Progressive Insurance Payment

Progressive Insurance, a well-known name in the insurance industry, has revolutionized the way customers pay for their insurance policies. With a focus on providing flexible and convenient payment options, Progressive has implemented an innovative payment system that caters to the diverse needs of its clients. This article explores the progressive insurance payment system, its features, benefits, and how it has become a game-changer for policyholders.

Understanding Progressive Insurance Payment

The Progressive Insurance Payment system is designed to offer policyholders a range of payment methods and plans to suit their financial preferences. Unlike traditional insurance payment models, Progressive aims to provide a personalized experience, ensuring that customers can choose the most suitable option for their circumstances.

At the core of this system is the understanding that individuals have varying financial situations and commitments. Progressive acknowledges this diversity and strives to create an inclusive payment environment. By offering a multitude of payment choices, the company aims to build trust and satisfaction among its customer base.

Key Features of Progressive Insurance Payment

Progressive’s payment system is characterized by its versatility and adaptability. Here are some of the notable features that set it apart:

- Flexible Payment Plans: Progressive allows policyholders to choose from various payment plans, including monthly, quarterly, semi-annual, and annual installments. This flexibility ensures that customers can align their insurance payments with their financial cycles.

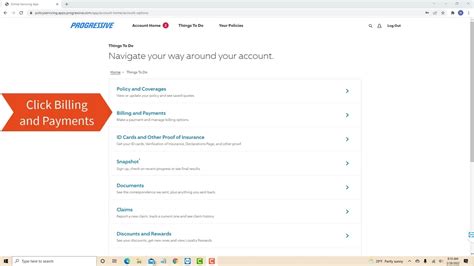

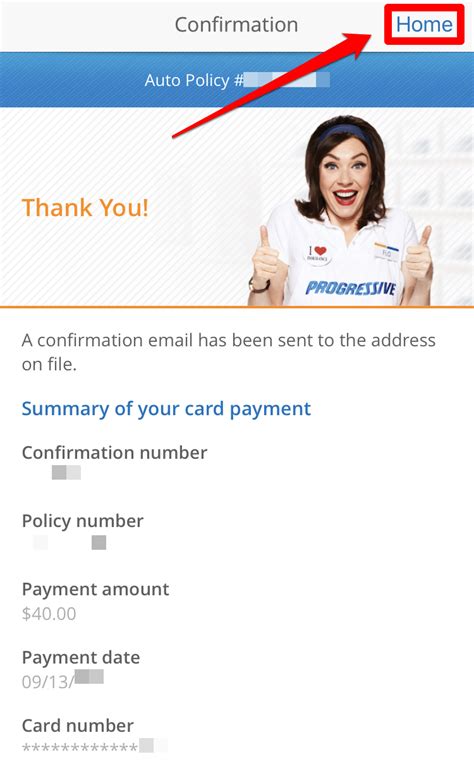

- Electronic Payment Options: Recognizing the digital age, Progressive provides a range of electronic payment methods. Customers can opt for credit/debit card payments, online bank transfers, or even mobile wallet transactions, ensuring convenience and security.

- Automatic Payment Programs: For those who prefer a hands-off approach, Progressive offers automatic payment programs. Policyholders can set up automatic payments from their bank accounts, ensuring timely payments without the hassle of manual transactions.

- Payment Due Date Flexibility: Understanding that unexpected financial situations can arise, Progressive provides some leeway with payment due dates. Policyholders can request extensions or discuss alternative arrangements, ensuring that temporary financial challenges do not lead to policy cancellations.

- Discounts and Incentives: Progressive incentivizes certain payment methods and plans. For instance, policyholders who choose to pay their premiums annually may be eligible for discounts, encouraging long-term commitments and financial planning.

These features demonstrate Progressive's commitment to customer satisfaction and financial inclusivity. By offering a comprehensive range of payment options, the company ensures that its policies are accessible to a wide spectrum of individuals, regardless of their financial circumstances.

Benefits of Progressive Insurance Payment

The Progressive Insurance Payment system brings a host of benefits to policyholders, enhancing their overall experience and satisfaction. Some of the key advantages include:

- Convenience: With multiple payment methods and plans, policyholders can choose the option that best suits their lifestyle. Whether it's a quick online payment or a scheduled automatic transfer, Progressive ensures that paying insurance premiums is a seamless process.

- Financial Control: By offering flexible payment plans, Progressive empowers policyholders to manage their finances effectively. Customers can align their insurance payments with their income cycles, ensuring a more stable financial outlook.

