Umbrella Coverage Insurance

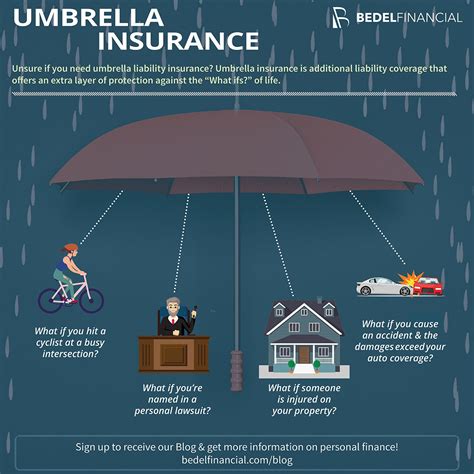

Umbrella insurance, a vital yet often overlooked component of a comprehensive financial safety net, offers an extra layer of protection beyond standard liability insurance. This policy type is designed to shield individuals and businesses from catastrophic financial losses resulting from unexpected events, such as serious accidents or high-value lawsuits. With the increasing complexity and unpredictability of modern life, the importance of umbrella coverage is becoming more evident. This guide aims to delve into the nuances of umbrella insurance, its applications, and its pivotal role in safeguarding your financial future.

Understanding Umbrella Insurance

Umbrella insurance, also known as excess liability insurance, is a specialized form of coverage that provides an additional layer of liability protection on top of existing policies, such as homeowners, renters, auto, or boat insurance. It is essentially an extension of your primary liability coverage, designed to kick in when the limits of those policies are exhausted.

For instance, if you are sued for an accident that results in significant property damage or bodily injury, and the damages exceed the liability limits of your homeowners or auto insurance, your umbrella policy would step in to cover the remaining amount, up to the policy limit.

The key benefit of umbrella insurance is its broader coverage and higher limits compared to standard liability policies. While homeowners or auto insurance typically offer liability coverage of $100,000 to $300,000, umbrella policies can provide an additional $1 million to $10 million or more in coverage. This additional layer of protection can be critical in situations where liability costs could exceed the limits of primary insurance policies.

Umbrella insurance also broadens the scope of liability coverage to include risks that may not be covered by standard policies. For example, umbrella insurance often covers personal liability for accidents that occur away from your home or vehicle, such as while you're on vacation or participating in recreational activities. It can also provide coverage for certain types of personal liability lawsuits, such as those related to defamation or false arrest.

Who Needs Umbrella Insurance?

While umbrella insurance is beneficial for a wide range of individuals and businesses, there are certain groups who may find it particularly advantageous:

High-Net-Worth Individuals

Those with substantial assets, such as multiple properties, high-value investments, or valuable collections, stand to lose more in the event of a liability claim. An umbrella policy can protect these assets by providing additional liability coverage beyond the limits of standard insurance policies.

Business Owners

Business owners face a unique set of risks, from product liability to professional liability. Umbrella insurance can provide an extra layer of protection, covering claims that exceed the limits of their commercial liability policies. This is especially crucial for small businesses that may not have the financial resources to withstand large liability payouts.

Families with High-Risk Activities

Families with children, teenagers, or young adults who engage in high-risk activities such as driving, sports, or recreational activities that involve a higher likelihood of accidents or injuries may benefit from umbrella insurance. This policy can provide additional protection in the event of an accident or lawsuit resulting from these activities.

Individuals with High-Risk Occupations

Certain professions, such as healthcare workers, lawyers, or real estate agents, carry a higher risk of liability claims. Umbrella insurance can provide an extra layer of protection for individuals in these professions, ensuring they are adequately covered in the event of a claim.

How Does Umbrella Insurance Work?

Umbrella insurance policies typically follow the terms and conditions of the underlying liability policies they cover. This means that the umbrella policy will provide coverage for the same types of liability claims as your primary policies, but with higher limits.

For example, if your homeowners insurance policy provides $300,000 in liability coverage and you have an umbrella policy with a $1 million limit, the umbrella policy will cover liability claims that exceed $300,000 up to $1 million. If the claim is for $1.2 million, the homeowners insurance would cover the first $300,000, and the umbrella policy would cover the remaining $900,000.

It's important to note that umbrella insurance does not replace primary liability coverage. It is an additional layer of protection that kicks in when the limits of your primary policies are reached. This means you must have underlying liability insurance policies in place, such as homeowners or auto insurance, for an umbrella policy to provide coverage.

Benefits of Umbrella Insurance

Enhanced Liability Protection

The primary benefit of umbrella insurance is the additional liability coverage it provides. With limits typically starting at 1 million and going up to 10 million or more, umbrella policies offer a substantial increase in protection over standard liability insurance.

Broadened Coverage

Umbrella insurance policies expand the scope of liability coverage to include risks that may not be covered by primary policies. This can include personal liability for accidents away from your home or vehicle, certain types of personal liability lawsuits, and even coverage for specific business-related risks for business owners.

Cost-Effective Protection

Despite the extensive coverage they provide, umbrella policies are often surprisingly affordable. The cost of an umbrella policy is typically much lower than the cost of increasing the liability limits on your primary policies. This makes umbrella insurance an efficient and cost-effective way to enhance your liability protection.

Peace of Mind

With an umbrella policy in place, you can have the peace of mind that comes with knowing you have substantial liability coverage. This can be especially beneficial for individuals and businesses with substantial assets or those who face a higher risk of liability claims.

Considerations and Limitations

Underlying Insurance Requirements

To obtain an umbrella policy, you typically need to have underlying liability insurance policies in place, such as homeowners or auto insurance. The umbrella policy will follow the terms and conditions of these primary policies, so it’s important to ensure your primary policies provide adequate coverage.

