Health Insurance Marketplace 1095A

The Health Insurance Marketplace has become an essential component of the healthcare system in the United States, providing individuals and families with a platform to access affordable health insurance options. At the heart of this system lies the 1095-A form, a crucial document that plays a significant role in the enrollment process and tax implications. In this comprehensive article, we will delve into the intricacies of the Health Insurance Marketplace, focusing on the 1095-A form and its impact on individuals and the healthcare industry.

Understanding the Health Insurance Marketplace

The Health Insurance Marketplace, also known as the Health Insurance Exchange, was established as part of the Affordable Care Act (ACA) to create a centralized platform for individuals and small businesses to compare and purchase health insurance plans. This marketplace aims to increase competition among insurers, making health coverage more accessible and affordable. It offers a range of qualified health plans with various levels of coverage, allowing consumers to choose the plan that best suits their needs and budget.

The Marketplace is divided into two main categories: the Individual Marketplace and the Small Business Health Options Program (SHOP). The Individual Marketplace is designed for individuals and families who are not eligible for employer-sponsored health insurance or government programs like Medicare or Medicaid. On the other hand, the SHOP Marketplace caters to small businesses with up to 50 full-time equivalent employees, providing them with affordable group health insurance options.

One of the key advantages of the Health Insurance Marketplace is the availability of financial assistance. Individuals with low to moderate incomes may qualify for premium tax credits, which help reduce the cost of their monthly premiums. Additionally, those with very low incomes may be eligible for cost-sharing reductions, further lowering their out-of-pocket expenses. This financial support plays a crucial role in making healthcare more accessible to a wider population.

The Role of the 1095-A Form

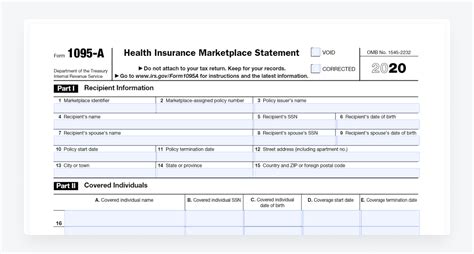

The 1095-A form, officially known as the Health Insurance Marketplace Statement, is a vital document issued by the Marketplace to individuals who have enrolled in a qualified health plan through the Marketplace. This form serves as a record of the coverage and any financial assistance received during the previous tax year. It contains important information such as the individual’s name, the plan’s coverage period, and the premium tax credits and cost-sharing reductions applied.

The 1095-A form is an essential component of the tax filing process for individuals who have received premium tax credits or cost-sharing reductions. It provides the necessary details to reconcile the advanced premium tax credits received during the year with the actual tax credit amount calculated at the end of the tax year. This reconciliation ensures that individuals receive the correct amount of financial assistance and helps prevent overpayments or underpayments of tax credits.

Here's a breakdown of the key information found on the 1095-A form:

| Section | Details |

|---|---|

| Coverage Information | Details about the health plan, including the coverage period, plan type, and monthly premiums. |

| Financial Assistance | Information on the premium tax credits and cost-sharing reductions received, including the advance amounts and the actual credit amounts. |

| Member Information | Personal details of the individual or family members covered by the plan, including names and dates of birth. |

| Taxpayer Identification | The individual's Social Security Number or Taxpayer Identification Number. |

It's important to note that the 1095-A form is only issued to individuals who have received financial assistance through the Marketplace. Those who pay their premiums in full and do not receive any advanced premium tax credits or cost-sharing reductions will not receive this form.

Filing Taxes with the 1095-A Form

When it comes to tax filing, the 1095-A form plays a crucial role in ensuring accuracy and compliance. Here’s a step-by-step guide on how to use the 1095-A form for tax purposes:

-

Reconciliation of Premium Tax Credits: The first step is to reconcile the advanced premium tax credits received during the year with the actual tax credit amount calculated at the end of the tax year. This involves comparing the amounts listed on the 1095-A form with the tax credit calculations on your tax return.

