Car Insurance Estimate Calculator

Welcome to our comprehensive guide on car insurance estimate calculators! In today's fast-paced world, obtaining an accurate and efficient car insurance quote is essential for anyone looking to protect their vehicle and budget. This article will delve into the world of car insurance estimate calculators, exploring their features, benefits, and how they can simplify the insurance process for you.

With the ever-evolving digital landscape, insurance providers have embraced technology to enhance their services. Car insurance estimate calculators have emerged as a powerful tool, offering a convenient and transparent way to compare insurance options and make informed decisions. In this article, we will uncover the intricacies of these calculators, their inner workings, and the valuable insights they provide.

Understanding Car Insurance Estimate Calculators

Car insurance estimate calculators are sophisticated online tools designed to provide personalized insurance quotes based on various factors specific to your vehicle and driving profile. These calculators serve as a digital assistant, guiding you through the insurance estimation process and delivering accurate results in a matter of minutes.

The beauty of these calculators lies in their ability to consider a multitude of variables that influence your insurance premium. From the make and model of your car to your driving history and location, these calculators analyze data points to generate tailored quotes. By inputting relevant information, you gain a clear understanding of the insurance options available to you, empowering you to make well-informed choices.

Key Features of Car Insurance Estimate Calculators

Car insurance estimate calculators offer a wealth of features that enhance the insurance estimation process. Let's explore some of the key functionalities that make these tools invaluable:

- Customizable Input Fields: These calculators allow you to input specific details about your vehicle, such as the year, make, model, and mileage. Additionally, you can provide information about your driving history, including any accidents or traffic violations.

- Coverage Options: Estimate calculators present a range of coverage options, allowing you to select the level of insurance you require. From comprehensive coverage to liability-only plans, these tools provide a clear overview of the available choices.

- Real-Time Quotes: One of the standout features is the ability to receive real-time quotes instantly. As you input information, the calculator processes the data and generates an accurate estimate, ensuring you get an up-to-date and reliable quote.

- Comparison Tools: Many car insurance estimate calculators offer comparison features, enabling you to assess quotes from multiple insurance providers side by side. This feature simplifies the process of finding the best deal and helps you make an informed decision.

- Personalized Recommendations: Advanced calculators take into account your unique circumstances and provide personalized recommendations. Whether you're a young driver or have a spotless driving record, these tools offer tailored advice to help you choose the most suitable insurance plan.

The Benefits of Using Car Insurance Estimate Calculators

Car insurance estimate calculators offer a multitude of benefits that streamline the insurance process and provide significant advantages. Let's explore some of the key advantages:

- Convenience and Time-Saving: One of the primary benefits is the convenience and time-saving nature of these calculators. Instead of spending hours on the phone or visiting multiple insurance agents, you can obtain multiple quotes in a matter of minutes. This efficiency allows you to make quick comparisons and find the best insurance option without sacrificing your time.

- Transparency and Control: These calculators provide a transparent and user-friendly interface, allowing you to have control over the estimation process. You can easily adjust variables, such as coverage limits or deductibles, to see how they impact your premium. This level of transparency empowers you to make informed decisions and understand the factors influencing your insurance costs.

- Instant Comparison: With car insurance estimate calculators, you can compare quotes from various insurance providers instantly. This feature eliminates the need for tedious manual research and ensures you can find the most competitive rates in a matter of seconds. By having multiple quotes at your fingertips, you can easily identify the best value for your insurance needs.

- Personalized Experience: Advanced calculators take into account your unique circumstances and offer personalized recommendations. Whether you're a student, a business owner, or a retiree, these tools consider your specific needs and provide tailored advice. This personalized approach ensures you receive insurance coverage that aligns with your lifestyle and budget.

- Educational Resource: Car insurance estimate calculators serve as valuable educational tools. As you navigate through the estimation process, you gain a deeper understanding of the factors that influence your insurance premium. From learning about different coverage options to exploring deductibles and policy limits, these calculators provide insights that enhance your knowledge and help you make more informed choices.

How Car Insurance Estimate Calculators Work

Car insurance estimate calculators utilize advanced algorithms and data analysis to generate accurate quotes. These calculators consider a wide range of factors to assess your insurance needs and provide a personalized estimate. Let's delve into the inner workings of these powerful tools.

Data Collection and Analysis

When you interact with a car insurance estimate calculator, you are providing valuable data that forms the basis of your insurance quote. The calculator collects information about your vehicle, such as the make, model, year, and mileage. Additionally, it gathers details about your driving history, including any accidents, traffic violations, and claims made.

The calculator then analyzes this data using sophisticated algorithms. These algorithms take into account various risk factors, such as the statistical likelihood of accidents based on your vehicle's characteristics and your driving behavior. By considering these factors, the calculator can assess the level of risk associated with insuring your vehicle and provide an accurate estimate of the premium.

Risk Assessment and Pricing

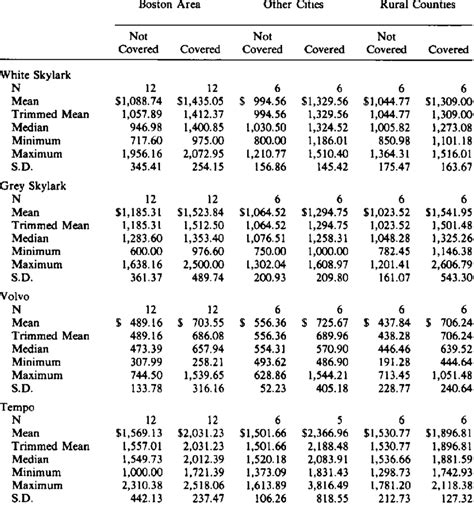

Car insurance estimate calculators employ risk assessment models to determine the appropriate pricing for your insurance policy. These models consider a range of variables, including your age, gender, location, and driving experience. By analyzing these factors, the calculator can identify potential risks and assign a corresponding premium.

