Cheap Full Coverage Auto Insurance Quotes

Securing affordable full coverage auto insurance is a crucial aspect of responsible vehicle ownership. With the right policy, you can protect yourself financially in the event of an accident or unforeseen circumstances. In this comprehensive guide, we delve into the world of cheap full coverage auto insurance quotes, exploring the factors that influence premiums, the benefits of comprehensive coverage, and strategies to obtain the best rates available. Whether you're a seasoned driver or a newcomer to the roads, understanding the intricacies of auto insurance is essential for making informed decisions and keeping your costs manageable.

Understanding Full Coverage Auto Insurance

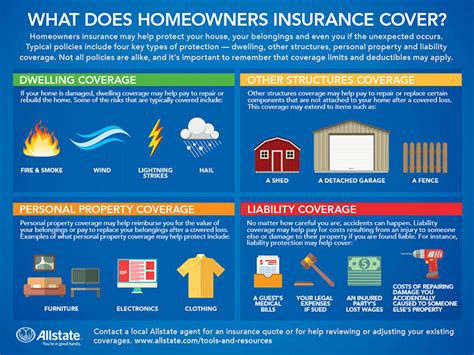

Full coverage auto insurance is a comprehensive policy that combines liability coverage with collision and comprehensive coverage. It provides a higher level of protection compared to basic liability-only insurance, offering financial coverage for a wide range of incidents. Here’s a breakdown of the key components:

Liability Coverage

Liability insurance is a fundamental aspect of any auto insurance policy. It protects you financially if you’re found at fault in an accident that causes injuries or property damage to others. This coverage includes:

- Bodily Injury Liability: Covers medical expenses and lost wages for injured individuals in an accident you caused.

- Property Damage Liability: Pays for repairs or replacements of damaged property, including other vehicles, structures, or objects.

Collision Coverage

Collision coverage is designed to cover the cost of repairing or replacing your vehicle if it’s damaged in an accident, regardless of fault. This coverage is especially beneficial for newer or more valuable vehicles. Here are some key points:

- Repairs or replacements are typically done using original equipment manufacturer (OEM) parts.

- You’ll have a deductible, which is the amount you pay out of pocket before your insurance kicks in.

- Collision coverage can also provide protection if your vehicle is damaged by an uninsured or underinsured driver.

Comprehensive Coverage

Comprehensive insurance covers damages to your vehicle caused by events other than collisions. This coverage is essential for protecting your vehicle from unexpected incidents. Here’s what it covers:

- Theft: Reimburses you for the loss or theft of your vehicle.

- Vandalism: Pays for repairs if your vehicle is vandalized.

- Natural Disasters: Covers damages from events like hurricanes, floods, or wildfires.

- Falling Objects: Protects against damages caused by falling debris or tree limbs.

- Animal Collisions: Pays for repairs if you hit an animal, such as a deer.

Factors Influencing Full Coverage Auto Insurance Quotes

The cost of full coverage auto insurance can vary significantly based on several factors. Understanding these factors can help you make informed decisions and potentially reduce your premiums. Here are some key influences on insurance rates:

Vehicle Type and Usage

The make, model, and year of your vehicle play a significant role in determining insurance rates. Factors such as repair costs, safety features, and theft rates impact the overall cost. Additionally, the purpose of your vehicle usage, whether for commuting, pleasure, or business, can also affect your premiums.

| Vehicle Type | Average Annual Premium |

|---|---|

| Economy Car | $1,200 - $1,500 |

| Mid-Size Sedan | $1,500 - $2,000 |

| SUV | $1,800 - $2,500 |

| Luxury Vehicle | $3,000 - $5,000 |

Driving History and Record

Your driving history is a crucial factor in determining insurance rates. Insurance companies consider factors such as:

- Traffic Violations: Speeding tickets, DUI convictions, and other violations can lead to higher premiums.

- Accidents: At-fault accidents can significantly impact your rates, especially if they result in injuries or substantial property damage.

- Claims History: Frequent claims, even if not at-fault, may raise suspicions of risky driving behavior.

Age and Gender

Age and gender are often considered in insurance pricing. Young drivers, especially those under 25, tend to have higher premiums due to their perceived lack of experience. Similarly, gender may play a role, with some insurers charging different rates based on statistical data.

| Age Group | Average Annual Premium |

|---|---|

| 16-20 years | $3,500 - $4,500 |

| 21-25 years | $2,500 - $3,000 |

| 26-35 years | $1,800 - $2,200 |

| 36+ years | $1,500 - $1,800 |

Tips for Getting Cheap Full Coverage Auto Insurance Quotes

While insurance rates can vary, there are strategies you can employ to obtain more affordable full coverage auto insurance quotes. Here are some effective tips:

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Shopping around and comparing quotes from multiple insurers is crucial. Online comparison tools can provide a quick and convenient way to assess different options. Remember, insurance companies have different rating factors and pricing structures, so you may find significant variations in quotes.

