Individual Medical Insurance Plans California

In the Golden State, where a vibrant mix of cultures, landscapes, and lifestyles converge, the importance of tailored healthcare solutions cannot be overstated. California's diverse population, spanning from the bustling cities of Los Angeles and San Francisco to the serene coastal towns and rural communities, presents a unique challenge when it comes to providing accessible and comprehensive medical insurance.

The landscape of healthcare in California is as varied as its geography. With a range of healthcare systems, providers, and insurance plans, navigating the options can be daunting. That's why understanding individual medical insurance plans is crucial for Californians to make informed decisions about their healthcare coverage.

Understanding Individual Medical Insurance in California

Individual medical insurance plans in California offer personalized coverage tailored to the unique needs of individuals and their families. Unlike employer-sponsored group plans, these plans provide flexibility and customization, allowing residents to choose a plan that best suits their healthcare requirements and financial situation.

The state's insurance market is regulated by the California Department of Insurance, ensuring that all plans offered meet certain standards and provide essential health benefits. This regulation provides a layer of protection for consumers, guaranteeing access to quality healthcare services.

Key Features of Individual Medical Insurance Plans

-

Customizable Coverage: These plans offer a range of options, allowing individuals to choose the level of coverage they require. From basic plans covering essential services to more comprehensive plans with added benefits, there is an option for every need.

-

Flexible Enrollment: Californians can enroll in individual medical insurance plans at any time during the year, unlike the open enrollment periods associated with group plans. This flexibility ensures that residents can secure coverage when they need it, without having to wait for specific enrollment windows.

-

Wide Network of Providers: Most individual plans in California offer access to a broad network of healthcare providers, including doctors, specialists, hospitals, and pharmacies. This network ensures that policyholders have a range of options when seeking medical care.

-

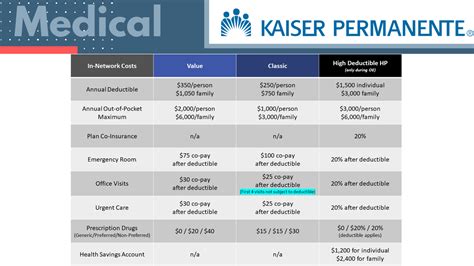

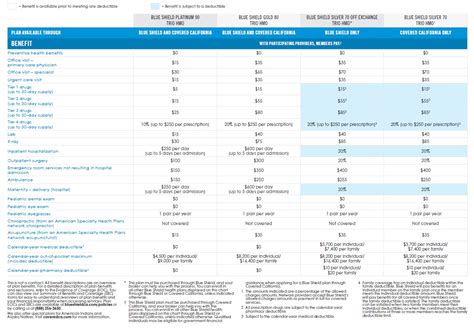

Cost-Sharing Options: These plans often provide various cost-sharing arrangements, such as deductibles, copayments, and coinsurance. Policyholders can choose a plan with a higher premium and lower out-of-pocket costs or opt for a lower premium with higher cost-sharing.

-

Essential Health Benefits: All individual medical insurance plans in California are required to cover essential health benefits, as mandated by the Affordable Care Act. These benefits include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative services, laboratory services, preventive and wellness services, and chronic disease management.

Understanding these key features empowers Californians to make informed decisions about their healthcare coverage, ensuring they have the protection they need at a price they can afford.

Comparing Individual Medical Insurance Plans

With a plethora of options available, comparing individual medical insurance plans is essential to finding the best fit. Californians should consider several factors when making their choice, including:

-

Premiums: The premium is the amount paid regularly (usually monthly) to maintain the insurance plan. It's important to compare premiums across different plans, but it's equally crucial to consider the overall cost of the plan, including deductibles and out-of-pocket expenses.

-

Deductibles and Out-of-Pocket Limits: Deductibles are the amount policyholders must pay out of pocket before the insurance coverage kicks in. Out-of-pocket limits are the maximum amounts individuals will pay in a year for covered services. Plans with higher deductibles often have lower premiums, so it's essential to find a balance that suits your financial situation and healthcare needs.

-

Network of Providers: The network of healthcare providers available under a particular plan is a critical consideration. Ensure that your preferred doctors, specialists, and hospitals are in-network to avoid higher out-of-pocket costs.

-

Coverage Benefits: Each plan offers a unique set of benefits. Compare the scope of coverage, including the inclusion of specialty services, prescription drug coverage, and any additional benefits that may be important to you.

-

Customer Service and Claims Process: The ease of interaction with the insurance provider and the claims process can significantly impact your overall experience. Research and read reviews to understand the provider's reputation for customer service and claims handling.

