Best Home Insurance Rate

Home insurance is an essential aspect of financial planning and protection for homeowners. It provides coverage against various risks and liabilities, ensuring peace of mind and financial security. In the ever-changing landscape of insurance rates, finding the best home insurance rate that offers comprehensive coverage at an affordable price is a priority for many homeowners.

This comprehensive guide aims to explore the factors that influence home insurance rates, provide insights into how to obtain the most competitive quotes, and offer expert strategies to secure the best coverage at the most favorable rates. By understanding the dynamics of the insurance market and implementing strategic approaches, homeowners can make informed decisions to protect their homes and finances effectively.

Understanding Home Insurance Rates

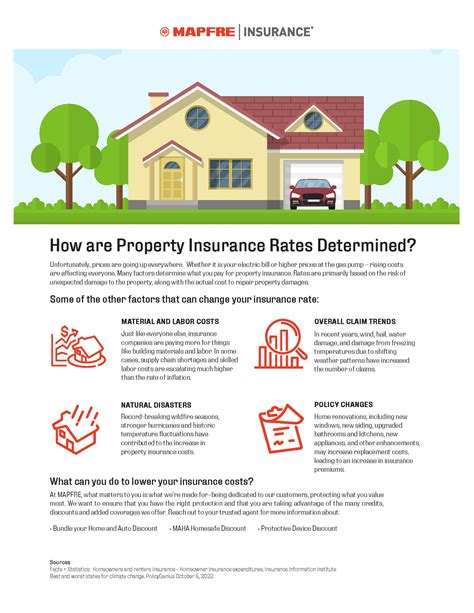

Home insurance rates are determined by a complex interplay of factors, each contributing to the overall cost of coverage. These factors are influenced by both individual circumstances and broader market dynamics. Understanding these elements is crucial for homeowners seeking the best rates and coverage.

Risk Assessment

Insurance companies assess various risks associated with a property to determine insurance rates. These risks include:

- Property Value: The value of a home plays a significant role in determining insurance rates. Higher-value properties often incur higher premiums.

- Location: The geographical location of a home can impact rates. Areas prone to natural disasters, high crime rates, or extreme weather conditions may result in higher insurance costs.

- Construction and Age: The construction materials and age of a home influence insurance rates. Older homes may require more extensive coverage, while newer homes built with modern materials may be deemed less risky.

- Claims History: A property’s claims history is a critical factor. Properties with a history of frequent claims may be considered high-risk, leading to higher insurance rates.

Coverage and Deductibles

The level of coverage chosen by a homeowner significantly affects insurance rates. Comprehensive coverage, which includes protection against a wide range of risks, will typically result in higher premiums. Additionally, the deductible, which is the amount a homeowner pays out of pocket before insurance coverage kicks in, directly impacts rates. Higher deductibles can lead to lower premiums, while lower deductibles may result in higher rates.

Discounts and Bundles

Insurance companies often offer discounts to encourage certain behaviors or to reward loyalty. Common discounts include:

- Safety Features: Discounts may be available for homes equipped with security systems, fire alarms, or sprinkler systems.

- Bundling Policies: Insuring multiple properties or combining home and auto insurance with the same provider can result in significant savings.

- Loyalty Rewards: Some insurance companies offer discounts to long-term customers as a loyalty incentive.

Strategies to Obtain the Best Home Insurance Rates

Homeowners can employ various strategies to secure the best insurance rates while maintaining adequate coverage. These strategies involve a combination of market research, provider negotiations, and lifestyle adjustments.

Shop Around and Compare Quotes

Obtaining multiple quotes from different insurance providers is a fundamental step in securing the best rates. Homeowners should compare not only the cost of premiums but also the coverage offered. It’s essential to understand the specific risks and needs associated with their property to make an informed comparison.

Online quote comparison tools can provide a quick and convenient way to gather initial quotes. However, it's crucial to follow up with individual insurance providers to discuss specific coverage needs and any available discounts.

Understand Coverage Options

Home insurance policies offer a range of coverage options, and understanding these options is vital to securing the best rates. Homeowners should be aware of the different types of coverage, including:

- Dwelling Coverage: Protects the structure of the home.

- Personal Property Coverage: Covers the contents of the home.

- Liability Coverage: Provides protection against legal liabilities.

- Additional Living Expenses: Covers temporary living expenses if the home becomes uninhabitable due to a covered event.

By understanding these coverage options, homeowners can tailor their policies to their specific needs, ensuring they have adequate protection without paying for unnecessary coverage.

Consider Higher Deductibles

Choosing a higher deductible can significantly reduce insurance rates. While this strategy requires a larger upfront payment in the event of a claim, it can result in substantial savings over time. However, it’s essential to ensure that the chosen deductible is affordable and doesn’t strain financial resources.

Explore Discounts and Bundles

Insurance providers often offer a variety of discounts to encourage certain behaviors or to reward loyalty. Homeowners should inquire about these discounts and ensure they are applied to their policies. Common discounts include:

- Multi-Policy Discounts: Bundling home and auto insurance with the same provider can result in significant savings.

- Safety Feature Discounts: Homes equipped with security systems, fire alarms, or sprinkler systems may be eligible for discounts.

- Loyalty Discounts: Long-term customers may receive loyalty rewards or discounts.

