Affordable Medical Insurance Plans

In today's world, having access to quality healthcare is essential, but the rising costs of medical treatments and insurance premiums often pose a significant challenge for many individuals and families. Affordable medical insurance plans have become a crucial aspect of financial planning, ensuring that people can access necessary healthcare services without breaking the bank. This comprehensive guide aims to explore the various facets of affordable medical insurance, offering insights and strategies to help you navigate the complex healthcare landscape.

Understanding Affordable Medical Insurance

Affordable medical insurance plans are designed to provide comprehensive healthcare coverage at a cost that is manageable for individuals and families. These plans aim to strike a balance between offering essential health benefits and being financially accessible. While the definition of “affordable” can vary based on personal circumstances, it generally refers to insurance plans that cover a wide range of medical services without placing an excessive financial burden on the policyholder.

The concept of affordable medical insurance has gained significant attention, especially with the implementation of healthcare reforms and initiatives aimed at making healthcare more accessible. These reforms often focus on expanding coverage options, improving competition among insurance providers, and providing subsidies or tax credits to make insurance more affordable for low- and middle-income households.

Key Features of Affordable Medical Insurance Plans

Affordable medical insurance plans typically offer a range of benefits to policyholders. Here are some key features to look for when considering these plans:

- Broad Coverage: These plans should cover a comprehensive range of medical services, including doctor visits, hospital stays, prescription medications, and preventive care. Look for plans that offer coverage for both routine and specialized healthcare needs.

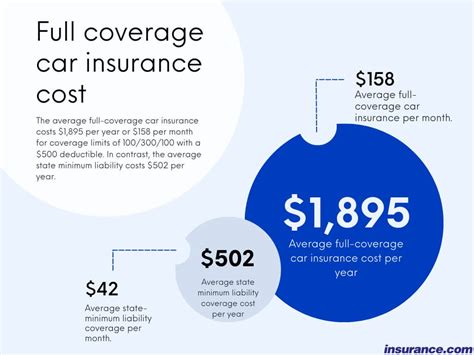

- Reasonable Premiums: Affordable insurance plans are characterized by premiums that are within the reach of the average person. While the exact definition of "reasonable" can vary, it generally refers to premiums that do not exceed a significant portion of your income.

- Low Deductibles and Copays: Plans with lower deductibles and copays can make healthcare more accessible. A lower deductible means you won't have to pay a large sum upfront before your insurance coverage kicks in. Similarly, lower copays reduce the out-of-pocket expenses for each healthcare service.

- Network of Providers: Affordable plans often have a network of healthcare providers, including doctors, specialists, and hospitals. It's essential to ensure that your preferred healthcare providers are included in the plan's network to avoid higher out-of-network costs.

- Additional Benefits: Some affordable plans may offer additional benefits such as dental, vision, or mental health coverage. These added benefits can enhance the overall value of the insurance plan.

Strategies for Finding Affordable Medical Insurance

Securing an affordable medical insurance plan requires careful research and consideration of various factors. Here are some strategies to help you in your search:

1. Explore Government-Sponsored Programs

Government-sponsored healthcare programs are designed to provide affordable insurance options for specific demographics. These programs often offer subsidized premiums and comprehensive coverage. Some of the key programs to consider include:

- Medicaid: Medicaid is a federal and state-funded program that provides health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. The eligibility criteria vary by state, but it's an excellent option for those who meet the income requirements.

- Children's Health Insurance Program (CHIP): CHIP offers low-cost health coverage to children in families that earn too much to qualify for Medicaid but can't afford private insurance. This program focuses on providing essential health benefits to children, ensuring they receive the healthcare they need.

- Veterans Affairs (VA) Health Care: Veterans and their families may be eligible for VA healthcare benefits. These benefits can include comprehensive medical, dental, and mental health services, making it an affordable option for those who have served in the military.