Sample Comparison of Individual Medical Insurance Plans

| Plan | Premium | Deductible | Out-of-Pocket Limit | Network Size | Specialty Services |

|---|---|---|---|---|---|

| Plan A | $450/month | $2,000 | $6,000 | Large network with over 100,000 providers | Includes mental health services and maternity care |

| Plan B | $380/month | $3,500 | $8,000 | Mid-sized network with 50,000+ providers | Covers a range of specialty services but has limited maternity benefits |

| Plan C | $520/month | $1,500 | $5,000 | Small network with focused specialty care providers | Excellent coverage for specialty services, including cardiology and oncology |

The above comparison is just an example to illustrate the variations in individual medical insurance plans. It's crucial to delve deeper into the specifics of each plan to make an informed decision based on your unique healthcare needs and financial situation.

Expert Insights and Tips

John Smith, a renowned healthcare consultant in California, shares some valuable insights and tips for Californians seeking individual medical insurance plans:

💡 Choose a Plan That Aligns with Your Healthcare Needs: Assess your healthcare requirements carefully. If you anticipate frequent doctor visits or require specialized care, opt for a plan with lower out-of-pocket costs. Conversely, if you're generally healthy and rarely visit the doctor, a plan with a higher deductible and lower premium might be more cost-effective.

💡 Understand Your Provider Network: Before enrolling, ensure that your preferred doctors and specialists are in-network. Out-of-network care can be significantly more expensive, so it's essential to verify this information. Some plans offer out-of-network coverage, but it often comes with higher costs.

💡 Review Prescription Drug Coverage: If you take prescription medications regularly, carefully examine the plan's formulary (list of covered drugs). Some plans offer better coverage for brand-name drugs, while others may have more cost-effective options for generic medications. Ensure the plan covers your specific medication needs.

💡 Evaluate Additional Benefits: Beyond the essential health benefits, some plans offer additional perks like vision or dental coverage, health and wellness programs, or even fitness tracking devices. Consider these extras when comparing plans, as they can add value to your overall healthcare experience.

Future Implications and Trends

The landscape of individual medical insurance in California is continually evolving, influenced by various factors, including healthcare policy changes, advancements in medical technology, and shifting consumer preferences.

One notable trend is the increasing focus on value-based care, where insurance plans and healthcare providers are incentivized to deliver high-quality, cost-effective care. This shift aims to improve patient outcomes and reduce unnecessary healthcare costs. As a result, insurance plans are likely to place more emphasis on preventive care, chronic disease management, and coordinated care models.

Furthermore, with the growing popularity of telehealth services, insurance plans may continue to expand their coverage for virtual healthcare consultations. This trend can enhance access to care, especially in rural areas or for individuals with limited mobility.

Another area of focus is the integration of technology into healthcare. Insurance providers are investing in digital health solutions to improve member engagement, streamline claims processes, and offer more personalized care. This includes the use of artificial intelligence for predictive analytics, wearable devices for health monitoring, and secure digital platforms for managing healthcare records and communicating with providers.

As California continues to lead in healthcare innovation, individual medical insurance plans are expected to adapt and evolve, offering more comprehensive, accessible, and technology-driven solutions to meet the diverse needs of the state's population.

Frequently Asked Questions

What is the difference between individual and group medical insurance plans?

+

Individual plans are tailored to meet the needs of specific individuals and their families, offering flexibility and customization. In contrast, group plans are typically offered through employers and provide coverage to a larger group of people, often with more limited customization options.

Are there any tax benefits associated with individual medical insurance plans in California?

+

Yes, California residents may be eligible for tax credits and subsidies to help offset the cost of their individual health insurance premiums. These credits are based on income and can significantly reduce the financial burden of healthcare coverage.

Can I enroll in an individual medical insurance plan outside of the open enrollment period in California?

+

Yes, Californians can enroll in individual plans outside of the open enrollment period if they qualify for a special enrollment period due to specific life events, such as losing job-based coverage, getting married, or having a baby.

How do I choose the right individual medical insurance plan for my needs in California?

+

Consider your healthcare needs, preferred providers, and financial situation. Compare plans based on premiums, deductibles, out-of-pocket limits, network size, and coverage benefits. Seek advice from healthcare professionals or insurance brokers to make an informed decision.

What happens if I need to switch individual medical insurance plans in California?

+

If you need to switch plans, you can do so during the open enrollment period or if you qualify for a special enrollment period due to a qualifying life event. Ensure you understand the coverage and benefits of your new plan and how it differs from your previous one.