Insurance Enrollment

The process of insurance enrollment is a crucial step in securing financial protection and coverage for individuals and businesses. It involves selecting the right insurance policy, providing accurate information, and completing the necessary steps to activate the coverage. In this comprehensive guide, we will delve into the world of insurance enrollment, exploring the key aspects, best practices, and potential challenges to ensure a smooth and informed journey.

Understanding Insurance Enrollment: A Comprehensive Overview

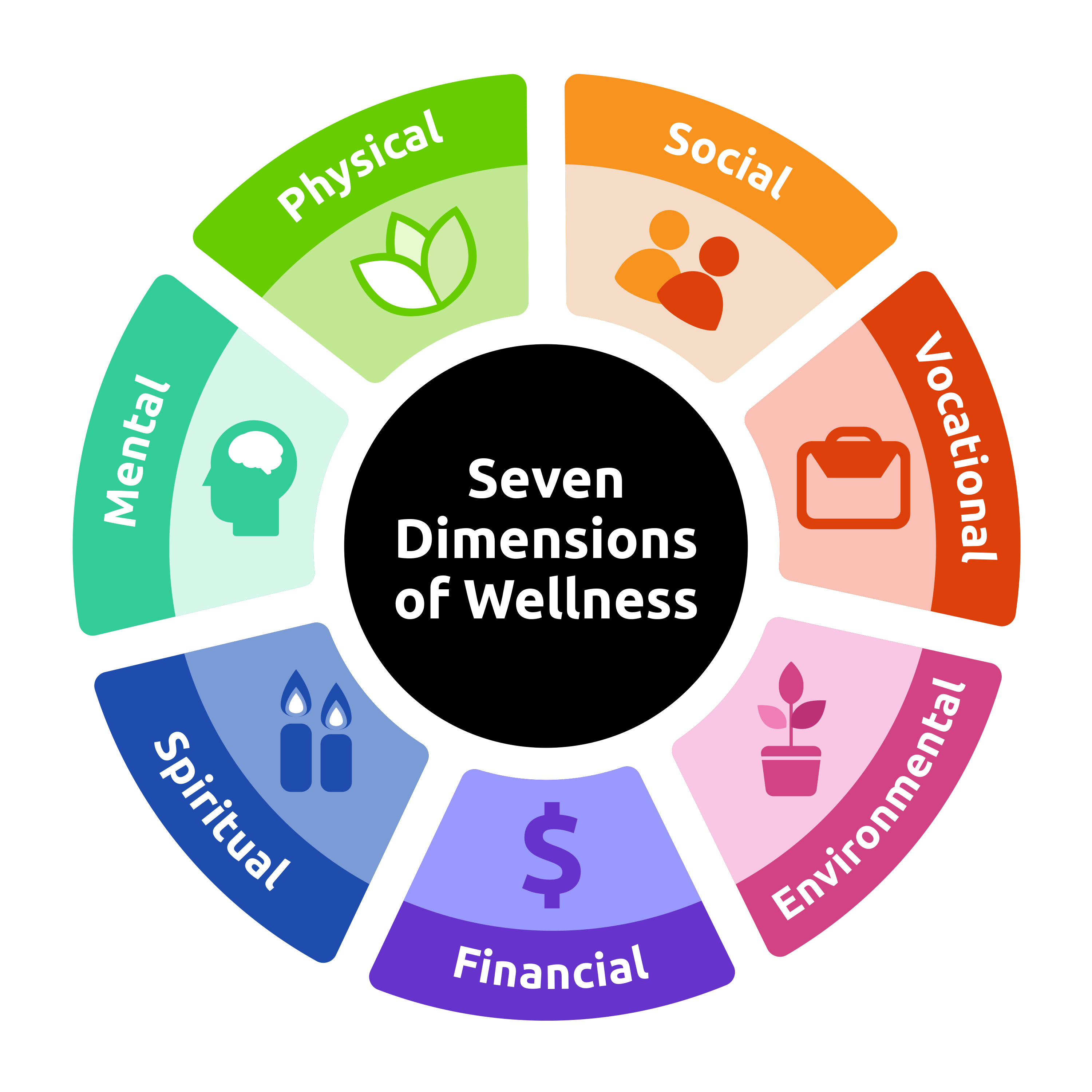

Insurance enrollment is the gateway to accessing the benefits and security provided by insurance policies. It is a critical process that allows individuals and entities to tailor their coverage according to their unique needs. Whether it’s health insurance, auto insurance, life insurance, or property coverage, the enrollment process serves as the foundation for a robust risk management strategy.

