Tenant Insurance Definition

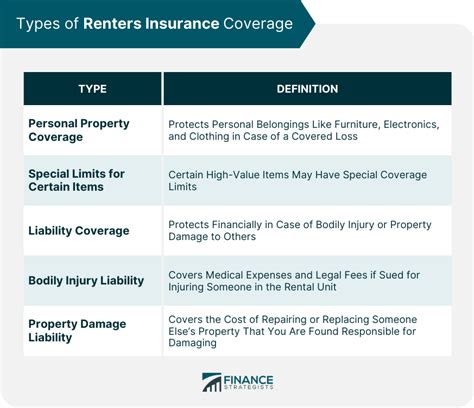

Tenant insurance, also known as renter's insurance, is a type of property insurance specifically designed to meet the needs of individuals who are renting a home, apartment, or any other residential property. It provides coverage for personal belongings and liability protection, offering peace of mind to tenants in various living situations.

Understanding Tenant Insurance: The Essentials

In the world of insurance, tenant insurance stands out as a vital safeguard for renters. It’s tailored to protect your personal property and provides liability coverage, ensuring you’re financially secure in case of unexpected events. Let’s delve into the specifics of what tenant insurance covers and why it’s essential.

Coverage for Personal Belongings

One of the primary functions of tenant insurance is to safeguard your personal belongings. This includes items like furniture, electronics, clothing, and any other possessions you may have in your rented home. Should any of these items be damaged or lost due to covered perils, such as fire, theft, or vandalism, tenant insurance steps in to reimburse you for the cost of repairing or replacing them.

| Covered Perils | Description |

|---|---|

| Fire | Protection against damage caused by fire, including smoke damage. |

| Theft | Coverage for items stolen from your rented property, including break-ins. |

| Vandalism | Reimbursement for damage caused by malicious acts of vandalism. |

| Water Damage | Protection against damage caused by water, including burst pipes or storms. |

It's important to note that tenant insurance typically covers the actual cash value of your belongings, which takes into account depreciation. If you prefer replacement cost coverage, where you receive the full cost to replace your items without deducting for depreciation, you can opt for this coverage for an additional premium.

Liability Protection

Tenant insurance also offers liability protection, which is a crucial aspect for renters. This coverage provides financial protection if you’re found legally responsible for bodily injury or property damage caused to others. For instance, if a guest slips and falls in your rented apartment and sues you, your tenant insurance policy can help cover the legal fees and any settlement costs.

Liability protection typically extends to situations that occur both inside and outside your rented property. For example, if your dog bites someone while you're out on a walk, your tenant insurance can provide coverage for the medical expenses and any legal costs associated with the incident.

Additional Living Expenses

In the event that your rented home becomes uninhabitable due to a covered loss, such as a fire or severe storm damage, tenant insurance often includes coverage for additional living expenses. This means the policy can reimburse you for the cost of temporary housing and any extra costs you incur while your rental property is being repaired or rebuilt.

For instance, if you need to stay in a hotel or rent a furnished apartment while your rented home is being restored, your tenant insurance policy can help cover these expenses, ensuring you're not left with a financial burden during a challenging time.

Other Potential Coverages

Beyond the core coverages, tenant insurance policies can also include additional benefits, depending on the provider and the specific policy. These may include:

- Personal Liability: Increased liability limits for added peace of mind.

- Medical Payments: Coverage for minor injuries sustained by visitors on your property.

- Identity Theft: Assistance and reimbursement for costs associated with identity theft.

- Loss Assessment: Coverage for your share of costs resulting from damage to common areas in a condo or co-op building.

- Personal Injury: Protection against lawsuits for libel, slander, or other personal injuries.

The Importance of Tenant Insurance

Tenant insurance is a vital component of any renter’s financial plan. It provides a safety net against potential financial losses due to unexpected events, offering protection for your personal belongings and peace of mind regarding liability risks. With tenant insurance, you can focus on enjoying your rented home without worrying about the financial implications of unforeseen circumstances.

Furthermore, tenant insurance can be particularly beneficial in situations where renters may face increased risks. For example, in urban areas with higher crime rates, tenant insurance can provide coverage against theft or vandalism. Similarly, in regions prone to natural disasters like hurricanes or earthquakes, tenant insurance can offer protection against damage caused by these events.

It's important to note that tenant insurance is separate from the landlord's insurance policy. Landlord insurance covers the structure of the rental property and any appliances or fixtures that are part of the building. Tenant insurance, on the other hand, is tailored to protect the renter's personal belongings and provide liability coverage for their specific needs.

