How Much Should Home Insurance Cost

Home insurance is a crucial aspect of safeguarding your most valuable asset—your home. It provides financial protection against various risks and unexpected events, offering peace of mind to homeowners. However, one common question that arises is, "How much should home insurance cost?" In this comprehensive guide, we will delve into the factors that influence home insurance rates, provide real-world examples, and offer insights to help you understand and manage your home insurance expenses effectively.

Understanding Home Insurance Premiums

The cost of home insurance, often referred to as the premium, is determined by a combination of factors unique to each homeowner’s situation. It is essential to recognize that premiums can vary significantly based on these factors, so understanding them is key to managing your insurance expenses.

Key Factors Influencing Home Insurance Costs

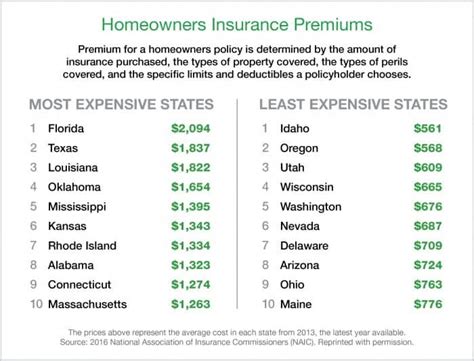

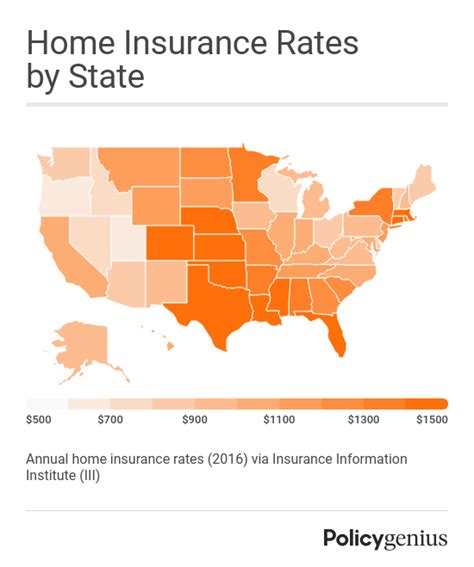

- Location: The geographical location of your home plays a pivotal role. Areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, generally carry higher insurance premiums. Additionally, crime rates and local construction costs can impact insurance rates.

- Home Value and Replacement Cost: The value of your home and the cost to rebuild or replace it in the event of a total loss are crucial considerations. Higher-value homes typically require more extensive coverage, leading to higher premiums.

- Coverage Limits: The level of coverage you choose directly affects your premium. Opting for higher coverage limits for property damage, personal liability, or additional living expenses during repairs will increase your insurance costs.

- Deductibles: Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums, as you’re taking on more financial responsibility in the event of a claim.

- Age and Condition of the Home: Older homes may require more specialized coverage due to outdated construction materials or systems. Additionally, homes in need of repairs or with known structural issues may face higher insurance costs.

- Claims History: Insurers consider your claims history when setting premiums. Multiple claims in the past can lead to higher rates, as it indicates a higher risk to the insurer.

- Discounts and Bundles: Many insurance providers offer discounts for various reasons, such as loyalty, safety features, or bundling multiple insurance policies (e.g., home and auto insurance) with the same company.

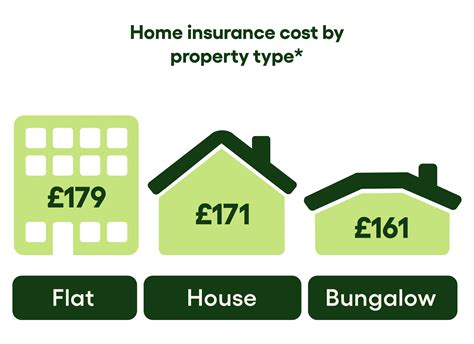

Real-World Examples of Home Insurance Premiums

To illustrate the variability of home insurance costs, let’s explore some real-world examples. These examples are based on actual data and provide a glimpse into the range of premiums homeowners might encounter.

| Home Characteristics | Estimated Annual Premium |

|---|---|

| Single-family home in a suburban area, with a value of $300,000, located in a low-risk zone, and built within the last 10 years. | $1,200 to $1,800 |

| Condominium in an urban high-rise building, valued at $500,000, located in an area with moderate natural disaster risks, and built over 20 years ago. | $1,500 to $2,200 |

| Rural farmhouse with a historical designation, valued at $250,000, located in a region prone to severe weather, and in need of significant updates. | $2,000 to $3,000 |

| Modern townhouse in a developing urban neighborhood, valued at $450,000, located in a low-crime area, and built with sustainable materials. | $1,300 to $1,900 |

