Cheapest Family Health Insurance

Finding affordable and comprehensive health insurance coverage for your family is a crucial aspect of financial planning and ensuring your loved ones' well-being. With the rising costs of healthcare, it's essential to explore options that provide adequate protection without breaking the bank. In this article, we delve into the world of family health insurance, uncovering the most cost-effective plans available and providing valuable insights to help you make informed decisions.

Understanding Family Health Insurance

Family health insurance, also known as group health insurance or family coverage, is a policy that provides medical benefits to an entire family unit. It covers the primary policyholder, their spouse, and dependent children, offering a comprehensive approach to healthcare management. These plans are designed to offer financial protection against unexpected medical expenses, ensuring that families can access necessary healthcare services without facing significant financial burdens.

When exploring family health insurance options, it's crucial to consider various factors, including the scope of coverage, network of healthcare providers, prescription drug benefits, and out-of-pocket costs. Additionally, understanding the different types of plans available, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs), can help tailor your choice to your family's specific needs.

Factors Influencing the Cost of Family Health Insurance

The cost of family health insurance can vary significantly based on several key factors. These include the age and health status of family members, the geographic location where the policy is purchased, and the chosen coverage level and plan type. Moreover, the inclusion of certain benefits, such as maternity care or mental health services, can impact the overall premium.

Understanding these factors is essential when shopping for the cheapest family health insurance. By considering your family's unique needs and researching the market, you can identify plans that offer the right balance between affordability and comprehensive coverage.

Researching and Comparing Plans

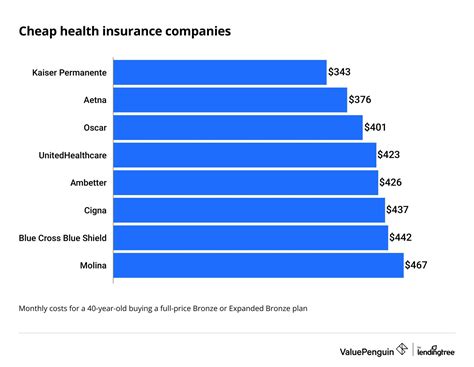

To find the cheapest family health insurance, thorough research and comparison are essential. Begin by identifying reputable insurance providers in your area and gathering information about their family health insurance plans. Compare the features, benefits, and costs of each plan, paying close attention to the fine print to ensure you understand the coverage limitations and exclusions.

Utilize online resources and insurance comparison websites to streamline your search. These platforms often provide user-friendly interfaces, allowing you to input your family's details and preferences to generate a list of suitable plans with their respective costs. Additionally, seek recommendations from friends, family, or financial advisors who may have firsthand experience with different insurance providers.

Key Considerations When Comparing Plans

- Premiums: Evaluate the monthly premiums for each plan. While lower premiums may be attractive, consider the overall cost-effectiveness by assessing the coverage and potential out-of-pocket expenses.

- Deductibles and Copayments: Understand the deductibles and copayments associated with each plan. Higher deductibles may result in lower premiums, but they can increase your out-of-pocket costs when accessing healthcare services.

- Network of Providers: Check the network of healthcare providers included in each plan. Ensure that your preferred doctors, hospitals, and specialists are covered to avoid unexpected costs.

- Prescription Drug Coverage: If your family relies on prescription medications, verify the plan’s prescription drug benefits, including the cost of generic and brand-name drugs.

- Additional Benefits: Some plans offer extra benefits such as dental, vision, or wellness programs. Assess whether these additional benefits align with your family’s needs and budget.

Exploring Cost-Saving Strategies

While finding the cheapest family health insurance is a priority, it’s equally important to explore strategies that can further reduce your overall healthcare costs.

Employer-Sponsored Plans

Many employers offer group health insurance plans as part of their employee benefits package. These plans often provide substantial savings compared to individual or family plans purchased independently. If your employer offers such a plan, carefully review the coverage options and consider enrolling your family.

Government-Sponsored Programs

Government-sponsored health insurance programs, such as Medicaid and the Children’s Health Insurance Program (CHIP), provide low-cost or no-cost health coverage to eligible families. These programs have specific income and other eligibility criteria, so be sure to research and understand your family’s potential qualifications.

High-Deductible Health Plans (HDHPs)

High-deductible health plans typically have lower premiums but higher deductibles. While these plans may require a larger upfront payment when accessing healthcare services, they can be cost-effective for families with minimal healthcare needs. Pairing an HDHP with a Health Savings Account (HSA) can offer additional tax benefits and savings opportunities.

Family-Friendly Discounts and Incentives

Some insurance providers offer discounts or incentives specifically tailored for families. These may include family plan discounts, multi-policy discounts (if you have other insurance policies with the same provider), or wellness program incentives that reward healthy lifestyle choices.

Negotiating for Better Rates

In certain cases, negotiating with insurance providers can lead to more favorable rates. If you have a strong relationship with your insurance agent or broker, discuss your family’s unique circumstances and negotiate a customized plan that meets your needs and budget. Additionally, consider switching insurance providers if you find a more affordable option with comparable coverage.

Seeking Professional Guidance

Navigating the complex world of family health insurance can be challenging, especially when trying to find the cheapest option. Seeking guidance from insurance professionals or financial advisors can provide valuable insights and help you make informed decisions. These experts can assess your family’s specific needs, recommend suitable plans, and assist with the enrollment process.

The Importance of Continuous Evaluation

Finding the cheapest family health insurance is an ongoing process that requires regular evaluation and adjustments. As your family’s needs and circumstances change, it’s essential to reassess your coverage annually or whenever significant life events occur, such as marriage, childbirth, or job changes. Regularly reviewing your policy ensures that your family’s healthcare needs remain adequately addressed while maintaining cost-effectiveness.

Conclusion: Empowering Your Family’s Health

Securing affordable and comprehensive family health insurance is a crucial step towards ensuring your loved ones’ well-being. By understanding the factors influencing costs, researching and comparing plans, exploring cost-saving strategies, and seeking professional guidance, you can navigate the complex world of health insurance with confidence. Remember, finding the cheapest option is not just about saving money; it’s about empowering your family to access the healthcare they need without financial strain.

How can I determine if a family health insurance plan is suitable for my family’s needs?

+Assessing a family health insurance plan’s suitability involves evaluating factors such as coverage scope, network of providers, prescription drug benefits, and out-of-pocket costs. Consider your family’s unique healthcare needs and preferences to ensure the plan aligns with your requirements.

What are the potential disadvantages of choosing the cheapest family health insurance plan?

+The cheapest plans may have higher deductibles and copayments, limiting your access to certain healthcare services. Additionally, these plans might have a narrower network of providers, restricting your choice of healthcare professionals. Always weigh the trade-offs between cost and coverage to make an informed decision.

Can I customize my family health insurance plan to suit my family’s specific needs?

+Yes, many insurance providers offer customizable plans that allow you to choose the coverage levels and benefits that align with your family’s unique requirements. Discuss your options with your insurance agent or broker to create a tailored plan that meets your needs.