Homeowners And Auto Insurance

In the realm of personal insurance, two critical coverages stand out: homeowners' insurance and auto insurance. These policies serve as vital safeguards for two of life's most significant investments: your home and your vehicle. Understanding the intricacies of these insurance types, from their basic coverage to their more nuanced features, is essential for every homeowner and vehicle owner. This comprehensive guide aims to demystify homeowners' and auto insurance, providing an in-depth analysis of their coverage, benefits, and considerations.

Homeowners’ Insurance: A Pillar of Protection

Homeowners’ insurance is a cornerstone of financial security for property owners. This coverage provides a safety net against a range of potential risks, from natural disasters to theft and liability claims. It’s tailored to meet the unique needs of homeowners, offering peace of mind and protection against unforeseen events that could otherwise cause significant financial strain.

Key Components of Homeowners’ Insurance

The coverage provided by homeowners’ insurance can be divided into several key components, each addressing a specific aspect of homeownership:

- Dwelling Coverage: This covers the physical structure of the home, including walls, roofs, and foundations. It protects against damages caused by perils such as fire, storms, and vandalism.

- Personal Property Coverage: This covers the contents of your home, including furniture, appliances, and personal belongings. It provides financial protection in case of theft, damage, or loss due to covered perils.

- Liability Coverage: This protects homeowners from financial losses resulting from lawsuits and medical claims due to injuries sustained on their property. It covers legal fees and any settlements or judgments against the homeowner.

- Additional Living Expenses (ALE): In the event that your home becomes uninhabitable due to a covered loss, ALE coverage provides for temporary housing and additional living expenses until your home is repaired or rebuilt.

- Loss of Use Coverage: Similar to ALE, this coverage reimburses homeowners for additional living expenses incurred when they are temporarily unable to use their home due to a covered loss.

- Medical Payments Coverage: This coverage provides for medical expenses for injuries sustained by guests on your property, regardless of liability. It's a no-fault coverage, meaning it pays out regardless of who is at fault.

| Component | Coverage Description |

|---|---|

| Dwelling Coverage | Covers the physical structure of the home. |

| Personal Property Coverage | Protects the contents of the home. |

| Liability Coverage | Covers legal and medical expenses for third-party claims. |

| Additional Living Expenses (ALE) | Reimburses costs for temporary housing during repairs. |

| Loss of Use Coverage | Covers additional living expenses during home uninhabitability. |

| Medical Payments Coverage | Pays for medical expenses for guests injured on the property. |

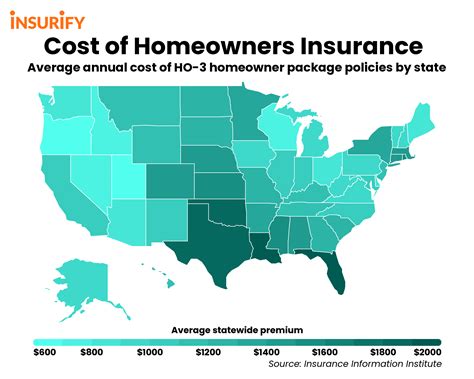

Considerations for Homeowners’ Insurance

When selecting a homeowners’ insurance policy, several factors should be considered to ensure adequate coverage:

- Coverage Limits: Ensure the policy limits are sufficient to cover the cost of rebuilding your home and replacing your belongings. Consider the potential for inflation and the cost of labor and materials in your area.

- Perils Covered: Review the policy's list of covered perils. Standard policies often exclude certain events, such as floods or earthquakes, which may require separate coverage.

- Deductibles: Choose a deductible that aligns with your financial comfort level. Higher deductibles can lower your premium, but they also mean you'll pay more out of pocket in the event of a claim.

- Discounts: Many insurers offer discounts for policy bundling (combining homeowners' and auto insurance), as well as for safety features like smoke detectors, security systems, and fire-resistant roofs.

Auto Insurance: Navigating the Road with Confidence

Auto insurance is a legal requirement in most states and an essential component of responsible vehicle ownership. It provides financial protection against physical damage, bodily injury, and liability arising from road accidents, vandalism, and other covered events.

Key Coverages in Auto Insurance

Auto insurance policies typically offer a range of coverages, each addressing different aspects of vehicle ownership and usage:

- Liability Coverage: This coverage is mandatory in most states and provides financial protection against claims arising from bodily injury or property damage caused by the policyholder.

- Collision Coverage: This optional coverage pays for the repair or replacement of the insured vehicle if it's damaged in a collision, regardless of fault.

- Comprehensive Coverage: This coverage protects against damage to the insured vehicle caused by events other than collision, such as theft, vandalism, fire, or natural disasters.

- Personal Injury Protection (PIP): Also known as No-Fault Insurance, PIP covers medical expenses and lost wages for the policyholder and their passengers, regardless of who is at fault in an accident.

- Medical Payments Coverage: Similar to PIP, this coverage pays for medical expenses for the policyholder and their passengers in an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder in case of an accident with a driver who either has no insurance or does not have enough insurance to cover the damages.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers bodily injury and property damage caused by the policyholder. |

| Collision Coverage | Pays for repairs or replacement of the insured vehicle after a collision. |

| Comprehensive Coverage | Protects against non-collision events like theft, vandalism, and natural disasters. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for the policyholder and passengers. |

| Medical Payments Coverage | Pays for medical expenses for the policyholder and passengers. |

| Uninsured/Underinsured Motorist Coverage | Protects the policyholder in case of an accident with an uninsured or underinsured driver. |

Factors Affecting Auto Insurance Premiums

Several factors influence the cost of auto insurance premiums, including:

- Vehicle Type: The make, model, and year of the vehicle can impact insurance costs. Sports cars and luxury vehicles often have higher premiums due to their higher replacement costs and potential for higher speeds and accidents.

- Driver Profile: The age, gender, driving record, and credit score of the primary driver can significantly affect insurance premiums. Younger drivers and those with a history of accidents or traffic violations may pay higher rates.

- Location: The area where the vehicle is primarily garaged can impact insurance costs. Urban areas often have higher premiums due to higher risks of accidents and theft.

- Coverage Options and Deductibles: The more coverage and higher limits chosen, the higher the premium. Similarly, a higher deductible can lower premiums, as it reduces the insurer's risk.

Conclusion: Navigating the Insurance Landscape

Understanding the intricacies of homeowners’ and auto insurance is a crucial step in protecting your assets and financial well-being. By selecting the right policies and coverage limits, you can ensure you’re adequately protected against a range of risks. Remember, insurance is a vital tool for managing risk, and the right coverage can provide peace of mind and financial security.

How often should I review my homeowners’ and auto insurance policies?

+It’s recommended to review your insurance policies annually or whenever there are significant changes to your circumstances, such as home renovations, the addition of a teen driver, or the purchase of valuable possessions.

What are some common exclusions in homeowners’ insurance policies?

+Common exclusions in homeowners’ insurance policies include damage caused by floods, earthquakes, and nuclear incidents. It’s essential to review your policy’s exclusions to understand what perils are not covered.

Can I bundle my homeowners’ and auto insurance policies for discounts?

+Yes, many insurance companies offer discounts for policy bundling. By combining your homeowners’ and auto insurance policies with the same insurer, you can often save money on your premiums.