Cheap Instant Auto Insurance

In today's fast-paced world, finding affordable and instant insurance solutions is a top priority for many individuals. With the rise of technology and a growing demand for convenience, the insurance industry has adapted, offering innovative options like cheap instant auto insurance. This type of insurance provides a quick and cost-effective way to obtain coverage for your vehicle, ensuring peace of mind without breaking the bank. In this comprehensive guide, we will delve into the world of cheap instant auto insurance, exploring its benefits, how it works, and why it has become a popular choice for vehicle owners worldwide.

Understanding Cheap Instant Auto Insurance

Cheap instant auto insurance, as the name suggests, offers an immediate and affordable solution for vehicle insurance. It is designed to cater to individuals who seek a swift and straightforward process without compromising on coverage. This type of insurance has gained popularity due to its accessibility, convenience, and ability to provide comprehensive protection at competitive rates.

Unlike traditional insurance policies that often require extensive paperwork, multiple quotes, and lengthy wait times, cheap instant auto insurance aims to simplify the entire process. By leveraging advanced technology and a streamlined approach, insurance providers can offer real-time quotes and instant coverage, allowing individuals to secure the protection they need within minutes.

Key Features and Advantages

Cheap instant auto insurance boasts several features and advantages that make it an attractive option for vehicle owners:

- Instant Quotes: One of the standout features is the ability to obtain instant quotes online. By providing basic information about your vehicle and driving history, you can receive a personalized quote within seconds. This eliminates the need for multiple phone calls or meetings with insurance agents.

- Quick Coverage: Once you accept the quote, coverage is often immediate. You can receive your policy documents electronically, allowing you to start driving with peace of mind right away.

- Flexible Payment Options: Many cheap instant auto insurance providers offer flexible payment plans, including monthly or quarterly installments, making it easier to manage your insurance costs.

- Comprehensive Coverage: Despite the affordable nature of this insurance, it typically provides comprehensive coverage, including liability, collision, and comprehensive protection. Some providers even offer additional coverage options such as rental car reimbursement or roadside assistance.

- Discounts and Savings: Cheap instant auto insurance often comes with various discounts. These can include safe driver discounts, multi-policy discounts, and loyalty rewards, helping you save even more on your insurance premiums.

How Cheap Instant Auto Insurance Works

The process of obtaining cheap instant auto insurance is straightforward and user-friendly. Here’s a step-by-step breakdown of how it typically works:

- Online Quote Request: You start by visiting the insurance provider's website and filling out a simple online form. This form typically asks for basic information such as your name, address, vehicle make and model, and driving history.

- Instant Quote Generation: Within seconds of submitting your information, the insurance provider's system generates a personalized quote based on your details and the coverage options you select.

- Review and Compare: You can review the quote and compare it with other providers if desired. Many insurance comparison websites make this process even easier by allowing you to see multiple quotes side by side.

- Acceptance and Payment: If you're satisfied with the quote, you can proceed to accept the offer and make the initial payment. Payment methods often include credit/debit cards or online banking.

- Instant Coverage: Upon payment confirmation, your coverage becomes effective immediately. You will receive an electronic copy of your policy documents, providing proof of insurance.

- Policy Management: Most cheap instant auto insurance providers offer online policy management tools. You can make changes to your policy, add additional drivers, or update your personal information directly through their website or mobile app.

Real-World Examples and Case Studies

To illustrate the benefits of cheap instant auto insurance, let’s explore a few real-world examples and case studies:

| Scenario | Cheap Instant Auto Insurance | Traditional Insurance |

|---|---|---|

| John, a young professional, needs insurance for his new car. |

|

|

| Sarah, a busy mom, needs to insure her family's second car. |

|

|

| Mike, a student, needs insurance for his first car. |

|

|

Choosing the Right Cheap Instant Auto Insurance Provider

With numerous cheap instant auto insurance providers available, it’s essential to choose one that suits your specific needs and preferences. Here are some factors to consider when making your decision:

- Coverage Options: Ensure the provider offers the type of coverage you require, whether it's basic liability, comprehensive, or specialized coverage for high-performance vehicles.

- Reputation and Financial Stability: Research the provider's reputation and financial standing. Look for customer reviews and ratings to gauge their reliability and customer satisfaction.

- Discounts and Rewards: Explore the provider's discount offerings. Common discounts include safe driver, multi-policy, and loyalty rewards. These can significantly reduce your insurance costs over time.

- Customer Service: Evaluate the provider's customer support options. Check if they offer 24/7 assistance, live chat, or dedicated phone lines for quick resolution of any issues or queries.

- Online Tools and Resources: Assess the provider's digital capabilities. Look for user-friendly websites, mobile apps, and online policy management tools that allow you to easily make changes to your policy or access important documents.

Top Cheap Instant Auto Insurance Providers

While there are numerous providers offering cheap instant auto insurance, here are a few popular options worth considering:

- InsureMeNow: InsureMeNow is known for its fast and efficient quote process. They offer a wide range of coverage options, including specialty insurance for classic cars and high-risk drivers. Their customer support is highly rated, providing assistance via live chat and phone.

