Cheapest Health Insurance Family

Finding affordable and comprehensive health insurance for your family is a crucial task, especially when balancing the need for adequate coverage and managing household expenses. This article aims to provide an in-depth exploration of the factors that influence the cost of family health insurance, strategies to secure the most cost-effective plans, and an analysis of the best value options available in the market.

Understanding the Factors Influencing Family Health Insurance Costs

The cost of health insurance for families is influenced by a multitude of factors, each playing a significant role in determining the final premium. Understanding these factors is essential for making informed decisions and securing the most affordable coverage.

Family Size and Age Distribution

One of the primary determinants of health insurance costs for families is the size and age composition of the household. Generally, larger families will face higher premiums, as the risk pool expands and the likelihood of medical claims increases. Moreover, the age of family members is crucial; younger families may enjoy lower rates, while those with older members, especially those approaching retirement, can expect higher premiums due to the increased risk of age-related health issues.

| Family Size | Average Premium |

|---|---|

| Couple | $500 - $800 per month |

| Couple with 1 child | $600 - $1000 per month |

| Couple with 2 children | $750 - $1200 per month |

| Couple with 3+ children | $1000+ per month |

These figures are merely estimates and can vary significantly based on the factors outlined below.

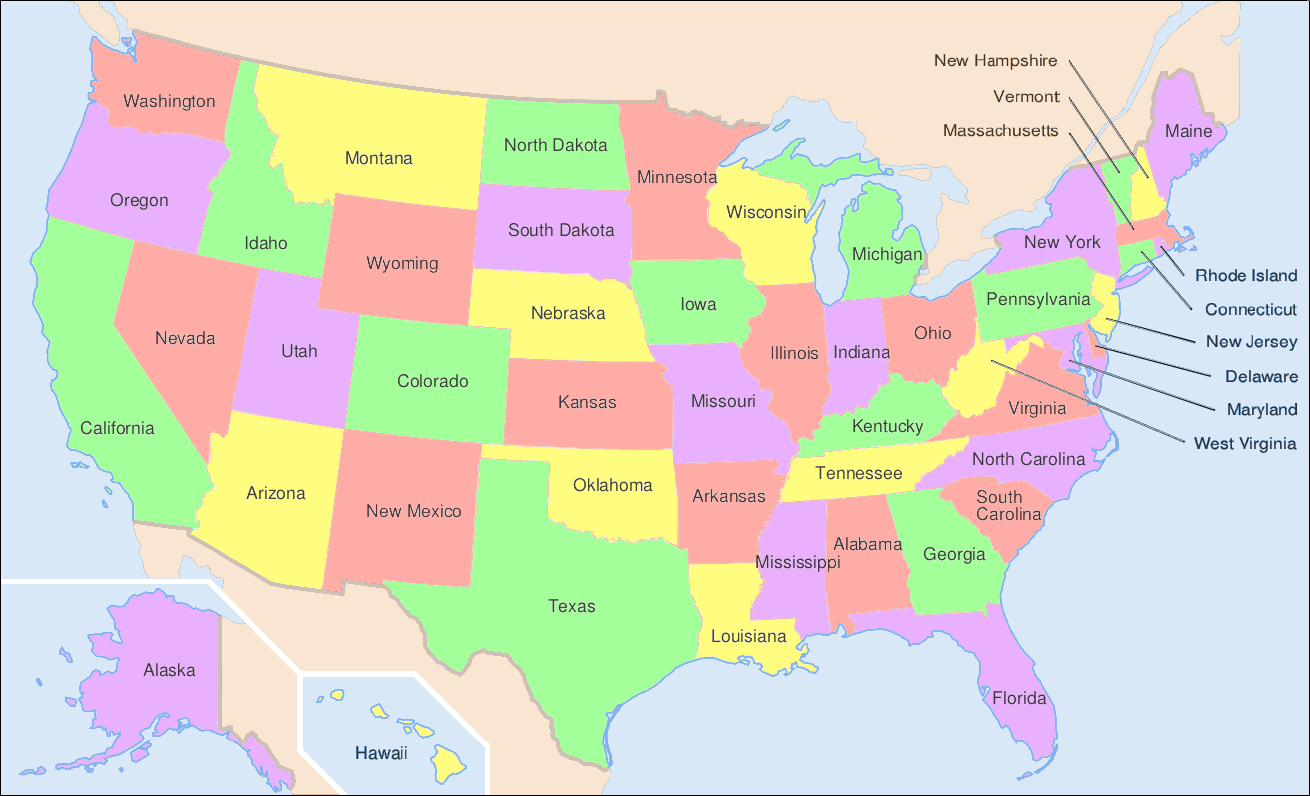

Geographic Location

Health insurance costs can vary greatly based on your geographical location. Different regions have varying healthcare costs, influenced by factors such as the local cost of living, the availability of healthcare providers, and the overall demand for healthcare services. Generally, urban areas and regions with a higher cost of living tend to have more expensive health insurance premiums.

Type of Plan and Coverage Options

The type of health insurance plan you choose significantly impacts the cost. There are various plan options available, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Point of Service (POS) plans. Each type offers different coverage options and cost structures. For instance, HMOs typically have lower premiums but may restrict your choice of healthcare providers, while PPOs offer more flexibility but at a higher cost.

Additionally, the coverage options you select will affect the premium. This includes deductibles, copayments, and out-of-pocket maximums. Plans with higher deductibles and copayments usually have lower monthly premiums, while those with lower deductibles and copayments can be more expensive. It's essential to strike a balance between these factors based on your family's healthcare needs and financial capabilities.

Income and Subsidies

Your family’s income can also influence the cost of health insurance. In many countries, including the United States, income-based subsidies are available for those who qualify. These subsidies can significantly reduce the cost of health insurance premiums, making coverage more affordable for lower-income families. To determine if you’re eligible for such subsidies, you can use the Health Insurance Marketplace’s income calculator or consult with a health insurance broker.

