Geyco Car Insurance

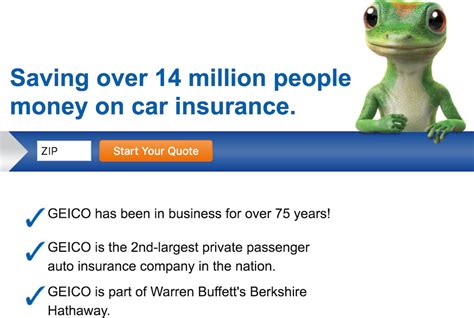

Welcome to a comprehensive exploration of Geyco Car Insurance, a prominent player in the auto insurance industry. With a rich history and a vast array of offerings, Geico has established itself as a trusted name for millions of policyholders across the United States. In this article, we delve into the intricacies of Geico's services, its unique selling points, and the impact it has had on the insurance landscape. Get ready to uncover the facts, figures, and real-world examples that make Geico a standout choice for car insurance.

A History of Innovation and Trust

Geico, an acronym for Government Employees Insurance Company, has a legacy spanning over 80 years. Founded in 1936, the company initially focused on providing insurance to government employees, leveraging the expertise of its founder Leo Goodwin, Sr., who was a former manager at a prominent insurance carrier. The company’s early success was built on the foundation of offering affordable rates to a specific demographic, a strategy that soon expanded to include military personnel and their families.

The 1970s marked a significant turning point for Geico. The company began to advertise directly to the public, a bold move that was met with great success. Geico's iconic advertising campaigns, featuring the memorable slogan "15 minutes could save you 15% or more on car insurance", became household names and helped solidify Geico's position as a major player in the insurance industry. This period of growth and expansion led to Geico becoming a household name, synonymous with reliable and affordable car insurance.

The Geico Advantage: Comprehensive Coverage Options

One of the key strengths of Geico lies in its diverse range of coverage options. Geico offers a comprehensive suite of car insurance policies designed to cater to the unique needs of its policyholders. Whether you’re seeking basic liability coverage or a more extensive policy that includes collision, comprehensive, and additional benefits, Geico has a plan tailored to your requirements.

Liability Coverage

Liability coverage is a fundamental aspect of any car insurance policy, and Geico offers robust protection in this area. This type of coverage ensures that you are financially protected in the event that you cause an accident that results in bodily injury or property damage to others. Geico’s liability coverage includes both bodily injury liability and property damage liability, providing peace of mind and protection against potentially devastating financial consequences.

Collision and Comprehensive Coverage

For those seeking more extensive protection, Geico offers collision and comprehensive coverage. Collision coverage safeguards you against the costs associated with repairing or replacing your vehicle after an accident, regardless of who is at fault. Comprehensive coverage, on the other hand, provides protection against non-collision incidents, such as theft, vandalism, or damage caused by natural disasters. Together, these coverages offer a robust safety net for your vehicle, ensuring that you are prepared for a wide range of potential mishaps.

Additional Benefits and Customization

Geico understands that every driver’s needs are unique, which is why they offer a range of additional benefits and customization options to tailor your policy to your specific circumstances. Some of these optional coverages include:

- Medical Payments Coverage: Provides coverage for medical expenses incurred by you or your passengers in the event of an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you financially if you're involved in an accident with a driver who has no insurance or insufficient insurance coverage.

- Rental Car Coverage: Offers reimbursement for rental car expenses if your vehicle is being repaired after an insured incident.

- Emergency Roadside Assistance: Provides assistance for various roadside emergencies, such as flat tires, dead batteries, or running out of gas.

By offering these additional coverages, Geico empowers its policyholders to create a car insurance policy that aligns perfectly with their individual needs and preferences.

Geico’s Technological Innovations and Customer Experience

Geico has consistently been at the forefront of technological advancements in the insurance industry. The company’s commitment to innovation is evident in its range of digital tools and resources, designed to enhance the customer experience and streamline the insurance process.

Mobile App and Online Platform

Geico’s mobile app and online platform are highly acclaimed for their user-friendly design and extensive functionality. Policyholders can manage their policies, make payments, file claims, and access important documents with just a few taps or clicks. The app also features a digital ID card, allowing users to access their insurance information quickly and easily, whether they’re on the go or at home.

Claim Processing and Customer Support

Geico’s claim processing system is renowned for its efficiency and effectiveness. The company utilizes advanced technologies, such as artificial intelligence and machine learning, to streamline the claims process and ensure prompt resolution. Policyholders can track the progress of their claims online, providing transparency and peace of mind during what can often be a stressful time.

Additionally, Geico's customer support team is highly trained and dedicated to providing exceptional service. They offer 24/7 assistance, ensuring that policyholders can receive support whenever they need it. Whether it's answering questions about coverage, assisting with policy changes, or guiding customers through the claims process, Geico's customer support team is known for its responsiveness and expertise.

Competitive Pricing and Discounts

One of the most attractive features of Geico car insurance is its competitive pricing. Geico offers some of the most affordable rates in the industry, making it an excellent choice for budget-conscious policyholders. The company’s commitment to providing value for money is evident in its range of discounts, which can significantly reduce the cost of your insurance premiums.

Discounts and Savings

Geico offers a wide array of discounts to help policyholders save on their car insurance premiums. These discounts include:

- Multi-Policy Discount: Policyholders who bundle their car insurance with other Geico policies, such as homeowners or renters insurance, can save up to 25% on their car insurance premiums.

- Military Discount: Active-duty military personnel, veterans, and their spouses are eligible for a discount on their car insurance premiums, recognizing their service and commitment.

