Tesla Insurance Price

Tesla, the renowned electric vehicle (EV) manufacturer, has taken a bold step by introducing its own insurance program, Tesla Insurance. This innovative initiative aims to offer comprehensive coverage for Tesla owners, ensuring a seamless and cost-effective insurance experience. With a focus on transparency and tailored policies, Tesla Insurance has sparked curiosity and interest among EV enthusiasts and industry experts alike. In this comprehensive analysis, we delve into the world of Tesla Insurance, exploring its pricing strategies, unique features, and the potential impact it may have on the automotive insurance landscape.

Understanding Tesla Insurance Pricing

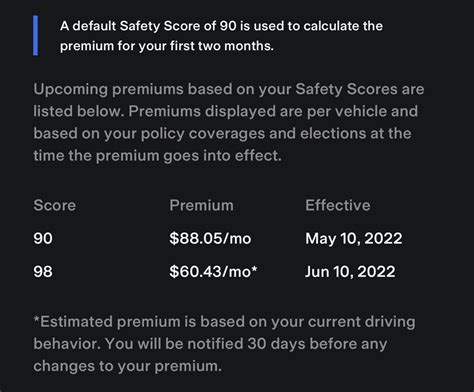

Tesla Insurance has garnered attention for its competitive pricing, challenging traditional insurance providers. The company boasts a transparent and straightforward pricing structure, aiming to provide affordable coverage options for Tesla owners. By leveraging advanced technology and data analytics, Tesla Insurance offers personalized quotes based on individual driving behaviors and vehicle usage patterns.

One of the key advantages of Tesla Insurance is its ability to utilize the extensive data collected by Tesla's fleet of connected vehicles. This data-driven approach allows for precise risk assessment, resulting in more accurate pricing. Tesla's autonomous driving features, such as Autopilot and Full Self-Driving, play a significant role in determining insurance rates. The company's focus on safety and advanced driver-assistance systems (ADAS) contributes to a reduced risk profile, potentially leading to lower insurance premiums for Tesla owners.

Personalized Pricing Factors

Tesla Insurance takes into account various factors when determining insurance premiums. These factors include:

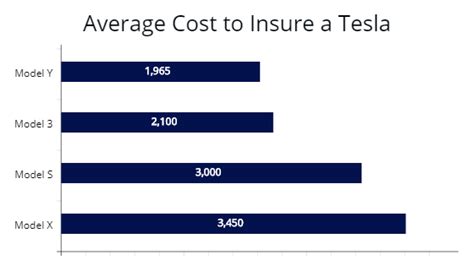

- Vehicle Model and Specifications: Different Tesla models have unique features and performance capabilities. Insurance premiums may vary based on the specific model, battery size, and range.

- Driving Behavior: Tesla Insurance analyzes driving data to assess an individual's risk profile. Factors such as driving frequency, acceleration patterns, and adherence to speed limits influence the pricing.

- Location and Usage: The geographic location and intended usage of the vehicle are considered. Urban areas with higher accident rates may result in slightly elevated premiums compared to rural areas.

- Claim History: Tesla Insurance takes into account an individual's claim history, including any previous accidents or insurance claims. A clean record can positively impact insurance rates.

It's important to note that Tesla Insurance aims to provide fair and transparent pricing, rewarding safe driving behaviors and promoting responsible vehicle usage. The company's focus on data-driven insights allows for a more accurate assessment of risk, ultimately benefiting Tesla owners with potentially lower insurance costs.

Comparative Analysis: Tesla Insurance vs. Traditional Providers

When comparing Tesla Insurance to traditional automotive insurance providers, several key differences emerge. Tesla’s innovative approach to insurance sets it apart from conventional insurers, offering unique advantages to Tesla owners.

Direct-to-Consumer Model

Tesla Insurance operates on a direct-to-consumer model, eliminating the need for intermediaries. By cutting out the middleman, Tesla is able to offer more competitive pricing and streamlined services. This approach allows Tesla to maintain control over the entire insurance process, from quoting to claims handling.

Enhanced Safety Features

Tesla vehicles are renowned for their advanced safety features, and these attributes significantly impact insurance pricing. The company’s focus on safety technology, such as Autopilot and Full Self-Driving, reduces the likelihood of accidents and subsequent insurance claims. As a result, Tesla Insurance can offer lower premiums compared to traditional providers who may have a broader customer base with varying safety features.

Data-Driven Risk Assessment

Tesla’s ability to collect and analyze extensive data from its connected vehicles gives it a distinct advantage in risk assessment. By leveraging real-time driving data, Tesla Insurance can accurately identify potential risks and offer tailored coverage. This data-driven approach ensures that insurance premiums are fair and reflective of an individual’s actual risk profile, rather than relying on general assumptions or industry averages.

