Auto Insurance Per Month

Auto insurance is an essential aspect of vehicle ownership, providing financial protection in case of accidents, theft, or other mishaps. The cost of auto insurance varies greatly depending on several factors, including the type of coverage, the driver's profile, and the region. This comprehensive guide will delve into the world of auto insurance costs, specifically focusing on the average monthly premiums and the factors that influence them.

Understanding Auto Insurance Costs

Auto insurance is a contractual agreement between a policyholder and an insurance company. The policyholder pays a monthly premium, and in return, the insurance company agrees to provide financial coverage for specific types of losses as outlined in the policy. These losses can include damage to the insured vehicle, damage to other vehicles or property, and bodily injury claims. The cost of auto insurance is influenced by a multitude of factors, and understanding these factors is crucial to grasp the variations in monthly premiums.

Factors Influencing Auto Insurance Premiums

Several key factors contribute to the determination of auto insurance rates. These factors are used by insurance companies to assess the risk associated with insuring a particular driver and vehicle. Here are some of the primary considerations:

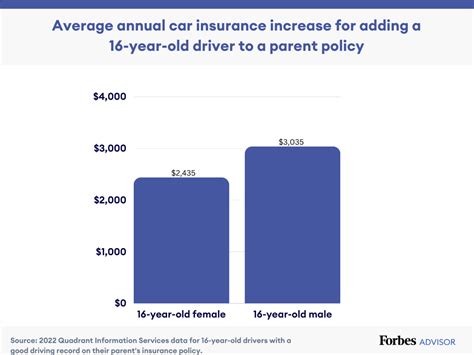

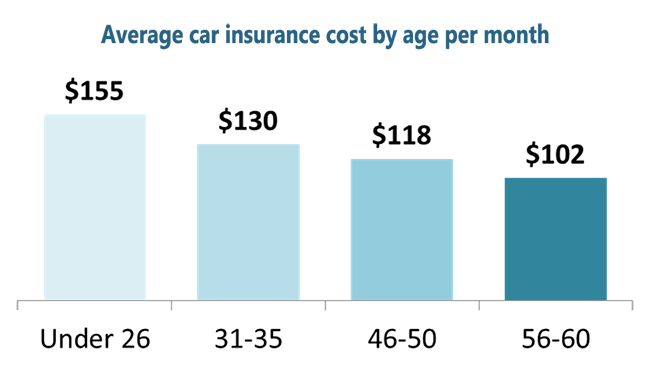

- Driver's Profile: The age, gender, driving history, and credit score of the driver significantly impact insurance rates. Younger drivers, especially males, are often considered higher-risk due to their propensity for accidents. A clean driving record with no accidents or violations can lead to lower premiums.

- Vehicle Type: The make, model, and year of the vehicle play a role in insurance costs. Sports cars and luxury vehicles typically attract higher premiums due to their expensive repair costs. Additionally, vehicles with advanced safety features may qualify for discounts.

- Coverage Level: The level of coverage chosen by the policyholder directly affects the monthly premium. Comprehensive coverage, which includes collision, liability, and uninsured motorist protection, is more expensive than basic liability-only coverage.

- Location: The region where the vehicle is primarily driven and garaged can impact insurance rates. Urban areas often have higher premiums due to increased traffic congestion and the higher likelihood of accidents and theft.

- Mileage: The number of miles driven annually can influence rates. High-mileage drivers may face higher premiums, as they are statistically more likely to be involved in accidents.

- Insurance Company: Different insurance companies have varying rate structures and offer different discounts. Shopping around and comparing quotes from multiple insurers can lead to significant savings.

