Insurance Small Businesses

In the realm of small businesses, one of the most critical yet often overlooked aspects is insurance. It plays a pivotal role in safeguarding these enterprises against various risks and unforeseen circumstances. From protecting against property damage to ensuring business continuity, insurance provides a vital safety net. This comprehensive guide aims to demystify the world of insurance for small businesses, offering an in-depth analysis and practical insights.

Understanding the Basics: Insurance for Small Businesses

Insurance, at its core, is a mechanism designed to mitigate risks and provide financial protection. For small businesses, it serves as a crucial tool to navigate the myriad of potential challenges, be it natural disasters, lawsuits, or employee injuries. A well-structured insurance portfolio can be the difference between a business’s survival and its demise.

The landscape of insurance for small businesses is diverse, offering a range of policies tailored to specific needs. These include general liability insurance, professional liability insurance (or errors and omissions insurance), workers' compensation insurance, property insurance, and business interruption insurance, among others. Each type of insurance addresses a unique set of risks, highlighting the importance of a comprehensive understanding.

General Liability Insurance

General liability insurance is often considered the foundation of any small business insurance portfolio. It protects against a wide range of common risks, including bodily injury, property damage, and advertising injury claims. For instance, if a customer slips and falls on your business premises, this insurance would cover the associated medical costs and potential legal fees.

| General Liability Insurance Coverage | Description |

|---|---|

| Bodily Injury | Covers medical expenses and legal costs if someone gets injured on your premises. |

| Property Damage | Provides coverage if your business causes damage to someone else's property. |

| Advertising Injury | Protects against claims of copyright infringement, libel, or slander in your advertising. |

Professional Liability Insurance

Also known as errors and omissions (E&O) insurance, this type of coverage is essential for businesses that provide professional services. It safeguards against claims of negligence, errors, or omissions in the course of providing those services. For example, if a consulting firm provides incorrect advice leading to financial losses for a client, professional liability insurance would cover the potential compensation costs.

Workers’ Compensation Insurance

This insurance is mandated by law in most states and covers medical expenses and a portion of wages lost if an employee is injured or becomes ill due to work-related causes. It also provides death benefits to dependents if a work-related incident results in fatality. Workers’ compensation insurance helps small businesses manage these potentially costly situations while ensuring their employees are taken care of.

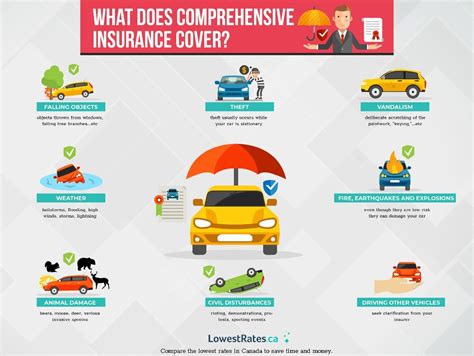

Property Insurance

Property insurance protects a business’s physical assets, including buildings, equipment, inventory, and furniture. It covers damages caused by a variety of events, such as fires, storms, vandalism, or theft. For businesses that own or rent their premises, property insurance is crucial to ensure financial recovery in the event of a disaster.

Business Interruption Insurance

Business interruption insurance, often overlooked, can be a lifesaver for small businesses. It provides coverage for lost income and ongoing expenses if a business is forced to shut down temporarily due to a covered peril, such as a fire or a natural disaster. This insurance ensures that the business can continue to pay its bills and maintain its financial obligations during this challenging period.

Tailoring Insurance to Your Small Business

The beauty of insurance for small businesses lies in its adaptability. Every business is unique, and insurance policies can be customized to address specific risks. This customization ensures that the coverage aligns perfectly with the business’s needs, offering peace of mind without unnecessary expenses.

Assessing Risks

The first step in tailoring insurance is to conduct a comprehensive risk assessment. This involves identifying the potential hazards and liabilities specific to your business. For instance, a tech startup may need to prioritize cyber liability insurance, while a manufacturing business might focus more on product liability insurance.

Choosing the Right Coverage

Once the risks are identified, the next step is to select the appropriate insurance coverage. This involves balancing the need for protection against the cost of premiums. Small business owners should work closely with insurance professionals to understand the intricacies of each policy and make informed decisions.

For example, a small retail store might opt for a business owner's policy (BOP) which combines general liability and property insurance, offering a cost-effective solution. On the other hand, a service-based business might prioritize professional liability insurance to protect against potential client lawsuits.

Bundle and Save

Many insurance providers offer discounts when small businesses bundle multiple policies. By purchasing multiple types of insurance from the same provider, businesses can often secure significant savings. This bundling strategy can be particularly beneficial for startups or businesses with limited budgets.

The Importance of Regular Review

Insurance needs for small businesses are not static; they evolve with the business. As the business grows, expands its operations, or introduces new products or services, its insurance requirements will also change. Regularly reviewing and updating insurance policies is essential to ensure ongoing protection.

Business Growth and Expansion

As a small business grows, its insurance needs may change dramatically. For instance, if the business expands to multiple locations, it may require additional property insurance to cover all sites. Similarly, if the business starts offering new services, it might need to update its professional liability insurance to account for these new risks.

Employee Changes

Changes in employee numbers or roles can also impact insurance needs. For example, if a small business hires more employees, it may need to increase its workers’ compensation insurance coverage to ensure adequate protection for all staff. Similarly, if the business introduces remote work options, it might need to consider cyber liability insurance to protect against potential data breaches.

