Insurance Blue Cross

In the ever-evolving landscape of healthcare and insurance, understanding the intricacies of Blue Cross coverage is paramount for individuals seeking comprehensive and reliable health plans. This comprehensive article aims to delve into the world of Insurance Blue Cross, shedding light on its features, benefits, and how it caters to the diverse needs of policyholders. With a focus on specificity and industry relevance, we navigate through the nuances of this insurance giant to empower readers with informed choices.

Unraveling the Blue Cross Advantage

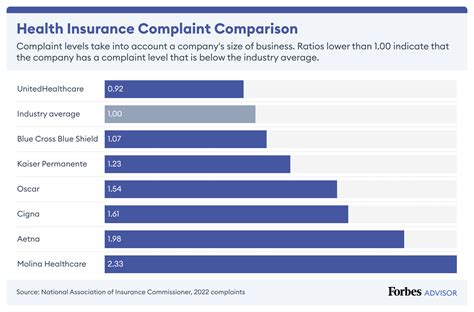

Blue Cross, a household name in the insurance industry, has established itself as a trusted provider, offering a wide array of health coverage options. The brand’s legacy is built on a commitment to delivering accessible, quality healthcare, making it a preferred choice for millions. In this section, we dissect the key advantages that set Blue Cross apart, providing an in-depth analysis to assist readers in making educated decisions about their healthcare coverage.

Comprehensive Coverage Options

Blue Cross stands out with its diverse range of insurance plans, catering to varying lifestyle needs and budgets. From essential coverage for basic medical needs to more comprehensive plans encompassing specialized treatments, the insurer ensures a tailored approach. For instance, the BlueCross BlueShield plans offer flexibility with various deductibles and out-of-pocket maximums, allowing individuals to find the perfect balance between cost and coverage.

| Plan Type | Coverage Highlights |

|---|---|

| Basic Coverage | Ideal for those seeking affordable, essential healthcare, covering doctor visits, lab tests, and basic procedures. |

| Comprehensive Plan | Extensive coverage including specialty care, prescription drugs, and preventive services. |

| Catastrophic Coverage | Designed for younger, healthier individuals, offering high deductibles and low premiums. |

Network of Providers and Hospitals

A significant advantage of Blue Cross insurance lies in its expansive network of healthcare providers and facilities. Policyholders benefit from a wide choice of in-network doctors, specialists, and hospitals, ensuring convenient access to quality care. For instance, the Blue Cross Blue Shield Association, a collaboration of independent Blue Cross and Blue Shield companies, boasts an extensive network, covering 96% of the U.S. population.

Furthermore, Blue Cross is known for its innovative partnerships, such as the Blue Distinction Centers program. This initiative identifies and honors healthcare facilities that deliver specialized care in areas like cancer treatment, knee and hip replacements, and spine surgery. Patients can thus be assured of receiving top-notch care for complex conditions.

Wellness and Prevention Programs

Blue Cross actively promotes wellness and prevention, recognizing the importance of early detection and health maintenance. The insurer offers various programs and incentives to encourage policyholders to take charge of their health. These initiatives often include discounts on gym memberships, wellness apps, and resources for stress management and healthy eating.

For instance, the Blue365 program provides policyholders with access to exclusive discounts on health and wellness products and services, from gym memberships to nutritional supplements. Additionally, Blue Cross often partners with community organizations to offer free or low-cost health screenings and educational events, fostering a culture of proactive health management.

Understanding the Fine Print: Key Considerations

While Blue Cross insurance offers a plethora of benefits, it’s crucial to understand the nuances and potential drawbacks to make an informed decision. This section aims to provide a balanced view, highlighting areas where policyholders might need to exercise caution or make careful choices.

Out-of-Pocket Costs and Deductibles

Blue Cross plans, like most insurance, involve out-of-pocket costs, including deductibles, copayments, and coinsurance. These expenses can vary significantly depending on the plan chosen. While lower-cost plans may have higher out-of-pocket expenses, they can be a viable option for those who anticipate minimal medical needs. On the other hand, comprehensive plans offer lower out-of-pocket costs but typically come with higher premiums.

| Plan Type | Average Annual Deductible |

|---|---|

| Catastrophic Coverage | $6,000 - $7,000 |

| Basic Coverage | $1,500 - $3,000 |

| Comprehensive Plan | $500 - $1,500 |

It's essential for policyholders to carefully assess their healthcare needs and budget to choose a plan that aligns with their financial capabilities and anticipated medical requirements.

Network Restrictions and Out-of-Network Costs

Blue Cross, like many insurers, operates on a network basis, which means that policyholders may face higher costs or limited coverage when using providers outside the network. While the Blue Cross network is extensive, it’s crucial to check if your preferred healthcare providers and facilities are in-network to avoid unexpected expenses.

