Auto Insurance Coverage Explained

Understanding auto insurance coverage is essential for every vehicle owner. It provides financial protection and peace of mind in case of accidents, vehicle damage, or other unforeseen events. Auto insurance policies can vary significantly, offering different levels of coverage to suit diverse needs and preferences. This comprehensive guide will delve into the various aspects of auto insurance, from the different types of coverage to the factors that influence premiums and the claims process.

Types of Auto Insurance Coverage

Auto insurance policies typically offer a range of coverage options, allowing policyholders to tailor their insurance to their specific needs. Here are some of the key types of coverage available:

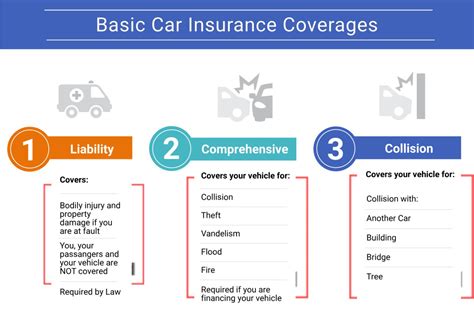

Liability Coverage

Liability coverage is a fundamental component of auto insurance. It protects the policyholder from financial losses arising from accidents where they are at fault. This coverage includes:

- Bodily Injury Liability: Pays for medical expenses and compensation for injuries sustained by others involved in an accident caused by the policyholder.

- Property Damage Liability: Covers the cost of repairing or replacing damaged property, such as another vehicle, fence, or building, in an accident caused by the policyholder.

Collision Coverage

Collision coverage is an optional coverage that pays for the repair or replacement of the policyholder’s vehicle after an accident, regardless of who is at fault. It covers damages caused by collisions with other vehicles, objects, or animals. Collision coverage typically includes a deductible, which is the amount the policyholder pays out of pocket before the insurance kicks in.

Comprehensive Coverage

Comprehensive coverage, also known as “other than collision” coverage, protects against damages caused by events other than collisions. This can include theft, vandalism, natural disasters, falling objects, and collisions with animals. Like collision coverage, comprehensive coverage usually comes with a deductible.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a coverage option that provides compensation for medical expenses and lost wages resulting from an accident, regardless of fault. It is mandatory in some states and offers additional protection for policyholders and their passengers.

Uninsured/Underinsured Motorist Coverage

This coverage protects policyholders when involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages. It can provide compensation for medical expenses, lost wages, and other related costs.

Medical Payments Coverage

Medical Payments Coverage, often referred to as MedPay, helps cover medical expenses for the policyholder and their passengers in the event of an accident, regardless of fault. It can provide quick access to funds for medical bills, making it a valuable addition to any auto insurance policy.

Rental Car Reimbursement

Rental Car Reimbursement coverage provides financial assistance for renting a vehicle while the policyholder’s car is being repaired or replaced after an insured incident. This coverage ensures the policyholder has a temporary vehicle to use during the repair process.

Factors Affecting Auto Insurance Premiums

The cost of auto insurance, known as the premium, can vary significantly based on several factors. Understanding these factors can help policyholders make informed decisions and potentially reduce their insurance costs.

Driver’s Profile

The driver’s profile is a critical factor in determining insurance premiums. This includes factors such as age, gender, driving record, and credit history. Younger drivers and those with a history of accidents or traffic violations may face higher premiums.

Vehicle Type and Usage

The type of vehicle being insured and its intended usage can also impact premiums. High-performance cars, luxury vehicles, and those with a higher risk of theft or damage may be more expensive to insure. Additionally, vehicles used for business purposes or long-distance commuting may attract higher premiums.

Coverage and Deductibles

The level of coverage chosen and the associated deductibles play a significant role in determining premiums. Higher coverage limits and lower deductibles generally result in higher premiums, as they provide more comprehensive protection.

Location and Driving Conditions

The policyholder’s location and the driving conditions they typically encounter can influence premiums. Areas with high traffic congestion, frequent accidents, or a high incidence of theft may have higher insurance rates. Similarly, weather conditions and the risk of natural disasters can impact insurance costs.

Insurance Company and Discounts

Different insurance companies offer varying rates and discounts. Policyholders can often find better deals by comparing quotes from multiple insurers. Additionally, many companies offer discounts for safe driving records, multiple policies, or vehicle safety features.

The Claims Process

Knowing how to navigate the claims process is crucial when it comes to auto insurance. Here’s an overview of what to expect:

Reporting an Accident

After an accident, it’s essential to report the incident to your insurance company as soon as possible. Most insurers have a 24⁄7 claims hotline for such situations. Be prepared to provide details about the accident, including the date, time, location, and any relevant information about the other parties involved.

Filing a Claim

Once you’ve reported the accident, you’ll need to file a claim. This typically involves providing additional information, such as photos of the damage, police reports, and any relevant medical records. Your insurance company will then assess the claim and determine the extent of coverage based on your policy.

Repair or Replacement

If your vehicle is repairable, the insurance company will often work with a preferred repair shop to ensure quality repairs. You may have the option to choose your own repair shop, but be aware that this could impact your coverage. If the vehicle is deemed a total loss, the insurance company will provide a settlement based on the vehicle’s value before the accident.

Settlement and Deductible

Once the claim is approved, the insurance company will provide a settlement amount. This amount will be subject to your policy’s deductible. For example, if you have a 500 deductible and the repair costs 2,000, you will be responsible for paying the first 500, and the insurance company will cover the remaining 1,500.

Additional Claims Considerations

It’s important to keep accurate records of all communication with the insurance company and to understand the specific terms of your policy. Some policies may have time limits for filing claims or specific requirements for documentation. Always review your policy details and don’t hesitate to ask your insurance provider for clarification if needed.

FAQ

What is the difference between liability and comprehensive coverage?

+

Liability coverage protects you financially if you’re at fault in an accident, covering bodily injury and property damage costs for others. Comprehensive coverage, on the other hand, protects your own vehicle from damages caused by events other than collisions, such as theft, vandalism, or natural disasters.

How do deductibles work in auto insurance?

+

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. For example, if you have a 500 deductible and your repairs cost 2,000, you’ll pay the first 500, and your insurance will cover the remaining 1,500.

Can I switch auto insurance providers mid-policy term?

+

Yes, you can switch insurance providers at any time. However, you may need to pay a cancellation fee if you’re still within the policy term. It’s a good idea to compare quotes from multiple providers to find the best coverage and rates for your needs.

What should I do if I’m involved in an accident with an uninsured driver?

+

If you have uninsured motorist coverage, your insurance provider can help you file a claim and provide compensation for damages. It’s important to document the accident and any injuries sustained, and to report the incident to the police.

How often should I review and update my auto insurance policy?

+

It’s recommended to review your auto insurance policy annually, or whenever your circumstances change significantly. This includes changes in your vehicle, driving habits, or personal situation. Regular reviews ensure your coverage remains adequate and cost-effective.