Best Cheapest Health Insurance

Finding the best and cheapest health insurance plan can be a daunting task, especially with the vast array of options available. The complexity of healthcare systems and insurance policies often leaves individuals searching for a balance between comprehensive coverage and affordability. This comprehensive guide aims to demystify the process, offering expert insights and practical tips to help you secure the most cost-effective health insurance coverage tailored to your needs.

Understanding Health Insurance Basics

Health insurance is a crucial aspect of financial planning, providing individuals and families with access to medical care and protection against the potentially devastating costs of unexpected illnesses or injuries. In the United States, the healthcare system is largely private, with insurance companies offering a wide range of plans to suit different budgets and healthcare requirements.

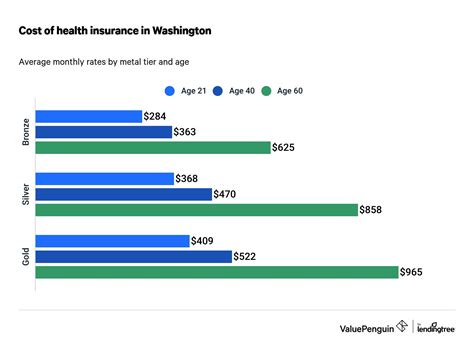

The cost of health insurance can vary significantly depending on factors such as age, location, pre-existing medical conditions, and the level of coverage desired. It's important to strike a balance between affordability and adequate coverage to ensure you're protected in the event of a medical emergency.

Types of Health Insurance Plans

There are several types of health insurance plans available in the market, each with its own unique features and benefits. Understanding these plan types is essential to making an informed decision.

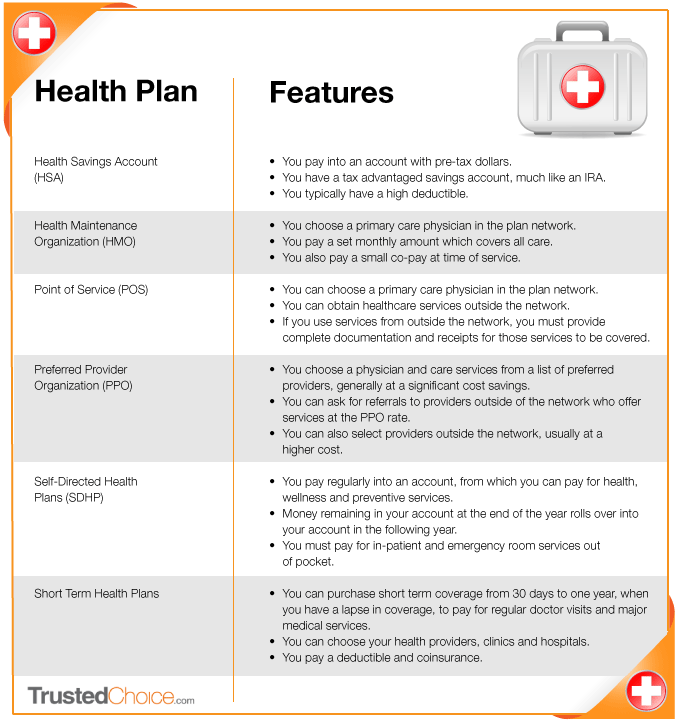

- Managed Care Plans: These plans typically offer more affordable premiums in exchange for some limitations on the healthcare providers and services you can access. Examples include Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). HMOs usually require you to choose a primary care physician who coordinates your care and refers you to specialists within the network. PPOs offer more flexibility, allowing you to see out-of-network providers, but at a higher cost.

- Indemnity Plans: Also known as fee-for-service plans, indemnity plans provide the most flexibility in terms of healthcare provider choice. You can visit any doctor or hospital, and the insurance company will reimburse you for a portion of the costs. However, these plans often come with higher premiums and deductibles.

- High-Deductible Health Plans (HDHPs): HDHPs are designed to be more cost-effective, with lower premiums and higher deductibles. They are often paired with Health Savings Accounts (HSAs), which allow you to save pre-tax dollars for medical expenses. HDHPs are a good option for healthy individuals who don't anticipate frequent medical needs.