Maintain a Good Claims History

A property’s claims history is a critical factor in determining insurance rates. Homeowners should strive to maintain a clean claims history by taking steps to prevent potential claims. This includes regular home maintenance, such as roof inspections, plumbing checks, and ensuring the home is secure against potential hazards.

Work with an Insurance Broker

Insurance brokers can be a valuable resource for homeowners seeking the best insurance rates. Brokers have access to a wide range of insurance providers and can negotiate on behalf of their clients to secure the most competitive rates and coverage. They can also provide personalized advice based on a homeowner’s specific needs and circumstances.

The Impact of Location and Natural Disasters

The geographical location of a home plays a significant role in determining insurance rates. Areas prone to natural disasters, such as hurricanes, tornadoes, or earthquakes, often face higher insurance costs due to the increased risk of damage.

Homeowners in these high-risk areas should consider the following strategies to mitigate the impact of natural disasters on their insurance rates:

Mitigation and Prevention

Implementing measures to mitigate the impact of natural disasters can help reduce insurance rates. This includes:

- Hurricane Shutters: Installing hurricane shutters can protect against wind damage and reduce the risk of broken windows.

- Reinforced Roofs: Upgrading to a reinforced roof can provide better protection against high winds and heavy rainfall.

- Elevated Homes: In areas prone to flooding, elevating the home above the base flood elevation can reduce the risk of water damage.

Discounts for Mitigation Measures

Insurance providers often offer discounts to homeowners who take steps to mitigate the impact of natural disasters. These discounts can significantly reduce insurance rates and provide an incentive for homeowners to invest in mitigation measures.

Understand Coverage for Natural Disasters

It’s crucial for homeowners in high-risk areas to understand their coverage options for natural disasters. Standard home insurance policies often exclude coverage for certain natural disasters, such as floods or earthquakes. Homeowners should consider purchasing additional coverage, such as flood insurance or earthquake insurance, to ensure they are adequately protected.

The Future of Home Insurance Rates

The home insurance market is constantly evolving, and advancements in technology and risk assessment are shaping the future of insurance rates. Here are some key trends and developments to watch:

Data Analytics and Risk Assessment

Insurance companies are leveraging advanced data analytics and risk assessment tools to more accurately predict and manage risks. This includes the use of artificial intelligence and machine learning to analyze vast amounts of data, such as property characteristics, weather patterns, and historical claims data, to better understand and mitigate risks.

Telematics and Usage-Based Insurance

Usage-based insurance, also known as telematics, is gaining traction in the home insurance market. This approach uses sensors and technology to monitor and assess a property’s risk factors in real time. By analyzing factors such as occupancy patterns, temperature control, and security system usage, insurance providers can offer more personalized and dynamic insurance rates based on actual usage and risk exposure.

Sustainable and Resilient Construction

The focus on sustainable and resilient construction is growing, and insurance providers are taking note. Homes built with sustainable and resilient materials and designs may be eligible for discounted insurance rates. This trend encourages homeowners to invest in energy-efficient and resilient construction practices, reducing the environmental impact and long-term insurance costs.

Collaborative Risk Management

Insurance providers are increasingly collaborating with homeowners, local governments, and other stakeholders to manage risks collectively. This approach involves sharing data, resources, and best practices to mitigate risks and reduce insurance costs for all parties involved. By working together, communities can become more resilient to natural disasters and other risks, leading to more stable and affordable insurance rates.

Conclusion

Securing the best home insurance rate is a complex but achievable task. By understanding the factors that influence rates, implementing strategic approaches, and staying informed about market trends, homeowners can protect their homes and finances effectively. Whether it’s through risk mitigation measures, exploring discounts and bundles, or working with insurance brokers, there are numerous ways to obtain the best coverage at the most favorable rates.

As the home insurance market continues to evolve, staying proactive and engaged is key to navigating the changing landscape. By adopting a proactive approach to risk management and staying informed about emerging trends, homeowners can make informed decisions to secure the best home insurance rates and comprehensive coverage.

What are the key factors that influence home insurance rates?

+Home insurance rates are influenced by a variety of factors, including property value, location, construction and age of the home, claims history, coverage level, and deductibles. These factors collectively determine the risk profile of a property and, consequently, the insurance rates.

How can I obtain the best home insurance rates?

+To obtain the best home insurance rates, homeowners should shop around and compare quotes from multiple providers. Understanding coverage options and tailoring policies to specific needs is crucial. Additionally, considering higher deductibles, exploring discounts and bundles, maintaining a good claims history, and working with an insurance broker can all help secure the most competitive rates.

What impact do natural disasters have on home insurance rates?

+Natural disasters, such as hurricanes, tornadoes, and earthquakes, can significantly impact home insurance rates. Areas prone to these disasters often face higher insurance costs due to the increased risk of damage. Homeowners in high-risk areas can mitigate this impact by implementing mitigation measures, understanding their coverage options for natural disasters, and exploring discounts for taking steps to reduce risks.

How is the future of home insurance rates shaping up?

+The future of home insurance rates is characterized by advancements in data analytics and risk assessment, the rise of usage-based insurance, a focus on sustainable and resilient construction, and collaborative risk management. These trends are likely to lead to more personalized and dynamic insurance rates, with incentives for homeowners who embrace sustainable practices and actively manage risks.