All Car Insurance

Welcome to this comprehensive guide on car insurance, a topic that is essential for every vehicle owner. Car insurance is a crucial aspect of responsible vehicle ownership, providing financial protection and peace of mind in the event of accidents, theft, or other unforeseen circumstances. With the vast array of insurance options available, it's important to understand the intricacies of this industry to make informed decisions.

In this expert-level journal article, we will delve into the world of car insurance, exploring its various facets, including coverage types, policy options, pricing factors, and the claims process. We aim to provide you with a thorough understanding of the subject, empowering you to navigate the insurance landscape with confidence and make choices that best suit your needs.

Understanding Car Insurance: A Comprehensive Overview

Car insurance is a contract between you, the policyholder, and the insurance company. It is a legally binding agreement that outlines the coverage, limits, and exclusions of your insurance policy. This contract ensures that you are financially protected in the event of an accident, theft, or other covered incidents involving your vehicle.

The primary purpose of car insurance is to safeguard you and your vehicle from the financial burdens that can arise from accidents or unforeseen events. It provides a safety net, ensuring that you can receive compensation for damages to your vehicle, cover medical expenses for injuries sustained, and even protect against liability claims from other parties involved in an accident.

Key Components of Car Insurance

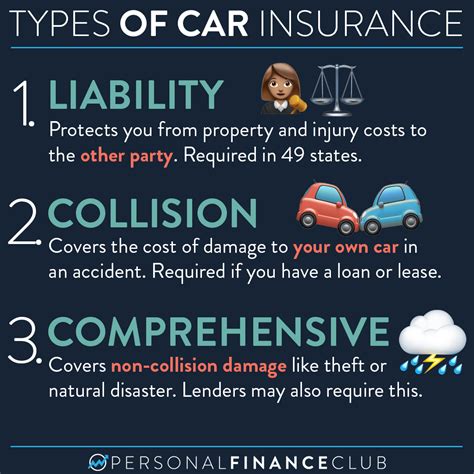

Car insurance policies typically consist of several key components, each offering different types of coverage:

- Liability Coverage: This is the most fundamental component of car insurance. It covers the costs associated with injuries or property damage you cause to others in an accident. It protects you from legal liability and includes both bodily injury liability and property damage liability.

- Collision Coverage: Collision coverage is an optional coverage that pays for repairs to your vehicle if it’s damaged in a collision, regardless of fault. This coverage is essential for protecting your vehicle’s value and ensuring it remains in good condition.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, natural disasters, or damage caused by animals. It provides a comprehensive safety net for your vehicle.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident. It ensures that medical bills are covered promptly, providing financial relief during a difficult time.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has little or no insurance. It ensures that you are not left financially vulnerable in such situations.

Factors Influencing Car Insurance Rates

Car insurance rates are determined by a variety of factors, each playing a role in the overall cost of your policy. Understanding these factors can help you make informed decisions when choosing insurance coverage.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as its primary usage (commuting, business, pleasure), can significantly impact your insurance rates. Insurers consider factors such as the vehicle’s safety features, repair costs, and its popularity for theft when calculating rates.

- Driver’s Profile: Your driving history, including any accidents or violations, is a critical factor in determining insurance rates. Insurers also consider your age, gender, marital status, and years of driving experience. Younger, less experienced drivers, for example, are often considered higher-risk and may face higher premiums.

- Location: Where you live and where your vehicle is primarily garaged can affect your insurance rates. Areas with higher populations, congested roads, or a higher incidence of accidents and thefts may result in increased premiums.

- Coverage and Deductibles: The level of coverage you choose and the deductibles you select can impact your insurance rates. Higher coverage limits and lower deductibles typically result in higher premiums, as they provide greater financial protection.

