Personal Health Insurance Texas

In the vast landscape of healthcare, understanding the intricacies of personal health insurance is crucial, especially when considering the diverse needs of Texans. This comprehensive guide aims to shed light on the essential aspects of personal health insurance in Texas, providing an in-depth analysis of coverage options, cost factors, and the unique challenges faced by residents.

Navigating Personal Health Insurance in Texas: A Comprehensive Overview

Texas, known for its diverse demographics and geographical expanse, presents a unique challenge when it comes to healthcare coverage. With a population of over 29 million, ensuring access to quality healthcare is a complex task. Personal health insurance, a cornerstone of the healthcare system, plays a pivotal role in providing financial protection and peace of mind to individuals and families.

Understanding Coverage Options

Texas offers a range of health insurance plans tailored to meet the diverse needs of its residents. From comprehensive PPO (Preferred Provider Organization) plans to cost-effective HMO (Health Maintenance Organization) options, individuals can choose coverage that aligns with their healthcare requirements and budget.

For those seeking flexibility, PPO plans provide the advantage of choosing any healthcare provider, both in and out of the network, with varying levels of coverage. On the other hand, HMO plans, known for their affordability, typically require members to select a primary care physician and utilize a network of preferred providers, often with lower out-of-pocket costs.

| Plan Type | Key Features |

|---|---|

| PPO | Flexible provider choice, wider network, typically higher premiums |

| HMO | Affordable, requires use of preferred providers, often lower out-of-pocket costs |

Additionally, POS (Point of Service) plans offer a blend of PPO and HMO features, allowing members to choose their provider but requiring a referral for out-of-network services. High-Deductible Health Plans (HDHPs), paired with Health Savings Accounts (HSAs), provide a tax-efficient way to save for healthcare expenses, making them attractive to those who are generally healthy and prefer lower monthly premiums.

Cost Factors and Considerations

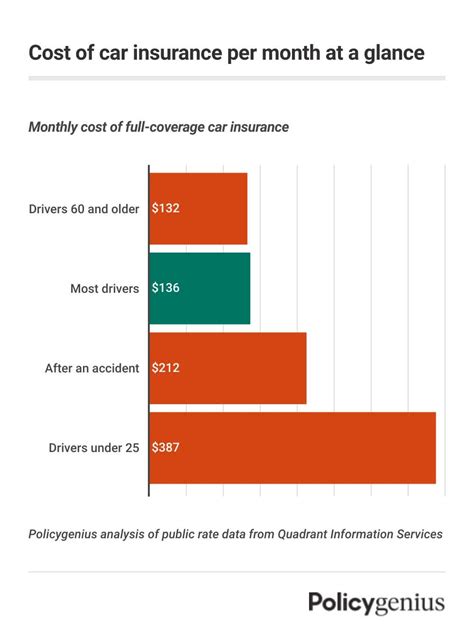

When selecting a personal health insurance plan in Texas, cost is a significant factor. Premiums, deductibles, copays, and coinsurance all contribute to the overall expense. The cost of health insurance can vary based on several factors, including the type of plan, the provider network, and individual health needs.

Premiums, the monthly cost of insurance, can range from a few hundred to several thousand dollars, depending on the plan's coverage and the insured's age and location. Deductibles, the amount an individual must pay out-of-pocket before insurance coverage kicks in, can also vary widely, with some plans offering lower premiums but higher deductibles, and vice versa.

Copays, a fixed amount paid for specific services like doctor visits or prescriptions, and coinsurance, the percentage of costs an individual shares with the insurer, are additional cost considerations. These factors can significantly impact the overall affordability of a health insurance plan.

Unique Challenges in Texas

Texas faces unique challenges when it comes to personal health insurance. The state’s large rural population often struggles with limited access to healthcare providers, leading to higher costs and reduced plan options. Additionally, the state’s diverse demographic makeup, including a large uninsured population, poses challenges in ensuring equitable access to healthcare.

To address these challenges, Texas has implemented initiatives such as the Healthy Texas Program, which offers low-cost health insurance to individuals and families who do not qualify for other state or federal programs. This program, among others, aims to improve healthcare accessibility and affordability for Texans.

Key Considerations for Texans Seeking Personal Health Insurance

When navigating the complex world of personal health insurance in Texas, several key considerations come into play. Understanding these factors can empower individuals to make informed decisions about their healthcare coverage.

Assessing Healthcare Needs

The first step in selecting a health insurance plan is assessing one’s healthcare needs. This involves evaluating current and potential future medical requirements, including chronic conditions, medications, and anticipated healthcare services. By understanding their unique healthcare landscape, individuals can choose a plan that provides adequate coverage without unnecessary expenses.

For instance, individuals with pre-existing conditions may require plans with comprehensive coverage and lower out-of-pocket costs. Conversely, those who are generally healthy and only require occasional doctor visits may opt for plans with higher deductibles and lower premiums, effectively saving on monthly costs.

Evaluating Network Providers

The provider network is a critical aspect of personal health insurance. Texans should ensure that their preferred healthcare providers, including specialists and hospitals, are included in the plan’s network. This ensures access to quality care without incurring additional out-of-network costs.

Researching the plan's network, particularly for those with specific healthcare needs or who prefer certain providers, is essential. Many insurance companies provide online tools or directories to help individuals verify network coverage. Additionally, contacting the provider directly can provide clarity on their participation in specific health insurance plans.

