What Is Liability Coverage Insurance

Liability coverage insurance is a fundamental aspect of risk management and financial protection for individuals, businesses, and organizations. It plays a crucial role in safeguarding policyholders from potential financial burdens arising from legal liabilities and third-party claims. This comprehensive guide aims to unravel the intricacies of liability coverage insurance, exploring its definition, types, benefits, and real-world applications.

Understanding Liability Coverage Insurance

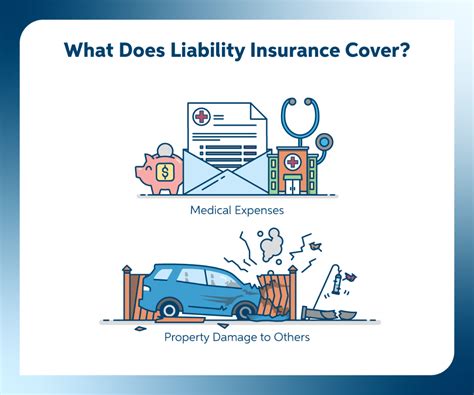

Liability coverage insurance, often referred to as liability insurance, is a type of insurance policy that provides protection against claims alleging that the policyholder’s negligence or actions have caused bodily injury, property damage, or other specified types of loss to a third party. This coverage serves as a safety net, ensuring that policyholders can manage the financial implications of such claims without devastating personal or business consequences.

The primary objective of liability coverage is to protect the insured from financial losses arising from legal actions taken against them. This coverage extends to various scenarios, including personal injury claims, property damage claims, and other forms of liability as outlined in the insurance policy. By transferring the financial risk associated with these potential liabilities to an insurance company, policyholders can maintain their financial stability and avoid the potential ruinous effects of unexpected legal expenses.

Types of Liability Coverage Insurance

Liability coverage insurance comes in various forms, each tailored to specific needs and risks. Understanding the different types is essential for selecting the most appropriate coverage for your situation.

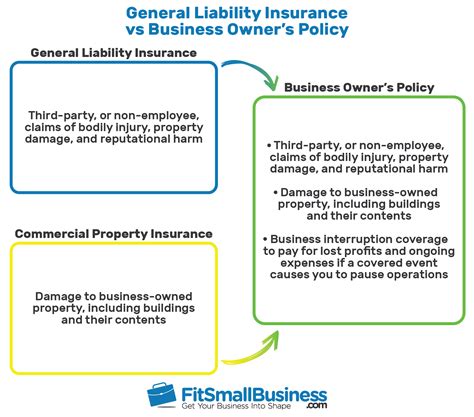

General Liability Insurance

General liability insurance, often considered the foundation of liability coverage, is a broad policy that provides protection for bodily injury, property damage, and personal and advertising injury claims. This type of insurance is particularly relevant for businesses and organizations, offering coverage for common risks such as slips and falls on business premises, product defects, and copyright infringement claims.

Professional Liability Insurance (Errors and Omissions Insurance)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is designed for professionals such as doctors, lawyers, accountants, and consultants. It protects against claims arising from professional services, covering allegations of negligence, errors, or omissions in the provision of those services. This coverage is vital for professionals who face the risk of lawsuits due to the nature of their work.

Product Liability Insurance

Product liability insurance is tailored for manufacturers, distributors, and retailers, providing coverage for claims arising from defects in products they produce or sell. This insurance is crucial as it protects businesses from financial losses due to product recalls, lawsuits, and other liability issues related to their products.

Commercial Auto Liability Insurance

Commercial auto liability insurance is a must-have for businesses that utilize vehicles in their operations. This coverage protects the business and its employees against claims resulting from vehicle accidents, including bodily injury and property damage. It ensures that businesses can manage the financial risks associated with their fleet of vehicles.

Homeowner’s and Renter’s Liability Insurance

Homeowner’s and renter’s liability insurance provides coverage for individuals against claims arising from accidents or injuries that occur on their property. This coverage is a crucial component of homeowner’s insurance policies, offering protection against a range of liabilities that may arise from ownership or occupancy of a home.

Other Specialized Liability Coverages

In addition to the above, there are numerous specialized liability insurance policies designed for specific industries and professions. These may include cyber liability insurance, directors and officers (D&O) liability insurance, employment practices liability insurance (EPLI), and more. Each of these policies addresses unique risks and provides tailored protection for specific situations.

Benefits of Liability Coverage Insurance

The benefits of liability coverage insurance are far-reaching and offer significant advantages to both individuals and businesses.

Financial Protection

The primary benefit of liability coverage is financial protection. Legal actions can result in substantial financial burdens, including settlement costs, legal fees, and potential damages. Liability insurance steps in to cover these expenses, ensuring that policyholders can manage the financial fallout of such claims without depleting their personal or business assets.

Peace of Mind

Knowing that you have liability coverage in place provides a sense of security and peace of mind. It allows individuals and businesses to focus on their daily operations and personal lives without the constant worry of unforeseen legal liabilities. This peace of mind is invaluable and can significantly reduce stress and anxiety.

Protection from Business Risks

For businesses, liability coverage is a crucial component of risk management. It helps protect the business’s assets, reputation, and continuity. By transferring the financial risk associated with legal liabilities to an insurance company, businesses can focus on their core operations and strategic growth without the constant threat of financial ruin.

Enhanced Credibility

Liability coverage can also enhance a business’s credibility and reputation. Many clients and partners view the presence of liability insurance as a sign of professionalism and financial responsibility. This can lead to increased trust and confidence in the business, potentially opening doors to new opportunities and partnerships.

Real-World Applications of Liability Coverage Insurance

Liability coverage insurance has proven its worth in a multitude of real-world scenarios, providing essential protection to individuals and businesses.

