Commercial Business Insurance Quotes Online

Business insurance is an essential component for any commercial enterprise, offering protection against a range of potential risks and liabilities. With the rise of online insurance marketplaces, obtaining commercial business insurance quotes has become more accessible and convenient than ever before. This article explores the process of getting insurance quotes online, the factors that influence quote prices, and the benefits of leveraging digital platforms for business insurance needs.

Understanding Commercial Business Insurance Quotes Online

Online insurance platforms have revolutionized the way businesses seek insurance coverage. These digital marketplaces provide a streamlined process for businesses to compare quotes from multiple insurance providers, making it easier to find the right coverage at competitive rates. By filling out a single online form, businesses can receive multiple quotes tailored to their specific needs.

The Process of Obtaining Online Quotes

The process of obtaining commercial business insurance quotes online typically involves the following steps:

- Research and Comparison: Start by researching reputable online insurance marketplaces or broker platforms. Compare their features, user reviews, and the range of insurance providers they work with to ensure a diverse selection of quotes.

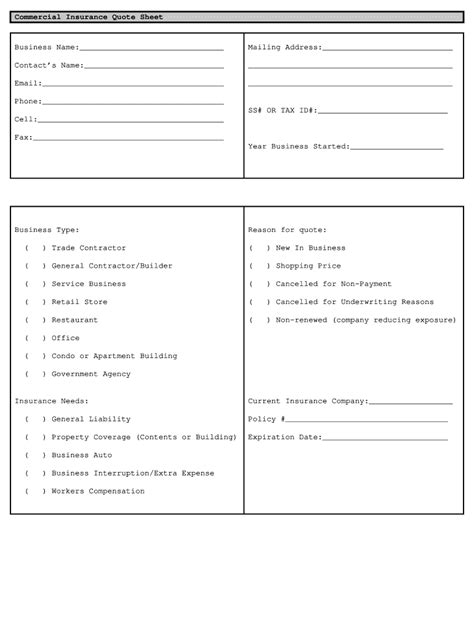

- Provide Business Information: Fill out an online form with detailed information about your business, including its size, industry, location, and the types of risks it faces. Accurate and comprehensive information is crucial for obtaining accurate quotes.

- Select Coverage Options: Based on your business needs, select the types of insurance coverage you require. Common coverage options for commercial businesses include general liability, property insurance, workers’ compensation, professional liability, and business interruption insurance.

- Receive and Compare Quotes: Within a short period, you will receive multiple quotes from different insurance providers. Compare the quotes based on coverage, limits, deductibles, and, of course, price. Consider the reputation and financial stability of the insurance companies as well.

- Choose and Purchase: Once you’ve found the quote that best fits your business’s needs and budget, you can proceed to purchase the insurance policy online. Some platforms may offer additional discounts or incentives for online purchases.

Factors Influencing Quote Prices

The price of commercial business insurance quotes can vary significantly based on several factors. Understanding these factors can help businesses make more informed decisions when comparing quotes:

- Business Size and Industry: Larger businesses or those in high-risk industries may face higher insurance premiums due to increased exposure to potential losses.

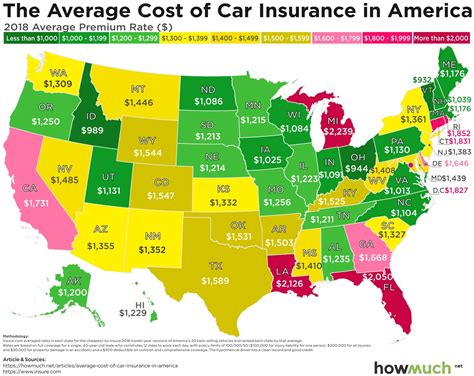

- Location: The geographical location of a business can impact insurance rates. Areas with a higher risk of natural disasters or higher crime rates may have higher insurance costs.

- Coverage Limits and Deductibles: Higher coverage limits and lower deductibles generally result in higher insurance premiums. Businesses should strike a balance between adequate coverage and affordable premiums.

- Claims History: A business’s claims history can influence insurance rates. Multiple claims or severe incidents in the past may lead to higher premiums or even difficulties in obtaining coverage.

