Cheap Health Insurance Washington State

Health insurance is a vital aspect of modern life, ensuring individuals have access to essential healthcare services without facing financial ruin. In Washington State, the cost of healthcare and insurance can vary significantly depending on various factors such as age, location, and the type of coverage required. This article aims to delve into the world of affordable health insurance options in Washington, exploring the factors that influence costs, the different plans available, and strategies to secure the best coverage at the most competitive prices.

Understanding the Landscape of Health Insurance in Washington

Washington State offers a diverse range of health insurance plans, catering to the varying needs and budgets of its residents. From comprehensive coverage for families to more affordable options for individuals, the market provides a plethora of choices. However, understanding the unique factors that influence insurance rates is crucial to making an informed decision.

Key Factors Affecting Health Insurance Costs

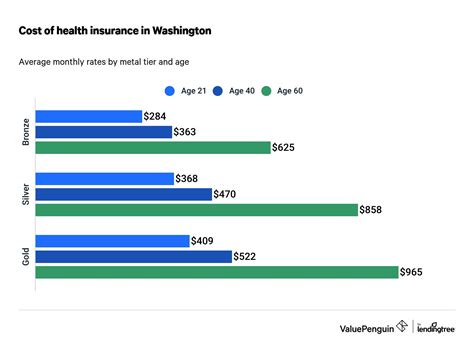

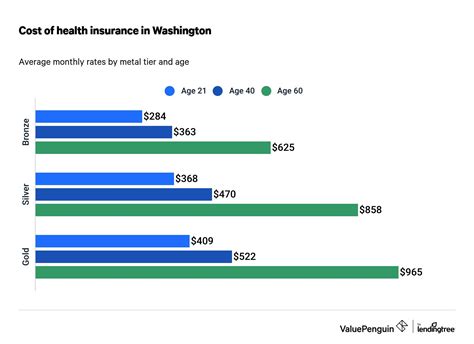

The cost of health insurance in Washington, as with any other state, is influenced by several key factors. Age is a significant determinant, with younger individuals generally paying lower premiums compared to older adults. This is primarily due to the lower risk of health issues among younger people.

Another critical factor is the location. The cost of living and healthcare services can vary drastically between cities and rural areas. Urban centers like Seattle often have higher insurance rates due to the concentration of medical facilities and higher demand for healthcare services.

The type of coverage chosen also plays a pivotal role. Different plans offer varying levels of coverage, from basic essential health benefits to more comprehensive plans that include dental, vision, and prescription drug coverage. The more extensive the coverage, the higher the premium.

| Plan Type | Coverage | Average Premium (Monthly) |

|---|---|---|

| Basic Health Plan | Essential health benefits only | $350 - $450 |

| Comprehensive Plan | Includes dental, vision, and prescription drugs | $500 - $700 |

| Catastrophic Plan | For young adults under 30 or specific hardship exemptions | $250 - $300 |

Additionally, the use of tobacco and pre-existing medical conditions can significantly impact insurance rates. Tobacco users often pay higher premiums due to the increased risk of health complications, while individuals with pre-existing conditions might need to consider plans with higher out-of-pocket maximums to ensure comprehensive coverage.

Exploring Affordable Health Insurance Options in Washington

Washington State provides several avenues for residents to secure affordable health insurance. One of the most significant initiatives is the Washington Healthplanfinder, a state-based marketplace that offers a range of health insurance plans from various carriers.

Through Healthplanfinder, individuals and families can browse and compare plans based on their specific needs and budgets. The marketplace offers both Qualified Health Plans (QHPs) and Catastrophic Plans, catering to different demographic segments.

QHPs are comprehensive plans that cover a range of essential health benefits, including doctor visits, hospital stays, prescription drugs, and more. These plans are ideal for families and individuals with varying healthcare needs. The premiums for QHPs can vary depending on the level of coverage chosen, with bronze, silver, gold, and platinum plans offering different cost-sharing structures.

For young adults under the age of 30 or individuals with specific hardship exemptions, Catastrophic Plans provide a more affordable option. These plans have lower premiums but higher deductibles, making them suitable for those who prioritize affordability over extensive coverage.