The Importance of Timely Enrollment

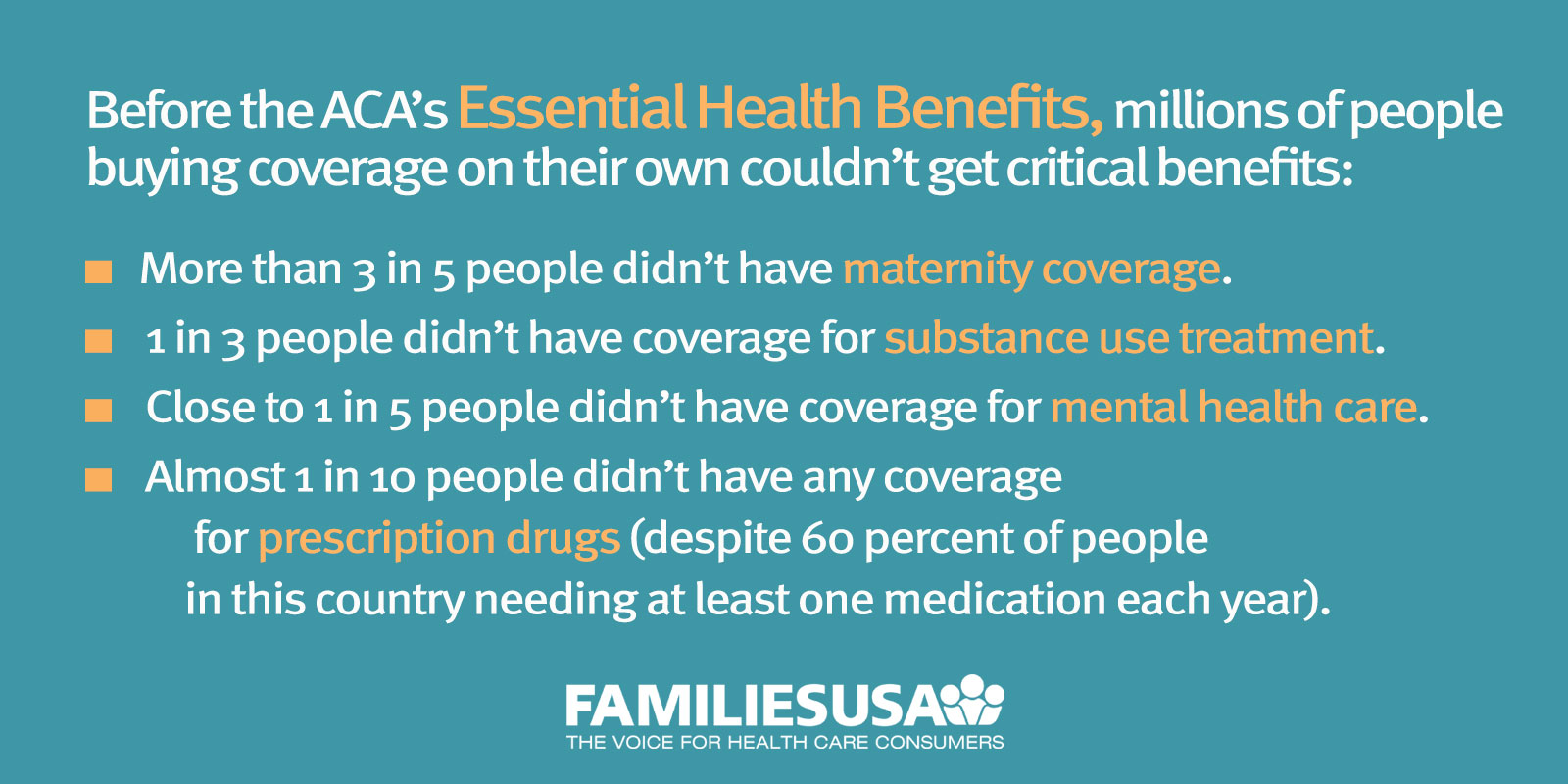

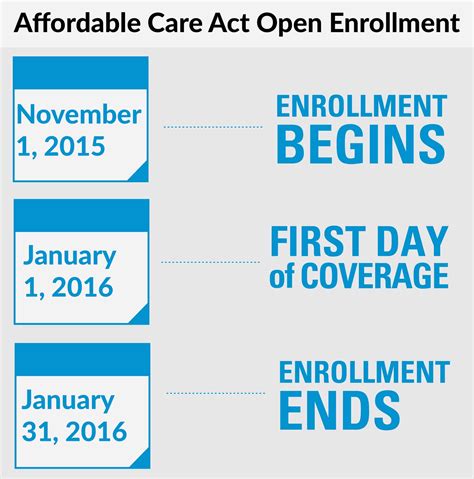

One of the key aspects of insurance enrollment is understanding the timelines involved. Many insurance plans have specific enrollment periods, often referred to as open enrollment or special enrollment periods. Missing these windows can result in delays or restrictions on coverage. For instance, in the context of health insurance, open enrollment periods are typically annual events, offering a limited time frame to review and select plans. Outside of these periods, special circumstances or qualifying events may be required to initiate enrollment.

