covering a broad geographical area. This ensures that policyholders, regardless of their location, have access to a diverse range of healthcare options. The network includes primary care physicians, specialists in various fields, urgent care centers, and hospitals, enabling individuals to find the right care for their specific needs.

BCBS recognizes the importance of continuity of care, and thus, the PPO plan allows policyholders to build long-term relationships with their healthcare providers. This continuity ensures a comprehensive understanding of an individual's medical history and needs, leading to more personalized and effective treatment plans.

To illustrate, consider a family with a young child who has a chronic condition requiring regular specialist visits. With BCBS PPO Insurance, they can choose a specialist within the network who understands their child's unique needs and provides ongoing care, without the hassle of referrals or changing providers.

| Network Coverage | Key Benefits |

|---|---|

| Primary Care Physicians | Comprehensive primary care, including annual check-ups and preventative services. |

| Specialists | Access to a wide range of specialists for specific medical conditions and needs. |

| Urgent Care Centers | Quick and convenient access to urgent medical care without the need for appointments. |

| Hospitals | In-network hospital stays provide coverage for a variety of medical procedures and treatments. |

Coverage and Benefits

BCBS PPO Insurance offers a comprehensive suite of coverage options, providing policyholders with financial protection and peace of mind. The plan typically includes coverage for essential health benefits, such as:

- Doctor visits and check-ups

- Prescription medications

- Hospitalization

- Maternity and newborn care

- Mental health and substance abuse services

- Preventative care and screenings

- Dental and vision care (in select plans)

Cost-Sharing and Out-of-Pocket Expenses

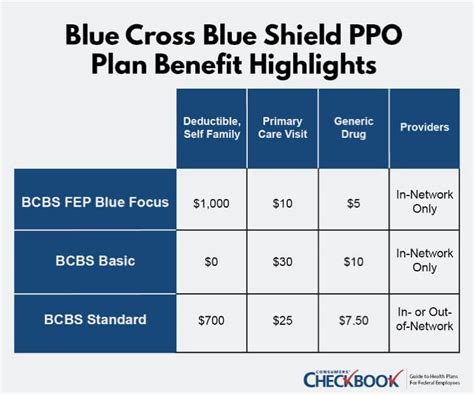

BCBS PPO Insurance plans often come with cost-sharing arrangements, which include deductibles, copayments, and coinsurance. These out-of-pocket expenses vary depending on the specific plan and the policyholder’s coverage needs.

For example, a policyholder with a higher deductible may have lower monthly premiums, making it a suitable option for individuals who prioritize lower costs upfront and anticipate fewer medical expenses. On the other hand, plans with lower deductibles and higher copayments provide more financial protection for those who anticipate frequent doctor visits or specialized treatments.

BCBS understands the importance of transparency, so policyholders can easily access information about their out-of-pocket expenses and coverage limits through their online accounts or by contacting BCBS customer support.

Wellness Programs and Preventative Care

BCBS PPO Insurance places a strong emphasis on preventative care and wellness. The plan encourages policyholders to take an active role in their health by offering incentives and resources for maintaining a healthy lifestyle.

Some of the wellness programs and benefits may include:

- Discounts on gym memberships or fitness tracking devices.

- Access to online health and wellness platforms with educational resources.

- Rewards for completing health assessments or participating in wellness challenges.

- Coverage for preventative services like vaccinations, cancer screenings, and annual physicals.

By promoting preventative care, BCBS aims to reduce the incidence of chronic diseases and improve the overall health of its policyholders, leading to better long-term outcomes and reduced healthcare costs.

Flexibility and Customization

BCBS PPO Insurance plans are designed to be flexible and customizable, catering to the diverse needs of individuals and families. Policyholders can choose from a range of coverage options and benefit levels to find the plan that best fits their budget and healthcare requirements.

Plan Options and Add-ons

BCBS offers a variety of PPO plan options, allowing policyholders to select the level of coverage that aligns with their preferences. These plans may include:

- Basic PPO: A cost-effective option with a higher deductible and limited benefits, suitable for those with lower healthcare needs.

- Standard PPO: A balanced plan with moderate deductibles and comprehensive coverage, catering to a wide range of healthcare requirements.

- Enhanced PPO: Premium plans with lower deductibles and expanded benefits, providing extensive coverage for individuals with complex healthcare needs.

Additionally, BCBS PPO Insurance offers the flexibility to add optional coverage to the base plan. These add-ons can include:

- Dental and vision coverage for comprehensive oral and eye care.

- Short-term disability insurance to provide income protection in case of temporary disabilities.

- Critical illness coverage for financial support in the event of a critical illness diagnosis.

- Accidental injury coverage for additional protection against unforeseen accidents.

Tailoring Coverage to Individual Needs

BCBS understands that every individual has unique healthcare needs. To address this, the PPO plans allow policyholders to customize their coverage by adjusting benefit levels, deductibles, and out-of-pocket expenses. This customization ensures that policyholders can find a plan that fits their budget while providing the necessary coverage for their specific health concerns.