Strategies to Secure the Cheapest Health Insurance for Your Family

With a comprehensive understanding of the factors influencing health insurance costs, you can now employ effective strategies to find the cheapest and most suitable coverage for your family. Here are some expert tips to help you navigate the complex world of family health insurance.

Compare Plans and Providers

One of the most effective ways to secure the cheapest health insurance for your family is to compare plans from different providers. Each insurance company offers a unique set of plans with varying coverage options and premium rates. By shopping around and comparing these plans, you can identify the most cost-effective options that best fit your family’s healthcare needs.

Online comparison tools and websites can be invaluable resources in this process. These platforms allow you to input your family's details, such as age, location, and desired coverage, and then present you with a range of plans and their corresponding premiums. This not only saves you time but also ensures you're making an informed decision based on accurate, up-to-date information.

Utilize Tax Benefits and Subsidies

As mentioned earlier, income-based subsidies can significantly reduce the cost of health insurance premiums. If your family’s income falls within the eligible range, taking advantage of these subsidies can make a substantial difference in the affordability of your health insurance. Additionally, tax benefits, such as the Health Savings Account (HSA) in the United States, can provide further financial relief. HSAs allow you to set aside pre-tax dollars to pay for qualified medical expenses, reducing your taxable income and potentially saving you money.

Consider High-Deductible Health Plans (HDHPs)

High-Deductible Health Plans (HDHPs) are a cost-saving option for families who are healthy and don’t anticipate frequent medical expenses. These plans typically have lower monthly premiums but higher deductibles, meaning you’ll pay more out-of-pocket before your insurance coverage kicks in. However, if you rarely need medical services, an HDHP can be a financially prudent choice.

It's worth noting that HDHPs often come with Health Savings Accounts (HSAs), which can provide additional tax benefits. HSAs allow you to save pre-tax money specifically for medical expenses, further reducing your overall healthcare costs.

Bundle Policies and Leverage Group Plans

If you or your spouse are employed, it’s worth exploring the group health insurance plans offered by your employer. Group plans often provide more comprehensive coverage at a lower cost than individual plans. Additionally, consider bundling your health insurance with other policies, such as life or dental insurance. Many insurance providers offer discounts when you purchase multiple policies from them, potentially reducing the overall cost of your health insurance.

Maintain a Healthy Lifestyle

A healthy lifestyle can have a significant impact on the cost of your health insurance. Many insurance providers now offer incentives and discounts for maintaining a healthy lifestyle, such as regular exercise, a balanced diet, and abstaining from smoking. Some insurers even provide fitness trackers or wearable devices to encourage healthy habits, which can lead to reduced premiums over time.