Analyzing Your Home Insurance Needs

To determine the appropriate level of coverage and manage your home insurance costs effectively, it’s crucial to assess your specific needs. Here are some key considerations:

Assessing Your Home’s Value and Replacement Cost

Understanding the true value of your home and the cost to rebuild it accurately is essential. This information is used to set your coverage limits and ensures you’re not underinsured or overinsured.

Reviewing Your Policy’s Coverage Limits and Deductibles

Regularly review your home insurance policy to ensure it aligns with your current needs. Consider increasing your coverage limits if your home’s value has appreciated, and evaluate whether your chosen deductibles still make sense for your financial situation.

Evaluating Your Claims History and Risk Profile

If you’ve had multiple claims in the past, it’s worth discussing this with your insurance provider. They may be able to offer guidance on steps to reduce your risk profile and potentially lower your premiums.

Exploring Discounts and Bundling Options

Inquire about discounts your insurer offers. Common discounts include those for safety features like smoke detectors or security systems, loyalty discounts for long-term customers, and discounts for bundling multiple policies.

Optimizing Your Home Insurance Costs

While home insurance is essential, managing its cost is equally important. Here are some strategies to optimize your insurance expenses:

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Obtain quotes from multiple insurers to compare rates and coverage options. Online comparison tools can be a convenient way to gather initial quotes.

Consider Higher Deductibles for Lower Premiums

Increasing your deductible can lead to significant premium savings. However, ensure that the chosen deductible amount is manageable in the event of a claim.

Bundle Your Policies for Discounts

Bundling your home insurance with other policies, such as auto insurance, can result in substantial discounts. Many insurers offer multi-policy discounts as an incentive to consolidate your insurance needs with them.

Maintain a Good Claims History

A clean claims history can lead to lower premiums over time. Avoid making small claims that might not significantly impact your finances, as these can potentially raise your rates.

Explore Home Improvement Discounts

Some insurers offer discounts for homes with specific safety features or those that have undergone recent updates. Investing in home improvements like fire-resistant roofing or updated electrical systems might qualify you for these discounts.

Future Implications and Trends in Home Insurance

The home insurance industry is continuously evolving, and several factors are likely to influence premiums in the future. Here’s a glimpse into some potential trends and their impact on homeowners:

Climate Change and Natural Disasters

The increasing frequency and severity of natural disasters due to climate change are likely to impact insurance rates. Areas prone to these events may see higher premiums as insurers adjust their risk assessments.

Technological Advances and Smart Home Features

The integration of smart home technology and the Internet of Things (IoT) can potentially reduce insurance costs. Insurers may offer discounts for homes equipped with smart security systems or fire prevention devices.

Changing Regulatory Environment

Shifts in insurance regulations at the state or federal level can impact the cost and availability of home insurance. Stay informed about any changes that might affect your coverage or premiums.

Rising Construction Costs

Inflation and rising construction costs can lead to increased replacement costs for homes, which may translate to higher insurance premiums. Regularly reviewing your coverage limits to ensure they align with these rising costs is essential.

Conclusion

Understanding the factors that influence home insurance costs and taking proactive steps to manage your insurance expenses are key to making informed decisions as a homeowner. By assessing your unique circumstances, comparing quotes, and exploring various strategies, you can find the right balance between comprehensive coverage and affordable premiums. Remember, home insurance is an investment in your financial security, and being an informed consumer is essential to making the most of this vital protection.

How often should I review my home insurance policy?

+It’s a good practice to review your home insurance policy annually or whenever your circumstances change significantly. This ensures your coverage remains up-to-date and aligned with your needs.

Can I negotiate my home insurance premiums with my insurer?

+While negotiating premiums directly may be challenging, you can discuss your concerns and inquire about any available discounts or adjustments with your insurer. They might offer guidance on ways to reduce your premiums.

What should I do if my home insurance premiums are unaffordable?

+If your home insurance premiums are causing financial strain, consider exploring options like increasing your deductible or shopping around for more competitive quotes. Additionally, consult with your insurer to understand if there are any discounts or adjustments you can make to lower your costs.