- InstantCover: InstantCover focuses on providing affordable insurance with a seamless online experience. They offer flexible payment plans and a user-friendly mobile app for policy management. Additionally, they provide 24/7 roadside assistance as an optional add-on.

- QuickInsure: QuickInsure is a well-established provider known for its competitive rates and comprehensive coverage. They offer discounts for safe driving, multi-policy bundles, and loyalty rewards. Their website provides an intuitive quote process and allows you to compare multiple quotes side by side.

Tips for Maximizing Savings and Coverage

To make the most of your cheap instant auto insurance experience, here are some tips to consider:

- Shop Around: Compare quotes from multiple providers to find the best deal. Online insurance comparison websites can be a valuable tool for this purpose.

- Bundle Policies: If you have multiple vehicles or own a home, consider bundling your insurance policies. Many providers offer discounts for bundling auto and home insurance.

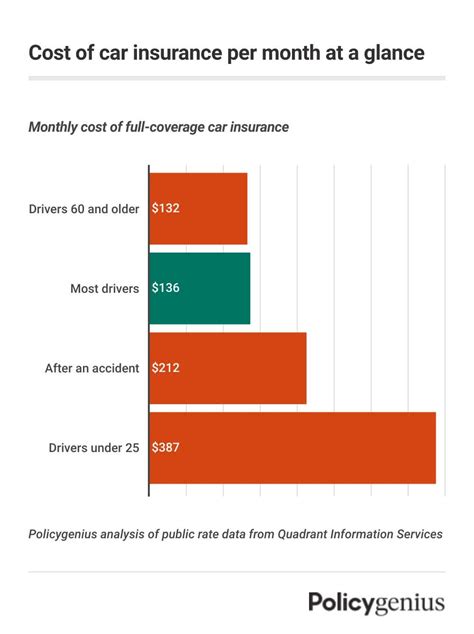

- Maintain a Clean Driving Record: A clean driving history can lead to significant savings. Avoid traffic violations and accidents to qualify for safe driver discounts.

- Increase Your Deductible: Opting for a higher deductible can reduce your insurance premiums. However, ensure you choose a deductible amount you can afford in case of an accident.

- Explore Optional Coverages: Evaluate your needs and consider adding optional coverages like rental car reimbursement or roadside assistance. These add-ons can provide extra peace of mind at a reasonable cost.

Future Trends and Innovations

The world of insurance is constantly evolving, and cheap instant auto insurance is no exception. Here are some future trends and innovations to watch out for:

- Telematics-Based Insurance: Telematics technology uses sensors and GPS to track driving behavior. This data is used to offer personalized insurance rates based on individual driving habits. Insurers are increasingly adopting this technology to provide more accurate and customized coverage.

- Blockchain Technology: Blockchain has the potential to revolutionize the insurance industry by enhancing security, transparency, and efficiency. It can streamline the claims process, reduce fraud, and provide a decentralized platform for policy management.

- AI-Powered Customer Service: Artificial Intelligence (AI) is being utilized to enhance customer support. Chatbots and virtual assistants can provide instant assistance, answer common queries, and guide customers through the insurance process.

- Pay-As-You-Drive Insurance: This innovative concept allows insurance premiums to be calculated based on actual miles driven. It provides flexibility for individuals with varying driving needs and can lead to significant savings for low-mileage drivers.

Conclusion

Cheap instant auto insurance offers a convenient and cost-effective solution for vehicle owners seeking comprehensive coverage. With its instant quotes, quick coverage, and flexible payment options, it has become a popular choice for individuals looking for a streamlined insurance experience. By understanding the features, benefits, and trends in this industry, you can make an informed decision and enjoy the peace of mind that comes with affordable and reliable auto insurance.

How do I know if cheap instant auto insurance is right for me?

+

Cheap instant auto insurance is ideal for individuals seeking a quick, affordable, and hassle-free insurance solution. It’s particularly beneficial for those who value convenience, have a clean driving record, and prefer a digital insurance experience. If you’re looking for immediate coverage, flexible payment options, and competitive rates, cheap instant auto insurance could be the perfect fit.

Are there any downsides to cheap instant auto insurance?

+

While cheap instant auto insurance offers many advantages, it’s important to consider potential downsides. Some providers may have limited coverage options or higher deductibles compared to traditional insurance. Additionally, instant quotes may not always capture all the details of your driving history, so it’s essential to carefully review the policy documents and understand the coverage provided.

Can I switch from traditional insurance to cheap instant auto insurance mid-policy term?

+

Yes, you can switch insurance providers at any time, including mid-policy term. However, it’s important to carefully review the terms and conditions of your current policy to understand any potential fees or penalties for canceling it early. Make sure to compare quotes and thoroughly understand the coverage and benefits offered by the new provider before making the switch.