-

Determining Tax Liability: The 1095-A form helps determine your tax liability for the year. If you received more in advanced premium tax credits than you are entitled to, you may owe a repayment. Conversely, if you are eligible for a larger tax credit than what you received in advance, you may be entitled to a refund.

-

Filing the Form: The 1095-A form should be attached to your tax return when filing. This provides the IRS with the necessary information to verify your healthcare coverage and financial assistance received.

-

Penalties for Non-Compliance: It's important to note that failing to file the 1095-A form or providing incorrect information can result in penalties. The IRS may impose a penalty for non-filing or for providing inaccurate or incomplete information on the form.

The Impact of the Health Insurance Marketplace

The introduction of the Health Insurance Marketplace and the associated 1095-A form has had a significant impact on both individuals and the healthcare industry. Here are some key implications:

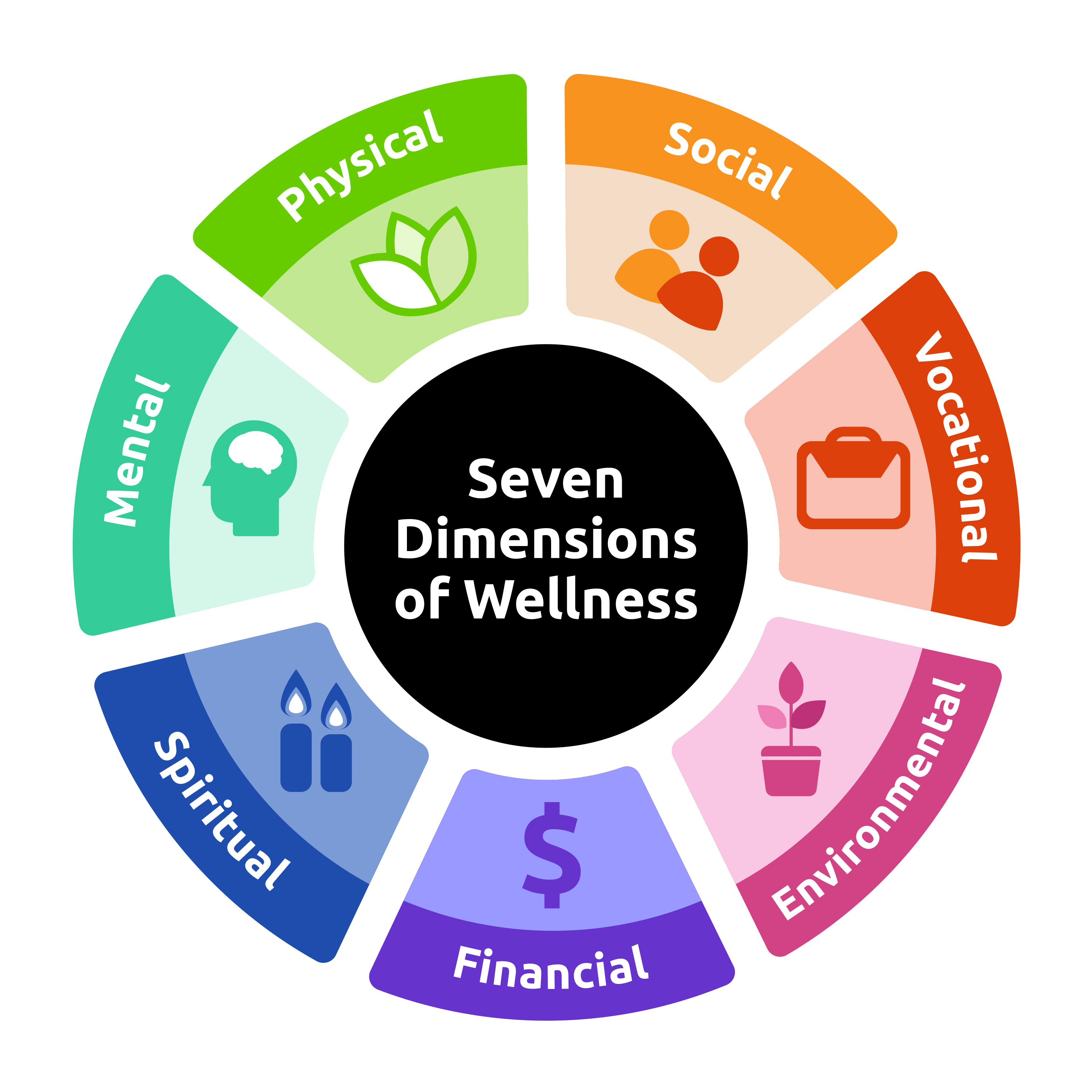

Increased Access to Healthcare

The Marketplace has expanded access to affordable health insurance for millions of Americans. By providing a centralized platform and offering financial assistance, the Marketplace has enabled individuals and families to obtain healthcare coverage that may have been out of reach previously. This has led to improved healthcare outcomes and reduced financial strain for many.

Enhanced Competition and Consumer Choice

The Marketplace has fostered increased competition among insurers, driving down premiums and improving the quality of healthcare plans. Consumers now have a wider range of options to choose from, allowing them to select plans that align with their specific needs and preferences. This competition has also incentivized insurers to innovate and offer more comprehensive and affordable coverage.

Simplified Enrollment Process

The Health Insurance Marketplace has streamlined the enrollment process, making it more accessible and user-friendly. The online platform provides a centralized location for individuals to compare plans, apply for coverage, and receive financial assistance. This has reduced the administrative burden on both consumers and insurers, leading to a more efficient and convenient experience.

Data-Driven Healthcare Insights

The data collected through the 1095-A form and the Marketplace as a whole provides valuable insights into healthcare trends and consumer behavior. This data can be used to inform policy decisions, improve healthcare delivery, and identify areas for cost-saving measures. It also enables researchers and analysts to study the impact of the ACA and make evidence-based recommendations for future healthcare reforms.

Future Implications and Challenges