- Discounts and Bundles: Insurance companies often offer discounts for various reasons, such as good driving records, safety features in your vehicle, or bundling multiple insurance policies (e.g., auto and home insurance) with the same provider. These discounts can significantly reduce your overall insurance costs.

| Factor | Impact on Rates |

|---|---|

| Vehicle Type | High-end vehicles with expensive repairs may have higher rates. |

| Driver's Profile | Young drivers with less experience may face higher premiums. |

| Location | Urban areas with higher accident rates may result in increased rates. |

| Coverage and Deductibles | Higher coverage and lower deductibles often lead to higher premiums. |

Navigating the Claims Process: A Step-by-Step Guide

When an accident occurs, knowing how to navigate the claims process efficiently can make a significant difference in the outcome. Here’s a step-by-step guide to help you through the process:

- Report the Accident: Immediately after an accident, contact your insurance company to report the incident. Most insurers have a dedicated phone line for emergency claims, ensuring prompt assistance.

- Gather Information: Collect as much information as possible at the scene of the accident. This includes details of the other driver(s) involved, such as their name, contact information, insurance details, and license plate number. Also, take photographs of the accident scene, damage to vehicles, and any visible injuries.

- Contact the Police (if necessary): In certain situations, such as hit-and-runs, serious injuries, or disputes over fault, it’s advisable to call the police. A police report can be valuable evidence when filing a claim.

- Seek Medical Attention: Even if you don’t feel injured immediately after an accident, it’s crucial to seek medical attention. Some injuries may not be apparent right away, and a medical professional can assess your condition and provide necessary treatment.

- File Your Claim: Once you’ve gathered the necessary information, file your claim with your insurance company. Provide them with all the details, including the police report (if applicable), photographs, and any other relevant documentation.

- Cooperate with the Insurance Adjuster: An insurance adjuster will be assigned to your case to investigate the accident and determine liability. Cooperate fully with the adjuster, providing them with any additional information they request. Be truthful and accurate in your statements.

- Receive a Settlement Offer: After the investigation, the insurance company will offer a settlement for your claim. Carefully review the offer, considering the extent of the damages and your policy’s coverage limits. If you’re not satisfied with the offer, you can negotiate or seek the assistance of a legal professional.

- Resolve the Claim: Once you’ve reached an agreement with the insurance company, they will process your claim and provide you with the agreed-upon settlement. This may involve repairs to your vehicle, reimbursement for medical expenses, or compensation for other covered losses.

Tips for a Smooth Claims Process

To ensure a smooth and efficient claims process, consider the following tips:

- Keep a copy of your insurance policy handy, so you’re aware of your coverage limits and any exclusions.

- Document everything related to the accident, including photographs, witness statements, and medical records.

- Maintain regular communication with your insurance company and keep them updated on the status of your claim.

- If you have concerns or questions, don’t hesitate to seek clarification from your insurer or a legal professional.

- Understand your rights and responsibilities as outlined in your insurance policy.

Choosing the Right Car Insurance Provider: Key Considerations

Selecting the right car insurance provider is a critical decision that can significantly impact your overall experience and the level of protection you receive. Here are some key considerations to guide your choice:

Financial Stability and Reputation

Look for insurance companies with a solid financial background and a positive reputation in the industry. Check their financial strength ratings from reputable agencies like A.M. Best, Moody’s, or Standard & Poor’s. A strong financial rating indicates the company’s ability to pay claims promptly and fulfill its financial obligations.

Coverage Options and Customization

Evaluate the range of coverage options offered by different insurers. Some providers offer comprehensive coverage packages, while others may specialize in certain types of policies. Consider your specific needs and choose a provider that offers customizable options to fit your requirements. For example, if you have a classic car, you may need a provider that specializes in collector car insurance.

Claims Handling and Customer Service

The efficiency and responsiveness of an insurance company’s claims handling process are crucial. Research the company’s reputation for handling claims fairly and promptly. Look for providers with a track record of excellent customer service, as this can make a significant difference during the claims process. Consider factors such as the ease of filing a claim, the speed of claim resolution, and the overall customer satisfaction ratings.

Pricing and Discounts

While cost is an important factor, it should not be the sole determinant of your choice. Compare quotes from multiple insurers to find the best value for your specific circumstances. Keep in mind that the cheapest option may not always provide the best coverage or service. Look for providers that offer discounts for various factors, such as safe driving records, vehicle safety features, or bundling multiple policies.

