What Is Cheapest Car Insurance

Car insurance is a necessary expense for any vehicle owner, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. With numerous insurance providers offering a wide range of policies, finding the cheapest car insurance can be a daunting task. However, with the right approach and an understanding of the factors that influence insurance costs, it is possible to secure affordable coverage. In this comprehensive guide, we will delve into the world of car insurance, exploring the key factors that affect premiums, comparing different coverage options, and providing valuable tips to help you find the most cost-effective policy for your needs.

Understanding the Factors That Influence Car Insurance Costs

The cost of car insurance can vary significantly depending on several key factors. By understanding these influences, you can make more informed decisions when shopping for insurance. Here are the primary factors that impact insurance premiums:

Driver Profile

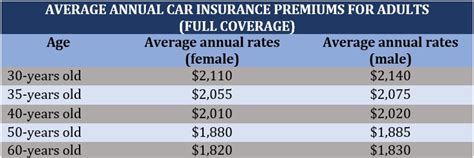

Your personal information, including age, gender, driving record, and location, plays a crucial role in determining insurance rates. Generally, younger drivers, especially males, tend to pay higher premiums due to their perceived higher risk of accidents. A clean driving record with no accidents or traffic violations can significantly reduce insurance costs. Additionally, the type of vehicle you drive and its age and make can also impact your insurance rates.

Coverage and Deductibles

The level of coverage you choose directly affects your insurance premiums. Comprehensive and collision coverage, which provide protection for your vehicle in the event of accidents or damage, typically cost more. On the other hand, liability-only coverage, which covers damage you cause to others, is generally more affordable. The deductible, the amount you pay out of pocket before your insurance kicks in, also influences premiums. Opting for a higher deductible can result in lower monthly premiums.

Insurance Provider and Policy Features

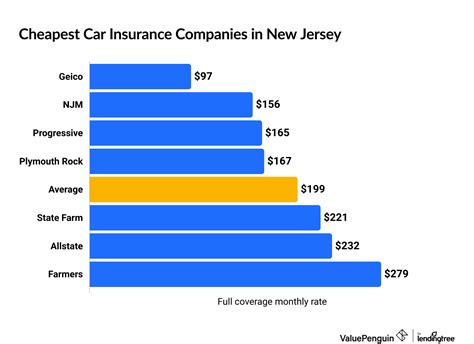

Different insurance companies offer varying rates and policy features. Some providers may specialize in offering affordable coverage for specific driver profiles or vehicle types. It’s essential to compare quotes from multiple insurers to find the best deal. Additionally, consider the policy features offered, such as accident forgiveness, roadside assistance, and rental car coverage, as these can impact the overall cost and value of the insurance.

State Regulations and Discounts

Each state has its own regulations and laws governing car insurance, which can influence the cost of premiums. Some states have mandatory minimum coverage requirements, while others may offer discounts for safe driving or for belonging to certain organizations. Understanding your state’s regulations and taking advantage of available discounts can help reduce insurance costs.

Comparing Different Types of Car Insurance Coverage

When it comes to car insurance, there are several coverage options available, each with its own advantages and cost implications. Understanding these coverage types will help you make an informed decision about the level of protection you need and can afford.

Liability Coverage

Liability coverage is the most basic and often the cheapest type of car insurance. It provides financial protection if you are found at fault for an accident that causes injuries or damage to others. Liability coverage typically includes bodily injury liability and property damage liability. While liability-only coverage is affordable, it may not provide sufficient protection for your own vehicle in the event of an accident.

Collision and Comprehensive Coverage

Collision coverage and comprehensive coverage are optional types of insurance that provide more extensive protection for your vehicle. Collision coverage pays for repairs or replacement if your car is damaged in an accident, regardless of who is at fault. Comprehensive coverage, on the other hand, covers damage caused by non-collision incidents, such as theft, vandalism, natural disasters, or collisions with animals. These coverages can be more expensive but offer valuable protection for your vehicle.

Personal Injury Protection (PIP) and Medical Payments Coverage

Personal Injury Protection (PIP) and Medical Payments coverage provide financial support for medical expenses incurred by you or your passengers in the event of an accident, regardless of fault. PIP coverage typically covers a wider range of medical expenses and may also provide wage loss and funeral expense coverage. Medical Payments coverage, on the other hand, provides more limited medical expense coverage. These coverages can be beneficial, especially if you have high medical costs or want additional peace of mind.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist coverage provides protection in the event that you are involved in an accident with a driver who has little or no insurance. This coverage can help cover your medical expenses and damages if the other driver is unable to pay. Uninsured/Underinsured Motorist coverage is an important consideration, as it ensures you are protected even when dealing with irresponsible drivers.

Tips for Finding the Cheapest Car Insurance

Now that we have a better understanding of the factors that influence car insurance costs and the different coverage options available, let’s explore some practical tips to help you find the cheapest car insurance that meets your needs.

Shop Around and Compare Quotes

The insurance market is highly competitive, and prices can vary significantly between providers. Shopping around and comparing quotes from multiple insurers is essential to finding the best deal. Use online quote comparison tools or directly contact insurance companies to obtain quotes. Make sure to compare not only the premiums but also the coverage limits, deductibles, and policy features offered by each provider.

