Long Term Care Insurance Business

In an era where healthcare costs are soaring and longevity is on the rise, the need for long-term care (LTC) insurance has become increasingly crucial. As the world grapples with the challenges of an aging population, the LTC insurance business has emerged as a vital sector, offering financial protection and peace of mind to individuals and families. This comprehensive article delves into the intricacies of the LTC insurance business, exploring its history, impact, and future prospects.

A Brief History of Long-Term Care Insurance

The concept of long-term care insurance traces its roots back to the early 20th century when private insurance companies began offering limited coverage for extended care needs. However, it was not until the 1970s that LTC insurance gained traction as a specialized product. The catalyst for this development was the rising awareness of the financial burden associated with extended care, particularly for the elderly.

In the 1980s, a significant shift occurred as LTC insurance evolved from a niche product to a more mainstream offering. Insurance providers recognized the potential of this market and started designing comprehensive policies that covered a wide range of care services. This period saw the introduction of innovative features, such as inflation protection and tax benefits, making LTC insurance an attractive option for individuals seeking financial security.

The 1990s and early 2000s brought further advancements. Insurance companies began collaborating with healthcare providers to enhance policy benefits and improve overall care quality. Additionally, government initiatives played a pivotal role in promoting LTC insurance, with various incentives and awareness campaigns aimed at encouraging individuals to plan for their future care needs.

Understanding Long-Term Care Insurance

Long-term care insurance is a specialized type of coverage designed to provide financial assistance for individuals requiring extended care services due to age, illness, or disability. Unlike traditional health insurance, which primarily covers acute medical conditions, LTC insurance focuses on the unique needs of those requiring assistance with daily activities over an extended period.

Key Components of LTC Insurance

- Eligibility Criteria: Policies typically cover individuals aged 65 and above, though some providers offer coverage to younger individuals with specific health conditions.

- Coverage Period: LTC insurance policies can provide coverage for a specified duration, ranging from a few months to several years, depending on the policyholder’s needs and budget.

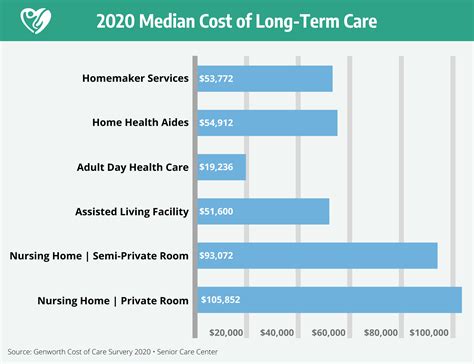

- Benefit Types: Policies offer a range of benefits, including home health care, assisted living, nursing home care, and respite care. The specific benefits and their limits are outlined in the policy contract.

- Waiting Period: Most policies have a waiting period, known as the elimination period, during which the policyholder must pay for their own care before the insurance coverage kicks in. This period can vary from a few days to several months.

One of the unique aspects of LTC insurance is its focus on promoting independence and quality of life. Policies often include features such as caregiver training, care coordination, and access to specialized services, ensuring that policyholders receive the best possible care.

The Impact of Long-Term Care Insurance

The LTC insurance business has had a profound impact on both individuals and society as a whole. By providing financial protection, LTC insurance has empowered individuals to make informed choices about their future care, reducing the burden on families and healthcare systems.

Financial Security for Individuals

For policyholders, LTC insurance offers a sense of security and peace of mind. Knowing that their future care needs are financially covered allows them to plan their retirement and aging journey with confidence. LTC insurance can significantly reduce the strain on personal savings and ensure that individuals can access the care they need without depleting their assets.

Reducing Burden on Families

The emotional and financial toll of long-term care can be overwhelming for families. LTC insurance eases this burden by providing a structured financial plan for caregiving. Families can focus on providing emotional support and quality care without the added stress of managing the financial aspects.

Benefits for Healthcare Systems

The widespread adoption of LTC insurance has positive implications for healthcare systems. By shifting the financial responsibility from individuals and families to insurance providers, healthcare facilities can better allocate resources and improve the overall quality of care. This, in turn, leads to more efficient healthcare delivery and potentially reduced strain on public healthcare budgets.

Challenges and Innovations in the LTC Insurance Business

While the LTC insurance business has grown exponentially, it has also faced unique challenges. One of the primary concerns is the potential for adverse selection, where individuals with higher care needs are more likely to purchase insurance. This can lead to increased costs for insurance providers and, consequently, higher premiums for policyholders.

Addressing Adverse Selection

To mitigate adverse selection, insurance companies have implemented various strategies. One approach is to offer comprehensive medical underwriting, where applicants undergo a thorough assessment of their health status. This helps identify individuals with higher care needs and allows for more accurate premium pricing.

Additionally, some providers offer hybrid products that combine life insurance and LTC coverage. These policies provide a death benefit if the insured passes away without utilizing the LTC benefits, reducing the risk of adverse selection.

Innovations in Policy Design

The LTC insurance business has embraced innovation to stay relevant and meet the evolving needs of policyholders. One notable trend is the introduction of flexible policies that offer customizable coverage options. Policyholders can now choose the level of coverage they require, with the ability to adjust their benefits as their care needs change.

Furthermore, the integration of technology has revolutionized the LTC insurance landscape. Telehealth services and remote monitoring have become integral parts of policy benefits, allowing for more efficient care coordination and improved policyholder engagement.

The Future of Long-Term Care Insurance

As the world continues to age, the demand for LTC insurance is expected to surge. However, the industry must adapt to changing demographics and evolving care needs to remain sustainable.

Focus on Prevention and Wellness

A key trend in the future of LTC insurance is the emphasis on prevention and wellness. Insurance providers are recognizing the importance of promoting healthy lifestyles and early intervention to reduce the likelihood of individuals requiring extended care. This shift is likely to result in policies that incentivize policyholders to adopt healthier habits and access preventive care services.

Collaboration with Healthcare Providers

Collaboration between insurance companies and healthcare providers is set to intensify. By working together, these entities can streamline care delivery, improve outcomes, and reduce costs. Integrated care models, where insurance providers and healthcare facilities share data and coordinate services, will become increasingly common.

Utilization of Technology

Technology will continue to play a pivotal role in the LTC insurance business. Artificial intelligence and machine learning algorithms will enhance policy administration, risk assessment, and claim processing, leading to more efficient operations. Additionally, digital platforms will facilitate better policyholder engagement, allowing individuals to manage their policies and access care services seamlessly.

| LTC Insurance Statistics | Data |

|---|---|

| Average LTC Insurance Premium | $2,300 per year |

| Number of LTC Insurance Policies in the US | Over 7 million |

| Average Length of LTC Stay | 3 years |

| Percentage of Adults with LTC Insurance | 10% |

How does LTC insurance differ from traditional health insurance?

+LTC insurance focuses on extended care needs, covering services such as home health care, assisted living, and nursing home care. Traditional health insurance, on the other hand, primarily covers acute medical conditions and short-term care.

What are the eligibility criteria for LTC insurance?

+Eligibility criteria vary, but most policies cover individuals aged 65 and above. Some providers offer coverage to younger individuals with specific health conditions.

How can I choose the right LTC insurance policy?

+When selecting an LTC insurance policy, consider your care needs, budget, and the level of coverage you require. It’s essential to review the policy’s benefits, waiting periods, and eligibility criteria carefully. Consulting with a financial advisor or insurance professional can also be beneficial.