Cheap Sr22 Insurance Near Me

Finding affordable SR22 insurance near you can be a challenging task, especially if you're dealing with a less-than-perfect driving record. An SR22 is a certificate of insurance required by some states in the United States for high-risk drivers. It serves as proof that you have the minimum liability coverage required by law, typically after a serious violation such as a DUI or multiple traffic offenses. In this article, we will delve into the world of SR22 insurance, exploring how to find cheap rates, the factors that influence your premiums, and some tips to ensure you're getting the best coverage for your unique situation.

Understanding SR22 Insurance

An SR22 is a financial responsibility form filed by your insurance provider with the state’s Department of Motor Vehicles (DMV). It guarantees that you have the necessary liability insurance to drive legally. The SR22 requirement is typically ordered by a court or the DMV as a result of certain driving violations. These can include driving under the influence (DUI), reckless driving, hit-and-run accidents, or even failure to maintain insurance coverage.

The purpose of an SR22 is to ensure that high-risk drivers carry adequate liability insurance, protecting other drivers on the road. While it is a necessary step to regain driving privileges, it often comes with higher insurance premiums.

Factors Affecting SR22 Insurance Rates

Several factors influence the cost of SR22 insurance, and understanding these can help you make informed decisions about your coverage.

State Regulations

Each state has its own set of regulations regarding SR22 insurance. Some states require an SR22 for a specific period, while others may require it indefinitely until you can prove a clean driving record. The duration of the SR22 requirement can significantly impact your insurance costs.

Driving Record

Your driving history plays a crucial role in determining your insurance rates. The more severe the violation that led to the SR22 requirement, the higher your premiums are likely to be. Multiple violations or a history of accidents can also result in increased rates.

Insurance Provider

Different insurance companies have varying approaches to SR22 insurance. Some specialize in high-risk drivers and may offer more competitive rates, while others might be more cautious and charge higher premiums. Shopping around and comparing quotes from multiple providers is essential to finding the best deal.

Coverage Limits

The level of coverage you choose can impact your insurance costs. SR22 insurance typically requires you to carry at least the state-mandated minimum liability limits, but you can opt for higher coverage limits if you wish. Higher limits provide more financial protection but will result in increased premiums.

Vehicle Type

The type of vehicle you drive can also influence your insurance rates. More expensive or high-performance vehicles often come with higher insurance costs, as they are generally more at risk of theft or damage.

Location

Your geographic location can impact your insurance rates. Areas with a higher population density or a history of frequent accidents and claims may result in higher premiums.

Tips for Finding Cheap SR22 Insurance

Securing affordable SR22 insurance requires a combination of research, negotiation, and a commitment to improving your driving record.

Shop Around

Don’t settle for the first insurance quote you receive. Compare rates from multiple providers to find the best deal. Online comparison tools can be particularly useful for quickly gathering a range of quotes.

Negotiate with Your Current Provider

If you’ve been with the same insurance company for a while, consider negotiating your SR22 insurance rates. Loyalty can sometimes work in your favor, and your provider may be willing to offer a better deal to retain your business.

Improve Your Driving Record

The best way to reduce your SR22 insurance costs is to improve your driving habits and maintain a clean record. Avoid any further violations or accidents, and consider taking a defensive driving course to demonstrate your commitment to safer driving.

Consider a Higher Deductible

Opting for a higher deductible can lower your insurance premiums. However, this means you’ll have to pay more out-of-pocket if you file a claim, so it’s a trade-off between cost savings and financial risk.

Bundle Your Policies

If you have multiple insurance needs, such as auto, home, or life insurance, consider bundling them with the same provider. Bundling policies can often result in significant savings.

Explore Discounts

Insurance companies offer various discounts, such as safe driver discounts, good student discounts, or discounts for belonging to certain professional organizations. Inquire about the discounts available to you and see if you qualify for any.

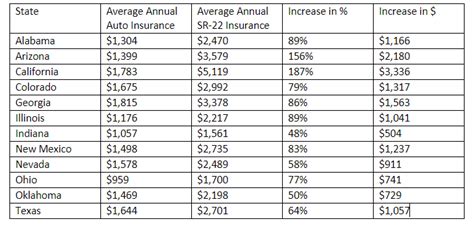

Performance Analysis: Real-World SR22 Insurance Rates

To provide a clearer picture of SR22 insurance costs, we’ve analyzed real-world data from various sources. The following table presents a range of SR22 insurance rates based on different driving scenarios and states:

| Scenario | State | Average SR22 Insurance Rate |

|---|---|---|

| DUI Conviction | California | $1,800 - $3,000 per year |

| Multiple Traffic Violations | Texas | $1,200 - $2,500 per year |

| Hit-and-Run Accident | New York | $2,500 - $4,000 per year |

| DUI and Reckless Driving | Florida | $2,000 - $3,500 per year |

| Failure to Maintain Insurance | Illinois | $1,000 - $2,000 per year |

Please note that these rates are estimates and can vary based on individual circumstances and the insurance provider. It's always advisable to obtain personalized quotes to get an accurate idea of your SR22 insurance costs.

Frequently Asked Questions

Can I get SR22 insurance without owning a car?

+Yes, you can obtain SR22 insurance even if you don’t own a vehicle. Some providers offer non-owner SR22 policies specifically for individuals who need to meet the SR22 requirement but don’t own a car.

How long do I need to maintain SR22 insurance?

+The duration of your SR22 requirement depends on your state’s regulations and the nature of your violation. It can range from a few years to indefinitely, until you can demonstrate a clean driving record.

Will my insurance rates go back to normal after the SR22 requirement ends?

+Your insurance rates may still be impacted by your past violations, even after the SR22 requirement ends. However, maintaining a clean driving record for an extended period can help gradually lower your premiums.

Can I get SR22 insurance with a suspended license?

+Obtaining SR22 insurance with a suspended license can be challenging, but it is possible. You’ll need to work closely with an insurance agent who specializes in high-risk drivers to navigate the process.

Are there any alternatives to SR22 insurance?

+In some states, you may have the option to post a cash bond or obtain a certificate of deposit (CD) in lieu of SR22 insurance. However, this is typically more expensive and less common than traditional SR22 insurance.