Best Rate Car Insurance

Finding the best car insurance policy at the most affordable rate is a top priority for many vehicle owners. The insurance market is vast and complex, offering a wide range of options and coverage types. Navigating this landscape can be challenging, but with the right knowledge and strategy, you can secure the best coverage for your vehicle while keeping costs under control.

In this comprehensive guide, we will delve into the world of car insurance, exploring the factors that influence rates, the different coverage options available, and the steps you can take to identify and secure the best insurance policy for your needs. Whether you're a seasoned driver or a first-time car owner, understanding the intricacies of car insurance is essential to making informed decisions and ensuring you get the most value for your money.

Understanding Car Insurance Rates: Factors and Influences

Car insurance rates are determined by a multitude of factors, each playing a unique role in shaping the overall cost of your policy. From your personal information and driving history to the make and model of your vehicle, every detail contributes to the final price. Understanding these factors is crucial in identifying the best insurance options and potentially negotiating better rates.

Personal Information and Demographics

Your age, gender, marital status, and even your occupation can significantly impact your car insurance rates. For instance, young drivers, especially males, are often considered high-risk and face higher premiums. Similarly, certain occupations with higher exposure to risk, such as delivery drivers or sales representatives, may also attract higher insurance costs. Understanding how your personal demographics influence rates can help you make more informed choices when selecting insurance providers.

In addition to these factors, your driving history is a critical consideration for insurance companies. A clean driving record with no accidents or violations can lead to more favorable rates. Conversely, a history of accidents or traffic violations can significantly increase your insurance premiums. It's essential to maintain a safe driving record to keep your insurance costs as low as possible.

Vehicle Type and Usage

The type of vehicle you drive and how you use it also play a significant role in determining your insurance rates. Sports cars and luxury vehicles, for example, often attract higher insurance costs due to their higher repair costs and potential for theft. Additionally, vehicles used for business purposes or those driven frequently may be subject to higher premiums.

The safety features and anti-theft devices installed in your vehicle can also influence insurance rates. Vehicles equipped with advanced safety technologies or security systems may be eligible for discounts, as they are considered less risky to insure. Understanding the specific features of your vehicle and how they impact insurance rates can help you make informed decisions when choosing a policy.

Location and Coverage Options

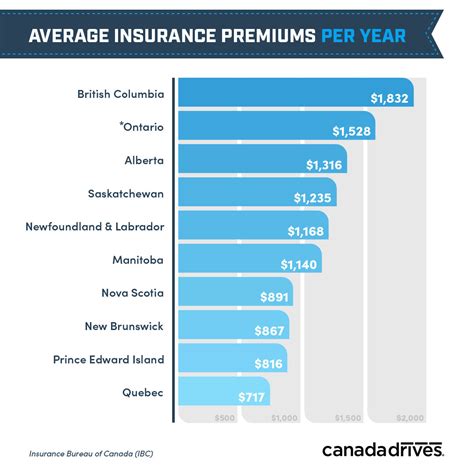

Your geographical location is another critical factor in determining car insurance rates. Areas with higher populations, dense traffic, or a history of frequent accidents or crimes often experience higher insurance costs. Similarly, the specific coverage options you choose, such as liability, collision, comprehensive, or additional add-ons, can significantly impact your overall insurance rate.

It's essential to carefully consider the coverage options available and select the ones that best suit your needs. While comprehensive coverage offers more protection, it may also result in higher premiums. Balancing your coverage needs with your budget is crucial in finding the best insurance policy for your situation.

Comparing Insurance Providers: Strategies for the Best Rates

With numerous insurance providers offering a wide range of policies, comparing and choosing the best option can be a daunting task. However, with a systematic approach and a thorough understanding of your needs, you can identify the providers that offer the best rates and coverage for your specific circumstances.

Researching and Comparing Providers

Start by researching and comparing multiple insurance providers. Look for companies that have a good reputation, positive customer reviews, and a track record of fair claims processing. Online platforms and comparison websites can be valuable resources for gathering information and comparing quotes from different providers.

When comparing providers, pay attention to the coverage options they offer, the discounts they provide, and their overall customer satisfaction ratings. Look for providers that offer customized policies and flexible coverage options to meet your specific needs. Additionally, consider the financial stability and reliability of the insurance company to ensure they will be able to provide long-term coverage and support.

Understanding Coverage Options and Add-ons

Car insurance policies come with various coverage options and add-ons that can be tailored to your specific needs. Understanding these options is crucial in selecting the right policy and ensuring you’re adequately protected.

Liability coverage, for instance, is a fundamental component of most car insurance policies. It covers the costs associated with injuries or damages you cause to others in an accident. Collision coverage, on the other hand, covers the costs of repairing or replacing your vehicle after an accident, regardless of who is at fault. Comprehensive coverage provides protection against damages caused by non-accident events, such as theft, vandalism, or natural disasters.

In addition to these basic coverages, there are various add-ons available, such as rental car reimbursement, gap insurance, or roadside assistance. These add-ons can provide additional peace of mind and convenience in specific situations. However, it's important to carefully evaluate your needs and choose add-ons that offer the most value for your money.

Negotiating Better Rates and Discounts

Negotiating with insurance providers can often lead to better rates and discounts. Many insurance companies offer various discounts, such as safe driver discounts, multi-policy discounts, or loyalty discounts. By understanding these discount options and negotiating with providers, you can potentially reduce your insurance costs significantly.

When negotiating, highlight your safe driving record, any safety features or anti-theft devices installed in your vehicle, and any other factors that might reduce your risk profile. Additionally, consider bundling your insurance policies, such as combining your car insurance with home or renters insurance. Bundling policies can often result in substantial savings and simplify your insurance management.