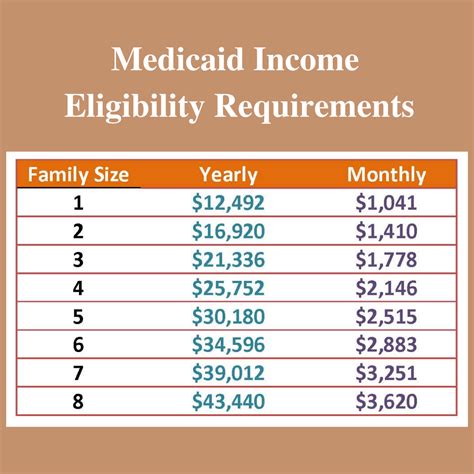

Moreover, Washington State also offers Medicaid, a government-funded program that provides free or low-cost health insurance to eligible residents. Medicaid covers a wide range of services, including doctor visits, hospital stays, prescription drugs, mental health services, and more. Eligibility for Medicaid is primarily based on income, with certain exceptions for pregnant women, children, and individuals with disabilities.

Another affordable option in Washington is the Basic Health Program (BHP). BHP is a state-based program that offers comprehensive health coverage to individuals who earn too much to qualify for Medicaid but cannot afford private insurance. The program provides essential health benefits at a lower cost, making it an attractive option for those in the coverage gap.

Tips for Securing the Best Health Insurance Deal in Washington

Navigating the health insurance market in Washington can be daunting, but with the right strategies, individuals can secure the best coverage at the most competitive prices.

- Compare Plans: Utilize resources like the Washington Healthplanfinder to compare different plans based on coverage, cost, and provider networks. Consider your specific healthcare needs and budget to make an informed decision.

- Understand Your Coverage Needs: Assess your healthcare requirements. If you have a chronic condition or anticipate needing extensive medical care, a more comprehensive plan might be beneficial. Conversely, if you're generally healthy and prioritize affordability, a basic plan might suffice.

- Consider Premium vs. Deductible Trade-offs: Plans with lower premiums often have higher deductibles, and vice versa. Weigh the trade-off between premium payments and out-of-pocket costs to find the right balance for your financial situation.

- Take Advantage of Subsidies: If your income qualifies, you may be eligible for premium tax credits or cost-sharing reductions, which can significantly reduce your out-of-pocket costs. These subsidies are available through the Washington Healthplanfinder.

- Explore Special Enrollment Periods: Outside of the open enrollment period, you may qualify for a Special Enrollment Period if you experience certain life events, such as marriage, divorce, birth or adoption of a child, loss of other coverage, or a change in income. These periods allow you to enroll in a new plan or change your existing coverage.

Future Implications and Ongoing Changes in Health Insurance

The landscape of health insurance in Washington State, and across the nation, is constantly evolving. The ongoing COVID-19 pandemic has highlighted the importance of accessible and affordable healthcare, leading to potential policy changes and reforms.

In Washington, there is a growing emphasis on expanding access to healthcare services, particularly in rural areas where healthcare facilities and insurance options may be limited. Initiatives such as the Washington Health Benefit Exchange and the Affordable Care Act continue to shape the state's health insurance market, aiming to make coverage more affordable and accessible to all residents.

Additionally, the increasing focus on preventative care and the integration of technology in healthcare delivery may also influence the future of health insurance. Telehealth services, for instance, have gained traction during the pandemic, offering a more convenient and cost-effective way to access medical advice and treatment. The continued development and adoption of such technologies could potentially drive down insurance costs and improve access to care.

Frequently Asked Questions

What is the average cost of health insurance in Washington State for an individual?

+

The average cost of health insurance for an individual in Washington State can vary significantly based on factors like age, location, and the level of coverage chosen. Generally, a basic health plan with essential benefits can cost around 350 to 450 per month, while more comprehensive plans can range from 500 to 700 per month.

Are there any government-funded programs that provide free or low-cost health insurance in Washington State?

+

Yes, Washington State offers Medicaid, a government-funded program that provides free or low-cost health insurance to eligible residents. Eligibility is primarily based on income, and the program covers a wide range of essential health services.

What is the Washington Healthplanfinder, and how can it help me find affordable health insurance?

+

The Washington Healthplanfinder is a state-based marketplace that offers a range of health insurance plans from various carriers. It allows individuals and families to compare and choose plans based on their specific needs and budgets. The marketplace provides both Qualified Health Plans (QHPs) and Catastrophic Plans, catering to different demographic segments.

Can I enroll in a health insurance plan outside of the open enrollment period in Washington State?

+

Yes, outside of the open enrollment period, you may qualify for a Special Enrollment Period if you experience certain life events like marriage, divorce, birth or adoption of a child, loss of other coverage, or a change in income. These periods allow you to enroll in a new plan or change your existing coverage.

Are there any subsidies available to help reduce the cost of health insurance in Washington State?

+

Yes, if your income qualifies, you may be eligible for premium tax credits or cost-sharing reductions. These subsidies are available through the Washington Healthplanfinder and can significantly reduce your out-of-pocket costs for health insurance.