Industry Trends and Changes

Staying abreast of industry trends and changes is crucial for small businesses. These changes can introduce new risks or affect existing ones. For instance, the rise of e-commerce has led to an increased need for cyber liability insurance to protect against online threats. Similarly, changes in environmental regulations might impact businesses in certain industries, requiring them to reevaluate their insurance coverage.

Maximizing Insurance Benefits

Insurance for small businesses is not just about protection; it also offers a range of benefits that can help businesses thrive. By understanding these benefits and utilizing them effectively, small businesses can gain a competitive edge and enhance their overall financial health.

Risk Management and Prevention

Insurance providers often offer risk management services and resources to help small businesses identify and mitigate potential risks. These resources can include safety training materials, loss prevention tools, and access to experts who can provide guidance on best practices. By leveraging these resources, businesses can proactively reduce the likelihood of incidents, thereby minimizing their insurance claims.

Business Continuity Planning

Insurance plays a critical role in business continuity planning. By having the right insurance coverage, small businesses can ensure they have the financial resources to recover from disruptions, whether they’re caused by natural disasters, cyber attacks, or other unforeseen events. Business interruption insurance, in particular, can provide a crucial lifeline during these challenging times, allowing businesses to maintain their operations and financial stability.

Access to Capital and Growth Opportunities

Insurance can also facilitate small business growth and access to capital. Many lenders and investors view a robust insurance portfolio as a sign of a well-managed business, making it easier for small businesses to secure loans or attract investment. Additionally, certain types of insurance, like key person insurance, can provide the capital needed to replace a critical employee in the event of their death or disability, ensuring business continuity.

Common Challenges and How to Overcome Them

While insurance is vital for small businesses, it’s not without its challenges. From understanding the complex language of insurance policies to managing costs, there are several hurdles that small business owners may face. However, with the right strategies and resources, these challenges can be effectively overcome.

Understanding Policy Language

Insurance policies are often written in complex legal language that can be difficult for non-experts to understand. This can lead to confusion about what is and isn’t covered, potentially leaving small businesses vulnerable. To address this challenge, small business owners should seek guidance from insurance professionals who can explain policies in plain language and ensure they understand the coverage they’re purchasing.

Managing Costs

Insurance can be a significant expense for small businesses, especially those with limited budgets. To manage these costs effectively, small business owners should shop around for competitive rates, compare quotes from multiple providers, and consider bundling policies to take advantage of potential discounts. Additionally, they should regularly review their coverage to ensure they’re not paying for unnecessary or duplicate insurance.

Navigating Claims Process

The claims process can be complex and time-consuming, especially for small businesses that may not have dedicated resources to handle it. To streamline this process, small business owners should familiarize themselves with their insurance policies and the claims process before an incident occurs. They should also keep thorough records and documentation to support any potential claims.

The Future of Insurance for Small Businesses

The insurance landscape for small businesses is evolving rapidly, driven by technological advancements, changing consumer expectations, and emerging risks. As small businesses adapt to these changes, the role of insurance will continue to evolve, offering new opportunities and challenges.

Technology and Digital Transformation

The digital transformation of the insurance industry is bringing about significant changes. From online policy management and claims submission to the use of advanced analytics and AI for risk assessment, technology is making insurance more accessible, efficient, and personalized for small businesses. For instance, small businesses can now leverage digital tools to quickly compare quotes and manage their policies, making the process more streamlined and convenient.

Changing Consumer Expectations

With the rise of digital technologies, consumer expectations have shifted. Small businesses are expected to provide seamless digital experiences, including when it comes to insurance. This means offering easy online purchasing, clear and concise policy information, and efficient digital claims processes. Insurance providers that can meet these expectations will be well-positioned to serve the needs of small businesses in the digital age.

Emerging Risks and New Insurance Products

As the business landscape evolves, so too do the risks. New technologies and business models bring new risks, such as cyber threats and data breaches. In response, the insurance industry is developing innovative products to address these emerging risks. For example, cyber liability insurance has become increasingly important for small businesses that operate online or store sensitive customer data.

How do I choose the right insurance provider for my small business?

+Choosing the right insurance provider involves several key considerations. First, look for a provider that specializes in small business insurance and understands the unique risks and needs of your industry. Consider their financial stability and reputation, as well as their customer service ratings. Compare quotes from multiple providers to find the best coverage at a competitive price. Finally, don't underestimate the importance of personal recommendations from other small business owners.

What are some common mistakes small business owners make with their insurance?

+One common mistake is underestimating the value of insurance and opting for the cheapest option without fully understanding the coverage. This can leave small businesses vulnerable to significant financial losses. Another mistake is failing to review and update insurance policies regularly, which can result in gaps in coverage as the business evolves. Finally, not being proactive about risk management and prevention can lead to more frequent and costly insurance claims.

How can small businesses leverage insurance to improve their financial health and growth prospects?

+Insurance can be a powerful tool for small businesses to protect their financial health and foster growth. By having the right coverage, small businesses can ensure they have the resources to recover from disruptions and continue their operations. Insurance can also provide access to capital, making it easier for small businesses to secure loans or attract investment. Additionally, insurance can facilitate business continuity planning, helping small businesses develop strategies to navigate challenging times.