Streamlined Claims Process

Tesla Insurance aims to revolutionize the claims process by leveraging its extensive network of service centers and repair facilities. In the event of an accident, Tesla owners can benefit from a simplified and efficient claims experience. With direct access to Tesla’s specialized repair teams and parts inventory, the claims process is streamlined, reducing downtime and potential inconveniences.

| Comparative Factors | Tesla Insurance | Traditional Providers |

|---|---|---|

| Pricing | Competitive rates based on data-driven risk assessment | May have higher premiums due to broader customer base and traditional risk assessment methods |

| Safety Features | Advanced safety technology reduces accident risk | Varying safety features across different vehicle models |

| Claims Process | Streamlined and efficient with direct access to Tesla's service centers | May involve third-party adjusters and potentially longer processing times |

Real-World Performance and Customer Experience

Tesla Insurance has gained traction among Tesla owners, with many praising its competitive pricing and seamless integration with Tesla’s ecosystem. Real-world experiences highlight the benefits of Tesla Insurance, particularly in terms of cost savings and the convenience of a direct-to-consumer model.

Tesla owners have reported significant savings on their insurance premiums compared to traditional providers. The company's focus on data-driven risk assessment and personalized pricing has resulted in lower insurance costs for many customers. Additionally, the ease of obtaining quotes and managing policies through Tesla's digital platform has been well-received, providing a user-friendly experience.

However, it's important to note that Tesla Insurance is currently available only in select regions, primarily in the United States. The company is gradually expanding its insurance offerings to additional states, but there are still limitations on its availability. Tesla aims to broaden its insurance presence to cater to a wider customer base, ensuring that more Tesla owners can benefit from its innovative insurance program.

Customer Testimonials and Feedback

“Tesla Insurance has been a game-changer for me. I’ve saved hundreds of dollars on my insurance premiums compared to my previous provider. The process of obtaining a quote and managing my policy is incredibly straightforward, and I appreciate the transparency in pricing. I feel confident knowing that my Tesla is covered by an insurance program specifically designed for its unique features.”

"I was initially hesitant about Tesla Insurance, but after experiencing their exceptional customer service and the convenience of their digital platform, I'm a convert. The claims process was seamless, and I received a fair settlement quickly. Tesla Insurance has definitely earned my trust, and I highly recommend it to other Tesla owners."

Future Implications and Industry Impact

Tesla Insurance’s entry into the automotive insurance market has the potential to disrupt traditional insurance providers and shape the future of insurance coverage. As Tesla continues to expand its insurance offerings and gain market share, several key implications emerge:

Increased Competition

The introduction of Tesla Insurance adds a new player to the automotive insurance market, intensifying competition among insurers. Traditional providers may need to reevaluate their pricing strategies and consider adopting more data-driven approaches to remain competitive. This increased competition benefits consumers, driving down insurance costs and improving overall service standards.

Data-Driven Insurance Evolution

Tesla’s reliance on data analytics and connected vehicle technology sets a precedent for the future of insurance. As more vehicles become connected and data-rich, insurers will increasingly turn to data-driven risk assessment models. This evolution will lead to more accurate pricing, tailored coverage, and improved customer experiences. Tesla Insurance’s success could accelerate the adoption of data-driven insurance practices across the industry.

Integration of Safety Technology

Tesla’s focus on advanced safety features, such as Autopilot and Full Self-Driving, highlights the potential impact of safety technology on insurance rates. As more vehicles incorporate similar features, insurers may increasingly consider these technologies when determining premiums. This integration of safety technology into insurance pricing could incentivize automakers to prioritize safety innovations, ultimately benefiting consumers.

Expansion of Insurance Services

Tesla’s entry into the insurance market demonstrates its commitment to providing a comprehensive ownership experience. As Tesla Insurance gains traction, the company may expand its insurance services to include additional coverage options, such as warranty extensions, roadside assistance, and even specialized coverage for autonomous driving features. This expansion could further enhance Tesla’s position as a one-stop solution for EV owners.

How does Tesla Insurance determine its pricing?

+Tesla Insurance utilizes a data-driven approach, analyzing factors such as vehicle model, driving behavior, location, and claim history to determine personalized pricing. This allows for more accurate risk assessment and competitive premiums.

Is Tesla Insurance available in my region?

+Tesla Insurance is currently available in select regions, primarily in the United States. Tesla is gradually expanding its insurance offerings, so it’s advisable to check Tesla’s official website or contact their customer support for the latest availability information.

Can I switch to Tesla Insurance if I already have insurance with another provider?

+Absolutely! Tesla Insurance welcomes new customers, including those with existing insurance policies. To switch to Tesla Insurance, you can obtain a quote online, compare the premiums, and make the transition seamlessly. Tesla’s customer support team can assist with any necessary paperwork and ensure a smooth transfer of coverage.