What Does Insure Mean

The term "insure" is a crucial concept in the world of finance and risk management, and it holds immense importance in our daily lives. When we delve into the meaning and implications of insurance, we uncover a fascinating realm that offers protection, peace of mind, and a safety net for individuals and businesses alike. This article will explore the depths of insurance, its history, mechanics, and the profound impact it has on our modern world.

The Essence of Insure

At its core, the act of insuring involves a contractual agreement between an individual or entity (the insured) and an insurance company (the insurer). This agreement, known as an insurance policy, provides a financial safeguard against potential losses or damages that may arise due to unforeseen events.

Insurance serves as a tool to mitigate the risks and uncertainties that life presents. Whether it's protecting your health, your home, your business, or your assets, insurance offers a way to transfer these risks to a specialized entity, thereby reducing the financial burden that unforeseen circumstances can impose.

Historical Context

The origins of insurance can be traced back to ancient civilizations, where early forms of risk-sharing agreements were established. However, it was in the 17th century that modern insurance practices began to take shape. The concept gained momentum with the establishment of the first insurance company, Lloyd’s of London, in 1688, which initially focused on marine insurance.

Since then, insurance has evolved into a complex and diverse industry, offering a wide range of coverage options to meet the diverse needs of individuals and businesses worldwide.

How Insurance Works

The process of insuring involves several key components that work together to create a comprehensive risk management system:

Risk Assessment

Before an insurance policy is issued, a thorough risk assessment is conducted. This involves evaluating the likelihood and potential impact of various risks associated with the insured individual or entity. Insurance companies employ actuaries and risk analysts who use statistical models and historical data to determine the level of risk and, consequently, the premium to be charged.

For instance, when insuring a vehicle, the insurer considers factors such as the driver's age, driving record, and the vehicle's make and model to assess the risk of accidents and determine the appropriate premium.

Premium Payments

The premium is the amount paid by the insured to the insurer in exchange for the coverage provided by the insurance policy. Premiums are typically paid on a regular basis, such as monthly or annually, and they vary based on the type of insurance, the level of coverage, and the assessed risk.

Insurance companies utilize complex algorithms and actuarial science to calculate premiums, ensuring that they are fair and adequately cover potential losses. Premiums also serve as a means to distribute the financial burden of risks across a large pool of policyholders.

Policy Coverage and Benefits

An insurance policy outlines the specific coverage and benefits provided by the insurer. It defines the types of risks or events that are covered, the limits of liability, and any exclusions or limitations. Policyholders can choose from various coverage options, tailored to their specific needs.

For example, a health insurance policy may cover hospital stays, prescription medications, and specialist visits, while a home insurance policy may provide coverage for property damage, theft, and liability claims.

Claims Process

When an insured individual or entity experiences a covered loss or damage, they can file a claim with the insurance company. The claims process involves submitting documentation and evidence to support the claim, such as police reports, medical records, or repair estimates.

Insurance companies have claims adjusters who review the submitted information and determine the validity and extent of the claim. If the claim is approved, the insurer provides financial compensation to the policyholder, helping them recover from the loss or damage.

Types of Insurance

The insurance industry offers a vast array of coverage options to address various risks and needs. Here are some of the most common types of insurance:

- Life Insurance: Provides financial protection to beneficiaries upon the death of the insured individual. It can help cover funeral expenses, outstanding debts, and provide income replacement.

- Health Insurance: Covers medical expenses, including hospital stays, surgeries, prescription drugs, and preventive care. It ensures access to quality healthcare without the burden of exorbitant costs.

- Auto Insurance: Protects vehicle owners against financial losses resulting from accidents, theft, or damage. It may include liability coverage, collision coverage, and comprehensive coverage.

- Homeowners Insurance: Offers protection for homeowners against property damage, theft, and liability claims. It can cover the structure of the home, personal belongings, and additional living expenses in case of a covered loss.

- Business Insurance: Provides coverage for businesses, including property damage, liability, business interruption, and professional liability (errors and omissions). It helps mitigate the financial risks associated with running a business.

Specialty Insurance

In addition to the common types of insurance, there are also specialized policies designed for specific needs. These include:

- Travel Insurance: Covers unforeseen events during travel, such as trip cancellations, medical emergencies, and lost luggage.

- Pet Insurance: Provides coverage for veterinary expenses, including illnesses, injuries, and accidents.

- Cyber Insurance: Protects businesses and individuals against cyber risks, such as data breaches, hacking, and identity theft.

- Umbrella Insurance: Offers additional liability coverage beyond the limits of other insurance policies, providing an extra layer of protection.

The Impact of Insurance

Insurance has become an integral part of modern society, offering a multitude of benefits and shaping various aspects of our lives. Here are some key impacts of insurance:

Financial Security

Insurance provides a vital financial safety net, ensuring that individuals and businesses can recover from unexpected losses or damages. It helps mitigate the financial risks associated with accidents, illnesses, natural disasters, and other unforeseen events.