To illustrate, consider the case of Jane, a young professional who recently started her first job. Her employer offers a comprehensive health insurance plan with an annual open enrollment period in November. By being aware of this timeline, Jane can ensure she selects the right coverage for her needs before the enrollment deadline.

Gathering Essential Information

Effective insurance enrollment requires gathering detailed information about one’s circumstances. This includes personal details, financial considerations, and an assessment of potential risks. For instance, when enrolling in health insurance, factors such as pre-existing conditions, family size, and income levels play a significant role in determining the most suitable plan.

Take the example of David, a self-employed photographer. To choose the right health insurance plan, David needs to consider his irregular income, potential for injury or illness due to the nature of his work, and any existing medical conditions. By evaluating these factors, he can make an informed decision during enrollment.

Navigating the Enrollment Process: A Step-by-Step Guide

The insurance enrollment process can vary depending on the type of insurance and the provider. However, there are common steps that individuals can expect when enrolling in various insurance plans.

Step 1: Research and Comparison

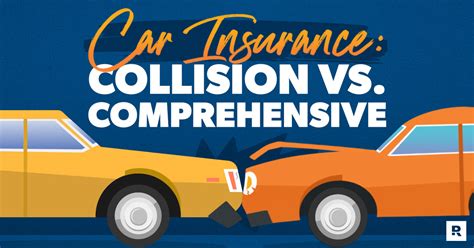

Before initiating enrollment, it is essential to research and compare different insurance options. This step involves understanding the coverage offered, premiums, deductibles, and any additional benefits or exclusions. Online resources, insurance brokers, and provider websites can provide valuable insights to help narrow down the choices.

For instance, when enrolling in auto insurance, individuals can compare policies based on factors such as liability coverage, collision and comprehensive coverage, and any additional perks like roadside assistance. By comparing these aspects, drivers can find a policy that aligns with their driving habits and preferences.

Step 2: Gather Documentation

Once the research phase is complete, the next step is to gather the necessary documentation for enrollment. This typically includes personal identification, proof of income or employment, and any relevant medical records or assessments. Ensuring that all required documents are readily available can streamline the enrollment process.

In the case of life insurance enrollment, individuals may need to provide detailed health information, including medical history and lifestyle factors. Accurate and comprehensive documentation is crucial to ensure the policy reflects the individual's unique circumstances.

Step 3: Complete Enrollment Forms

The heart of the enrollment process lies in completing the required forms. These forms capture essential details, such as personal information, coverage preferences, and payment arrangements. It is important to review these forms carefully, ensuring accuracy and completeness. Any errors or omissions can lead to delays or complications in the enrollment process.

For instance, when enrolling in a health insurance plan, individuals may need to specify their preferred healthcare providers, select a primary care physician, and indicate any preferred prescription drug options. Providing accurate information on these forms is crucial for a seamless transition into the new coverage.

Step 4: Payment and Confirmation

Upon completing the enrollment forms, the next step is to arrange payment for the insurance premium. This can be done through various methods, including online payments, direct deposit, or traditional checks. Once the payment is processed, individuals should receive a confirmation of enrollment, which serves as a record of their coverage.

It is important to keep this confirmation document in a safe place, as it may be required for future reference or to prove coverage in case of an incident. Additionally, individuals should review the terms and conditions outlined in the confirmation to ensure they understand the coverage limits and any potential exclusions.

Addressing Common Challenges in Insurance Enrollment

While insurance enrollment is a straightforward process for many, certain challenges can arise. Being aware of these potential hurdles can help individuals navigate them effectively.

Understanding Enrollment Periods

As mentioned earlier, understanding enrollment periods is crucial to avoid missing out on coverage. However, these periods can vary based on the type of insurance and the provider. It is essential to stay informed about the specific timelines for the desired insurance plan.

For instance, health insurance open enrollment periods may vary depending on whether an individual is enrolling through a private marketplace or through their employer. Being aware of these nuances can prevent individuals from missing out on critical enrollment opportunities.

Dealing with Complex Forms

Insurance enrollment forms can sometimes be complex and lengthy, especially for comprehensive policies. It is common for individuals to feel overwhelmed by the amount of information required and the technical language used. To address this challenge, seeking assistance from insurance brokers or customer support can provide valuable guidance.

