Arizona State Insurance

Arizona State Insurance: Navigating Coverage and Understanding Your Policy

When it comes to protecting your assets and securing your future, understanding the intricacies of insurance is paramount. Arizona State Insurance, with its unique regulations and coverage options, plays a crucial role in the lives of residents across the Grand Canyon State. This comprehensive guide aims to demystify the world of insurance, providing you with the knowledge to make informed decisions and navigate the complexities of your policy.

The Landscape of Arizona State Insurance

Arizona’s insurance landscape is shaped by a combination of state-specific laws and regulations, coupled with the diverse needs of its residents. From mandatory auto insurance to specialized coverage for unique risks, such as those posed by the state’s desert climate, Arizona State Insurance offers a wide array of options to cater to its population’s diverse needs.

One of the key aspects of Arizona's insurance framework is its emphasis on consumer protection. The state's Department of Insurance, under the leadership of the Arizona Insurance Commissioner, works diligently to ensure that insurance companies operating within the state adhere to strict guidelines, providing fair and equitable coverage to policyholders.

Key Features of Arizona State Insurance

Arizona’s insurance market boasts several distinctive features that set it apart from other states. These include:

- No-Fault Auto Insurance: Arizona operates under a no-fault system for auto insurance, which means that, in the event of an accident, your own insurance provider covers your medical expenses and other related costs, regardless of who was at fault.

- Medicare Supplement Insurance: Arizona offers a range of Medicare Supplement Insurance plans, known as Medigap, to help seniors fill the gaps in their Medicare coverage. These plans can cover costs like co-pays, deductibles, and other out-of-pocket expenses.

- Homeowner’s Insurance: With its diverse climate and the potential for natural disasters like wildfires and flash floods, Arizona’s homeowner’s insurance policies often include coverage for these specific risks.

Additionally, Arizona's insurance market is highly competitive, with a large number of reputable insurance carriers operating within the state. This competition benefits consumers by driving down prices and increasing the variety of coverage options available.

| Insurance Type | Coverage Highlights |

|---|---|

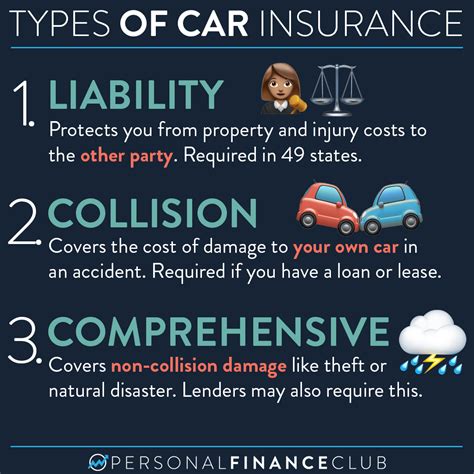

| Auto Insurance | Mandatory liability coverage; No-fault personal injury protection; Optional comprehensive and collision coverage. |

| Health Insurance | Comprehensive plans covering hospital stays, doctor visits, and prescription drugs; Specialized plans for seniors (Medicare) and low-income families (Medicaid) |

| Homeowner's Insurance | Coverage for fire, theft, and liability; Additional coverage for flood, earthquake, and other natural disasters. |

Navigating Your Arizona State Insurance Policy

With the diverse array of insurance options available in Arizona, it’s essential to understand the specifics of your policy to ensure you’re adequately covered. Here’s a step-by-step guide to help you navigate your Arizona State Insurance policy.

Understanding Your Policy Basics

Every insurance policy comes with a set of basic components that you should familiarize yourself with. These include:

- Policy Number: A unique identifier for your policy. Keep this number handy for all communications with your insurance provider.

- Policy Term: The duration for which your policy is active. Policies are typically valid for a year, but you can opt for shorter or longer terms based on your needs.

- Coverage Limits: The maximum amount your insurance provider will pay out for a covered loss. These limits are set for different types of coverage within your policy.

- Deductibles and Co-Pays: These are the amounts you’ll have to pay out-of-pocket before your insurance coverage kicks in. Higher deductibles often mean lower premiums.

Additionally, your policy will outline the specific types of coverage you've chosen, such as liability, collision, or comprehensive coverage for auto insurance, or coverage for specific perils like fire or theft for homeowner's insurance.