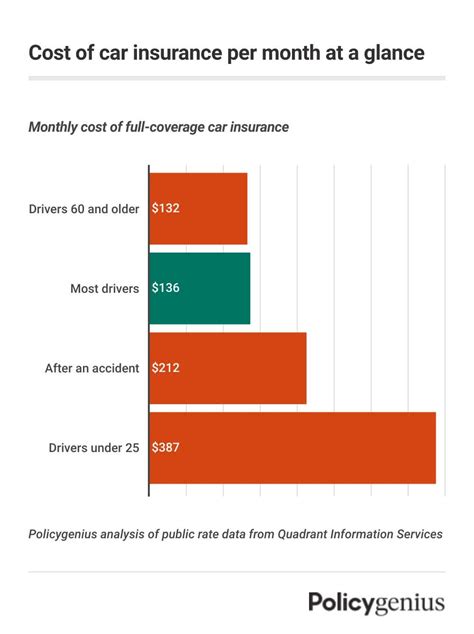

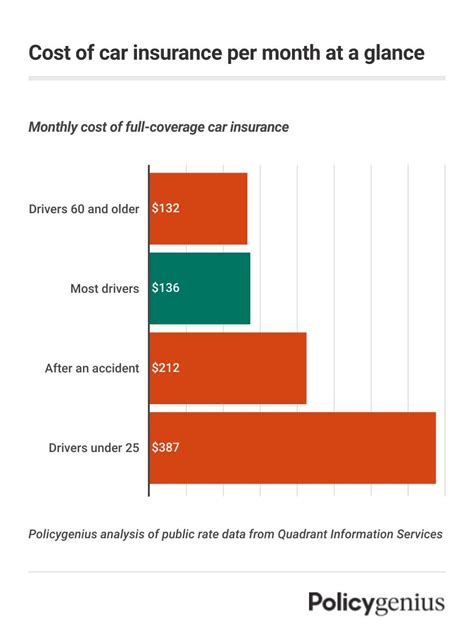

Average Monthly Auto Insurance Premiums

The average monthly auto insurance premium varies widely across the United States. According to the Insurance Information Institute, the national average for monthly auto insurance premiums was approximately $130 as of 2023. However, this average can be misleading, as it doesn’t account for the vast regional and individual variations.

Regional Variations

Insurance rates can differ significantly from state to state and even within regions of the same state. Factors such as the cost of living, traffic density, and the frequency of natural disasters all play a role in these variations. For instance, states with high population densities and heavy traffic, like California and New York, often have higher average premiums compared to more rural states.

| State | Average Monthly Premium |

|---|---|

| California | $160 |

| Texas | $120 |

| Florida | $140 |

| New York | $180 |

| Wisconsin | $100 |

The table above provides a glimpse into the regional variations in auto insurance premiums. It's important to note that these averages are estimates and may not reflect the exact rates for every individual in each state.

Individual Factors and Premium Variations

Beyond regional differences, individual factors such as the driver’s profile and the type of coverage chosen can lead to substantial variations in monthly premiums. For instance, a young male driver with a clean driving record may pay significantly less than an older driver with a history of accidents. Additionally, the choice of coverage level can result in wide-ranging premium differences. A policyholder who opts for comprehensive coverage with high liability limits will likely pay more than someone with basic liability-only coverage.

Strategies to Lower Monthly Auto Insurance Costs

While auto insurance is a necessary expense, there are strategies that policyholders can employ to potentially lower their monthly premiums. Here are some effective approaches:

- Shop Around: Compare quotes from multiple insurance companies. Rates can vary significantly between insurers, so shopping around can lead to substantial savings.

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance, under one provider.

- Maintain a Clean Driving Record: Avoid accidents and violations. A clean driving record can lead to lower premiums over time.

- Consider Higher Deductibles: Choosing a higher deductible can result in lower monthly premiums. However, it's important to ensure you can afford the deductible in case of a claim.

- Explore Discounts: Insurance companies often offer various discounts, such as safe driver discounts, good student discounts, and loyalty discounts. Be sure to inquire about all applicable discounts.

- Use Telematics Devices: Some insurance companies offer telematics devices or smartphone apps that track your driving behavior. Safe driving habits can lead to lower premiums.

Future Trends and Implications

The auto insurance industry is evolving, and several trends are likely to impact insurance rates in the coming years. One significant trend is the increasing adoption of autonomous vehicles. As self-driving cars become more prevalent, insurance companies will need to adjust their risk assessment models to account for the reduced human error factor. This could potentially lead to lower insurance premiums for autonomous vehicles.

Additionally, the rise of connected car technologies and telematics is enabling insurance companies to gather more precise data on driving behaviors. This data-driven approach allows insurers to offer personalized rates based on individual driving habits. Policyholders who demonstrate safe driving behaviors may be rewarded with lower premiums, while those with riskier driving patterns may face higher costs.

Furthermore, the increasing focus on sustainability and eco-friendly practices is likely to influence auto insurance rates. Insurance companies may offer incentives or discounts for policyholders who drive electric or hybrid vehicles, as these vehicles are generally considered safer and more environmentally friendly. This trend could encourage more drivers to adopt sustainable transportation options.

Conclusion

Understanding the factors that influence auto insurance rates and exploring strategies to lower monthly premiums can help policyholders make informed decisions. While the average monthly auto insurance premium provides a benchmark, individual circumstances and regional variations play a significant role in determining actual costs. By staying informed about industry trends and utilizing cost-saving strategies, policyholders can potentially reduce their insurance expenses while maintaining adequate coverage.

How often should I review my auto insurance policy and rates?

+It’s recommended to review your auto insurance policy and rates annually or whenever your circumstances change significantly. This includes changes in your driving record, vehicle, or personal situation. Regular reviews can help ensure you’re getting the best value and coverage for your needs.

Can I get auto insurance without owning a vehicle?

+Yes, it is possible to obtain auto insurance even if you don’t own a vehicle. This type of insurance, often called non-owner auto insurance, provides liability coverage for situations where you might be at fault while driving someone else’s car. It’s particularly useful for individuals who frequently borrow or rent vehicles.

What is comprehensive coverage, and is it necessary?

+Comprehensive coverage is an optional type of auto insurance that provides protection for damage caused by events other than collisions, such as theft, vandalism, natural disasters, or animal collisions. While it’s not legally required, comprehensive coverage is highly recommended, especially if your vehicle is financed or leased, as it can help cover the cost of repairs or replacements in unexpected situations.