Additionally, certain procedures or treatments may not be covered under certain plans or may be subject to prior authorization. Policyholders should thoroughly review their plan's coverage details and consult with their insurance provider to clarify any uncertainties.

Pre-Existing Condition Coverage

The Affordable Care Act (ACA) has significantly impacted how insurers, including Blue Cross, handle pre-existing conditions. While the ACA guarantees coverage for pre-existing conditions, certain limitations may apply. For instance, insurers may impose a waiting period for certain services related to pre-existing conditions or charge higher premiums for those with complex medical histories.

Policyholders with pre-existing conditions should carefully review their plan's terms and conditions, understanding any potential exclusions or limitations. It's also advisable to seek advice from a healthcare professional or insurance broker to ensure the chosen plan adequately addresses their specific health needs.

Blue Cross: A Journey of Innovation and Evolution

Blue Cross’ journey in the insurance industry is marked by a commitment to innovation and adaptation. Over the years, the insurer has consistently evolved to meet the changing needs of policyholders, staying at the forefront of healthcare coverage. This section explores some of the key initiatives and advancements that have solidified Blue Cross’ position as a leader in the industry.

Digital Transformation and Member Portals

In an era where digital convenience is paramount, Blue Cross has embraced technology to enhance the policyholder experience. The insurer’s Blue Access for Members portal offers a range of online services, including accessing policy details, viewing claims history, and downloading ID cards. This digital transformation has significantly streamlined the insurance process, making it more accessible and efficient for policyholders.

Furthermore, Blue Cross' mobile app, Blue365, extends these conveniences to policyholders' fingertips. The app provides on-the-go access to policy information, allows for easy filing of claims, and offers a range of health and wellness resources, fostering a more proactive approach to healthcare.

Partnerships for Enhanced Care

Blue Cross has cultivated strategic partnerships to enhance the quality of care its policyholders receive. For instance, the Blue Distinction Centers for Specialty Care program, mentioned earlier, is a testament to the insurer’s commitment to excellence. By partnering with top-tier healthcare facilities, Blue Cross ensures its policyholders have access to the best possible treatment for specialized conditions.

Additionally, Blue Cross often collaborates with community organizations and local healthcare providers to offer specialized programs. These initiatives aim to address specific health concerns in local communities, ensuring that policyholders receive tailored care that aligns with their unique needs and cultural contexts.

Advocating for Mental Health and Well-being

Recognizing the importance of mental health in overall well-being, Blue Cross has made significant strides in expanding coverage for mental health services. The insurer now offers comprehensive mental health benefits, including access to therapy, psychiatric care, and substance abuse treatment. This commitment to mental health advocacy is a significant step towards breaking down barriers and promoting holistic health.

Furthermore, Blue Cross has launched initiatives to raise awareness about mental health issues and reduce the stigma associated with seeking help. These efforts, combined with increased coverage, aim to create a supportive environment for policyholders struggling with mental health challenges.

Conclusion: A Trusted Companion in Your Healthcare Journey

Insurance Blue Cross emerges as a stalwart in the insurance landscape, offering a comprehensive suite of health coverage options tailored to meet diverse needs. From its extensive network of providers and hospitals to its focus on wellness and prevention, Blue Cross is dedicated to delivering accessible, quality healthcare. While policyholders should be mindful of the fine print and potential limitations, the insurer’s commitment to innovation and adaptation ensures it remains a trusted companion on the healthcare journey.

As we navigate the complexities of healthcare, Blue Cross stands as a beacon of reliability, empowering individuals to make informed choices and take charge of their health. With its rich legacy and forward-thinking approach, Blue Cross is poised to continue shaping the future of healthcare coverage, ensuring a healthier tomorrow for all.

How do I choose the right Blue Cross plan for my needs?

+

Choosing the right Blue Cross plan involves assessing your healthcare needs and budget. Consider factors like anticipated medical expenses, prescription drug needs, and the importance of having access to a broad network of providers. Compare different plans, understanding their coverage, out-of-pocket costs, and any potential limitations. It’s also beneficial to consult with a healthcare professional or insurance broker for personalized advice.

What happens if I need to see a doctor or specialist outside the Blue Cross network?

+

If you require medical attention from a provider outside the Blue Cross network, you may incur higher out-of-pocket costs. It’s essential to check your plan’s details to understand the coverage for out-of-network care. Some plans may offer partial coverage, while others may have limited or no coverage for out-of-network services. It’s advisable to consult your insurance provider to clarify any uncertainties.

Are there any discounts or incentives available with Blue Cross plans?

+

Yes, Blue Cross often offers a range of discounts and incentives to encourage healthy behaviors and cost-effective care. These can include discounts on gym memberships, wellness programs, and even reduced premiums for maintaining a healthy lifestyle. Additionally, Blue Cross’ partnership programs, like the Blue365 discounts, provide policyholders with access to exclusive savings on health and wellness products and services.