- Short-Term Health Insurance: Short-term plans provide temporary coverage, typically for a period of up to 12 months. They are ideal for individuals between jobs or those who are awaiting enrollment in a long-term plan. However, it's important to note that short-term plans often have limited benefits and may not cover pre-existing conditions.

- Medicaid and Medicare: These are government-funded insurance programs that cater to specific groups of people. Medicaid is available to low-income individuals and families, while Medicare is primarily for seniors aged 65 and older, as well as certain younger people with disabilities.

Key Considerations When Choosing a Plan

When selecting a health insurance plan, it’s crucial to consider your specific healthcare needs and financial situation. Here are some key factors to keep in mind:

- Premium Costs: Premiums are the regular payments you make to maintain your insurance coverage. While it's tempting to opt for the lowest premium, remember that it might come with higher deductibles or limited coverage.

- Deductibles and Out-of-Pocket Limits: Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Out-of-pocket limits are the maximum amount you'll pay in a year for covered services. Lower deductibles often mean higher premiums, so strike a balance that aligns with your healthcare needs and budget.

- Network of Providers: Check if your preferred doctors and hospitals are included in the insurance plan's network. Out-of-network care can be significantly more expensive.

- Coverage for Specific Services: Different plans offer varying levels of coverage for services like prescription drugs, mental health care, maternity care, and preventive services. Ensure the plan covers the services you're likely to need.

- Prescription Drug Coverage: If you regularly take prescription medications, make sure the plan includes a robust prescription drug benefit.

- Pre-existing Conditions: If you have a pre-existing medical condition, choose a plan that covers it. Some plans have waiting periods or exclusions for pre-existing conditions, so read the fine print carefully.

Comparing Health Insurance Plans

To find the best and cheapest health insurance plan for your needs, it’s essential to compare multiple options. Here’s a step-by-step guide to help you in the comparison process:

Step 1: Determine Your Healthcare Needs

Start by assessing your current and potential future healthcare needs. Consider factors such as your age, any existing medical conditions, and your lifestyle. If you’re generally healthy and don’t anticipate frequent doctor visits, a high-deductible plan might be suitable. On the other hand, if you have ongoing medical needs or a family history of certain conditions, a plan with lower out-of-pocket costs could be a better fit.

Step 2: Research Insurance Providers

There are numerous insurance providers in the market, each offering a range of plans. Start by researching reputable providers in your area. Check online reviews and ratings to gauge customer satisfaction and the provider’s track record. Consider asking for recommendations from friends, family, or healthcare professionals you trust.

Step 3: Understand Plan Details

When comparing plans, pay close attention to the fine print. Here are some key aspects to evaluate:

- Coverage Limits: Check the plan's coverage limits for various services, including hospital stays, specialist visits, and prescription medications. Ensure the limits align with your healthcare needs.

- Network of Providers: Verify that your preferred doctors and hospitals are included in the plan's network. Out-of-network care can lead to higher costs.

- Prescription Drug Formulary: If you take prescription medications, review the plan's formulary to ensure your medications are covered. Some plans have tiered formularies, with different cost-sharing amounts depending on the drug's tier.

- Preventive Care Coverage: Many plans offer free or low-cost preventive services like annual check-ups, screenings, and immunizations. Ensure the plan covers these services without requiring a copay or deductible.

- Specialist Referrals: If you anticipate needing specialist care, understand the plan's referral process. Some plans require referrals from your primary care physician, while others allow you to self-refer.

Step 4: Calculate Out-of-Pocket Costs

In addition to the premium, consider the potential out-of-pocket costs associated with each plan. These include deductibles, copayments, and coinsurance. Calculate the maximum out-of-pocket expenses you could incur under each plan, especially if you anticipate significant medical needs.

Step 5: Evaluate Customer Service and Claims Process

The insurance provider’s customer service and claims handling processes can significantly impact your experience. Research the provider’s reputation for prompt and efficient claims processing. Consider factors like ease of communication, responsiveness to inquiries, and the availability of online tools for managing your policy and submitting claims.

