Cheapest Auto Insurance In Ca

When it comes to finding the cheapest auto insurance in California, it's essential to understand the factors that influence insurance rates and explore the options available to get the best coverage at an affordable price. California, being the most populous state in the US, presents a unique insurance landscape, and it's crucial to navigate it wisely to secure the most cost-effective coverage.

Understanding Auto Insurance Rates in California

The cost of auto insurance in California varies significantly based on several factors, including your driving record, the type of vehicle you own, and your personal details such as age and gender. Additionally, the insurance provider and the coverage options you choose play a vital role in determining the overall cost.

California has implemented various regulations to ensure fair practices in the insurance industry. One notable regulation is the use of the California Automobile Assigned Risk Plan (CAARP), also known as the auto insurance "pool". This plan is designed to provide coverage for high-risk drivers who may face challenges in obtaining insurance through traditional means. The CAARP assigns these drivers to an insurance company, ensuring that even those with a less-than-perfect driving record can obtain the necessary coverage.

Factors Influencing Insurance Rates

- Driving Record: A clean driving record with no accidents or violations is generally rewarded with lower insurance rates. Conversely, a history of accidents or traffic violations can significantly increase your insurance premiums.

- Vehicle Type and Usage: The make, model, and age of your vehicle, as well as how you use it (e.g., commuting, business, or pleasure), can impact your insurance rates. High-performance cars and luxury vehicles often carry higher premiums due to their increased risk of theft or damage.

- Personal Information: Your age, gender, marital status, and even your credit score can influence insurance rates. Young drivers and those with a poor credit history may face higher premiums.

- Insurance Company and Coverage: Different insurance providers offer varying rates and coverage options. It’s essential to compare quotes from multiple companies to find the best deal. Additionally, the coverage you choose (e.g., liability-only vs. comprehensive) will impact the overall cost.

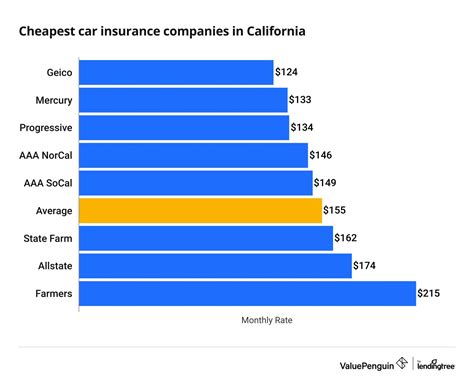

Exploring the Cheapest Auto Insurance Options in California

While finding the cheapest auto insurance in California involves a careful balance between cost and coverage, there are several strategies and options to consider:

Shop Around and Compare Quotes

Obtaining quotes from multiple insurance providers is crucial to finding the best deal. Online comparison tools and insurance brokers can simplify this process, allowing you to quickly compare rates and coverage options from various companies. Remember, the cheapest quote may not always offer the best value, so consider the coverage limits and any additional benefits provided.

Consider Minimum Liability Coverage

California mandates that all drivers carry a minimum level of liability insurance to cover damages to others in the event of an accident. Opting for minimum liability coverage can be a cost-effective option, especially if you own an older vehicle or have a limited budget. However, it’s essential to understand that minimum liability coverage may not fully protect you financially in the event of a serious accident.

| Minimum Liability Coverage Requirements in California |

|---|

| Bodily Injury Liability (per person): $15,000 |

| Bodily Injury Liability (per accident): $30,000 |

| Property Damage Liability: $5,000 |

Explore Discounts and Special Programs

Insurance companies in California offer various discounts and special programs to attract customers and reward safe driving practices. Some common discounts include:

- Good Driver Discount: Rewards drivers with a clean record and no accidents or violations.

- Multi-Policy Discount: Offers savings when you bundle your auto insurance with other policies, such as home or renters insurance.

- Low Mileage Discount: Recognizes drivers who use their vehicles less frequently, often measured through the use of telematics devices.

- Safe Vehicle Discount: Applies to vehicles equipped with safety features like anti-lock brakes, air bags, or theft-deterrent systems.

- Pay-in-Full Discount: Provides savings for policyholders who pay their annual premium upfront rather than in installments.

Utilize Government Programs

California offers specific programs to assist drivers who may face challenges in obtaining affordable insurance. One notable program is the California Low Cost Auto Insurance Program (CLCA). This program provides low-cost liability coverage to eligible drivers who meet certain income and driving record criteria. The CLCA program offers comprehensive and collision coverage options as well, making it a potentially attractive option for those seeking more robust protection.

Conclusion: Finding the Right Balance

While seeking the cheapest auto insurance in California is a common goal, it’s essential to strike a balance between cost and coverage. Opting for the lowest-priced policy without considering the potential risks and financial implications of an accident can be a costly mistake. By understanding the factors that influence insurance rates, exploring various options, and utilizing discounts and government programs, you can find a policy that offers both affordability and adequate protection.

Remember, auto insurance is a vital component of responsible driving, and it's crucial to tailor your coverage to your specific needs and circumstances. Take the time to compare quotes, review your options, and make an informed decision to ensure you're adequately protected on California's roads.

How often should I review and update my auto insurance policy in California?

+It’s recommended to review your auto insurance policy annually or whenever there are significant changes in your life or driving circumstances. This ensures that your coverage remains up-to-date and provides the necessary protection. Changes such as a new vehicle, an improved driving record, or a change in marital status can impact your insurance rates and coverage needs.

What factors can lead to an increase in auto insurance rates in California?

+Several factors can lead to an increase in auto insurance rates, including a poor driving record with accidents or violations, a history of insurance claims, and changes in personal circumstances such as a move to a higher-risk area or an increase in the value of your vehicle. It’s important to regularly review your policy and consider any changes that may impact your rates.

Are there any specific requirements for auto insurance in California beyond the minimum liability coverage?

+While minimum liability coverage is mandatory, California law also requires drivers to carry uninsured motorist coverage. This coverage protects you in the event of an accident with an uninsured or underinsured driver. Additionally, it’s wise to consider additional coverage options like comprehensive and collision coverage to protect your vehicle from damage caused by theft, vandalism, or natural disasters.