Car Insurance For Disabled Veterans

Ensuring the well-being and financial security of our disabled veterans is a paramount concern, and car insurance plays a vital role in this regard. With unique circumstances and specific needs, disabled veterans require tailored insurance solutions to navigate the roads safely and securely. This comprehensive guide aims to shed light on the intricacies of car insurance for disabled veterans, offering insights, practical advice, and industry-backed information to empower these brave individuals in making informed decisions.

Understanding the Challenges: A Unique Perspective

Disabled veterans face a distinct set of challenges when it comes to car insurance. From physical disabilities impacting mobility to service-related injuries affecting driving abilities, these individuals require specialized considerations that traditional insurance policies might not adequately address. Understanding these challenges is the first step towards finding suitable coverage.

Physical disabilities can range from mobility issues that necessitate wheelchair accessibility to visual impairments that require adaptive driving technologies. Moreover, the impact of service-related injuries, such as post-traumatic stress disorder (PTSD) or traumatic brain injuries, can further complicate matters, influencing an individual's driving abilities and insurance requirements.

The Importance of Specialized Insurance

Traditional car insurance policies often fail to cater to the unique needs of disabled veterans. Standard policies might not offer sufficient coverage for specialized equipment, such as wheelchair lifts or modified controls, which are essential for disabled individuals to drive safely. Additionally, these policies may not provide adequate liability protection in the event of an accident involving a disabled driver, leaving veterans vulnerable to financial burdens.

Specialized insurance for disabled veterans, on the other hand, is designed to address these specific concerns. These policies recognize the importance of adaptive equipment, offering coverage for its replacement or repair in the event of an accident. Moreover, they provide enhanced liability protection, ensuring that veterans are not left financially strained due to their unique driving circumstances.

Navigating the Insurance Landscape

When exploring car insurance options, disabled veterans must carefully evaluate their needs and research insurance providers that offer tailored policies. Many insurance companies now recognize the importance of serving this demographic and have developed specialized products to cater to their requirements.

Key considerations when choosing an insurance provider include:

-

Adaptive Equipment Coverage: Ensure that the policy covers the cost of repairing or replacing specialized equipment, such as wheelchair lifts or hand controls.

-

Liability Protection: Look for policies that provide comprehensive liability coverage, taking into account the unique driving circumstances of disabled veterans.

-

Discounts and Benefits: Many insurance companies offer discounts or additional benefits to veterans, which can significantly reduce the cost of insurance.

-

Claims Process: Understand the insurer's claims process, especially regarding specialized equipment or unique circumstances, to ensure a smooth and efficient experience.

Tailored Coverage Options: A Comprehensive Overview

Car insurance for disabled veterans offers a range of coverage options designed to address specific needs. Understanding these options is crucial for veterans to make informed choices and ensure they have the right protection.

Comprehensive Coverage

Comprehensive insurance provides protection against a wide range of incidents, including accidents, theft, and damage caused by natural disasters or vandalism. For disabled veterans, this coverage is particularly important as it ensures financial protection for their vehicles, which may include specialized modifications or adaptive equipment.

Collision Coverage

Collision coverage is essential for disabled veterans, as it provides financial protection in the event of an accident. This coverage pays for the repair or replacement of the insured vehicle, regardless of who is at fault. For veterans with modified vehicles or specialized equipment, collision coverage is crucial to ensure they can quickly get back on the road after an accident.

Liability Coverage

Liability insurance is a critical component of any car insurance policy, and it becomes even more important for disabled veterans. This coverage protects the insured against claims for bodily injury or property damage caused to others in an accident. Given the unique driving circumstances of disabled veterans, having sufficient liability coverage is essential to safeguard their financial well-being.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, provides financial assistance for medical expenses resulting from an accident, regardless of fault. For disabled veterans, this coverage can be especially beneficial, as it ensures quick access to medical treatment without the delay of determining liability. MedPay can cover a range of expenses, including ambulance services, hospital stays, and rehabilitation costs.

Uninsured/Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage provides protection in the event of an accident with a driver who either does not have insurance or does not have sufficient coverage to compensate for the damages caused. This coverage is crucial for disabled veterans, as it ensures they are not left financially burdened in the event of an accident with an uninsured or underinsured driver.

Discounts and Benefits: Maximizing Savings

Car insurance providers often offer a range of discounts and benefits to veterans, which can significantly reduce the cost of insurance. Understanding these discounts and taking advantage of them can lead to substantial savings on insurance premiums.

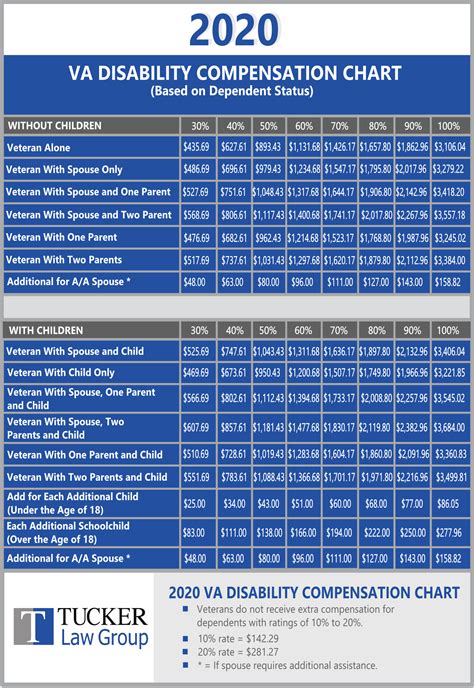

Veteran Discounts

Many insurance companies offer discounts specifically for veterans, recognizing their service and sacrifice. These discounts can be substantial, often ranging from 10% to 15% off the total premium. Veterans should inquire with insurance providers about these discounts and ensure they are applied to their policies.

