Health Insurance In Canada

Canada's healthcare system is a cornerstone of the nation's identity and a source of pride for its residents. It is a publicly funded, universally accessible, and comprehensive healthcare model, often referred to as "Medicare." This article aims to delve into the intricacies of health insurance in Canada, exploring its history, structure, coverage, and the unique features that make it a global leader in healthcare.

The Evolution of Healthcare in Canada

The journey towards a universal healthcare system in Canada began in the post-World War II era, with the province of Saskatchewan leading the way. In 1962, Saskatchewan introduced the first publicly funded hospital care insurance plan, which served as a blueprint for the rest of the country.

The Medicare model, as we know it today, was officially established in 1966 when the federal government passed the Medical Care Act. This act provided funding to provinces and territories for physician services, on the condition that they maintain comprehensive insurance plans accessible to all residents. Over time, the system evolved, with each province developing its own healthcare plan while adhering to the principles of universality, accessibility, portability, and comprehensiveness.

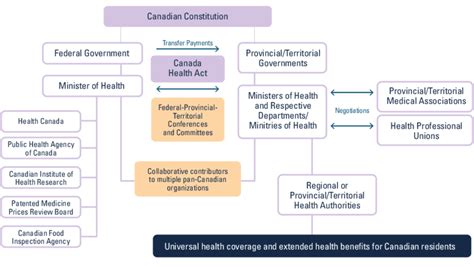

Understanding Canada’s Healthcare System

Canada’s healthcare system is a collaborative effort between the federal government and the provinces and territories. While the federal government sets the national standards and provides funding, the provinces and territories are responsible for the administration and delivery of healthcare services. This decentralized approach allows for regional customization while maintaining a national framework.

The cornerstone of Canada's healthcare system is the concept of Medicare, which guarantees the following rights:

- Universality: All legal residents of Canada have access to medically necessary hospital and physician services without direct charges at the point of service.

- Accessibility: Healthcare services are provided based on medical need, not on an individual's ability to pay.

- Portability: Canadians can access healthcare services across the country, ensuring continuity of care during travel or relocation.

- Comprehensiveness: The system covers a wide range of medically necessary services, including hospital care, physician services, diagnostic tests, and more.

Health Insurance Coverage in Canada

Health insurance in Canada is primarily provided through the provincial and territorial health insurance plans. These plans are funded by a combination of federal transfer payments and provincial/territorial taxes. Here’s a breakdown of the coverage provided by these plans:

Hospital Care

All provincial and territorial health plans cover the cost of medically necessary hospital services, including:

- Accommodation and meals during hospitalization.

- Nursing care, diagnostic services, and physician services.

- Medications and medical supplies administered during the hospital stay.

Physician Services

Physician services are also covered under the public health insurance plans. This includes:

- Office visits, consultations, and diagnostic procedures.

- Emergency room visits and urgent care.

- Specialist referrals and follow-up care.

Diagnostic Tests and Procedures

Medically necessary diagnostic tests and procedures, such as X-rays, MRIs, and CT scans, are covered by the public health insurance plans. These tests are typically ordered by a physician to aid in diagnosis or treatment planning.

Ambulance Services

Emergency ambulance services are covered by the public plans, ensuring timely access to medical care during critical situations.

Home Care and Long-Term Care

Some provinces and territories provide coverage for home care services, such as nursing care, personal support, and rehabilitation therapies. Long-term care, including nursing home care, is also covered in certain provinces, though eligibility criteria may vary.

Prescription Medications

The coverage for prescription medications varies across provinces and territories. While some provinces offer comprehensive coverage for essential medications, others may have more limited coverage or require patients to pay a portion of the cost.

Dental and Vision Care

Dental and vision care are generally not covered by the public health insurance plans in Canada. However, some provinces offer limited coverage for specific procedures or for vulnerable populations.

Private Health Insurance

While the public health insurance plans cover a wide range of services, there are certain gaps in coverage. Private health insurance plays a complementary role in filling these gaps. Here are some key aspects of private health insurance in Canada:

Supplementary Coverage

Private health insurance plans often provide supplementary coverage for services not covered by the public plans. This can include:

- Dental care, including routine check-ups, cleanings, and more extensive procedures.

- Vision care, covering eye exams, glasses, and contact lenses.

- Prescription medications, especially for non-essential or brand-name drugs.

- Alternative therapies and treatments, such as acupuncture or chiropractic care.

Travel Insurance

Private health insurance plans are essential for Canadians traveling outside the country. The public plans typically do not provide coverage for healthcare services received outside of Canada, making travel insurance a necessity.

Extended Health Benefits

Many employers offer extended health benefits to their employees, which can include coverage for a range of services, such as prescription medications, mental health services, and medical devices.

Challenges and Future Prospects

Despite its strengths, Canada’s healthcare system faces several challenges, including:

- Funding: With an aging population and rising healthcare costs, ensuring sustainable funding for the system is a significant challenge.

- Wait Times: Long wait times for certain procedures and services, particularly in specialized areas, have been a persistent issue.

- Access to Care: While the system guarantees universal access, there are disparities in access to care across different regions and populations.

- Technology and Innovation: Integrating new technologies and innovative healthcare solutions into the system can be a complex process.

Looking ahead, there is a growing emphasis on preventative care, mental health services, and the integration of digital health technologies. Additionally, efforts to address healthcare disparities and improve access to care for vulnerable populations are gaining traction.

FAQ

How do I access healthcare services in Canada as a new resident or visitor?

+As a new resident, you will need to apply for a provincial health card. The process varies by province, but generally involves providing proof of residency and identity. For visitors, travel insurance is recommended to cover any medical expenses incurred during your stay.

What services are not covered by the public health insurance plans in Canada?

+The public plans generally do not cover dental care, vision care, prescription medications (in some cases), cosmetic procedures, and certain alternative therapies. Additionally, some provinces have specific exclusions, so it’s important to check your provincial plan’s coverage details.

Are there any out-of-pocket expenses associated with public healthcare in Canada?

+In most cases, there are no direct charges for medically necessary hospital and physician services. However, there may be some costs associated with prescription medications, especially if they are not considered essential or if they are brand-name drugs. Additionally, certain diagnostic tests or procedures may have associated fees.