Vehicle Collision Insurance

In the world of automotive safety and financial protection, vehicle collision insurance stands as a crucial aspect for any vehicle owner. This comprehensive guide aims to delve into the intricacies of collision insurance, offering a deep understanding of its significance, coverage, and the benefits it brings to drivers and vehicle owners. With a focus on providing expert knowledge, this article will navigate through the key elements of collision insurance, ensuring an informed and confident approach to this essential aspect of vehicle ownership.

Understanding Collision Insurance: A Comprehensive Overview

Collision insurance is a specialized type of coverage within the broader spectrum of auto insurance policies. Its primary purpose is to provide financial protection in the event of a vehicle collision, irrespective of who is at fault. This form of insurance covers the cost of repairs or replacements for the insured vehicle, ensuring that the owner is not left with a significant financial burden following an accident. Understanding collision insurance is essential for vehicle owners, as it forms a critical layer of protection against unforeseen accidents and their potential financial repercussions.

The scope of collision insurance extends beyond simple vehicle repairs. It often includes provisions for rental car coverage during the period when the insured vehicle is undergoing repairs, ensuring uninterrupted mobility for the policyholder. Additionally, collision insurance can cover the cost of towing services, a vital aspect of post-accident assistance. This comprehensive approach to collision coverage makes it an indispensable component of a robust auto insurance portfolio.

From a financial perspective, collision insurance offers a strategic hedge against the often substantial costs associated with vehicle repairs. Whether it's a minor fender bender or a more severe collision, the expenses can quickly escalate, potentially leaving vehicle owners in a precarious financial situation. By electing collision insurance, policyholders can rest assured knowing that a significant portion of these costs will be covered, providing peace of mind and financial security.

In the context of comprehensive auto insurance, collision coverage forms a critical pillar. While other components of an auto insurance policy, such as liability coverage, protect against damages caused to others, collision insurance specifically safeguards the insured vehicle. This dual approach to auto insurance coverage ensures that vehicle owners are adequately protected from a wide range of potential risks, fostering a sense of security and confidence on the road.

Key Features and Benefits of Collision Insurance

Collision insurance boasts several key features that make it an attractive option for vehicle owners. Firstly, it offers a high degree of customization, allowing policyholders to tailor their coverage to their specific needs and budget. This flexibility ensures that vehicle owners can secure the level of protection that aligns with their individual circumstances, be it a high-performance sports car or a family sedan.

Another notable benefit of collision insurance is its potential for discounts. Many insurance providers offer incentives such as multi-policy discounts or loyalty bonuses, which can significantly reduce the overall cost of collision coverage. Additionally, certain safety features in vehicles, such as advanced driver-assistance systems or anti-theft devices, may also qualify policyholders for reduced collision insurance rates, rewarding vehicle owners for their proactive approach to safety.

The claims process for collision insurance is typically straightforward and efficient. Most insurance providers offer 24/7 claims support, ensuring that policyholders can quickly initiate the claims process following an accident. This timely response is critical in minimizing the disruption caused by an accident and expediting the repair or replacement of the vehicle.

| Safety Feature | Potential Discount |

|---|---|

| Advanced Driver-Assistance Systems | Up to 5% discount |

| Anti-Theft Devices | Up to 10% discount |

| Collision Avoidance Systems | Up to 3% discount |

Exploring Collision Insurance Coverage: What’s Included and What’s Not

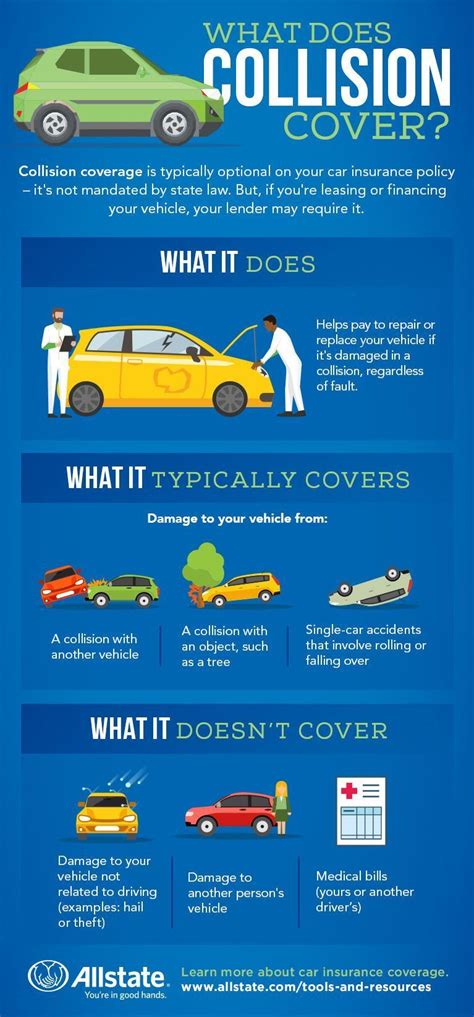

Collision insurance coverage is a comprehensive aspect of auto insurance, designed to provide financial protection in the event of a vehicle collision. This coverage typically includes repairs or replacements for the insured vehicle, ensuring that the policyholder is not left with the full financial burden of an accident. However, it’s essential to understand the specifics of what is and isn’t covered to ensure an informed decision when selecting a collision insurance policy.

Inclusions in Collision Insurance Coverage

Collision insurance primarily covers the costs associated with repairing or replacing the insured vehicle after a collision. This includes damage to the vehicle’s body, engine, or other components, provided the damage was a direct result of the collision. In cases where the vehicle is severely damaged and beyond repair, collision insurance will cover the cost of replacing the vehicle with one of similar make, model, and value.

