Best Supplemental Health Insurance

In today's dynamic healthcare landscape, understanding the intricacies of supplemental health insurance is crucial for making informed decisions about your well-being and financial security. Supplemental health insurance plans are designed to complement your primary insurance coverage, filling in gaps and providing additional benefits to ensure comprehensive protection.

This comprehensive guide aims to delve into the world of supplemental health insurance, exploring its key features, benefits, and how it can enhance your overall healthcare experience. By examining real-world examples and industry data, we will provide you with the knowledge to navigate the complexities of these plans and make choices that align with your unique needs.

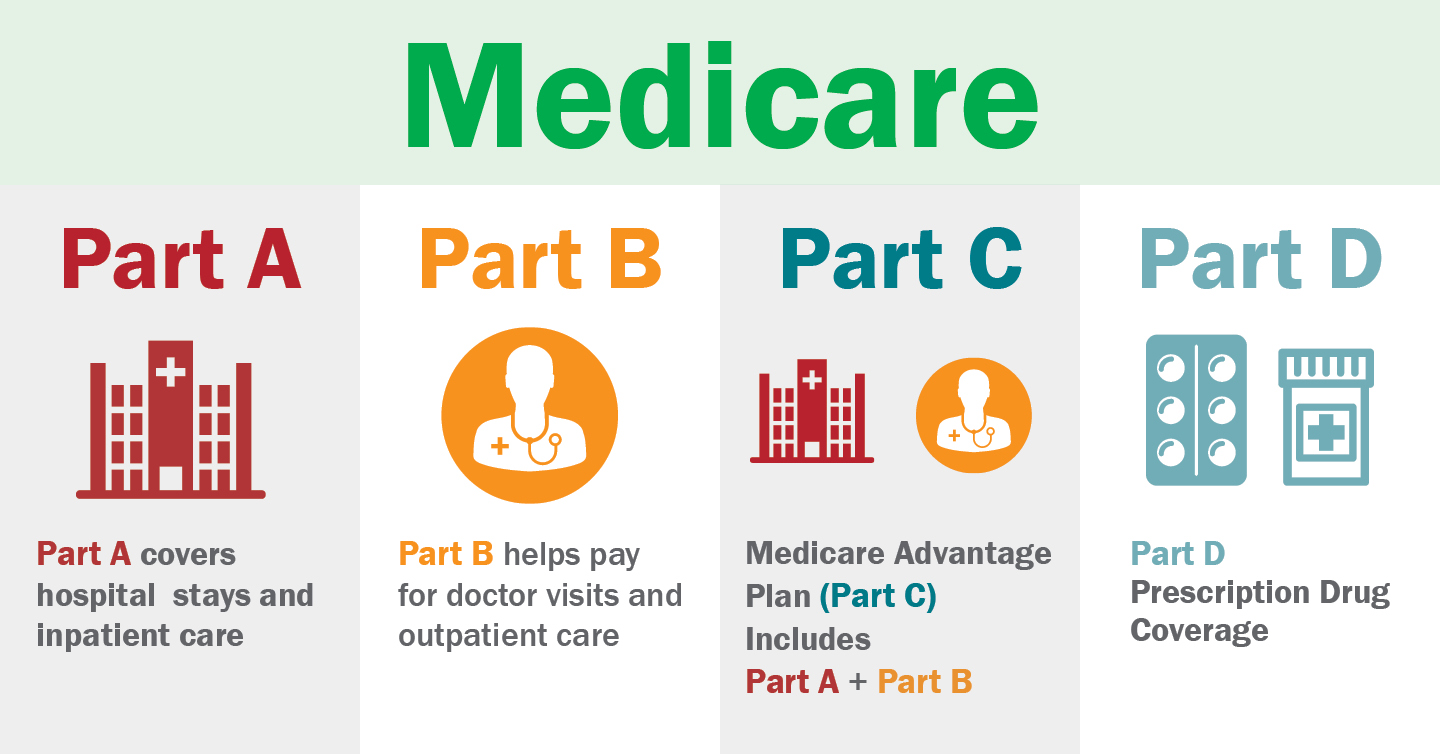

Understanding Supplemental Health Insurance

Supplemental health insurance, often referred to as ancillary or gap insurance, serves as an essential complement to your primary health insurance plan. It is specifically tailored to address the limitations and exclusions that may be present in your base coverage, ensuring you receive the most comprehensive healthcare benefits possible.

