Car Insurance For One Day

In today's fast-paced world, where convenience and flexibility are highly valued, the concept of one-day car insurance has emerged as a practical solution for temporary coverage needs. This innovative insurance option offers motorists a unique and tailored approach to protecting their vehicles for short-term use, making it an ideal choice for various scenarios. From test drives and loaner cars to occasional road trips, one-day car insurance provides an efficient and cost-effective solution, ensuring that drivers can hit the road with peace of mind. In this comprehensive article, we delve into the intricacies of this short-term insurance coverage, exploring its benefits, suitability, and the key factors to consider when opting for this temporary insurance solution.

Understanding One-Day Car Insurance

One-day car insurance, as the name suggests, is a type of temporary automobile insurance that provides coverage for a single day or a specified short-term period. It is designed to cater to individuals who require insurance coverage for their vehicles on an occasional basis, without the need for a long-term policy. This form of insurance is particularly advantageous for those who infrequently use their vehicles or who wish to insure a car for a specific event or trip.

The concept of one-day car insurance is a departure from traditional auto insurance policies, which typically offer coverage for an extended period, such as six months or a year. With this flexible insurance option, drivers can tailor their coverage to their exact needs, whether it's for a few hours or an entire day. This level of customization not only ensures that drivers are adequately protected but also prevents them from paying for coverage they don't require, making it a cost-efficient choice.

The Benefits of One-Day Car Insurance

One-day car insurance offers a host of advantages, making it an attractive option for many motorists. Firstly, it provides convenience and flexibility for drivers who need temporary coverage. Whether it’s for a quick errand, a test drive, or a spontaneous road trip, this insurance type allows individuals to insure their vehicles quickly and easily without committing to a long-term policy.

Secondly, one-day car insurance is an affordable alternative to traditional policies. Since it is tailored to cover specific, short-term needs, it is typically more cost-effective than standard insurance plans. This makes it an ideal choice for those who wish to keep their insurance expenses low while still ensuring they are protected when they need to drive.

Additionally, this type of insurance reduces risk for both the driver and the insurer. By providing coverage only for the period when the vehicle is in use, it minimizes the exposure to potential claims and thus, reduces the overall risk. This risk mitigation strategy benefits both parties, as it keeps insurance premiums low and ensures that the coverage provided is tailored to the actual needs of the driver.

Suitable Scenarios for One-Day Car Insurance

One-day car insurance is a versatile solution that can cater to a wide range of scenarios. Here are some situations where this type of insurance could be beneficial:

- Test Drives: When purchasing a new or used vehicle, taking it for a test drive is essential. With one-day car insurance, you can insure the vehicle for the duration of the test drive, ensuring both your safety and the safety of others on the road.

- Loaned or Borrowed Vehicles: If you're borrowing a friend's car for a day or need to insure a rental car for a short period, one-day insurance is a convenient and cost-effective solution.

- Occasional Driving: If you only drive your vehicle occasionally, such as for weekend getaways or special events, one-day insurance can provide coverage for those specific trips without the need for a full-year policy.

- Business Use: For businesses that occasionally need to use a vehicle, such as for deliveries or client meetings, one-day insurance can be a flexible and affordable option.

- Road Trips: Planning a spontaneous road trip but don't want to commit to a long-term insurance policy? One-day insurance allows you to insure your vehicle for the duration of your trip, ensuring you're covered wherever your travels take you.

Factors to Consider When Choosing One-Day Car Insurance

While one-day car insurance offers numerous benefits, there are several factors that motorists should consider before opting for this temporary coverage. These considerations will help ensure that the chosen insurance plan aligns with their specific needs and circumstances.

Coverage Options

One-day car insurance policies can vary in the types of coverage they offer. It’s essential to understand the different coverage options available, such as liability, collision, comprehensive, and personal injury protection (PIP). Each of these coverages serves a specific purpose, and choosing the right combination will depend on the intended use of the vehicle and the level of protection desired.

| Coverage Type | Description |

|---|---|

| Liability | Covers bodily injury and property damage to others if you are at fault in an accident. |

| Collision | Pays for damages to your vehicle if you collide with another vehicle or object. |

| Comprehensive | Provides coverage for damages caused by non-collision events, such as theft, vandalism, or natural disasters. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers, regardless of fault. |

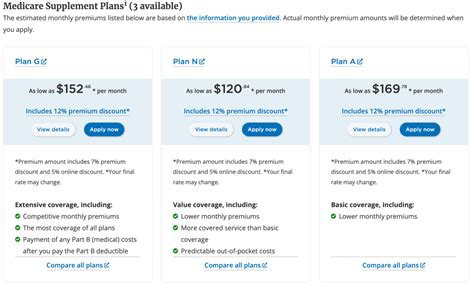

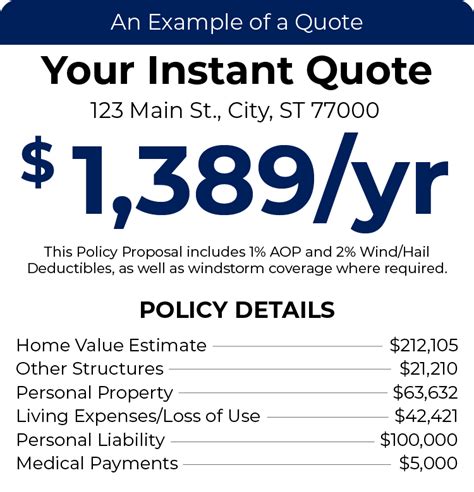

Cost and Pricing

The cost of one-day car insurance can vary based on several factors, including the coverage selected, the driver’s age and driving record, the make and model of the vehicle, and the location where the vehicle will be driven. It’s crucial to compare quotes from different insurers to find the most competitive rates. Additionally, some insurers may offer discounts for purchasing one-day insurance online or for being a loyal customer.