Understanding Plan Benefits and Limitations

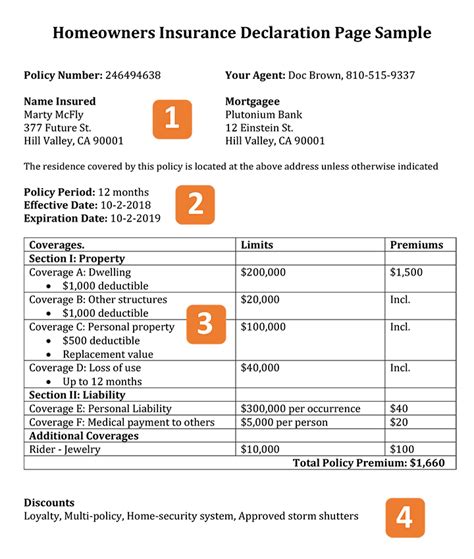

Personal health insurance plans in Texas offer a range of benefits and limitations. Understanding these aspects is crucial to avoid surprises when seeking healthcare services. Plans may have different coverage levels for preventive care, specialist visits, hospital stays, prescription medications, and mental health services.

It's important to review the plan's summary of benefits and coverage to understand what is included and excluded. This information, often available online or from the insurance provider, details the plan's coverage, including deductibles, copays, and coinsurance. Additionally, understanding the plan's annual and lifetime maximums can provide insight into potential out-of-pocket costs.

Real-World Examples: Navigating Personal Health Insurance in Texas

Let’s explore a few real-world scenarios to better understand how personal health insurance plays out in Texas. These examples highlight the importance of informed decision-making and the impact of various factors on healthcare coverage.

Scenario 1: Young Professional in Houston

Imagine a 25-year-old professional living in Houston who values flexibility and cost-efficiency. They opt for a PPO plan with a moderate premium and a higher deductible. This plan allows them to choose any healthcare provider, both in and out of the network, providing flexibility as they travel frequently for work.

With this plan, they can access specialists and hospitals across the state, paying a higher deductible but lower copays for services. This strategy works well for their active lifestyle and frequent travel, providing peace of mind while keeping monthly costs manageable.

Scenario 2: Family in Dallas with Chronic Conditions

Consider a family in Dallas with two children, one of whom has a chronic condition requiring regular medical attention. They choose an HMO plan with a lower premium and a moderate deductible. This plan requires them to select a primary care physician and utilize a network of preferred providers, ensuring lower out-of-pocket costs for their healthcare needs.

By choosing an HMO plan, the family can access specialized care for their child's condition without incurring high costs. The plan's network includes pediatric specialists and hospitals, providing comprehensive care while managing their healthcare budget effectively.

Scenario 3: Elderly Resident in a Rural Area

For an elderly resident in a rural area of Texas, access to healthcare providers can be a challenge. They opt for a POS plan with a balanced premium and deductible. This plan allows them to choose their provider but requires a referral for out-of-network services.

With this strategy, they can access local healthcare providers, including specialists, while still having the flexibility to seek care from urban centers if needed. The POS plan provides a middle ground, ensuring access to necessary healthcare services without the burden of high out-of-pocket costs.

The Future of Personal Health Insurance in Texas

The landscape of personal health insurance in Texas is evolving, driven by technological advancements, changing healthcare needs, and policy reforms. As we look ahead, several key trends and developments are shaping the future of healthcare coverage in the state.

Digital Innovation and Telehealth

Digital technology is revolutionizing the healthcare industry, and Texas is no exception. The rise of telehealth services, enabled by advanced digital platforms, is transforming how Texans access healthcare. With telehealth, individuals can consult with healthcare providers remotely, overcoming geographical barriers and providing convenient, cost-effective care.

Insurance companies are increasingly incorporating telehealth services into their plans, offering coverage for virtual doctor visits, mental health counseling, and even remote monitoring of chronic conditions. This trend not only improves access to care but also reduces the strain on healthcare facilities, particularly in rural areas.

Focus on Preventive Care and Wellness

There is a growing emphasis on preventive care and wellness initiatives in Texas’ healthcare landscape. Personal health insurance plans are increasingly incorporating coverage for preventive services, such as annual check-ups, screenings, and immunizations, to promote early detection and maintain overall health.

By encouraging preventive care, insurance providers aim to reduce the burden of chronic diseases and costly treatments. This shift towards wellness-focused coverage not only benefits individuals but also contributes to a healthier population and a more sustainable healthcare system.

Policy Reforms and Healthcare Access

Texas, like many states, is navigating policy reforms to improve healthcare access and affordability. The state’s initiatives, such as the Healthy Texas Program and Texas Uninsured Program, aim to provide coverage options for uninsured individuals and families, reducing the number of Texans without health insurance.

These reforms, coupled with federal initiatives like the Affordable Care Act, are expanding access to healthcare and driving down uninsured rates. As these policies evolve, Texans can expect more comprehensive coverage options and improved financial protection, ensuring better healthcare outcomes for all residents.

How do I choose the right personal health insurance plan in Texas?

+Choosing the right health insurance plan involves several factors. Assess your healthcare needs, including any pre-existing conditions and anticipated medical expenses. Compare plans based on coverage, network providers, and cost. Consider your preferred level of flexibility and out-of-pocket expenses. Research and seek advice from insurance brokers or healthcare professionals to make an informed decision.

What are the key differences between PPO, HMO, and POS plans in Texas?

+PPO plans offer flexibility with provider choice, allowing you to see any doctor or specialist, but often at a higher cost. HMO plans are more affordable, requiring you to select a primary care physician and use preferred providers, with lower out-of-pocket costs. POS plans blend features of both, allowing provider choice but requiring referrals for out-of-network services.

Are there any resources to help me understand and compare health insurance plans in Texas?

+Absolutely! The Texas Department of Insurance provides valuable resources and tools to help you understand and compare health insurance plans. Their website offers plan comparison tools, summary of benefits information, and other resources to assist you in making informed decisions about your healthcare coverage.