Performance Analysis: Assessing the Best Car Insurance Policies

Once you’ve gathered quotes and compared different insurance providers, it’s time to analyze the performance and reliability of the policies they offer. Assessing the quality of coverage, the claims process, and customer service is crucial in ensuring you select the best insurance policy for your needs.

Coverage Quality and Customization

Examine the coverage options offered by each insurance provider. Look for policies that provide comprehensive coverage, including liability, collision, and comprehensive coverage, as well as any additional add-ons that meet your specific needs. Consider the flexibility of the policy, allowing you to customize your coverage to match your budget and requirements.

Evaluate the policy limits and deductibles offered by each provider. Higher policy limits can provide more protection in the event of a severe accident or claim, but they may also result in higher premiums. Similarly, choosing a higher deductible can reduce your monthly premiums but may require you to pay more out-of-pocket in the event of a claim. It's important to find a balance that aligns with your financial capabilities and risk tolerance.

Claims Process and Customer Service

The claims process and customer service provided by an insurance company are critical factors in determining the overall quality of their service. Research and read reviews from existing customers to gauge the company’s responsiveness and efficiency in handling claims. Look for providers with a track record of timely and fair claims processing, as this can significantly impact your experience in the event of an accident or loss.

Additionally, assess the availability and accessibility of customer service representatives. A responsive and knowledgeable customer service team can provide valuable support and guidance throughout the claims process and address any concerns or questions you may have. Consider the different channels of communication offered by the insurance provider, such as phone, email, or online chat, and evaluate their response times and overall customer satisfaction ratings.

Financial Stability and Reliability

The financial stability and reliability of an insurance provider are crucial considerations when selecting a policy. Look for companies with a strong financial rating and a history of maintaining stable premiums. Financial stability ensures that the provider will be able to honor their commitments and pay out claims in the long term.

Research the insurance company's financial health and ratings from reputable agencies such as Standard & Poor's or Moody's. A high financial rating indicates the company's ability to manage risks effectively and maintain financial stability. Additionally, consider the company's track record of premium increases and their overall financial performance over the years.

The Future of Car Insurance: Emerging Trends and Technologies

The car insurance industry is continuously evolving, with emerging trends and technologies shaping the future of coverage and rates. Understanding these developments can provide valuable insights into the direction of the industry and help you make more informed decisions when selecting insurance providers.

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is gaining traction in the insurance industry. Usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive, use telematics data to assess an individual’s driving habits and offer personalized insurance rates. These policies can reward safe drivers with lower premiums, providing a more accurate reflection of their risk profile.

As telematics technology advances, insurance providers are increasingly incorporating it into their policies. This shift towards usage-based insurance offers a more dynamic and personalized approach to car insurance, allowing drivers to take control of their insurance costs by adopting safer driving habits.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing various industries, and the insurance sector is no exception. These technologies are being utilized to streamline processes, enhance risk assessment, and improve the accuracy of insurance pricing. AI-powered systems can analyze vast amounts of data, including driving behavior, weather conditions, and traffic patterns, to predict and mitigate risks more effectively.

Insurance providers are leveraging AI and ML to develop innovative solutions, such as automated claims processing and personalized risk assessment models. These advancements not only improve the efficiency and accuracy of insurance operations but also open up new opportunities for personalized coverage and potentially more affordable rates for policyholders.

Electric and Autonomous Vehicles

The rise of electric vehicles (EVs) and the development of autonomous driving technologies are set to disrupt the traditional car insurance market. EVs, with their advanced safety features and lower maintenance costs, are already influencing insurance rates. Insurance providers are adjusting their policies to accommodate the unique risks and benefits associated with EVs, offering specialized coverage and potentially lower premiums.

As autonomous vehicles become more prevalent, the insurance landscape will undergo significant changes. The shift towards shared mobility and the reduced risk of human error in autonomous driving could lead to a paradigm shift in insurance pricing and coverage. Insurance providers will need to adapt their policies to address the unique challenges and opportunities presented by this emerging technology.

Conclusion: Securing the Best Car Insurance Policy

Finding the best car insurance policy at the most competitive rate requires a comprehensive understanding of the factors that influence insurance rates, the coverage options available, and the strategies for negotiating better deals. By researching and comparing multiple insurance providers, understanding your coverage needs, and leveraging emerging technologies and trends, you can secure a policy that offers the best value for your money.

Remember, the car insurance market is highly competitive, and providers are constantly innovating to offer better rates and coverage. Stay informed about the latest developments, compare quotes regularly, and don't be afraid to negotiate with providers to get the best possible deal. With the right approach and a strategic mindset, you can navigate the complex world of car insurance and secure the coverage you need at the most affordable rate.

How often should I review and compare my car insurance policy?

+It’s recommended to review and compare your car insurance policy at least once a year, or whenever your policy is up for renewal. This allows you to stay updated with any changes in the market and ensures you’re getting the best rates and coverage available. Additionally, significant life changes, such as a new vehicle purchase, moving to a new location, or a change in marital status, can also warrant a review of your insurance policy.

What are some common discounts offered by insurance providers?

+Insurance providers offer a variety of discounts to attract customers and reward safe drivers. Common discounts include safe driver discounts, multi-policy discounts (bundling car insurance with home or renters insurance), loyalty discounts for long-term customers, and discounts for vehicles equipped with safety features or anti-theft devices. It’s worth exploring these options to reduce your insurance costs.

How can I improve my chances of getting lower insurance rates?

+To improve your chances of getting lower insurance rates, focus on maintaining a clean driving record with no accidents or traffic violations. Additionally, consider investing in safety features and anti-theft devices for your vehicle, as these can reduce your risk profile and potentially lead to discounts. Regularly comparing quotes from different providers and negotiating rates can also help you secure more favorable insurance terms.