2. Utilize the Health Insurance Marketplace

The Health Insurance Marketplace, established by the Affordable Care Act (ACA), offers a platform for individuals and families to compare and purchase health insurance plans. The marketplace provides a range of affordable options, and you may even be eligible for subsidies or tax credits to reduce your insurance costs. Here’s how to navigate the marketplace:

- Determine Eligibility for Subsidies: The marketplace offers income-based subsidies to help reduce the cost of insurance premiums. To determine your eligibility, you can use the Premium Tax Credit Estimator provided by the HealthCare.gov website.

- Compare Plans: The marketplace presents various insurance plans with different coverage levels and premiums. Take the time to compare the benefits and costs of each plan to find the one that best suits your needs and budget.

- Open Enrollment Period: Keep in mind that there is a designated open enrollment period each year when you can sign up for a new plan or make changes to your existing coverage. It's essential to be aware of these deadlines to avoid missing out on affordable insurance options.

3. Consider Employer-Sponsored Insurance

Many employers offer health insurance plans as part of their employee benefits package. These plans can be an excellent option for affordable coverage, as the employer often contributes a significant portion of the premium. Here are some considerations when exploring employer-sponsored insurance:

- Review Plan Options: Employers typically provide multiple insurance plans with varying levels of coverage and costs. Take the time to review these options and choose the one that best aligns with your healthcare needs and budget.

- Understand Coverage Limits: Be aware of any coverage limits or restrictions that may be associated with your employer's insurance plan. This includes understanding the plan's network of providers and any out-of-pocket costs you may incur.

- Enroll During Open Enrollment: Just like with the Health Insurance Marketplace, employer-sponsored plans often have designated open enrollment periods. Ensure you are aware of these deadlines to make informed decisions about your insurance coverage.

4. Explore Private Insurance Options

If you’re not eligible for government-sponsored programs or employer-sponsored insurance, you can still find affordable private insurance plans. Here are some tips to help you navigate this option:

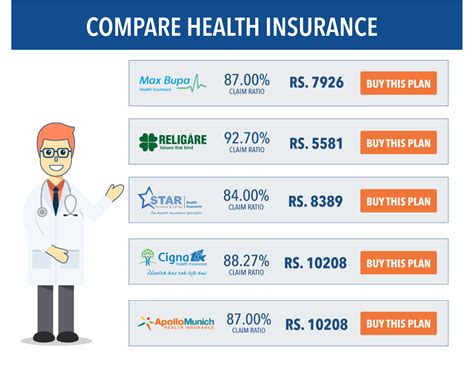

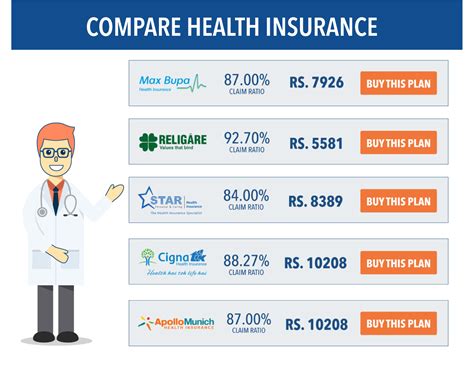

- Compare Multiple Insurers: Research and compare insurance plans from different private insurers. Consider factors such as coverage, premiums, deductibles, and copays to find the most suitable and affordable plan for your needs.

- Look for Discounts and Promotions: Private insurers often offer discounts or promotions, such as family discounts or loyalty programs. Keep an eye out for these opportunities to reduce your insurance costs.

- Consider High-Deductible Plans: While high-deductible plans may not be suitable for everyone, they can be a cost-effective option if you prioritize lower premiums. These plans typically have lower monthly premiums but higher deductibles, making them ideal for those who don't anticipate frequent medical expenses.

Managing the Cost of Healthcare

Affordable medical insurance is just one aspect of managing the cost of healthcare. Here are some additional strategies to help you keep your healthcare expenses in check:

1. Utilize Preventive Care

Preventive care is an essential component of maintaining good health and managing healthcare costs. Many insurance plans, including affordable options, cover preventive services such as annual physicals, immunizations, and screenings without any out-of-pocket costs. By taking advantage of these services, you can identify potential health issues early on, which can lead to more effective and less costly treatments.

