Sr22 Insurance

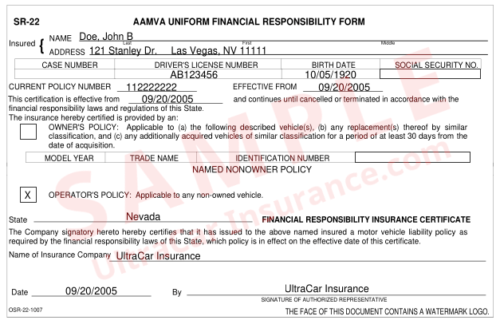

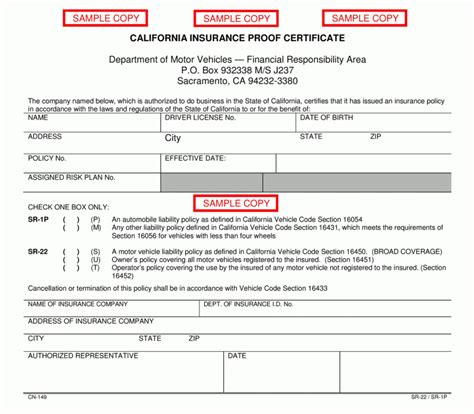

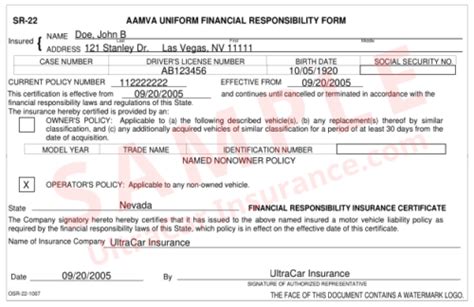

SR22 insurance, often referred to as a Certificate of Financial Responsibility, is a specific type of insurance document required in the United States for drivers who have had their licenses suspended or revoked due to certain traffic violations or incidents. This certificate acts as proof to the state that the driver now meets the minimum liability insurance requirements and is, therefore, financially responsible in the event of an accident.

The need for SR22 insurance arises when a driver commits a serious traffic offense, such as driving under the influence (DUI), multiple speeding tickets, or being involved in a hit-and-run accident. In these cases, the court or the Department of Motor Vehicles (DMV) may require the driver to obtain SR22 insurance before their driving privileges can be reinstated. The primary purpose of this requirement is to ensure that these high-risk drivers have the means to cover any potential damages or liabilities they may cause on the road.

Understanding SR22 Insurance

SR22 insurance is not a traditional car insurance policy but rather a form that your insurance provider files with the state to prove that you have the required level of liability insurance. This form certifies that you have purchased the necessary insurance coverage and that the insurance company will notify the state if the policy is canceled or lapses. It is important to note that SR22 insurance is often more expensive than regular car insurance due to the increased risk associated with the driver’s past behavior.

The specific requirements for SR22 insurance vary by state. Generally, the insurance must cover bodily injury liability, property damage liability, and, in some cases, uninsured/underinsured motorist coverage. The minimum liability limits for SR22 insurance are usually higher than those for standard car insurance policies. For instance, while a standard policy might have limits of 25/50/25 ($25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage), an SR22 policy could have limits of 50/100/50 or even higher.

Who Needs SR22 Insurance?

SR22 insurance is typically required for drivers who have had their licenses suspended or revoked due to serious traffic violations. Common reasons for needing SR22 insurance include:

- Driving under the influence (DUI) or driving while intoxicated (DWI)

- Refusing to submit to a chemical test for blood alcohol content

- Accumulating too many traffic tickets or moving violations

- Being involved in a hit-and-run accident

- Driving without insurance (in some states)

In addition to these common reasons, some states may require SR22 insurance for drivers with a history of serious accidents or for those who have failed to maintain financial responsibility in the past.

The Process of Obtaining SR22 Insurance

Obtaining SR22 insurance typically involves the following steps:

- Consult with your insurance provider: If you have received a notice from the court or DMV requiring SR22 insurance, contact your current insurance provider to see if they offer this type of coverage. Not all insurance companies provide SR22 insurance, so you may need to shop around.

- Purchase the required coverage: Once you find an insurer that offers SR22 insurance, you’ll need to purchase the necessary coverage. As mentioned earlier, the specific coverage requirements can vary by state, so ensure you meet your state’s minimum liability limits.

- File the SR22 form: After purchasing the insurance, your insurer will file the SR22 form with the state’s Department of Motor Vehicles (DMV). This form is what certifies that you have the required insurance coverage.

- Maintain the coverage: SR22 insurance is typically required for a set period, usually three years. During this time, it’s crucial to maintain continuous coverage. If your policy lapses or is canceled, the insurance company will notify the DMV, which could result in your license being suspended again.

It's important to remember that SR22 insurance is a temporary measure to regain your driving privileges. Once the required period has passed and you've demonstrated responsible driving behavior, you may be able to transition back to a standard car insurance policy.