Personal Injury Claims

Liability insurance plays a vital role in protecting individuals from personal injury claims. For instance, if a guest slips and falls on your property, liability coverage can help cover the medical expenses and potential compensation claims. This type of coverage is especially beneficial for homeowners, as it provides a safety net against unexpected accidents that may occur on their premises.

Product Defect Lawsuits

Businesses that produce or sell products rely on product liability insurance to protect them from lawsuits arising from product defects. In the event of a product recall or a lawsuit alleging product-related injuries, this coverage steps in to manage the financial fallout. This is crucial for businesses to maintain their financial stability and reputation in the face of such challenges.

Professional Negligence Claims

Professional liability insurance, or E&O insurance, is a lifeline for professionals such as doctors and lawyers. In the event of a claim alleging negligence or errors in their professional services, this insurance provides the necessary coverage to manage the financial implications. It ensures that professionals can continue their practice without the fear of financial ruin due to a single mistake.

Vehicle-Related Accidents

Commercial auto liability insurance is a vital component of fleet management for businesses. In the event of an accident involving a company vehicle, this coverage ensures that the business is protected from potential liability claims. It covers both the cost of repairs and any damages awarded to the injured party, providing peace of mind to business owners and their employees.

Data Breach and Cyber Liability

With the increasing prevalence of cyber threats, cyber liability insurance has become a critical component of liability coverage. This insurance protects businesses from the financial consequences of data breaches, hacking incidents, and other cyber-related liabilities. It ensures that businesses can manage the costs associated with data recovery, legal fees, and potential compensation claims arising from cyber attacks.

Choosing the Right Liability Coverage

Selecting the appropriate liability coverage is a critical decision that requires careful consideration. Here are some key factors to keep in mind when choosing your liability insurance policy.

Risk Assessment

Conduct a thorough risk assessment to identify the specific liabilities you or your business may face. Consider the nature of your operations, the products or services you offer, and the potential risks associated with them. This assessment will guide you in choosing the right type of liability coverage.

Policy Limits and Deductibles

Liability insurance policies come with different limits and deductibles. Ensure that the policy limits are sufficient to cover potential claims, and consider the financial impact of the deductible. Higher limits typically provide greater protection, but they may also come with a higher premium.

Exclusions and Endorsements

Carefully review the exclusions and endorsements in the policy. Exclusions are specific situations or claims that are not covered by the policy, while endorsements are additions or modifications to the policy that can provide more comprehensive coverage. Understanding these elements is crucial to ensure you have the protection you need.

Cost-Benefit Analysis

Conduct a cost-benefit analysis to determine the financial viability of the policy. Consider the premium cost against the potential financial risks you face. Remember that liability insurance is an investment in your financial security, and the cost should be weighed against the peace of mind and protection it provides.

Reputation and Reliability of the Insurance Provider

Choose a reputable and reliable insurance provider. Research their financial stability, customer satisfaction ratings, and claims handling processes. A reliable insurance company will be there to support you when you need them most, ensuring a smooth and efficient claims process.

The Future of Liability Coverage Insurance

The landscape of liability coverage insurance is continually evolving to keep pace with changing risks and technological advancements. As society becomes increasingly interconnected and digital, new risks and liabilities emerge, necessitating the development of innovative insurance solutions.

One of the most significant trends in liability coverage is the growing focus on cyber liability insurance. With the rise of remote work and the increasing reliance on digital technologies, businesses are more vulnerable to cyber attacks and data breaches. As a result, cyber liability insurance has become a critical component of liability coverage, offering protection against the financial consequences of these emerging risks.

Additionally, the concept of shared liability is gaining prominence, particularly in the context of autonomous vehicles and emerging technologies. As technology advances, the lines of responsibility become blurred, and traditional liability models may need to adapt to accommodate shared liability scenarios. Insurance providers are actively exploring ways to address these emerging risks and provide comprehensive coverage for their policyholders.

The future of liability coverage insurance also involves a more personalized approach to risk management. Insurance providers are leveraging advanced analytics and data-driven insights to offer tailored coverage options that address the unique risks faced by individuals and businesses. This shift towards personalized insurance is expected to continue, providing more flexible and targeted protection for policyholders.

In conclusion, liability coverage insurance is a critical component of financial protection and risk management for individuals and businesses alike. By understanding the various types of liability coverage, their benefits, and real-world applications, policyholders can make informed decisions to safeguard their financial well-being. As the insurance landscape continues to evolve, staying informed about emerging risks and insurance solutions will be essential for maintaining comprehensive protection.

What are the key differences between general liability insurance and professional liability insurance?

+General liability insurance provides broad coverage for bodily injury, property damage, and personal and advertising injury claims. It is suitable for a wide range of businesses and organizations. On the other hand, professional liability insurance, also known as errors and omissions (E&O) insurance, is tailored for professionals such as doctors, lawyers, and consultants. It specifically covers claims arising from professional services, including allegations of negligence, errors, or omissions.

How does liability coverage insurance work in the context of a product recall?

+In the event of a product recall, product liability insurance steps in to provide coverage. It helps cover the costs associated with the recall, including the cost of replacing or repairing defective products, as well as any legal fees and potential compensation claims arising from the recall. This insurance is crucial for manufacturers and distributors to manage the financial impact of product-related liabilities.

What should I consider when choosing liability coverage limits and deductibles?

+When selecting liability coverage limits and deductibles, it’s important to consider the potential financial risks you face. Higher limits provide greater protection but may come with a higher premium. Assess your business or personal financial stability and choose limits that offer adequate coverage without straining your finances. Additionally, consider the potential impact of the deductible and choose a deductible amount that you are comfortable paying out of pocket.