The primary function of supplemental insurance is to provide financial support for services and treatments that may not be fully covered by your primary plan. This can include a wide range of benefits, from routine wellness checks and dental care to more specialized services like vision correction and prescription medication coverage.

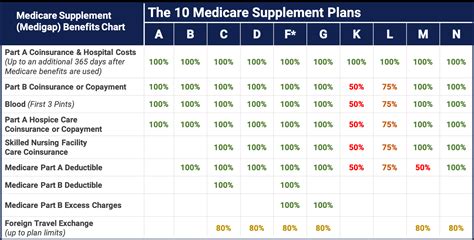

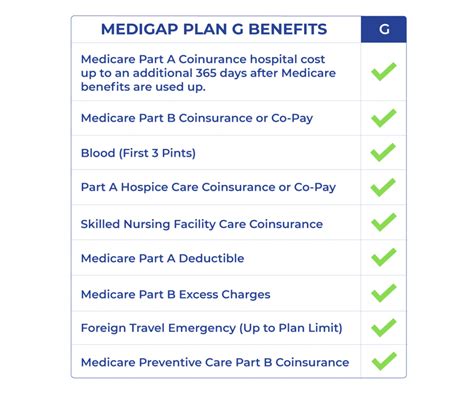

Key Features of Supplemental Health Insurance Plans

These plans are characterized by their flexibility and customization. They offer a range of features that can be tailored to meet the specific needs of individuals and families. Here are some key components that you can expect from a supplemental health insurance plan:

- Routine Care Coverage: Many plans cover routine medical check-ups, screenings, and preventative care services, ensuring you can maintain your health proactively.

- Dental and Vision Benefits: Supplemental insurance often includes coverage for dental procedures, eye exams, and prescription eyewear, providing comprehensive vision and oral health support.

- Prescription Drug Coverage: Plans may offer assistance with prescription medication costs, helping to manage the financial burden of ongoing medical treatments.

- Critical Illness Protection: Some policies provide specific coverage for critical illnesses like cancer, heart disease, or stroke, offering financial support during challenging times.

- Accidental Injury and Sickness Benefits: These plans can cover expenses related to accidental injuries and illnesses, providing peace of mind in unforeseen circumstances.

- Hospitalization Benefits: Supplemental insurance may offer additional benefits for hospital stays, including daily allowances and coverage for certain outpatient procedures.

- Travel Assistance: Certain plans provide travel-related benefits, such as emergency medical assistance and transportation coverage when traveling abroad.

The Importance of Customization in Supplemental Health Insurance

One of the most significant advantages of supplemental health insurance is its ability to be customized to your unique healthcare needs. Unlike primary insurance plans, which often have standardized benefits, supplemental insurance allows you to choose the specific coverage that aligns with your personal health priorities.

For instance, if you or a family member has a history of vision problems, you can opt for a plan with robust vision coverage, including regular eye exams and a generous allowance for prescription lenses. Similarly, if dental care is a priority, you can select a plan that offers comprehensive dental benefits, covering everything from routine cleanings to more complex procedures.

Real-World Examples of Customized Supplemental Plans

Let’s consider a few scenarios where customized supplemental health insurance plans have made a significant difference in individuals’ lives:

- Family with a History of Heart Disease: The Jones family, with a genetic predisposition to heart disease, chose a supplemental plan that offered extensive coverage for cardiac-related treatments. This included coverage for regular check-ups, diagnostic tests, and even cardiac rehabilitation programs, providing them with the necessary support to manage their health proactively.