The Cost of SR22 Insurance

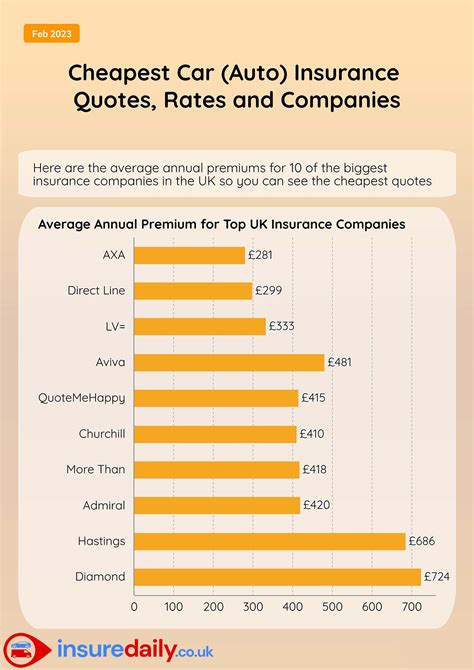

The cost of SR22 insurance can be significantly higher than regular car insurance due to the increased risk associated with the driver’s past behavior. Insurance companies consider drivers with SR22 requirements to be high-risk, which often results in higher premiums. The exact cost of SR22 insurance can vary widely based on factors such as the driver’s age, location, driving record, and the type of vehicle insured.

On average, drivers with SR22 requirements can expect to pay anywhere from $750 to $3,000 per year for their insurance. However, it's not uncommon for premiums to be even higher, especially for drivers with multiple DUI convictions or a history of serious accidents. Additionally, some insurance companies may refuse to provide coverage to drivers with certain violations, further limiting options and potentially driving up costs.

To mitigate the cost of SR22 insurance, it's recommended to shop around and compare quotes from multiple insurance providers. While the options may be limited, there are still insurers who specialize in high-risk drivers and may offer more competitive rates. Additionally, maintaining a clean driving record during the SR22 period and taking defensive driving courses can help improve your driving record and potentially lower your insurance premiums over time.

| State | Average SR22 Insurance Cost |

|---|---|

| California | $1,000 - $2,500 |

| Texas | $800 - $2,000 |

| Florida | $1,200 - $2,800 |

| New York | $1,500 - $3,000 |

| Illinois | $900 - $2,200 |

Common Misconceptions About SR22 Insurance

There are several misconceptions and myths surrounding SR22 insurance that can lead to confusion and misinformation. Here are some of the most common ones:

- SR22 Insurance is the Same as Regular Car Insurance: As mentioned earlier, SR22 insurance is not a traditional car insurance policy. It is a certificate of financial responsibility that you must obtain to prove you have the necessary liability insurance coverage. The actual insurance policy you purchase may have different terms and conditions compared to a standard policy.

- SR22 Insurance is Only for DUI Offenders: While DUI is a common reason for requiring SR22 insurance, it is not the only one. As we’ve discussed, various traffic violations and incidents can lead to the need for SR22 insurance. This includes excessive speeding, reckless driving, hit-and-run accidents, and more.

- SR22 Insurance is a Lifetime Requirement: In most cases, SR22 insurance is only required for a set period, typically three years. However, this can vary by state and the specific violation. Once the required period has passed and the driver has maintained continuous coverage, they may be able to transition back to a standard car insurance policy.

- SR22 Insurance is Automatic: Just because you’ve been convicted of a traffic violation does not automatically mean you need SR22 insurance. The requirement for SR22 insurance is typically ordered by the court or the DMV. It is the driver’s responsibility to understand and comply with these requirements.

Understanding these misconceptions can help drivers better navigate the process of obtaining and maintaining SR22 insurance. It's always recommended to consult with a legal professional or insurance expert if you have any questions or concerns about your specific situation.

Future Implications and Conclusion

SR22 insurance is a necessary step for drivers who have had their licenses suspended or revoked due to serious traffic violations. While it can be a complex and often expensive process, it is crucial for regaining driving privileges and demonstrating financial responsibility. By understanding the requirements, costs, and implications of SR22 insurance, drivers can make informed decisions about their coverage and take steps towards improving their driving record.

As with any insurance policy, it's important to shop around, compare quotes, and understand the specific terms and conditions of the coverage. With careful planning and responsible driving behavior, drivers can successfully navigate the SR22 process and ultimately transition back to standard car insurance policies.

FAQ

Can I get SR22 insurance if I don’t own a car?

+Yes, SR22 insurance can be obtained even if you don’t own a vehicle. In such cases, you would purchase what’s known as a “non-owner” SR22 policy, which covers you when you’re driving someone else’s car. This type of policy is often used by individuals who don’t own a car but still need to drive occasionally or by those who are in the process of purchasing a new vehicle.

How long does an SR22 insurance requirement typically last?

+The duration of an SR22 insurance requirement can vary depending on the state and the specific violation. However, in most cases, it is required for a period of three years. During this time, it’s crucial to maintain continuous coverage to avoid further legal complications.

Can I switch insurance providers while I have SR22 insurance?

+Yes, you can switch insurance providers while you have an SR22 requirement. However, it’s essential to ensure that your new insurance company offers SR22 insurance and that they file the necessary forms with the state. Make sure to maintain continuous coverage to avoid any lapses that could result in the suspension of your driving privileges.

What happens if my SR22 insurance lapses or is canceled?

+If your SR22 insurance lapses or is canceled, the insurance company is required to notify the state’s Department of Motor Vehicles (DMV). This could result in the immediate suspension of your driver’s license or the requirement to start the SR22 process over again. It’s crucial to maintain continuous coverage throughout the entire SR22 period.