Digital Tools and Convenience

In today’s digital age, many insurance companies offer online or mobile app platforms for policy management and claims filing. Consider the convenience and ease of use of these digital tools. Being able to manage your policy, make payments, and file claims online can save time and provide added flexibility.

Reviews and Recommendations

Seek out reviews and recommendations from trusted sources, such as friends, family, or consumer review websites. Real-life experiences can provide valuable insights into an insurer’s performance, claims handling, and overall customer satisfaction.

Future Trends and Innovations in Car Insurance

The car insurance industry is constantly evolving, driven by technological advancements and changing consumer needs. Here are some key trends and innovations shaping the future of car insurance:

Telematics and Usage-Based Insurance

Telematics refers to the use of technology to monitor and analyze driving behavior. Usage-based insurance (UBI) is a type of policy that utilizes telematics data to determine insurance rates. With UBI, drivers can potentially lower their premiums by demonstrating safe driving habits. This trend is gaining traction, offering a more personalized approach to insurance pricing.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are revolutionizing the insurance industry. These technologies are being used to automate various processes, from policy underwriting to claims handling. AI can analyze vast amounts of data, predict risks, and streamline the insurance journey for both insurers and policyholders.

Connected Cars and Data Analytics

The rise of connected cars, equipped with advanced sensors and communication technologies, is transforming the way insurance companies assess risk. These vehicles generate real-time data, providing insurers with insights into driving behavior, vehicle performance, and potential risks. This data-driven approach allows for more accurate risk assessment and personalized insurance offerings.

Blockchain Technology

Blockchain, the technology behind cryptocurrencies like Bitcoin, is making its way into the insurance industry. Blockchain offers enhanced security, transparency, and efficiency in insurance processes. It can be used for secure data storage, smart contracts, and peer-to-peer insurance models, revolutionizing the way insurance transactions are conducted.

Insurtech Innovations

Insurtech, a combination of insurance and technology, is driving innovation in the industry. Insurtech startups are developing new solutions, such as digital claim processing platforms, AI-powered risk assessment tools, and on-demand insurance apps. These innovations aim to improve the customer experience, streamline processes, and reduce costs.

FAQ

What is the difference between comprehensive and collision coverage in car insurance?

+Comprehensive coverage protects your vehicle against damages caused by non-collision incidents, such as theft, vandalism, natural disasters, or damage caused by animals. Collision coverage, on the other hand, covers damages to your vehicle resulting from a collision, regardless of fault. While comprehensive coverage is often optional, collision coverage is typically required if you have a loan or lease on your vehicle.

How do insurance companies determine my car insurance rates?

+Insurance companies consider various factors when determining your car insurance rates, including your vehicle type and usage, driver’s profile (age, gender, driving history), location, coverage and deductibles chosen, and any applicable discounts. These factors help insurers assess the level of risk associated with insuring you and determine the appropriate premium.

What should I do if I’m involved in an accident and need to file a claim?

+If you’re involved in an accident, the first step is to ensure your safety and the safety of others involved. Exchange contact and insurance information with the other driver(s). Report the accident to your insurance company promptly, gather evidence (photos, witness statements), and seek medical attention if needed. Follow the claims process outlined by your insurance provider, and cooperate with the insurance adjuster during the investigation.

How can I lower my car insurance premiums?

+There are several strategies to potentially lower your car insurance premiums. These include maintaining a clean driving record, increasing your deductibles, bundling multiple policies (e.g., auto and home insurance) with the same provider, taking advantage of available discounts (safe driver, good student, vehicle safety features), and regularly reviewing and adjusting your coverage to match your current needs.

What are some common mistakes to avoid when choosing car insurance?

+When choosing car insurance, avoid common mistakes like selecting the cheapest option without considering coverage and service quality, neglecting to compare quotes from multiple insurers, failing to understand the exclusions and limitations of your policy, and overlooking the importance of customer service and claims handling.