Bundle Policies for Discounts

Many insurance companies offer discounts when you bundle multiple policies together. For example, if you have homeowners or renters insurance, consider combining it with your auto insurance policy. Bundling can lead to substantial savings and simplify your insurance management.

Increase Your Deductible

Increasing your deductible, the amount you pay out of pocket before your insurance kicks in, can lower your premiums. However, be cautious and ensure you choose a deductible amount that you’re comfortable paying in the event of a claim. A higher deductible can significantly reduce your monthly premiums.

Explore Discounts and Special Programs

Insurance companies often provide various discounts and special programs to attract customers. Some common discounts include:

- Safe Driver Discount: Reward for maintaining a clean driving record.

- Good Student Discount: Offered to young drivers with good academic performance.

- Loyalty Discount: Incentive for long-term customers.

- Defensive Driving Course Discount: Completion of a certified course can lead to lower rates.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, uses real-time data to assess your driving behavior. This type of insurance can be beneficial for safe drivers, as it rewards those who drive cautiously and infrequently. Insurance providers use devices or smartphone apps to track your driving habits, including speed, braking, and mileage.

The Benefits of Full Coverage Auto Insurance

Full coverage auto insurance offers a comprehensive layer of protection, providing peace of mind and financial security in various situations. Here are some key benefits:

Financial Protection in Case of Accidents

The primary benefit of full coverage auto insurance is financial protection in the event of an accident. Whether you’re at fault or not, collision and comprehensive coverage ensure that you’re not left with overwhelming repair or replacement costs. This protection extends to damages caused by uninsured or underinsured drivers, offering additional peace of mind.

Protection Against Theft and Vandalism

Comprehensive coverage is essential for protecting your vehicle from theft and vandalism. If your car is stolen or vandalized, comprehensive insurance will cover the cost of repairs or replacements, ensuring you’re not left with the financial burden.

Coverage for Natural Disasters and Animal Collisions

Comprehensive coverage also provides protection against damages caused by natural disasters and animal collisions. In areas prone to hurricanes, floods, or wildfires, this coverage can be a lifesaver. Additionally, if you live in an area with a high deer population, comprehensive insurance can cover the cost of repairs if you hit an animal.

Future Trends in Auto Insurance

The auto insurance industry is evolving rapidly, and several trends are shaping the future of coverage. Here’s a glimpse into what we can expect:

Advanced Telematics and Data Analytics

Insurance companies are increasingly utilizing advanced telematics and data analytics to assess driving behavior. This technology allows for more accurate risk assessment, leading to fairer pricing. With the rise of connected cars and real-time data, insurers can offer more tailored and personalized policies.

Autonomous Vehicles and Safety Innovations

The advent of autonomous vehicles and advanced driver-assistance systems is expected to revolutionize road safety. As these technologies become more prevalent, insurance companies will need to adapt their coverage and pricing models. Reduced accident rates due to autonomous driving could lead to lower insurance premiums over time.

Digitalization and Convenience

The insurance industry is embracing digitalization, making it easier and more convenient for customers to manage their policies. Online platforms, mobile apps, and digital claims processes are becoming the norm. This shift towards digital insurance not only enhances customer experience but also allows for more efficient and cost-effective operations.

Conclusion

Securing cheap full coverage auto insurance is a balance between finding the right coverage and managing costs. By understanding the factors that influence premiums and employing strategic tips, you can obtain affordable quotes that provide the protection you need. Remember, full coverage auto insurance is an investment in your financial well-being, offering peace of mind and comprehensive protection for your vehicle.

What is the difference between full coverage and liability-only insurance?

+Full coverage insurance combines liability coverage with collision and comprehensive coverage, offering protection for a wide range of incidents. Liability-only insurance, on the other hand, provides coverage only for damages you cause to others. Full coverage is more comprehensive and includes protection for your own vehicle.

How can I reduce my full coverage auto insurance premiums?

+There are several strategies to reduce your premiums, including shopping around for quotes, bundling policies, increasing your deductible, and exploring discounts. Maintaining a clean driving record and taking advantage of safe driver programs can also lead to lower rates.

What is the average cost of full coverage auto insurance?

+The average cost of full coverage auto insurance can vary significantly based on factors such as vehicle type, driving history, age, and gender. On average, full coverage insurance ranges from 1,200 to 5,000 annually, with variations depending on individual circumstances.

Do I need full coverage auto insurance?

+The need for full coverage auto insurance depends on your personal circumstances and the value of your vehicle. If you have a newer or more expensive vehicle, full coverage is generally recommended to protect your investment. However, for older or lower-value vehicles, liability-only insurance may be sufficient.