2. Compare Prescription Drug Prices

Prescription medications can be a significant expense, but there are strategies to reduce these costs. Consider the following:

- Generic Medications: Generic drugs are often much more affordable than brand-name medications and offer the same therapeutic benefits. Discuss with your doctor about the possibility of using generic alternatives for your prescriptions.

- Pharmacy Discount Programs: Many pharmacies offer discount programs or loyalty cards that can provide savings on prescription medications. Explore these options to reduce your prescription costs.

- Online Pharmacies: Online pharmacies can sometimes offer lower prices on medications, especially if you purchase in bulk. However, ensure that the online pharmacy is reputable and licensed to avoid potential issues with medication quality or authenticity.

3. Shop Around for Healthcare Services

Just like with other purchases, it’s essential to shop around for healthcare services. Different providers may offer varying prices for the same procedures or treatments. Consider the following when comparing healthcare services:

- In-Network vs. Out-of-Network: If you have insurance, ensure you understand the difference between in-network and out-of-network providers. In-network providers typically offer lower costs, as they have negotiated rates with your insurance company. Out-of-network providers may charge significantly more.

- Price Transparency: Ask providers about their pricing and fee structures upfront. Many healthcare facilities now offer price transparency tools or estimators to help you understand the costs associated with various services.

- Negotiate Prices: Don't be afraid to negotiate the price of healthcare services, especially if you're paying out of pocket. Many providers are open to discussing payment plans or offering discounts for prompt payment.

Future Implications and Trends

The landscape of affordable medical insurance is continually evolving, influenced by various factors such as healthcare reforms, technological advancements, and economic conditions. Here are some key trends and implications to consider:

1. Continued Focus on Value-Based Care

Value-based care models, which focus on delivering high-quality healthcare outcomes while managing costs, are expected to play an increasingly prominent role in the healthcare industry. These models incentivize providers to deliver efficient and effective care, leading to better patient outcomes and potentially reducing overall healthcare costs.

2. Technological Advancements in Healthcare

The integration of technology into healthcare is transforming the industry. Telemedicine, for instance, has gained significant traction, offering convenient and often more affordable healthcare options. Additionally, digital health tools and apps can help patients better manage their health, leading to reduced healthcare utilization and costs.

3. Emphasis on Health Equity

There is a growing focus on health equity, aiming to ensure that all individuals have access to quality healthcare regardless of their socioeconomic status, race, or ethnicity. Efforts to address healthcare disparities and improve access to affordable insurance are expected to continue, benefiting underserved communities.

4. Impact of Economic Conditions

Economic factors, such as inflation and changes in employment rates, can significantly influence the affordability of medical insurance. During economic downturns, the demand for affordable insurance options often increases, leading to potential reforms and initiatives aimed at making healthcare more accessible.

How can I determine if a medical insurance plan is affordable for me?

+Affordability is subjective and depends on your financial situation. Consider your monthly budget and evaluate if the insurance premium is a manageable expense. Additionally, review the plan’s deductibles, copays, and out-of-pocket maximums to understand the potential costs associated with healthcare services.

What are some common challenges in finding affordable medical insurance?

+Common challenges include limited income, pre-existing medical conditions, and lack of access to employer-sponsored insurance. It’s important to research all available options, including government-sponsored programs and private insurance plans, to find the most suitable and affordable coverage for your circumstances.

Can I switch my medical insurance plan if I find a more affordable option?

+Yes, you can typically switch insurance plans during designated open enrollment periods or if you experience a qualifying life event, such as getting married, having a baby, or losing your current insurance coverage. However, it’s important to carefully review the new plan’s coverage and benefits to ensure it meets your healthcare needs.

How can I reduce my out-of-pocket expenses for medical care?

+To reduce out-of-pocket expenses, consider utilizing in-network providers, comparing prices for healthcare services, and negotiating costs when possible. Additionally, take advantage of preventive care services, which are often covered without any out-of-pocket costs, to maintain your health and potentially avoid more costly treatments down the line.