Reviewing Your Coverage

Once you’ve understood the basics, it’s time to delve deeper into your coverage. Ask yourself the following questions to ensure your policy aligns with your needs:

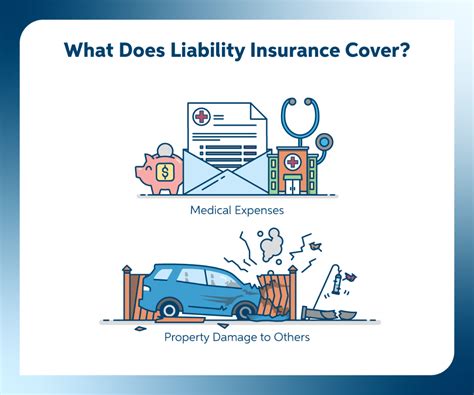

- Do I have enough liability coverage to protect my assets in the event of an accident or lawsuit? Consider factors like your net worth and the potential risks associated with your line of work.

- For auto insurance, have I considered adding optional coverages like rental car reimbursement or roadside assistance? These can provide added peace of mind.

- If I own a home, have I insured it for its full replacement cost, taking into account any recent upgrades or improvements?

- Have I reviewed my health insurance plan to ensure it covers my regular medications and any specific medical needs I have?

Understanding Exclusions and Limitations

Every insurance policy comes with exclusions and limitations. These are situations or events that are not covered by your policy. It’s crucial to understand these to avoid any unpleasant surprises.

For instance, standard homeowner's insurance policies often exclude coverage for damage caused by earthquakes and floods. If you live in an area prone to these natural disasters, you may need to purchase additional coverage.

Regular Policy Reviews

Insurance needs can change over time, whether due to life events like marriage, divorce, or the purchase of a new home, or changes in your financial situation. Regularly reviewing your policy ensures that your coverage remains up-to-date and adequate.

It's a good practice to review your policy annually or whenever a significant life event occurs. This way, you can adjust your coverage to reflect your current needs and ensure you're not overpaying for unnecessary coverage.

The Future of Arizona State Insurance

The insurance landscape in Arizona is continually evolving, driven by technological advancements, changing consumer needs, and shifts in the regulatory environment. Here’s a glimpse into the future of Arizona State Insurance.

Technology and Digital Innovation

The insurance industry in Arizona, like many others, is embracing digital transformation. From online policy management and claims processing to the use of telematics in auto insurance for real-time driving data, technology is revolutionizing the way insurance is delivered and experienced.

The rise of InsurTech startups is also bringing innovative solutions to the market, offering consumers more choices and personalized coverage options.

Regulatory Changes

Arizona’s insurance regulations are subject to periodic updates and revisions to keep pace with changing market dynamics and consumer needs. The Arizona Department of Insurance regularly reviews and updates its guidelines to ensure the state’s insurance market remains competitive and consumer-friendly.

One area of focus for regulatory changes is the increasing prevalence of climate-related risks, such as wildfires and extreme weather events. The department is working to ensure that insurance policies adequately address these risks and provide fair coverage to policyholders.

Consumer Education and Empowerment

The Arizona Department of Insurance is committed to empowering consumers with the knowledge they need to make informed insurance decisions. The department offers a wealth of resources, including educational materials, consumer guides, and assistance with policy disputes, to help Arizonans navigate the complex world of insurance.

By promoting transparency and consumer education, the department aims to foster a more informed and engaged insurance market, where consumers can confidently choose the coverage that best suits their needs.

Conclusion

Understanding Arizona State Insurance is a critical step towards financial security and peace of mind. By familiarizing yourself with the unique aspects of Arizona’s insurance landscape, reviewing your policy regularly, and staying informed about industry developments, you can ensure that you’re adequately protected for whatever life throws your way.

What are the mandatory insurance requirements in Arizona?

+In Arizona, the only mandatory insurance is auto insurance. You must carry liability coverage with minimum limits of 25,000 for bodily injury per person, 50,000 for bodily injury per accident, and $15,000 for property damage.

How can I save money on my Arizona State Insurance policy?

+There are several ways to save on your insurance premiums. These include bundling multiple policies with the same insurer, maintaining a clean driving record, taking advantage of loyalty discounts, and increasing your deductibles. Additionally, shopping around and comparing quotes from different insurers can often lead to significant savings.

What should I do if I’m involved in an accident in Arizona?

+If you’re involved in an accident, the first step is to ensure the safety of yourself and others involved. Then, call the police to file a report and exchange information with the other driver(s). Take photos of the accident scene and any damage to your vehicle. Finally, contact your insurance provider to file a claim and provide them with the details of the accident.