Good Driver Discounts

Insurance companies typically offer discounts to drivers with a clean driving record, and this extends to disabled veterans as well. If a veteran has a safe driving history, free of accidents or traffic violations, they may be eligible for good driver discounts, further reducing their insurance premiums.

Multi-Policy Discounts

Bundling insurance policies can lead to significant savings. If a veteran has multiple insurance needs, such as home, life, or health insurance, they can consider bundling these policies with their car insurance to take advantage of multi-policy discounts. This approach not only simplifies insurance management but also provides cost savings.

Other Savings Opportunities

Insurance companies may offer additional savings opportunities, such as discounts for safe driving devices or for completing defensive driving courses. Veterans should explore these options and take advantage of any available discounts to reduce their insurance costs.

Choosing the Right Provider: A Step-by-Step Guide

Selecting the right car insurance provider is a crucial decision for disabled veterans. Here’s a step-by-step guide to help veterans navigate the process and make an informed choice.

Research and Compare

Start by researching and comparing different insurance providers. Look for companies that specialize in serving veterans or those that offer tailored policies for disabled individuals. Compare the coverage options, premiums, and additional benefits offered by each provider to find the best fit for your needs.

Evaluate Coverage Options

Evaluate the coverage options offered by each provider. Ensure that the policy covers your specific needs, including any specialized equipment or modifications to your vehicle. Consider the limits and deductibles of each coverage type to ensure they align with your financial capabilities.

Assess Financial Stability

It’s essential to choose an insurance provider that is financially stable. Check the provider’s financial rating with independent agencies like AM Best or Standard & Poor’s to ensure they have the financial strength to pay out claims in the event of an accident or other covered incident.

Review Customer Service and Claims Handling

Customer service and claims handling are critical aspects of any insurance provider. Research the provider’s reputation for customer satisfaction and claims processing. Look for providers with a track record of timely and efficient claims handling, as this can significantly impact your experience if you ever need to file a claim.

Consider Additional Benefits

Beyond the standard coverage options, some insurance providers offer additional benefits that can be valuable for disabled veterans. These may include roadside assistance, rental car coverage, or accident forgiveness. Consider these benefits and how they might enhance your insurance experience.

Real-Life Examples: Success Stories

Understanding the experiences of fellow disabled veterans can provide valuable insights into the world of car insurance. Here are some real-life examples of how disabled veterans have successfully navigated the insurance landscape to find the right coverage.

John's Story: John, a veteran with a mobility impairment, required a wheelchair-accessible vehicle. He chose an insurance provider that specialized in insuring modified vehicles and was able to secure comprehensive coverage, including liability protection and medical payments coverage. John's insurance policy covered the cost of repairing his specialized equipment, ensuring he could continue driving safely.

Sarah's Experience: Sarah, a veteran with visual impairments, needed adaptive technology in her vehicle to drive safely. She researched insurance providers that offered coverage for assistive devices and found a policy that provided comprehensive protection, including collision coverage for her modified vehicle. Sarah's insurance company also offered her a good driver discount, further reducing her premiums.

Future Implications and Industry Trends

The car insurance landscape for disabled veterans is evolving, with ongoing developments and trends shaping the industry. Staying informed about these changes is crucial for veterans to make the most informed decisions about their insurance coverage.

Technological Advances

Advancements in technology are revolutionizing the way disabled veterans interact with their vehicles and insurance policies. Adaptive driving technologies, such as voice-controlled systems and advanced driver assistance systems (ADAS), are becoming more accessible and affordable. Insurance providers are recognizing the safety benefits of these technologies and may offer discounts or incentives for their use.

Increased Awareness and Support

There is a growing awareness within the insurance industry about the unique needs of disabled veterans. Insurance providers are developing more specialized products and services to cater to this demographic, recognizing the importance of providing tailored coverage. This increased awareness and support are leading to more inclusive and comprehensive insurance options for disabled veterans.

Policy Innovations

Insurance companies are continuously innovating their policies to better serve disabled veterans. This includes offering more flexible coverage options, such as usage-based insurance (UBI) or pay-as-you-drive policies, which can provide cost savings for veterans with specific driving patterns. Additionally, some providers are exploring the use of telematics devices to gather driving data, which can further personalize insurance coverage and premiums.

Conclusion: Empowering Veterans

Car insurance for disabled veterans is a complex but crucial aspect of their financial well-being and independence. By understanding their unique needs, researching specialized insurance options, and taking advantage of available discounts and benefits, veterans can secure the coverage they need to navigate the roads safely and with peace of mind. As the insurance industry continues to evolve and adapt, disabled veterans can expect even more tailored and inclusive insurance solutions.

Can I get car insurance as a disabled veteran with a modified vehicle?

+Absolutely! Many insurance providers now offer specialized policies for disabled veterans with modified vehicles. These policies ensure that your unique driving circumstances and specialized equipment are adequately covered.

Are there any discounts specifically for disabled veterans?

+Yes, several insurance companies offer discounts to veterans, recognizing their service. These discounts can significantly reduce your insurance premiums and are well worth exploring.

How can I find an insurance provider that specializes in serving disabled veterans?

+You can start by researching insurance companies that have a reputation for serving veterans or those that specifically mention their commitment to providing tailored coverage for disabled individuals. Online resources, veteran support groups, and recommendations from fellow veterans can also be valuable in your search.