Real-World Examples of Tenant Insurance Claims

Let’s explore some real-world scenarios where tenant insurance has proven its worth:

Example 1: Fire Damage

Imagine a tenant living in a rented apartment who, unfortunately, experiences a fire. The fire damages not only the apartment but also their personal belongings, including furniture, electronics, and clothing. With tenant insurance in place, the tenant can file a claim and receive compensation for the cost of replacing their damaged items. The insurance company may also cover the cost of temporary housing while the apartment is being repaired, ensuring the tenant has a place to stay during this challenging time.

Example 2: Liability Claim

Consider a renter who has a guest over for a dinner party. During the evening, the guest trips and falls, sustaining a serious injury. The guest decides to sue the renter for their medical expenses and other damages. In this scenario, the renter’s tenant insurance policy can provide liability coverage, helping to cover the legal fees and any settlement costs associated with the lawsuit. This protection ensures the renter doesn’t have to bear the financial burden of the accident alone.

Example 3: Natural Disaster

In a region prone to hurricanes, a renter experiences significant damage to their rented home due to a storm. The roof is damaged, allowing water to leak into the property and causing extensive damage to the tenant’s personal belongings. With tenant insurance, the renter can file a claim to receive compensation for the cost of repairing or replacing their damaged items. The insurance policy may also cover additional living expenses if the renter needs to find temporary housing while their home is being restored.

Choosing the Right Tenant Insurance Policy

When selecting a tenant insurance policy, it’s crucial to consider your specific needs and the value of your personal belongings. Here are some key factors to keep in mind:

Coverage Limits

Ensure that the policy provides adequate coverage limits for your personal property. Consider the value of your belongings and choose a policy that offers sufficient protection. It’s important to regularly review and update your coverage limits to reflect any changes in the value of your possessions.

Deductibles

Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. Choose a deductible that aligns with your financial situation and comfort level. While a higher deductible can result in lower premiums, it’s important to ensure you can afford the deductible in the event of a claim.

Policy Exclusions

Carefully review the policy’s exclusions to understand what’s not covered. Common exclusions may include damage caused by earthquakes, floods, or certain types of water damage. If you live in an area prone to these risks, you may need to purchase additional coverage or consider alternative insurance options.

Discounts and Bundling

Look for opportunities to save on your tenant insurance premiums. Many insurers offer discounts for bundling tenant insurance with other policies, such as auto insurance. Additionally, some providers offer discounts for security features like smoke detectors or security systems in your rented home.

Provider Reputation

Research the reputation and financial stability of the insurance provider. Choose a reputable company with a track record of paying claims promptly and fairly. Online reviews and ratings can provide valuable insights into the customer experience with different providers.

Conclusion: Tenant Insurance as a Smart Investment

Tenant insurance is more than just a financial safeguard; it’s a smart investment in your peace of mind. By protecting your personal belongings and providing liability coverage, tenant insurance ensures you’re prepared for unexpected events that could otherwise leave you financially vulnerable. Whether it’s a fire, theft, or an accident on your property, tenant insurance steps in to help you manage the financial fallout.

Moreover, tenant insurance offers flexibility to suit your specific needs. You can customize your policy with various coverage options, ensuring you're not paying for protection you don't need. This level of customization allows you to create a policy that fits your budget and provides the coverage that matters most to you.

In a world full of uncertainties, tenant insurance serves as a reliable partner, offering support and financial security when you need it most. It's an essential component of any renter's financial plan, providing the confidence to focus on what matters - enjoying your home and living your life to the fullest.

What is the average cost of tenant insurance?

+The average cost of tenant insurance can vary depending on several factors, including the location, the value of your belongings, and the coverage limits you choose. On average, tenant insurance policies can range from 150 to 300 per year. However, it’s important to note that prices can differ significantly based on individual circumstances.

Can tenant insurance cover my rental deposits?

+Tenant insurance typically does not cover rental deposits. Rental deposits are usually paid to the landlord to cover potential damages to the property. However, tenant insurance can provide coverage for damage to your personal belongings and liability protection, which can indirectly protect your rental deposit by ensuring you’re not held financially responsible for accidents or incidents that occur in your rented home.

Does tenant insurance cover my pets?

+Tenant insurance policies often include coverage for pets, specifically for injuries or illnesses sustained by your pet. However, it’s important to note that tenant insurance does not typically cover damage caused by your pet to others’ property. Additionally, some insurers may have specific restrictions or exclusions for certain types of pets, so it’s essential to review your policy carefully and discuss any concerns with your insurance provider.