Additionally, taking the time to thoroughly read and understand each section of the enrollment form can prevent errors and ensure a more accurate representation of one's circumstances. It may also be beneficial to create a checklist of required information to ensure nothing is overlooked.

Addressing Pre-existing Conditions

For certain types of insurance, such as health insurance, pre-existing conditions can pose a challenge during enrollment. Some insurance providers may impose waiting periods or exclusions for specific conditions. It is important to disclose all relevant health information during the enrollment process to avoid potential issues later on.

Individuals with pre-existing conditions should carefully review the insurance plan's coverage and any limitations or exclusions. Seeking advice from healthcare professionals or insurance experts can help navigate these complexities and ensure the best possible coverage.

Maximizing Benefits: Tips for a Successful Enrollment

To ensure a successful insurance enrollment experience, here are some valuable tips to keep in mind:

- Start Early: Begin the research and comparison process well in advance of the enrollment period. This allows for a more thorough evaluation of options and ensures that all necessary documents are prepared.

- Seek Expert Advice: Consider consulting insurance brokers or financial advisors who can provide personalized guidance based on your specific needs and circumstances.

- Understand Coverage Limits: Review the fine print of insurance policies to fully comprehend the coverage limits, deductibles, and any exclusions. This knowledge can prevent unexpected surprises later on.

- Stay Informed: Stay updated on insurance-related news and changes in regulations. This can help you make more informed decisions during enrollment.

- Review and Update Regularly: Insurance needs can evolve over time. Regularly review your coverage to ensure it aligns with your current circumstances and make adjustments as necessary.

By following these tips and staying proactive, individuals can maximize the benefits of insurance enrollment and secure the protection they need.

The Future of Insurance Enrollment: Technological Innovations

The insurance industry is undergoing a digital transformation, and enrollment processes are no exception. Technological advancements are streamlining the enrollment experience, making it more efficient and accessible.

Online Enrollment Platforms

Many insurance providers are now offering online enrollment platforms, allowing individuals to complete the entire enrollment process digitally. These platforms often provide interactive tools and personalized recommendations, making it easier for individuals to navigate their insurance options.

For instance, health insurance providers may use online platforms to guide individuals through a series of questions, helping them select the most suitable plan based on their responses. This not only simplifies the process but also ensures a more accurate representation of the individual's needs.

Artificial Intelligence and Personalized Recommendations

Artificial Intelligence (AI) is playing a significant role in enhancing the insurance enrollment experience. AI-powered algorithms can analyze an individual’s data and provide personalized recommendations for insurance plans. This technology considers factors such as age, health status, lifestyle, and financial situation to offer tailored suggestions.

By leveraging AI, insurance providers can offer a more customized approach to enrollment, ensuring that individuals receive coverage that truly meets their unique requirements.

Mobile Enrollment Apps

The rise of mobile technology has led to the development of insurance enrollment apps. These apps provide a convenient and accessible way for individuals to enroll in insurance plans on the go. With user-friendly interfaces and secure payment options, these apps are revolutionizing the way people access and manage their insurance coverage.

For example, auto insurance providers may offer mobile apps that allow users to quickly compare different policies, receive real-time quotes, and complete the enrollment process in a matter of minutes. This level of convenience is particularly beneficial for busy individuals who value their time.

Conclusion: Empowering Individuals through Informed Enrollment

Insurance enrollment is a critical process that empowers individuals and businesses to take control of their financial security. By understanding the steps involved, staying informed about enrollment periods, and leveraging technological innovations, individuals can navigate the enrollment process with confidence.

Whether it's health insurance, auto insurance, or any other type of coverage, the key to a successful enrollment lies in thorough research, accurate documentation, and a proactive approach. With the right knowledge and tools, individuals can make informed decisions, ensuring they have the protection they need when it matters most.

How often should I review my insurance coverage?

+It is recommended to review your insurance coverage at least once a year, or whenever there are significant life changes such as marriage, birth of a child, or a change in employment status. Regular reviews ensure that your coverage remains adequate and aligned with your current needs.

Can I enroll in insurance outside of the open enrollment period?

+In certain circumstances, yes. Some insurance providers offer special enrollment periods or allow for mid-year enrollment under specific qualifying events, such as a change in employment, marriage, or the birth of a child. It’s important to check with your provider or an insurance expert to understand your options.

What happens if I miss the open enrollment period for health insurance?

+Missing the open enrollment period can limit your options for obtaining health insurance. In some cases, you may need to wait until the next open enrollment period or qualify for a special enrollment period based on certain life events. It’s crucial to stay informed about enrollment timelines to avoid missing out on coverage.