For instance, a young professional who rarely requires medical care may opt for a plan with a higher deductible and lower premiums, while a family with young children might choose a plan with lower deductibles and expanded pediatric benefits.

Accessing Care and Managing Benefits

BCBS PPO Insurance aims to make accessing healthcare services and managing benefits as seamless as possible for its policyholders. The plan provides various tools and resources to facilitate the healthcare experience.

Finding In-Network Providers

Policyholders can easily search for in-network providers through the BCBS website or mobile app. The search feature allows individuals to locate healthcare professionals and facilities based on their specific needs and locations. This ensures that policyholders can find the right care close to home or work.

BCBS also provides detailed information about each provider, including their specialties, office hours, and patient reviews, helping policyholders make informed choices when selecting a healthcare provider.

Understanding Coverage and Benefits

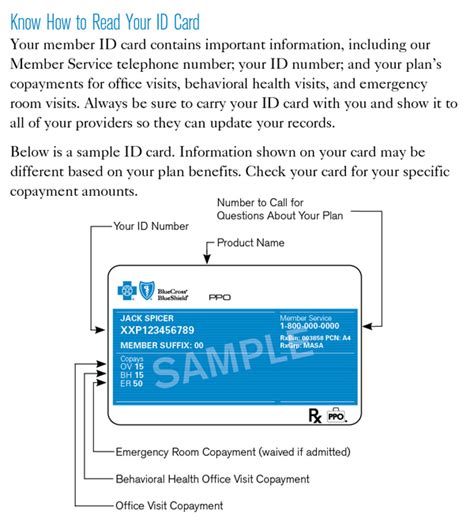

BCBS offers comprehensive resources to help policyholders understand their coverage and benefits. The online portal provides access to personalized benefit summaries, explaining deductibles, copayments, and coinsurance amounts for various services. This transparency empowers policyholders to make informed decisions about their healthcare choices.

Additionally, BCBS customer support is available to assist policyholders with any questions or concerns they may have regarding their coverage, billing, or claims processes. The support team can provide guidance on navigating the PPO plan and ensuring that policyholders receive the maximum benefits from their insurance.

Digital Tools for Convenience

BCBS recognizes the importance of convenience in today’s fast-paced world. To enhance the user experience, BCBS PPO Insurance offers a range of digital tools and mobile apps.

- Mobile App: The BCBS mobile app allows policyholders to access their insurance information on the go. They can view coverage details, locate in-network providers, and submit claims directly from their smartphones.

- Online Claims Submission: Policyholders can easily submit claims online, reducing paperwork and streamlining the reimbursement process.

- Digital ID Cards: Digital ID cards provide a convenient way to access insurance information, allowing policyholders to quickly share their coverage details with healthcare providers.

These digital tools enhance the overall experience of BCBS PPO Insurance, making it easier for policyholders to manage their healthcare needs and benefits.

Conclusion

BCBS PPO Insurance offers a comprehensive and flexible approach to healthcare coverage. With an extensive network of providers, customizable plans, and a focus on preventative care, BCBS aims to provide policyholders with the tools and resources they need to maintain their health and well-being.

By understanding the features and benefits of BCBS PPO Insurance, individuals and families can make informed decisions about their healthcare coverage, ensuring they have the necessary protection and access to quality healthcare services. BCBS's commitment to innovation and customer satisfaction makes it a trusted partner in the health insurance industry.

Frequently Asked Questions

How do I find an in-network provider with BCBS PPO Insurance?

+

You can easily locate in-network providers through the BCBS website or mobile app. Simply enter your location and select the type of provider or facility you’re looking for. The search results will provide you with a list of in-network options along with their contact information and specialties.

Can I change my BCBS PPO plan during the year?

+

Typically, you can only change your BCBS PPO plan during the open enrollment period or if you experience a qualifying life event, such as marriage, divorce, or the birth of a child. It’s important to review your plan’s guidelines and consult with BCBS customer support for more information.

What happens if I seek treatment from an out-of-network provider with BCBS PPO Insurance?

+

If you receive treatment from an out-of-network provider, you may be responsible for higher out-of-pocket costs, including higher deductibles, copayments, and coinsurance. It’s recommended to verify your coverage and costs before seeking treatment from out-of-network providers.

How can I access my BCBS PPO Insurance benefits and coverage information online?

+

You can access your BCBS PPO Insurance benefits and coverage information by creating an account on the BCBS website. Once logged in, you’ll have access to your personalized benefit summary, provider search tools, and other resources to manage your healthcare needs.

Are there any discounts or incentives for maintaining a healthy lifestyle with BCBS PPO Insurance?

+

Yes, BCBS PPO Insurance often includes wellness programs and incentives to encourage policyholders to maintain a healthy lifestyle. These may include discounts on gym memberships, rewards for completing health assessments, and coverage for preventative services. Check with your specific plan for available wellness benefits.