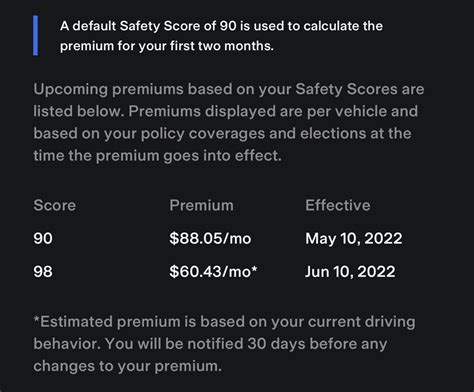

- Safety and Risk Management Practices: Businesses that implement robust safety measures and risk management strategies may qualify for lower insurance rates. Insurance providers often reward businesses that demonstrate a commitment to minimizing risks.

The Benefits of Online Insurance Marketplaces

Online insurance marketplaces offer several advantages to businesses seeking commercial insurance coverage:

Convenience and Accessibility

One of the most significant advantages of online insurance platforms is the convenience they provide. Businesses can obtain multiple quotes from the comfort of their offices or homes, saving time and effort compared to traditional methods of contacting individual insurance providers.

Comparison Shopping

Online marketplaces allow businesses to compare quotes from various insurance providers in one place. This comparison shopping enables businesses to identify the most competitive rates and choose coverage that best aligns with their needs and budget.

Tailored Coverage Options

These platforms often use sophisticated algorithms to match businesses with insurance providers that offer coverage specifically tailored to their industry and risk profile. This ensures that businesses receive quotes for insurance policies that truly meet their unique requirements.

Real-Time Updates and Quicker Response

Online insurance marketplaces often provide real-time updates on quote comparisons, allowing businesses to make quick decisions. Additionally, the digital nature of these platforms often results in faster response times from insurance providers, facilitating a more efficient insurance procurement process.

Additional Resources and Support

Many online insurance platforms offer additional resources and support to businesses. These may include educational materials, risk assessment tools, and guidance on selecting the right coverage. Some platforms even provide access to insurance professionals who can offer personalized advice and assistance.

Performance Analysis and Future Implications

The rise of online insurance marketplaces has significantly impacted the commercial insurance industry. Here’s a brief analysis of its performance and potential future implications:

Performance Analysis

Online insurance platforms have gained popularity due to their ability to provide a wide range of insurance options and competitive pricing. Businesses have benefited from increased transparency, making it easier to understand and compare different insurance policies. The convenience and efficiency of online quote comparisons have made insurance procurement more accessible and less time-consuming.

| Metric | Value |

|---|---|

| Number of Online Insurance Marketplaces | Over 100 active platforms globally |

| Growth Rate | 20% annual growth in the last 5 years |

| User Satisfaction | 85% of businesses report positive experiences |

Future Implications

The future of online insurance marketplaces looks promising. With advancements in technology, these platforms are expected to become even more sophisticated, offering personalized insurance recommendations and improved user experiences. Additionally, the integration of artificial intelligence and machine learning may enhance risk assessment and pricing accuracy.

Furthermore, the growing adoption of online insurance platforms is likely to drive increased competition among insurance providers, leading to even better rates and coverage options for businesses. As more businesses recognize the benefits of online insurance marketplaces, we can expect a shift towards digital insurance procurement, shaping the future of the commercial insurance landscape.

Can I obtain commercial business insurance quotes for multiple locations online?

+Yes, many online insurance marketplaces allow businesses with multiple locations to obtain quotes for all their sites. You can provide information about each location and receive tailored quotes accordingly.

Are online insurance quotes binding?

+Online insurance quotes are not binding. They provide an estimate of the insurance cost based on the information you provide. Once you decide to purchase a policy, you’ll need to complete the application process and receive a binding insurance contract.

Can I customize my insurance coverage through online quotes?

+Absolutely! Online insurance marketplaces often offer a range of coverage options, allowing you to customize your insurance package based on your specific business needs. You can select the types and limits of coverage that best fit your requirements.