Policy Limitations and Exclusions

While one-day car insurance offers flexibility and convenience, it’s important to be aware of any policy limitations or exclusions. Some insurers may have restrictions on the age of the driver or the type of vehicle that can be insured. Additionally, certain activities, such as off-roading or participating in racing events, may not be covered by one-day insurance policies. It’s crucial to carefully review the policy details to understand any restrictions and ensure that the coverage aligns with your intended use.

Claim Process and Customer Service

In the event of an accident or claim, it’s essential to understand the insurer’s claim process and the level of customer service they provide. Look for insurers that offer a straightforward and efficient claim process, with clear guidelines and timely response times. Additionally, consider the availability of customer service representatives and the quality of their support. Having a responsive and knowledgeable customer service team can make a significant difference in ensuring a smooth claims experience.

Comparing One-Day Car Insurance Policies

When considering one-day car insurance, it’s beneficial to compare different policies to find the best fit for your needs. Here are some key factors to consider when evaluating different options:

- Coverage Options: Ensure that the policy offers the specific coverages you require, whether it's liability-only coverage or a more comprehensive plan.

- Price and Discounts: Compare the prices of different insurers and look for any available discounts, such as multi-policy discounts or loyalty rewards.

- Policy Limits: Understand the policy limits for each type of coverage to ensure they align with your needs and provide adequate protection.

- Deductibles: Consider the deductibles associated with each coverage type. A higher deductible can lower the premium, but it also means you'll pay more out-of-pocket in the event of a claim.

- Policy Add-ons: Some insurers may offer additional policy add-ons, such as roadside assistance or rental car coverage, which can enhance your protection.

- Customer Reviews: Read customer reviews and ratings to gauge the insurer's reputation and the level of satisfaction their customers have with the service and coverage provided.

How to Obtain One-Day Car Insurance

Obtaining one-day car insurance is a straightforward process. Many insurers offer this type of coverage online, allowing you to purchase a policy in just a few clicks. Here’s a step-by-step guide to help you through the process:

- Research Insurers: Start by researching reputable insurers that offer one-day car insurance. Look for insurers with a strong track record and positive customer reviews.

- Compare Policies: Compare the coverage options, prices, and any additional benefits offered by different insurers. Use online comparison tools or directly visit the insurers' websites to gather quotes and information.

- Select Coverage: Choose the coverage options that best suit your needs. Consider the intended use of the vehicle and the level of protection you require.

- Provide Information: You'll need to provide personal and vehicle information, including your name, date of birth, driver's license number, and the make, model, and year of your vehicle.

- Make Payment: Once you've selected your coverage and provided the necessary information, you'll be prompted to make a payment. Most insurers accept various payment methods, including credit cards, debit cards, and online payment services.

- Receive Policy: After your payment is processed, you'll receive your one-day car insurance policy. This policy will include important details such as the effective dates of coverage, the coverages included, and any exclusions or limitations.

- Print or Save Policy: It's a good idea to print or save a copy of your policy for easy reference. You may also want to keep a digital copy on your phone or email for quick access.

One-Day Car Insurance vs. Other Temporary Insurance Options

While one-day car insurance is a popular choice for temporary coverage, it’s not the only option available. Here’s a comparison of one-day insurance with other temporary insurance solutions:

One-Day Insurance vs. Short-Term Insurance

Short-term insurance, also known as temporary insurance, is similar to one-day insurance but typically offers coverage for a longer period, such as a month or three months. While both options provide flexibility for temporary coverage needs, one-day insurance is ideal for very short-term use, such as a single day or a weekend, whereas short-term insurance is more suitable for extended temporary coverage requirements.

One-Day Insurance vs. Rental Car Insurance

When renting a car, you often have the option to purchase insurance from the rental company. This rental car insurance typically provides coverage for the duration of the rental period. While one-day car insurance can be used for rental cars, it’s important to compare the coverage and prices offered by the rental company with those of one-day insurance providers. This comparison will help you determine the most cost-effective and suitable option for your rental car needs.

The Future of One-Day Car Insurance

As the automotive and insurance industries continue to evolve, the demand for flexible and tailored insurance solutions, such as one-day car insurance, is likely to increase. With the rise of shared mobility services, such as car-sharing and ride-hailing platforms, the need for short-term insurance coverage will only grow. Insurers will need to adapt and offer innovative solutions to meet the changing needs of consumers.

Additionally, advancements in technology, such as the use of telematics and real-time data analysis, will play a significant role in shaping the future of one-day car insurance. Telematics devices, which track driving behavior and vehicle usage, can provide insurers with valuable data to offer more accurate and personalized quotes for short-term insurance policies. This technology can also help insurers identify and reward safe drivers with lower premiums, further enhancing the benefits of one-day car insurance.

Can I purchase one-day car insurance for multiple days if needed?

+Yes, you can purchase one-day car insurance for multiple days to cover a longer period. Many insurers offer the option to extend your coverage for additional days, allowing you to tailor your policy to your specific needs.

Do I need to provide any additional information or documentation to obtain one-day car insurance?

+In most cases, you will only need to provide basic personal and vehicle information to purchase one-day car insurance. However, some insurers may require additional documentation, such as proof of identity or a valid driver’s license, to verify your eligibility for coverage.

Can I add additional drivers to my one-day car insurance policy?

+Yes, many insurers allow you to add additional drivers to your one-day car insurance policy. This can be beneficial if you’re planning to share the driving responsibilities during your trip or if you need to insure a vehicle that will be driven by multiple people.