Policy Exclusions and Limitations

Like all insurance policies, umbrella insurance has certain exclusions and limitations. These can vary depending on the insurer and the specific policy, so it’s important to carefully review the policy terms and conditions to understand what is and is not covered.

Claims Process

In the event of a liability claim, the claims process for an umbrella policy can be complex. It often involves coordination between the insurer providing the umbrella coverage and the insurer(s) providing the underlying coverage. It’s important to understand this process and to have a clear idea of what to expect in the event of a claim.

Choosing the Right Umbrella Policy

Assessing Your Needs

Before purchasing an umbrella policy, it’s important to assess your unique liability risks and needs. Consider factors such as your assets, the type of business you own (if applicable), your lifestyle and activities, and any specific risks you may face. This will help you determine the appropriate amount of coverage you need.

Comparing Policies and Insurers

When choosing an umbrella policy, it’s beneficial to compare policies from different insurers. Consider factors such as the policy limits, the scope of coverage, the policy exclusions and limitations, and the claims process. It’s also important to choose an insurer with a strong financial rating and a good reputation for handling claims.

Working with an Insurance Professional

Given the complexity of umbrella insurance, it can be helpful to work with an insurance professional, such as an insurance broker or agent, who has experience with these types of policies. They can provide guidance on choosing the right policy and help you understand the nuances of the coverage.

Real-World Examples of Umbrella Insurance Claims

Homeowner Liability

A homeowner with an umbrella policy was sued after a guest at their home slipped and fell on their icy driveway, resulting in serious injuries. The guest filed a lawsuit seeking damages for medical expenses, pain and suffering, and lost wages. The homeowner’s primary liability insurance policy provided 300,000 in coverage, but the lawsuit claimed damages exceeding 1 million. The umbrella policy stepped in to cover the remaining amount, providing the homeowner with the financial protection they needed.

Auto Accident

A driver with an umbrella policy was involved in a serious auto accident that resulted in multiple injuries and significant property damage. The driver’s auto insurance policy provided liability coverage of 100,000, but the total damages from the accident exceeded 500,000. The umbrella policy, with a $1 million limit, covered the remaining amount, ensuring the driver was protected from financial ruin.

Business Liability

A small business owner with an umbrella policy was sued for product liability after one of their products caused an injury. The lawsuit sought damages for medical expenses and pain and suffering, totaling over 2 million. The business owner's commercial liability insurance policy provided 1 million in coverage, but the umbrella policy stepped in to cover the remaining $1 million, ensuring the business owner was protected from catastrophic financial loss.

The Future of Umbrella Insurance

Changing Risk Landscape

As the world becomes increasingly complex and interconnected, the risks we face are evolving. From emerging technologies to changing social and economic landscapes, the potential for liability claims is growing. Umbrella insurance is well-positioned to adapt to these changing risks, providing an essential layer of protection in an uncertain world.

Innovations in Coverage

Insurance providers are continuously innovating and expanding the scope of umbrella insurance coverage. This includes developing new policies to address emerging risks, such as cyber liability and privacy breaches. These innovations ensure that umbrella insurance remains a relevant and effective tool for managing liability risks in the digital age.

Growing Awareness and Adoption

While umbrella insurance has traditionally been seen as a luxury for high-net-worth individuals and businesses, there is a growing awareness of its importance and benefits. As more people understand the risks they face and the protection that umbrella insurance provides, there is a trend towards wider adoption of these policies, particularly among those with substantial assets or high-risk occupations.

Conclusion

Umbrella insurance is a powerful tool for managing liability risks and protecting your financial future. By providing an additional layer of protection beyond standard liability insurance, umbrella policies offer enhanced coverage, broader protection, and peace of mind. Whether you’re a homeowner, business owner, or individual with substantial assets, an umbrella policy can provide the financial security you need in an increasingly uncertain world.

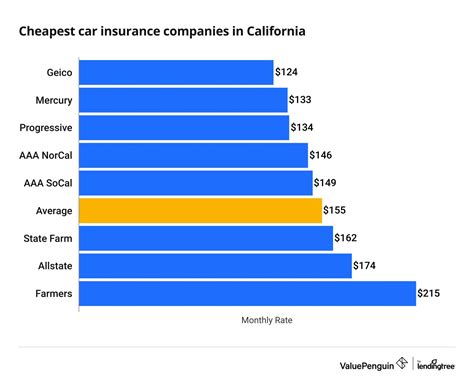

What is the typical cost of an umbrella insurance policy?

+The cost of an umbrella policy can vary depending on several factors, including the amount of coverage you choose, your location, your claims history, and the insurer you select. On average, the cost of an umbrella policy with 1 million in coverage is around 150 to $300 per year. However, it’s important to note that the price can be significantly higher or lower depending on your individual circumstances.

Can I purchase an umbrella policy without having other liability insurance policies in place?

+No, in order to obtain an umbrella policy, you typically need to have underlying liability insurance policies in place, such as homeowners or auto insurance. The umbrella policy will follow the terms and conditions of these primary policies, so it’s essential to have these policies as a foundation for your liability coverage.

Are there any discounts available for umbrella insurance policies?

+Yes, some insurers offer discounts for umbrella insurance policies. These discounts can be based on factors such as bundling your policies (e.g., having your home and auto insurance with the same insurer), the amount of coverage you choose, or the number of years you’ve been with the insurer. It’s always a good idea to inquire about potential discounts when shopping for an umbrella policy.

How often should I review my umbrella insurance policy?

+It’s recommended to review your umbrella insurance policy annually or whenever there are significant changes in your life or circumstances. This could include purchasing a new home, starting a business, getting married, or having children. These changes can impact your liability risks and the amount of coverage you need, so it’s important to ensure your policy is up-to-date and provides adequate protection.