While the Health Insurance Marketplace has made significant strides in improving access to healthcare, there are still challenges to address. Some of the key considerations for the future include:

-

Sustainability of Financial Assistance: Ensuring the long-term sustainability of premium tax credits and cost-sharing reductions is crucial to maintain access to affordable healthcare. Policymakers and stakeholders must explore sustainable funding mechanisms to support these financial assistance programs.

-

Improving Consumer Education: Educating consumers about the Marketplace, available plans, and the importance of the 1095-A form is essential. Clear and accessible information can empower individuals to make informed choices and navigate the healthcare system more effectively.

-

Addressing Coverage Gaps: Despite the progress made, there are still individuals who fall through the gaps in coverage. Efforts should be made to identify and address these gaps, ensuring that everyone has access to affordable and comprehensive healthcare.

Conclusion

The Health Insurance Marketplace, along with the 1095-A form, has revolutionized the way individuals access and manage their healthcare coverage. It has provided a platform for increased competition, expanded access to healthcare, and offered financial assistance to those in need. As we move forward, continued efforts to improve and refine the Marketplace will be essential to ensure its long-term success and the well-being of the population it serves.

What is the Health Insurance Marketplace?

+The Health Insurance Marketplace is a platform established by the Affordable Care Act to help individuals and small businesses compare and purchase health insurance plans. It offers a range of qualified health plans with different coverage levels and provides financial assistance to eligible individuals.

Who receives the 1095-A form?

+The 1095-A form is issued to individuals who have enrolled in a qualified health plan through the Marketplace and received financial assistance, such as premium tax credits or cost-sharing reductions.

How is the 1095-A form used for tax purposes?

+The 1095-A form is used to reconcile the advanced premium tax credits received during the year with the actual tax credit amount calculated at the end of the tax year. It helps individuals determine their tax liability and ensures compliance with IRS guidelines.

What are the benefits of the Health Insurance Marketplace?

+The Marketplace provides increased access to affordable healthcare, fosters competition among insurers, simplifies the enrollment process, and offers valuable data-driven insights for policy decisions.

What are the future challenges for the Health Insurance Marketplace?

+Future challenges include ensuring the sustainability of financial assistance programs, improving consumer education, and addressing coverage gaps to ensure comprehensive healthcare access for all.