Step 6: Consider Additional Benefits

Some insurance plans offer additional benefits that might be valuable to you. These could include wellness programs, travel insurance, or discounts on health-related products and services. While these benefits might not directly impact your healthcare costs, they can enhance your overall experience with the plan.

Tips for Getting the Best Value

Finding the best and cheapest health insurance plan involves more than just comparing premiums. Here are some additional tips to help you get the most value for your money:

Stay Healthy

One of the best ways to keep your health insurance costs down is to maintain a healthy lifestyle. Regular exercise, a balanced diet, and avoiding risky behaviors like smoking can reduce your likelihood of developing costly medical conditions. Many insurance plans also offer incentives and discounts for participating in wellness programs.

Utilize Preventive Care

Most health insurance plans cover a range of preventive services at no additional cost. These can include annual check-ups, immunizations, screenings for certain conditions, and counseling for topics like nutrition and weight management. Taking advantage of these services can help catch potential health issues early, when they’re often more treatable and less expensive to manage.

Shop Around and Negotiate

Don’t be afraid to shop around and compare quotes from multiple insurance providers. You might find significant variations in prices and coverage between different plans. Additionally, if you’re a loyal customer or have specific needs, consider negotiating with your current provider. They might be willing to offer a better rate or additional benefits to retain your business.

Understand Your Benefits

Take the time to thoroughly understand your health insurance benefits. Know what services are covered, what your out-of-pocket costs will be, and how to access your benefits. This knowledge can help you make more informed decisions about your healthcare and potentially save money by avoiding unnecessary expenses.

Manage Your Out-of-Pocket Costs

If you anticipate significant medical expenses, consider setting aside funds in a separate account to cover these costs. This can help you budget effectively and avoid financial strain when unexpected medical bills arrive. Additionally, some plans offer Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), which allow you to save pre-tax dollars specifically for healthcare expenses.

Choose an Appropriate Plan

While it might be tempting to opt for the cheapest plan, it’s essential to choose a plan that aligns with your healthcare needs. If you have a pre-existing condition or anticipate significant medical expenses, a plan with lower out-of-pocket costs might be more cost-effective in the long run. Conversely, if you’re generally healthy, a high-deductible plan could save you money on premiums.

Stay Informed

The healthcare industry and insurance market are constantly evolving. Stay informed about changes in coverage options, new plans, and updates to existing policies. Regularly review your insurance coverage to ensure it continues to meet your needs. Consider attending open enrollment periods or special enrollment periods to explore new plan options and make necessary adjustments.

FAQ

Can I get health insurance if I have a pre-existing condition?

+Yes, under the Affordable Care Act (ACA), insurance companies cannot deny coverage based on pre-existing conditions. However, some plans may have waiting periods or exclusions for certain conditions, so it’s important to carefully review the plan’s details.

What is the difference between a premium and a deductible?

+A premium is the regular payment you make to maintain your insurance coverage. It is typically paid monthly, quarterly, or annually. A deductible, on the other hand, is the amount you must pay out of pocket before your insurance coverage starts paying for eligible expenses.

Are there any government programs that offer free or low-cost health insurance?

+Yes, there are government-funded programs like Medicaid and Medicare that provide health insurance to eligible individuals. Medicaid is for low-income individuals and families, while Medicare primarily covers seniors aged 65 and older, as well as certain younger people with disabilities.

How can I reduce my out-of-pocket costs when using my health insurance?

+To minimize out-of-pocket costs, choose an in-network provider, understand your plan’s coverage for specific services, and take advantage of preventive care services that are often covered at no additional cost. Additionally, consider setting aside funds specifically for healthcare expenses to better manage your out-of-pocket costs.

What should I do if I have a dispute with my insurance company regarding a claim?

+If you have a dispute with your insurance company, it’s important to first understand your policy’s terms and conditions. Review the plan’s details and reach out to your insurance provider to discuss the issue. If the dispute remains unresolved, you can seek assistance from a healthcare advocate or consider filing a complaint with your state’s insurance department.