Additionally, collision insurance often includes provisions for rental car coverage during the period when the insured vehicle is undergoing repairs. This ensures that the policyholder can maintain their mobility and daily routine without disruption. Towing services are also typically included in collision insurance policies, providing immediate assistance in the event of a collision.

It's important to note that collision insurance does not cover damages caused to other vehicles or property in the event of an accident. This is where liability insurance comes into play, providing coverage for damages to third parties. Collision insurance is primarily focused on protecting the insured vehicle, ensuring that the policyholder's financial security is maintained in the aftermath of a collision.

Exclusions in Collision Insurance Coverage

While collision insurance provides comprehensive protection, there are certain scenarios where coverage may not apply. Exclusions in collision insurance policies typically include damage resulting from acts of nature such as floods, earthquakes, or hurricanes. These natural disasters are often covered under separate policies, such as comprehensive insurance or specific natural disaster coverage.

Collision insurance also does not cover wear and tear or mechanical breakdowns that are not directly related to a collision. Routine maintenance, repairs due to normal wear and tear, or mechanical failures are typically not covered by collision insurance and may require separate coverage or warranties. Additionally, collision insurance does not cover personal belongings inside the vehicle, highlighting the importance of additional coverage options for valuable items.

Furthermore, collision insurance does not provide coverage for medical expenses resulting from an accident. These expenses, including hospital stays, medical treatments, and rehabilitation, are typically covered by health insurance or specific medical coverage policies. It's crucial for policyholders to understand these exclusions to ensure they have the necessary coverage for all potential scenarios.

| Inclusions | Exclusions |

|---|---|

| Vehicle Repair or Replacement | Damage from Acts of Nature |

| Rental Car Coverage | Wear and Tear or Mechanical Breakdowns |

| Towing Services | Personal Belongings Inside the Vehicle |

| Collision-Related Damages | Medical Expenses |

The Importance of Collision Insurance: Financial Protection and Peace of Mind

Collision insurance plays a pivotal role in the world of auto insurance, offering a vital layer of financial protection for vehicle owners. The importance of collision insurance cannot be overstated, as it safeguards policyholders from the often substantial costs associated with vehicle repairs or replacements following an accident. This form of insurance provides peace of mind, ensuring that vehicle owners are not left with a financial burden that could potentially be devastating.

In the event of a collision, the costs of repairing or replacing a vehicle can quickly escalate, especially if the damage is extensive. This is where collision insurance steps in, providing coverage for these expenses. Whether it's a minor fender bender or a more severe accident, collision insurance ensures that policyholders are not financially ruined by the aftermath of an accident. It offers a safety net, allowing vehicle owners to focus on their recovery and getting back on the road without the added stress of financial strain.

Beyond the immediate financial benefits, collision insurance also provides long-term security. By ensuring that vehicle owners are not financially crippled by an accident, collision insurance promotes continued mobility and independence. This is particularly important for those who rely on their vehicles for daily commutes, business travel, or personal errands. With collision insurance, policyholders can have the confidence to drive knowing that they are protected, even in the face of an unforeseen accident.

Moreover, collision insurance contributes to overall road safety. By providing an incentive for vehicle owners to maintain their vehicles and driving habits, collision insurance encourages a culture of responsible driving. This, in turn, can lead to reduced accident rates and improved road conditions for all drivers. The peace of mind that collision insurance provides can also result in less stressful driving experiences, potentially leading to safer and more focused driving behaviors.

Choosing the Right Collision Insurance Policy

Selecting the right collision insurance policy is a critical decision that requires careful consideration. Policyholders should evaluate their specific needs and budget to determine the level of coverage that suits them best. This may involve assessing the value of their vehicle, the likelihood of accidents based on their driving history and location, and the potential costs of repairs in their area.

It's also essential to review the terms and conditions of different collision insurance policies. Policyholders should understand the specific coverage limits, deductibles, and any potential exclusions to ensure they are fully aware of what is and isn't covered. Additionally, comparing quotes from multiple insurance providers can help policyholders find the best value for their collision insurance, ensuring they receive the protection they need at a competitive price.

In conclusion, collision insurance is a vital component of any comprehensive auto insurance portfolio. It offers financial protection, peace of mind, and continued mobility in the event of a vehicle collision. By understanding the importance of collision insurance and making informed choices when selecting a policy, vehicle owners can ensure they are adequately protected on the road.

What is the average cost of collision insurance?

+

The average cost of collision insurance can vary significantly based on several factors, including the policyholder’s age, driving history, location, and the value of their vehicle. As a general guideline, collision insurance can range from 200 to 1,000 per year, with an average cost of around $500 annually. However, it’s important to note that these figures are estimates, and the actual cost can be higher or lower depending on individual circumstances.

Does collision insurance cover accidents with animals?

+

Collision insurance typically covers accidents involving vehicles and other objects, including animals. However, it’s essential to review the specific policy terms and conditions, as some insurance providers may have exclusions or limitations for accidents involving certain types of animals or in specific circumstances. It’s always advisable to check with your insurance provider to understand the extent of your coverage.

Can collision insurance be purchased separately from other auto insurance policies?

+

Yes, collision insurance can be purchased as a standalone policy, separate from other auto insurance policies. This provides policyholders with the flexibility to tailor their coverage to their specific needs and budget. However, it’s important to note that collision insurance is often most cost-effective when bundled with other auto insurance policies, such as liability and comprehensive coverage.