Renter Insurance What Does It Cover

Renters insurance, often overlooked, is a vital component of financial protection for individuals and families living in rented accommodations. This policy offers comprehensive coverage for a wide range of potential risks, providing peace of mind and ensuring that tenants can recover from unforeseen circumstances. Understanding the ins and outs of renters insurance is crucial for anyone looking to safeguard their belongings and personal liability.

Understanding the Basics: What is Renters Insurance?

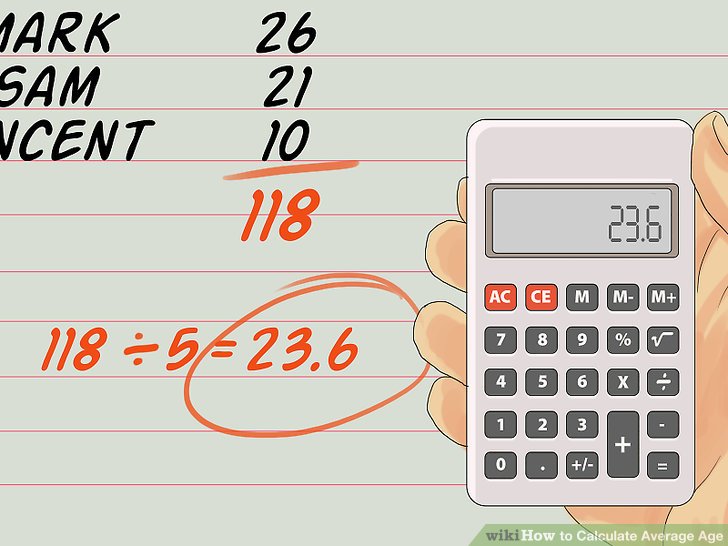

Renters insurance, also known as tenants insurance, is a type of property insurance designed specifically for people who lease or rent their living space. Unlike homeowners insurance, which covers the structure and its contents, renters insurance primarily focuses on protecting the personal property and liability of the policyholder. It is an essential tool for renters to mitigate the financial risks associated with theft, damage, or liability claims.

The coverage provided by renters insurance typically includes:

- Personal Property: Renters insurance covers the loss or damage of personal belongings due to various perils, such as fire, theft, vandalism, or natural disasters. This coverage extends to items like furniture, clothing, electronics, and appliances.

- Liability Protection: In the event of an accident or injury on the rental property that is deemed the policyholder's fault, renters insurance provides liability coverage. This protects the tenant from potential lawsuits and covers legal fees and medical expenses for injured parties.

- Additional Living Expenses: If a covered loss makes the rental property uninhabitable, this coverage helps cover the additional costs of temporary housing and meals until the residence is repaired or the tenant finds a new place to live.

- Medical Payments: Renters insurance often includes medical payments coverage, which provides for the medical expenses of guests who are injured on the rental property, regardless of fault.

- Personal Injury Protection: This coverage protects the policyholder from certain types of personal injury claims, such as libel or slander.

It's important to note that renters insurance typically does not cover damage to the rental unit itself or the building's structure, as this is the landlord's responsibility. However, it offers valuable protection for the tenant's possessions and personal liability, ensuring a more secure and financially stable living situation.

The Comprehensive Coverage Offered by Renters Insurance

Renters insurance provides a wide array of coverage options, ensuring that policyholders can tailor their protection to their specific needs. Here’s a detailed breakdown of the key coverages and their significance:

Personal Property Coverage

This coverage is the cornerstone of renters insurance, protecting the policyholder’s personal belongings against a range of perils. The specific items covered can vary, but typically include:

- Clothing and footwear

- Furniture and bedding

- Electronics and appliances

- Jewelry and watches

- Musical instruments

- Sports equipment

- Collectibles and hobby items

It's essential to note that there may be limits or sublimits on certain high-value items, such as jewelry or electronics. Policyholders should carefully review their policy to understand the coverage limits and consider purchasing additional coverage for valuable items if needed.

| Category | Coverage |

|---|---|

| Clothing | $3,000 |

| Electronics | $2,500 |

| Jewelry | $1,500 (sublimit) |

Liability Coverage

Liability coverage is a vital aspect of renters insurance, providing protection against claims of bodily injury or property damage caused by the policyholder or a member of their household. This coverage can be a lifesaver in the event of accidents or incidents that occur on the rental property, offering financial protection against lawsuits and legal fees.

Here's a real-world example of how liability coverage can be a tenant's saving grace:

- Scenario: A guest slips and falls on a wet floor in your rental unit, resulting in a broken arm. They decide to sue you for negligence. With liability coverage, your renters insurance policy would provide financial assistance to cover legal fees and any settlement or judgment awarded against you, up to the policy limits.