Bundle Your Insurance Policies

Many insurance companies offer discounts when you bundle multiple insurance policies with them. Consider bundling your car insurance with other types of insurance, such as home, renters, or life insurance. Bundling can result in significant savings and provide convenience by managing all your insurance needs with a single provider.

Maintain a Good Driving Record

A clean driving record is one of the most effective ways to keep your insurance premiums low. Avoid accidents and traffic violations, as these can significantly increase your insurance rates. Safe driving not only reduces the risk of accidents but also demonstrates your responsibility as a driver, which is highly valued by insurance companies.

Choose a Higher Deductible

Opting for a higher deductible can result in lower monthly premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you accept more financial responsibility in the event of an accident or claim. However, make sure the chosen deductible is affordable and doesn’t strain your finances in the event of a claim.

Explore Discounts and Savings Opportunities

Insurance companies offer various discounts and savings opportunities to attract customers. Some common discounts include safe driver discounts, good student discounts, loyalty discounts, and discounts for certain professions or organizations. Additionally, consider using telematics devices or apps that track your driving behavior and offer discounts for safe driving habits.

Consider Usage-Based Insurance (UBI)

Usage-Based Insurance, also known as Pay-As-You-Drive or Pay-How-You-Drive insurance, is an innovative approach to car insurance that bases premiums on your actual driving behavior. UBI programs use telematics devices or smartphone apps to track factors such as miles driven, time of day, and driving habits. By adopting safe driving practices and limiting your mileage, you can potentially qualify for lower insurance rates through UBI programs.

Performance Analysis and Future Implications

The car insurance market is dynamic, and several trends and developments are shaping the industry. Here’s a performance analysis and an overview of future implications:

Technological Advancements

Technology is playing an increasingly significant role in the car insurance industry. Telematics devices and smartphone apps are being utilized to track driving behavior and offer usage-based insurance programs. Additionally, advancements in vehicle safety features, such as advanced driver-assistance systems (ADAS) and autonomous driving technologies, are expected to reduce accident rates and influence insurance premiums.

Regulatory Changes

Regulatory changes can have a significant impact on car insurance rates and coverage. For example, changes in state laws regarding mandatory insurance coverage or discounts can affect the cost of insurance. Additionally, regulatory initiatives focused on promoting competition and transparency in the insurance market can benefit consumers by driving down premiums and improving overall market efficiency.

Competition and Innovation

The car insurance market is highly competitive, with traditional insurers and emerging digital insurers vying for customers. This competition drives innovation and the development of new products and services. Insurtech startups, for instance, are leveraging technology to offer innovative coverage options and personalized insurance experiences. As a result, consumers can expect more choice, better pricing, and enhanced customer service in the future.

Data-Driven Insurance

The insurance industry is increasingly leveraging data analytics and machine learning to better understand risk factors and personalize insurance offerings. By analyzing vast amounts of data, insurers can more accurately assess risk and offer customized coverage options. This data-driven approach is expected to continue shaping the industry, leading to more precise pricing and targeted insurance products.

Conclusion

Finding the cheapest car insurance requires a comprehensive understanding of the factors that influence premiums, a careful comparison of coverage options, and a strategic approach to selecting an insurance provider. By following the tips outlined in this guide, you can navigate the complex world of car insurance and secure affordable coverage that meets your specific needs. Remember to shop around, maintain a good driving record, and explore the various discounts and savings opportunities available to you.

What is the average cost of car insurance in the United States?

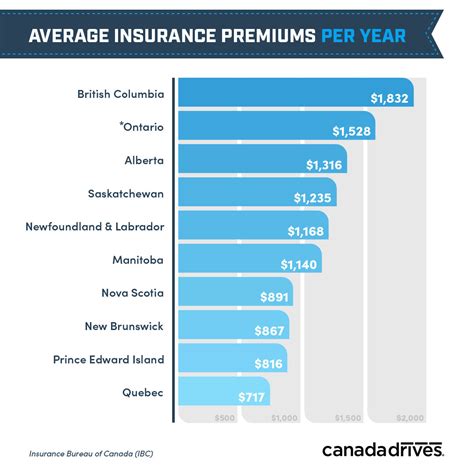

+The average cost of car insurance in the US varies depending on factors such as location, age, and driving history. According to recent data, the national average annual premium is around $1,674, with significant variations across states. Some states have much higher averages, while others offer more affordable rates.

How can I get the cheapest car insurance quote?

+To get the cheapest car insurance quote, it’s important to compare quotes from multiple providers. Use online quote comparison tools or directly contact insurance companies to obtain quotes. Additionally, consider adjusting your coverage limits and deductibles to find the most affordable option.

Are there any discounts available for car insurance?

+Yes, insurance companies offer various discounts to attract customers. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and discounts for certain professions or organizations. Additionally, some insurers provide discounts for bundling multiple insurance policies or for using telematics devices or apps.

What is the minimum car insurance coverage required by law?

+The minimum car insurance coverage required by law varies by state. However, most states require some form of liability insurance to cover damages you cause to others in an accident. It’s essential to understand your state’s specific requirements to ensure you have the necessary coverage.

How can I lower my car insurance premiums over time?

+To lower your car insurance premiums over time, maintain a good driving record by avoiding accidents and traffic violations. Consider increasing your deductible to reduce monthly premiums. Additionally, explore the option of usage-based insurance (UBI) programs, which offer discounts for safe driving habits and limited mileage.