- Active Individual with Outdoor Pursuits: John, an avid hiker and camper, opted for a supplemental plan that covered accidental injuries sustained during outdoor activities. This plan provided peace of mind, ensuring that any emergency medical expenses incurred while exploring the great outdoors were covered.

- Elderly Couple with Age-Related Health Concerns: Mr. and Mrs. Smith, in their golden years, selected a plan that focused on age-related health issues. Their supplemental insurance covered regular geriatric check-ups, prescription medications for chronic conditions, and even provided a daily allowance for assisted living expenses, ensuring they could age comfortably and with dignity.

Performance Analysis and Industry Insights

When it comes to choosing the best supplemental health insurance, it’s essential to examine real-world performance data and industry trends. Analyzing the success and popularity of various plans can provide valuable insights into which options are most beneficial for consumers.

Top-Performing Supplemental Health Insurance Plans

Based on industry data and customer feedback, here are some of the leading supplemental health insurance plans that consistently deliver exceptional value and coverage:

| Plan Name | Key Benefits | Coverage Highlights |

|---|---|---|

| WellnessPlus | Comprehensive routine care coverage, including annual check-ups and preventative screenings. | Offers a generous wellness allowance and covers a wide range of preventative services. |

| VisionClear | Specialized vision care plan, covering eye exams, prescription lenses, and even LASIK procedures. | Provides an annual allowance for vision-related expenses and includes discounts on eyewear. |

| DentalPro | Comprehensive dental plan, covering routine cleanings, fillings, and even orthodontics. | Offers a high annual maximum and covers a broad spectrum of dental procedures. |

| PrescriptionSaver | Plan designed to reduce prescription medication costs, covering a wide range of drugs. | Provides significant savings on brand-name and generic medications, making ongoing treatments more affordable. |

| AccidentCare | Specialized plan for accidental injuries, covering emergency treatments and rehabilitation. | Offers a daily allowance for hospital stays and covers a broad range of accident-related expenses. |

Industry Trends and Future Implications

The supplemental health insurance industry is continuously evolving, with insurers adapting to meet the changing needs of consumers. Here are some key trends and insights to consider:

- Focus on Preventative Care: There is a growing emphasis on preventative healthcare, with many insurers offering supplemental plans that incentivize regular check-ups and screenings. This shift towards proactive health management is expected to continue, with more comprehensive wellness benefits becoming standard.

- Personalized Medicine: As the field of medicine advances, supplemental insurance plans are likely to offer more tailored benefits based on an individual's genetic makeup and specific health risks. This could include customized medication plans and targeted preventative measures.

- Integration with Digital Health Solutions: With the rise of digital health technologies, insurers are exploring partnerships with telehealth and health tracking apps. This integration could lead to more efficient claim processing and personalized health management solutions.

- Expanded Mental Health Coverage: Recognizing the importance of mental health, many insurers are expanding their supplemental plans to include more comprehensive mental health benefits, such as coverage for therapy sessions and psychiatric care.

FAQs

What is the difference between primary and supplemental health insurance?

+

Primary health insurance is the foundational coverage that typically pays for the majority of your medical expenses. Supplemental insurance, on the other hand, is designed to fill in the gaps left by your primary plan, providing additional benefits and financial support.

How do I choose the right supplemental health insurance plan for me?

+

When selecting a supplemental plan, consider your unique health needs and priorities. Assess the benefits offered by different plans and choose the one that provides the most comprehensive coverage for your specific requirements. Consulting with an insurance expert can also be beneficial in making an informed decision.

Are there any age restrictions for supplemental health insurance plans?

+

Age restrictions can vary depending on the insurer and the specific plan. Some plans are designed for all ages, while others may have age limits or offer specialized coverage for certain age groups. It’s essential to review the terms and conditions of each plan to understand any age-related requirements or benefits.