Additional Living Expenses

In the unfortunate event of a covered loss that renders your rental unit uninhabitable, additional living expenses coverage kicks in. This coverage reimburses you for the extra costs incurred while you're temporarily displaced, such as hotel stays, restaurant meals, and other additional expenses.

Consider the following scenario:

- Your rental unit sustains significant water damage due to a burst pipe, requiring extensive repairs. During the renovation period, you and your family are forced to stay in a hotel for two weeks. Additional living expenses coverage would reimburse you for the hotel costs and any other reasonable expenses incurred during this time.

Medical Payments Coverage

Medical payments coverage is a valuable addition to renters insurance, as it provides coverage for the medical expenses of guests who are injured on the rental property, regardless of fault. This coverage is designed to offer quick assistance for minor injuries and can help prevent a small incident from escalating into a full-blown liability claim.

For instance, if a friend trips over a loose rug in your rental unit and sustains a minor injury, medical payments coverage would cover their medical bills, up to the policy limit, without the need for a formal liability claim.

Personal Injury Protection

Personal injury protection is an important coverage option that safeguards the policyholder from specific types of personal injury claims, including libel, slander, false arrest, and invasion of privacy. This coverage provides a layer of protection against potential lawsuits that could arise from these situations.

An example of how personal injury protection can be beneficial:

- You, as a tenant, are falsely accused of spreading rumors about your landlord's business practices, resulting in a libel lawsuit. Personal injury protection would cover the legal costs and any damages awarded, up to the policy limits, in your defense.

The Importance of Tailoring Your Renters Insurance Coverage

Renters insurance is a customizable solution, allowing policyholders to choose the coverage that best fits their needs and budget. It's essential to carefully review and understand the specific coverages and limits offered by your policy to ensure you have the right protection in place.

Here are some key considerations when tailoring your renters insurance coverage:

- Personal Property Coverage: Evaluate the value of your belongings and choose a coverage limit that adequately reflects their worth. Consider purchasing additional coverage for high-value items if needed.

- Liability Limits: Select liability limits that provide sufficient protection against potential lawsuits. Keep in mind that liability claims can be substantial, so it's advisable to opt for higher limits if your budget allows.

- Additional Coverages: Depending on your circumstances, you may want to consider adding optional coverages, such as identity theft protection, rental car coverage, or coverage for valuable items like fine art or musical instruments.

Real-World Example: Customizing Renters Insurance

Let's take the case of Sarah, a young professional renting an apartment in a bustling city. She has a modest collection of personal belongings, including clothing, furniture, and electronics, with a total estimated value of $15,000. She also has a few pieces of jewelry that are especially valuable to her.

Sarah decides to purchase renters insurance and carefully considers her coverage options. She selects a personal property coverage limit of $15,000 to adequately protect her belongings. Additionally, she purchases a separate rider for her jewelry, ensuring that her sentimental pieces are fully covered in the event of loss or damage.

Furthermore, Sarah opts for higher liability limits, recognizing the potential risks associated with urban living. She also adds identity theft protection coverage, given the increasing prevalence of cybercrime.

By customizing her renters insurance policy, Sarah ensures that she has the right level of protection for her specific needs and circumstances.

Conclusion: The Peace of Mind that Renters Insurance Offers

Renters insurance is a powerful tool for individuals and families living in rented accommodations. It provides comprehensive coverage for personal property, liability, and additional living expenses, offering a safety net against unexpected losses and legal liabilities. By understanding the ins and outs of renters insurance and tailoring their coverage to their specific needs, tenants can enjoy peace of mind and financial security in their rented homes.

What is the average cost of renters insurance?

+The average cost of renters insurance varies depending on several factors, including the location, the value of personal property, and the coverage limits chosen. On average, renters insurance policies range from 15 to 30 per month, but prices can be higher or lower based on individual circumstances.

Does renters insurance cover damage to the rental unit itself?

+No, renters insurance typically does not cover damage to the rental unit itself or the building’s structure. This responsibility falls on the landlord or property owner. Renters insurance primarily focuses on protecting the tenant’s personal property and liability.

What should I do if I need to file a claim under my renters insurance policy?

+If you need to file a claim, it’s important to act promptly. Contact your insurance provider as soon as possible and provide them with all the necessary details about the incident. Gather any relevant documentation, such as police reports, photos, or estimates of damage. Your insurance company will guide you through the claims process and help you receive the coverage you’re entitled to.