For instance, health insurance ensures that individuals can access necessary medical care without facing financial ruin. Similarly, homeowners insurance provides the means to rebuild and recover after a devastating fire or natural disaster.

Risk Management

Insurance serves as a powerful tool for risk management. By transferring risks to insurance companies, individuals and businesses can focus on their core activities and objectives without being overwhelmed by potential losses. Insurance allows for a more stable and predictable financial environment.

Economic Stability

The insurance industry plays a significant role in stabilizing economies. By pooling resources and spreading risks across a large population, insurance companies contribute to economic resilience. They provide financial support during times of crisis and help businesses and individuals recover from economic downturns.

Promoting Safety and Prevention

Insurance often encourages safer behavior and the adoption of preventive measures. For example, auto insurance companies may offer discounts to drivers with a clean driving record, incentivizing safe driving practices. Similarly, health insurance companies promote preventive care, helping individuals maintain their well-being and avoid costly treatments.

The Future of Insurance

The insurance industry is continuously evolving, driven by technological advancements and changing consumer needs. Here are some trends and future implications to consider:

Digital Transformation

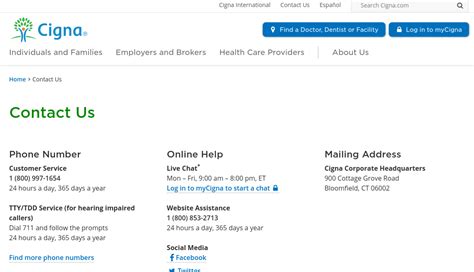

The rise of digital technologies has revolutionized the insurance industry. Online platforms and mobile apps have made it easier for individuals to compare policies, purchase insurance, and file claims. Insurers are investing in digital transformation to enhance customer experiences and streamline processes.

Data Analytics and AI

Advanced data analytics and artificial intelligence (AI) are transforming risk assessment and claims processing. Insurers can now analyze vast amounts of data to make more accurate predictions and improve underwriting decisions. AI-powered chatbots and virtual assistants are also enhancing customer service and claim management.

Personalized Insurance

With the availability of data and advanced analytics, insurance companies are moving towards more personalized insurance products. By considering individual risk factors and preferences, insurers can offer tailored coverage options that meet the unique needs of policyholders.

Insurtech Innovations

Insurtech startups are disrupting the traditional insurance landscape with innovative solutions. These companies leverage technology to offer efficient, transparent, and customer-centric insurance services. From peer-to-peer insurance platforms to usage-based insurance models, Insurtech is reshaping the industry.

Global Reach and Collaboration

The insurance industry is becoming increasingly global, with cross-border collaborations and partnerships. Insurers are expanding their reach to cater to a diverse range of clients and risks. International collaborations can lead to more comprehensive risk management solutions and improved access to insurance services worldwide.

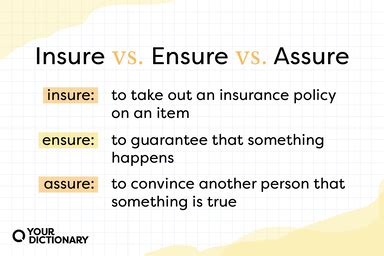

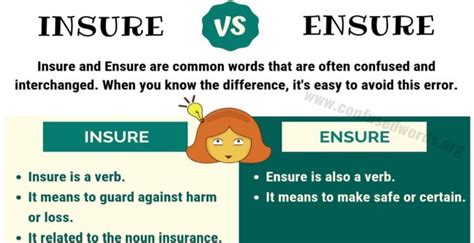

What is the difference between insure and ensure?

+While both words are often used interchangeably, there is a subtle distinction. “Insure” specifically refers to the act of obtaining insurance coverage, while “ensure” means to make certain or guarantee. In the context of insurance, “insure” is the correct term to use.

Is insurance mandatory in all countries?

+Insurance requirements vary across countries and regions. Some countries mandate specific types of insurance, such as auto insurance or health insurance, while others leave it as an optional choice. It is essential to research the insurance regulations in your specific jurisdiction.

Can insurance policies be customized to individual needs?

+Absolutely! Many insurance companies offer customizable policies that allow individuals and businesses to choose the level of coverage and benefits that align with their unique circumstances and preferences. Customization ensures that insurance policies are tailored to specific needs.

How do insurance companies determine premiums?

+Premiums are calculated based on a comprehensive risk assessment. Insurance companies use statistical models, historical data, and actuarial science to evaluate the likelihood and potential impact of risks. Factors such as age, health, occupation, and location are considered to determine an appropriate premium.

What should I do if I need to file an insurance claim?

+If you experience a covered loss or damage, it is important to contact your insurance company promptly. They will guide you through the claims process, which typically involves providing documentation and evidence to support your claim. It is beneficial to review your policy and understand the specific requirements for filing a claim.