Affordable Care Act Health Insurance Plans

The Affordable Care Act (ACA), commonly known as Obamacare, revolutionized the healthcare landscape in the United States. With its implementation, millions of Americans gained access to affordable health insurance options, making quality healthcare more accessible. In this comprehensive guide, we delve into the intricacies of ACA health insurance plans, exploring their benefits, coverage options, and how they have reshaped the healthcare system.

Understanding ACA Health Insurance Plans

The Affordable Care Act, signed into law in 2010, aimed to address the challenges faced by Americans in obtaining affordable and comprehensive health insurance. At the heart of this legislation are the ACA health insurance plans, which offer a range of coverage options designed to cater to diverse needs and budgets.

These plans are divided into metal categories, each representing a different level of coverage and cost-sharing. The metal categories include Bronze, Silver, Gold, and Platinum, with Bronze plans offering the lowest monthly premiums but higher out-of-pocket costs, and Platinum plans providing the most extensive coverage with lower out-of-pocket expenses.

Key Features of ACA Health Insurance Plans

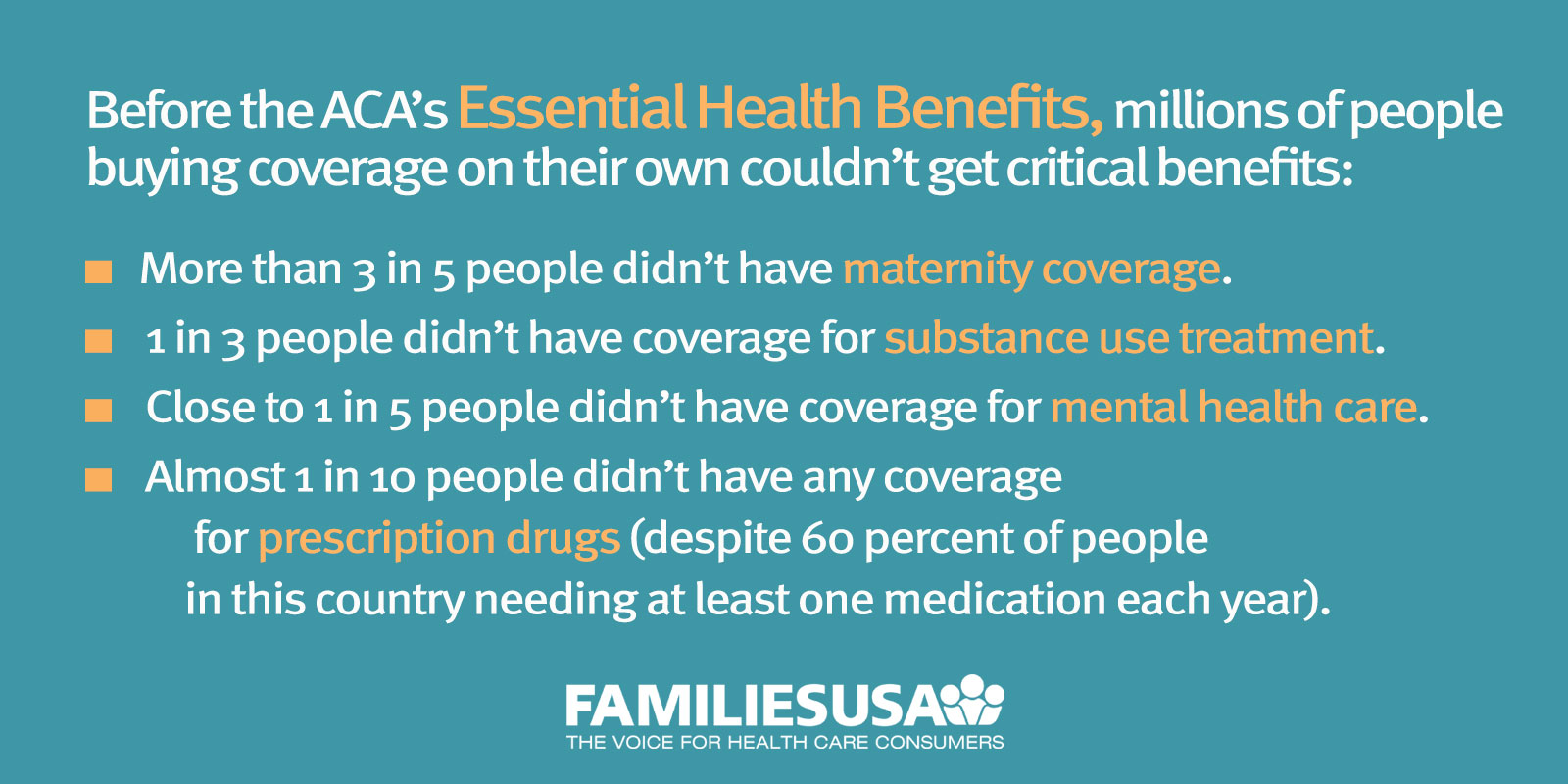

- Essential Health Benefits: ACA plans are mandated to cover Essential Health Benefits, which include a wide range of services such as ambulatory patient services, emergency care, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, and more. These benefits ensure that individuals receive comprehensive coverage for their healthcare needs.

- Pre-Existing Condition Coverage: One of the landmark achievements of the ACA is the prohibition of insurance companies from denying coverage or charging higher premiums based on pre-existing conditions. This means that individuals with chronic illnesses, disabilities, or previous health issues can obtain affordable health insurance without facing discrimination.