For instance, younger drivers or those with a history of accidents may be considered higher-risk, resulting in a higher insurance premium. On the other hand, experienced drivers with a clean driving record may benefit from lower rates. The calculator's risk assessment ensures that your insurance quote is fair and reflective of your unique circumstances.

Coverage Selection and Customization

Car insurance estimate calculators offer a range of coverage options, allowing you to tailor your insurance policy to your specific needs. Whether you require comprehensive coverage, liability-only insurance, or additional add-ons, these calculators present a variety of choices.

As you navigate through the calculator, you can select the coverage levels and additional benefits that align with your preferences. This customization ensures that your insurance policy is tailored to your requirements, providing the right level of protection for your vehicle and budget.

Comparing Quotes and Choosing the Right Insurance

Car insurance estimate calculators provide a convenient platform to compare quotes from multiple insurance providers. By leveraging these tools, you can make an informed decision and choose the insurance plan that best suits your needs.

Exploring Coverage Options

When comparing quotes, it's essential to understand the coverage options available. Car insurance estimate calculators present a comprehensive overview of different coverage types, allowing you to assess the level of protection offered by each plan.

From liability insurance, which covers damages to others in the event of an accident, to comprehensive coverage, which provides protection for a wide range of incidents, these calculators help you navigate the different options. By exploring the coverage details, you can make an informed choice and select a plan that provides the right balance of protection and affordability.

Analyzing Deductibles and Premiums

Car insurance estimate calculators also enable you to analyze deductibles and premiums, two crucial components of your insurance policy. Deductibles represent the amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, as you are assuming more financial responsibility.

By adjusting the deductible and premium levels within the calculator, you can see the impact on your overall insurance cost. This feature allows you to find the sweet spot between affordable premiums and manageable deductibles, ensuring you have a policy that fits your financial situation.

Reviewing Additional Benefits and Add-Ons

Car insurance estimate calculators often showcase additional benefits and add-ons that can enhance your insurance coverage. These features may include rental car coverage, roadside assistance, or coverage for specific events, such as natural disasters.

By reviewing these additional benefits, you can assess whether they align with your needs and budget. Some insurance providers offer customizable packages, allowing you to select the add-ons that provide the most value for your specific circumstances. This level of customization ensures you have a comprehensive insurance plan that meets your unique requirements.

Future Implications and Innovations in Car Insurance

As technology continues to advance, the world of car insurance is witnessing exciting innovations and developments. Car insurance estimate calculators are at the forefront of these advancements, offering enhanced features and improved accuracy.

Advanced Risk Assessment Models

Insurance providers are investing in advanced risk assessment models that utilize machine learning and artificial intelligence. These models analyze vast amounts of data, including historical claims, driving behavior, and real-time traffic conditions, to provide more accurate risk assessments.

By leveraging these advanced models, car insurance estimate calculators can offer more precise quotes. They can identify patterns and trends, allowing for a more nuanced understanding of risk factors. This level of accuracy ensures that your insurance quote is tailored to your unique driving profile, resulting in a fair and personalized insurance experience.

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of sensors and GPS devices, is revolutionizing the car insurance industry. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, utilizes telematics to monitor driving behavior and offer customized insurance rates.

Car insurance estimate calculators are integrating telematics data to provide more dynamic and accurate quotes. By considering factors such as driving distance, time of day, and driving style, these calculators can offer real-time adjustments to your insurance premium. This innovative approach rewards safe driving behavior and provides a more equitable insurance experience, where your premium reflects your actual driving habits.

Personalized Insurance Packages

Car insurance estimate calculators are increasingly offering personalized insurance packages tailored to individual needs. These packages take into account your lifestyle, driving habits, and specific requirements to create a customized insurance plan.

For example, if you frequently travel long distances or have a classic car collection, the calculator can suggest specialized coverage options to address these unique circumstances. By offering personalized insurance packages, car insurance providers can cater to a diverse range of customers, ensuring that each policyholder receives the right level of protection and value.

FAQs

Are car insurance estimate calculators accurate?

+Yes, car insurance estimate calculators are designed to provide accurate quotes based on the information you input. However, it's important to note that the final insurance premium may vary slightly when you apply for a policy. Factors such as additional discounts or specific underwriting considerations may impact the final price.

How often should I use a car insurance estimate calculator?

+It's recommended to use a car insurance estimate calculator whenever you are considering a change in your insurance coverage or when you purchase a new vehicle. Additionally, it's beneficial to revisit the calculator annually to ensure you are still receiving the most competitive rates based on your current circumstances.

Can I get multiple quotes at once using these calculators?

+Absolutely! Car insurance estimate calculators often allow you to compare quotes from multiple insurance providers simultaneously. This feature provides a comprehensive overview of the available options, making it easier to find the best deal.

Do car insurance estimate calculators consider my credit score?

+In some cases, car insurance estimate calculators may take into account your credit score as it can impact your insurance premium. However, not all calculators consider credit scores, so it's important to review the specific calculator's features and guidelines.

Are there any limitations to using car insurance estimate calculators?

+While car insurance estimate calculators are highly accurate, there may be certain limitations. For instance, some calculators may not consider all available discounts or specific coverage options offered by insurance providers. It's always advisable to review the terms and conditions and speak with an insurance agent to ensure you receive the most comprehensive coverage.

In conclusion, car insurance estimate calculators have revolutionized the way we obtain insurance quotes. These powerful tools provide a transparent, convenient, and personalized experience, empowering you to make informed decisions about your insurance coverage. By understanding the features, benefits, and inner workings of these calculators, you can navigate the insurance landscape with confidence and find the best insurance plan for your vehicle and budget.