- Good Student Discount: Students who maintain a certain grade point average or rank in the top 20% of their class can receive a discount on their car insurance premiums, encouraging academic excellence.

- Safe Driver Discount: Policyholders who have a clean driving record and have not been at fault in an accident for a specified period can receive a discount, rewarding safe and responsible driving behavior.

- Vehicle Equipment Discounts: Installing certain safety features or devices in your vehicle, such as anti-theft systems or air bags, can qualify you for a discount, as these features reduce the risk of accidents and theft.

By taking advantage of these discounts, policyholders can further reduce their insurance premiums and maximize their savings.

The Geico Experience: Real-World Testimonials

To truly understand the impact and value of Geico car insurance, we turn to the experiences of real policyholders. Here are some testimonials from satisfied Geico customers:

| Customer Name | Testimonial |

|---|---|

| John S. | "I've been a Geico customer for over 10 years, and their service has always been exceptional. The online platform is user-friendly, and their customer support team is incredibly responsive. When I had an accident, the claims process was seamless, and I received a fair settlement quickly. I highly recommend Geico for their reliability and excellent customer experience." |

| Emily R. | "As a young driver, I was concerned about the cost of car insurance. Geico offered me a great rate, and I've been impressed by their coverage options. Their app makes it easy to manage my policy, and I appreciate the additional benefits like emergency roadside assistance. I feel secure knowing that Geico has my back." |

| David M. | "Geico's commitment to innovation is evident in their digital tools. I can access my policy information and file claims with just a few clicks. Their AI-powered claim processing system is efficient and transparent, which is a huge relief when dealing with an accident. I trust Geico to provide me with the coverage I need and the support I deserve." |

These testimonials highlight the positive experiences that Geico customers have had, from the ease of managing their policies to the efficiency of the claims process. Geico's focus on customer satisfaction and technological advancements has undoubtedly contributed to its success and popularity among policyholders.

The Future of Geico: Expanding Horizons

Geico’s success and reputation as a trusted insurance provider have paved the way for future growth and expansion. The company continues to invest in innovative technologies and services, aiming to enhance the overall customer experience and stay ahead of the curve in the ever-evolving insurance landscape.

Digital Transformation and Personalization

Geico recognizes the importance of digital transformation in the insurance industry. The company is committed to further developing its digital platforms and tools, ensuring that policyholders have access to a seamless and personalized experience. By leveraging data analytics and artificial intelligence, Geico aims to offer customized insurance solutions that meet the unique needs of each policyholder.

Expanding Product Offerings

In addition to its comprehensive car insurance offerings, Geico is expanding its product portfolio to include a wider range of insurance products. This includes home insurance, renters insurance, life insurance, and even pet insurance. By offering a diverse range of insurance options, Geico aims to become a one-stop shop for all insurance needs, providing policyholders with convenience and comprehensive protection.

Community Engagement and Social Responsibility

Geico understands the importance of giving back to the communities it serves. The company actively engages in various social responsibility initiatives, supporting causes that align with its values and mission. From sponsoring educational programs to supporting environmental sustainability efforts, Geico demonstrates its commitment to making a positive impact beyond its core business operations.

Conclusion

Geico car insurance has established itself as a leading provider in the industry, offering a combination of comprehensive coverage, competitive pricing, and exceptional customer service. With a rich history of innovation and a commitment to technological advancements, Geico continues to shape the future of insurance. Whether you’re a new driver or a long-time policyholder, Geico’s range of coverage options, discounts, and digital tools make it an attractive choice for your car insurance needs.

As Geico looks ahead, its focus on digital transformation, expanding product offerings, and social responsibility initiatives positions the company for continued success and growth. With a customer-centric approach and a dedication to providing value, Geico is well-equipped to meet the evolving needs of its policyholders and remain a trusted name in the insurance industry.

How can I get a quote for Geico car insurance?

+Getting a quote for Geico car insurance is simple and convenient. You can start the process online by visiting the Geico website and entering your basic information, such as your name, address, and vehicle details. Alternatively, you can call their customer service hotline or visit a local Geico office to speak with an agent and obtain a personalized quote.

What factors influence the cost of Geico car insurance premiums?

+Several factors can influence the cost of Geico car insurance premiums, including your driving record, the type of vehicle you drive, your location, and the level of coverage you choose. Additionally, Geico offers various discounts that can help reduce your premiums, such as the multi-policy discount, military discount, and safe driver discount. It’s recommended to explore these discounts to find the most cost-effective coverage option for your needs.

How does Geico handle claims and customer support?

+Geico has a dedicated claims team that is available 24⁄7 to assist policyholders with their claims. The company utilizes advanced technologies, including AI and machine learning, to streamline the claims process and provide prompt and efficient service. Geico’s customer support team is highly trained and accessible through various channels, ensuring that policyholders receive timely assistance and support whenever needed.

What additional benefits does Geico offer to policyholders?

+Geico offers a range of additional benefits to policyholders, including emergency roadside assistance, rental car coverage, and medical payments coverage. These benefits are designed to provide added protection and peace of mind in various situations, such as breakdowns, accidents, or medical emergencies. Policyholders can customize their coverage to include these benefits based on their specific needs and preferences.

How does Geico contribute to social responsibility initiatives?

+Geico actively engages in social responsibility initiatives, demonstrating its commitment to giving back to the communities it serves. The company supports a variety of causes, including education, environmental sustainability, and community development. Through partnerships with nonprofit organizations and community-based programs, Geico aims to make a positive impact and create a better future for all.