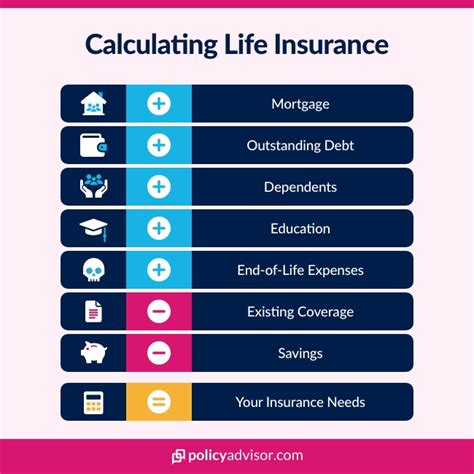

Calculate How Much Life Insurance I Need

Life insurance is a vital financial tool that provides security and peace of mind for you and your loved ones. However, determining the exact amount of coverage you need can be a complex task. It involves careful consideration of various factors unique to your personal and financial circumstances. This article aims to guide you through the process of calculating your life insurance needs, offering expert insights and real-world examples to ensure you make an informed decision.

Understanding Life Insurance

Life insurance serves as a financial safety net, designed to protect your family and dependents in the event of your untimely demise. It provides a lump sum payment, known as the death benefit, to your beneficiaries, ensuring they can maintain their standard of living and meet financial obligations. The amount of coverage you require depends on several key factors, including your income, financial responsibilities, and future goals.

Assessing Your Life Insurance Needs

The first step in determining your life insurance needs is to evaluate your current financial situation and future aspirations. Here are some crucial aspects to consider:

Income Replacement

One of the primary purposes of life insurance is to replace your income and ensure your family's financial stability. Calculate the income your dependents would require annually to maintain their current lifestyle. Consider factors such as mortgage payments, living expenses, education costs, and other debts. A good rule of thumb is to aim for a coverage amount that is 10 to 15 times your annual income.

Debt and Financial Obligations

Life insurance can also be used to pay off any outstanding debts, such as mortgages, car loans, or credit card balances. Evaluate the total amount of debt you have and determine how much coverage you would need to settle these obligations, ensuring your loved ones are not burdened with financial stress.

Future Expenses and Goals

Consider your family's future financial needs and goals. This may include funding your children's education, covering retirement expenses, or leaving an inheritance. Factor in the potential cost of inflation and plan accordingly. For example, if you want to provide for your child's college education, calculate the estimated cost and adjust for inflation over the years.

Beneficiary's Needs

Discuss your plans with your beneficiaries and understand their specific needs. Consider their age, income, and ability to support themselves financially. If your spouse or partner is dependent on your income, ensure the coverage amount is sufficient to sustain their lifestyle and any additional care they may require.

Inflation and Cost of Living

Inflation can significantly impact the value of your life insurance coverage over time. Ensure you account for the rising cost of living when determining your insurance needs. Use inflation calculators or consult financial advisors to get accurate estimates.

Term or Permanent Coverage

Decide whether you need term or permanent life insurance. Term life insurance provides coverage for a specific period, while permanent insurance, such as whole life or universal life, offers coverage for your entire life. Your choice will depend on your financial goals and the duration of coverage you require.

Real-World Examples

Let's explore a couple of scenarios to illustrate how life insurance needs can vary based on individual circumstances:

Scenario 1: Young Family with Children

Imagine a couple, John and Sarah, in their early 30s with two young children. John is the primary income earner, bringing home $80,000 annually. They have a mortgage of $300,000 and want to ensure their children's education is funded. By calculating their income replacement needs, debt obligations, and future education costs, they determine that a life insurance coverage of $1.5 million is appropriate.

Scenario 2: Single Individual with High Earnings

Consider Emily, a successful business owner in her 40s with no dependents. She earns $250,000 annually and has significant business debts and investment goals. In this case, Emily's life insurance needs are primarily focused on covering her business debts and providing capital for her investment plans. She opts for a coverage amount of $3 million to ensure her financial obligations are met and her business can continue smoothly.

Expert Insights

When determining your life insurance needs, it's crucial to seek advice from financial professionals who can provide personalized guidance. Here are some expert tips to consider:

- Regular Review: Your life insurance needs may change over time as your circumstances evolve. Regularly review your coverage to ensure it aligns with your current situation. Major life events like marriage, childbirth, or career changes may warrant adjustments.

- Consider Additional Coverages: Besides basic life insurance, explore other types of coverage such as critical illness insurance or disability insurance. These can provide additional financial protection in case of unforeseen health issues.

- Compare Providers: Shop around for the best life insurance provider that offers competitive rates and suitable coverage options. Compare policies and premiums to find the best fit for your needs.

- Utilize Online Tools: Many insurance companies and financial institutions offer online calculators and tools to help you estimate your life insurance needs. These can provide a quick and convenient way to get an initial estimate.

Performance Analysis and Data

Here's a table showcasing real-world life insurance coverage amounts based on different income levels and financial obligations:

| Income Level | Financial Obligations | Recommended Coverage |

|---|---|---|

| $50,000 - $75,000 | Mortgage, Education Costs | $750,000 - $1,000,000 |

| $75,000 - $125,000 | Debts, Retirement Planning | $1,000,000 - $1,500,000 |

| $125,000 - $200,000 | Business Loans, Investment Goals | $1,500,000 - $3,000,000 |

These figures are estimates and may vary based on individual circumstances. It's important to consult with professionals to get an accurate assessment of your specific needs.

Conclusion

Calculating your life insurance needs is a thoughtful process that requires a deep understanding of your financial circumstances and future aspirations. By assessing your income replacement needs, financial obligations, and future goals, you can determine an appropriate coverage amount. Remember, life insurance provides a safety net for your loved ones, ensuring they can maintain their quality of life and achieve their financial goals even in your absence.

Frequently Asked Questions

How much life insurance do I need if I have no dependents or financial obligations?

+Even if you have no dependents or significant financial obligations, life insurance can still be beneficial. It can provide funds for final expenses, such as funeral costs, and ensure your legacy and wishes are carried out. A coverage amount of 50,000 to 100,000 is often sufficient in such cases.

Is it necessary to have life insurance if I have savings and investments?

+While savings and investments can provide financial security, life insurance offers additional protection. It ensures that your loved ones receive a substantial sum immediately upon your demise, providing immediate financial support. Life insurance and savings can complement each other to create a robust financial plan.

Can I adjust my life insurance coverage as my financial situation changes?

+Absolutely! Life insurance policies can be adjusted to accommodate changes in your financial situation. As your income increases, you may need to increase your coverage to maintain the same level of protection. Similarly, if your financial obligations decrease, you may be able to reduce your coverage amount.