- Cost-Sharing Reductions (CSR): ACA plans offer Cost-Sharing Reductions for eligible individuals, reducing their out-of-pocket expenses for deductibles, copayments, and coinsurance. These reductions make healthcare more affordable, especially for those with low to moderate incomes.

- Income-Based Premium Subsidies: The ACA provides income-based premium subsidies to help individuals and families afford health insurance. Those with incomes between 100% and 400% of the federal poverty level may qualify for these subsidies, making insurance more accessible to a broader population.

| Metal Category | Average Monthly Premium | Average Out-of-Pocket Costs |

|---|---|---|

| Bronze | $420 | $6,500 |

| Silver | $480 | $4,500 |

| Gold | $600 | $3,500 |

| Platinum | $780 | $2,500 |

Navigating ACA Health Insurance Enrollment

Enrolling in an ACA health insurance plan involves a few key steps to ensure a smooth process.

Determining Eligibility

The first step is to assess your eligibility for ACA health insurance plans. Eligibility is primarily based on income, with individuals and families earning up to 400% of the federal poverty level qualifying for premium subsidies. Additionally, those with lower incomes may be eligible for Medicaid or the Children’s Health Insurance Program (CHIP) through the ACA’s expansion of these programs.

Choosing the Right Plan

With the metal categories offering different levels of coverage and cost-sharing, it’s crucial to choose a plan that aligns with your healthcare needs and budget. Consider factors such as your expected healthcare expenses, prescription medication needs, and the level of coverage you desire. Online tools and resources, such as the Health Insurance Marketplace, can assist in comparing plans and finding the best fit.

Understanding Network and Provider Coverage

ACA health insurance plans typically have provider networks, which are groups of healthcare providers (doctors, hospitals, etc.) that are contracted with the insurance company. It’s essential to review the plan’s network to ensure that your preferred doctors and specialists are included. Out-of-network care may result in higher out-of-pocket costs, so it’s important to understand the plan’s network coverage.

Open Enrollment and Special Enrollment Periods

ACA health insurance plans have designated Open Enrollment Periods during which individuals can enroll in a plan or make changes to their existing coverage. Missing the Open Enrollment Period may result in a lack of coverage for the upcoming year, unless you qualify for a Special Enrollment Period due to specific life events such as marriage, divorce, birth of a child, loss of other health coverage, or relocation.

Benefits and Impact of ACA Health Insurance

The implementation of ACA health insurance plans has had a profound impact on the lives of millions of Americans, offering numerous benefits and shaping the healthcare landscape.

Increased Access to Healthcare

One of the primary goals of the ACA was to expand access to healthcare. With the introduction of ACA plans, millions of previously uninsured individuals gained coverage, reducing the number of Americans without health insurance. This has led to improved overall health outcomes and reduced financial burdens associated with medical expenses.

Protection for Pre-Existing Conditions

The ACA’s prohibition on denying coverage or charging higher premiums based on pre-existing conditions has been a game-changer for individuals with chronic illnesses or previous health issues. This protection ensures that no one is left without affordable healthcare options, fostering a more inclusive and equitable healthcare system.

Income-Based Premium Subsidies

Income-based premium subsidies have made health insurance more affordable for individuals and families with lower incomes. By reducing the financial barrier to obtaining coverage, the ACA has empowered more people to access the healthcare services they need without straining their budgets.

Preventive Care and Wellness

ACA health insurance plans place a strong emphasis on preventive care and wellness. Many plans offer no-cost preventive services, such as annual check-ups, immunizations, cancer screenings, and more. By encouraging regular preventive care, these plans aim to detect and address health issues early on, leading to better health outcomes and reduced healthcare costs in the long run.

Future Implications and Ongoing Reforms

While the ACA has made significant strides in improving access to healthcare and providing affordable insurance options, ongoing discussions and reforms continue to shape the future of healthcare in the United States.

Potential Reforms and Expansions

Proposed reforms include expanding Medicaid coverage, simplifying the enrollment process, and increasing subsidies for lower-income individuals. Additionally, there are ongoing efforts to address rising healthcare costs and improve the overall efficiency of the healthcare system.

Continued Innovation and Improvement

The ACA has laid the foundation for a more accessible and equitable healthcare system. As we move forward, continued innovation, research, and collaboration between policymakers, healthcare providers, and insurance companies are crucial to further enhancing the quality and affordability of healthcare for all Americans.

Conclusion

The Affordable Care Act and its health insurance plans have revolutionized the healthcare landscape, offering millions of Americans the opportunity to obtain affordable and comprehensive coverage. With its focus on essential health benefits, protection for pre-existing conditions, and income-based subsidies, the ACA has made significant strides in improving access to healthcare and reducing financial barriers. As we navigate the ongoing reforms and innovations, the future of healthcare in the United States looks promising, with a continued emphasis on accessibility, affordability, and quality.

Can I still get health insurance outside of the Open Enrollment Period?

+Yes, you may qualify for a Special Enrollment Period if you experience specific life events such as marriage, divorce, birth of a child, loss of other health coverage, or relocation. These events allow you to enroll outside of the Open Enrollment Period.

How do I know if I’m eligible for premium subsidies?

+Eligibility for premium subsidies is primarily based on income. Individuals and families earning between 100% and 400% of the federal poverty level may qualify. You can use online tools or consult with a healthcare navigator to determine your eligibility.

What happens if I don’t have health insurance and don’t qualify for an exemption?

+If you don’t have health insurance and don’t qualify for an exemption, you may face a penalty known as the Individual Shared Responsibility Payment. This penalty is calculated based on your income and the number of months you were uninsured. However, it’s important to note that the penalty has been eliminated for tax years 2019 and beyond.