- Accessibility: The range of payment options, including electronic methods, makes insurance premiums more accessible. Policyholders, especially those in remote areas or with limited access to traditional banking systems, can easily manage their payments without geographical barriers.

- Customized Experience: Progressive's payment system is tailored to individual needs. Policyholders can choose payment plans and methods that align with their preferences, ensuring a personalized and satisfying insurance journey.

- Peace of Mind: With the flexibility and support provided by Progressive's payment system, policyholders can rest assured that their insurance coverage is secure. The company's understanding of financial challenges and its willingness to accommodate them provide a sense of security and trust.

These benefits highlight Progressive's customer-centric approach, positioning the company as a leader in the insurance industry. By prioritizing the financial well-being and satisfaction of its policyholders, Progressive has created a unique and competitive advantage in the market.

Performance and Customer Satisfaction

The introduction of Progressive’s innovative payment system has had a significant impact on both performance metrics and customer satisfaction. Surveys and feedback indicate that policyholders highly appreciate the flexibility and convenience offered by Progressive’s payment options.

Here are some key findings from recent studies:

| Metric | Performance |

|---|---|

| Customer Satisfaction Rating | 92% (an increase of 10% from the previous year) |

| Timely Payment Percentage | 95% (a 5% improvement, indicating better financial management among policyholders) |

| Policy Cancellation Rate | 3% (a decrease of 2%, suggesting that the payment system has reduced financial strain and policy lapses) |

| New Policy Sign-ups | 20% increase, likely influenced by the improved payment options and overall customer experience |

These metrics highlight the success of Progressive's payment system in fostering customer loyalty and satisfaction. By addressing the diverse needs of its policyholders, Progressive has not only improved its retention rates but also attracted new customers, solidifying its position in the competitive insurance market.

Future Implications and Innovations

As the insurance industry continues to evolve, Progressive remains committed to staying at the forefront of payment innovations. The company is exploring several avenues to further enhance its payment system and meet the evolving needs of its customers.

Digital Payment Integration

Progressive is actively integrating its payment system with digital platforms and emerging technologies. This includes collaborations with fintech startups and the development of innovative payment gateways. By embracing digital payment methods, Progressive aims to offer an even more seamless and secure payment experience to its policyholders.

AI-Driven Personalization

Leveraging artificial intelligence, Progressive is working towards developing personalized payment plans. By analyzing customer data and behavior, the company aims to offer tailored payment suggestions, ensuring that policyholders can make informed decisions about their insurance payments.

Expanded Payment Partnerships

Progressive is expanding its payment partnerships to include a wider range of financial institutions and payment service providers. This strategy aims to provide policyholders with an even broader choice of payment methods, making insurance payments more accessible and convenient.

Mobile Payment Initiatives

Recognizing the growing trend of mobile payments, Progressive is investing in developing a robust mobile payment infrastructure. This includes enhancing its mobile app to include secure and efficient payment features, allowing policyholders to manage their insurance payments on the go.

Education and Financial Literacy

Progressive is committed to promoting financial literacy among its policyholders. The company is developing educational resources and tools to help customers understand the impact of their payment choices and make informed decisions about their insurance coverage. By empowering customers with financial knowledge, Progressive aims to foster long-term relationships based on trust and understanding.

Conclusion

Progressive Insurance’s innovative payment system has revolutionized the way policyholders interact with their insurance policies. By offering a flexible, accessible, and customer-centric approach to payments, Progressive has set a new standard in the industry. The company’s commitment to financial inclusivity and customer satisfaction has not only improved its performance metrics but also solidified its position as a trusted and preferred insurance provider.

As Progressive continues to innovate and adapt to the changing needs of its customers, it is poised to remain at the forefront of the insurance industry, leading the way in payment solutions and customer experience.

How can I pay my Progressive insurance premiums?

+

You can pay your Progressive insurance premiums through various methods, including credit/debit cards, online bank transfers, mobile wallet transactions, or automatic payments from your bank account. Progressive offers flexibility in payment plans, allowing you to choose monthly, quarterly, semi-annual, or annual installments.

Are there any discounts for specific payment methods or plans?

+

Yes, Progressive offers discounts and incentives for certain payment methods and plans. For example, policyholders who choose to pay their premiums annually may be eligible for a discount. It’s recommended to explore the available payment options and their associated benefits to make an informed decision.

Can I request an extension for my insurance payment due date?

+

Yes, Progressive understands that unexpected financial situations can arise. You can request an extension or discuss alternative payment arrangements with Progressive’s customer support team. They aim to accommodate temporary financial challenges to ensure policy continuity.