Best Value Family Health Insurance Options

Now that we’ve explored the factors influencing the cost of family health insurance and strategies to secure the cheapest plans, let’s delve into some of the best value options available in the market. These plans offer a combination of comprehensive coverage and competitive pricing, ensuring your family’s healthcare needs are met without breaking the bank.

Blue Cross Blue Shield (BCBS)

Blue Cross Blue Shield is a well-known and trusted provider of health insurance, offering a wide range of plans across the United States. BCBS plans are known for their flexibility, allowing you to choose the level of coverage that best suits your family’s needs. Their network of healthcare providers is extensive, ensuring you have access to quality care wherever you are.

BCBS offers a variety of plan types, including HMOs, PPOs, and EPOs, each with its own unique coverage and cost structure. Their plans typically provide a good balance between cost and coverage, making them a popular choice for families seeking affordable, comprehensive health insurance.

Kaiser Permanente

Kaiser Permanente is a not-for-profit, integrated healthcare organization that provides both health insurance and medical care to its members. With a strong focus on preventive care and a coordinated approach to healthcare delivery, Kaiser Permanente aims to keep its members healthy and reduce the need for costly medical interventions.

Their health insurance plans are typically more affordable than many other providers, especially for families who prioritize preventive care and are willing to use the Kaiser Permanente network of providers. With a strong presence in California, Oregon, Washington, Colorado, Georgia, Hawaii, Maryland, Virginia, and the District of Columbia, Kaiser Permanente offers a cost-effective option for families in these regions.

Oscar Health

Oscar Health is a relatively new player in the health insurance market, but it has quickly gained a reputation for offering innovative, tech-driven health insurance plans. Oscar’s plans are designed with simplicity and transparency in mind, making it easy for families to understand their coverage and costs.

Oscar Health offers a range of plan types, including HMOs and PPOs, with competitive premiums. They also provide additional benefits such as free virtual doctor visits and a dedicated health assistant, who can help you navigate the healthcare system and find the best care options for your family. Oscar Health's plans are currently available in 9 states: Arizona, California, Colorado, Florida, Maryland, Michigan, New Jersey, New York, and Texas.

Cigna

Cigna is a global health service company that offers a wide range of health insurance plans tailored to individual and family needs. Cigna’s plans often provide a high level of flexibility, allowing you to customize your coverage to fit your family’s unique healthcare requirements.

Their network of healthcare providers is extensive, ensuring you have access to quality care wherever you are. Cigna's plans are competitively priced, especially when considering the level of coverage and flexibility they offer. They also provide additional benefits such as wellness programs and tools to help you manage your healthcare costs effectively.

Aetna

Aetna is another well-established health insurance provider offering a comprehensive range of plans for individuals and families. Aetna’s plans are known for their affordability and the wide variety of coverage options they provide. Whether you’re looking for a basic plan or a more comprehensive option, Aetna likely has a plan that fits your needs and budget.

Aetna's network of healthcare providers is extensive, covering all 50 states and offering a high level of convenience for families who travel or have diverse healthcare needs. Additionally, Aetna provides various tools and resources to help you manage your healthcare costs, such as a cost estimator and a medication management tool.

Conclusion

Finding the cheapest health insurance for your family is a complex task, but with the right strategies and an understanding of the key factors involved, it’s certainly achievable. By comparing plans, utilizing tax benefits and subsidies, considering high-deductible plans, and maintaining a healthy lifestyle, you can significantly reduce the cost of your family’s health insurance while still ensuring comprehensive coverage.

The best value health insurance plans for families offer a balance between cost and coverage, ensuring you receive the care you need without straining your finances. Whether you choose a provider like Blue Cross Blue Shield, Kaiser Permanente, Oscar Health, Cigna, or Aetna, each offers unique benefits and cost structures to meet your family's specific needs.

Remember, health insurance is an essential investment in your family's well-being. By making informed decisions and staying vigilant about your coverage and costs, you can ensure your family receives the quality healthcare they deserve.

How often should I review my family’s health insurance plan?

+

It’s a good practice to review your health insurance plan annually, especially during open enrollment periods. This allows you to assess whether your current plan still meets your family’s needs and to explore any new, more cost-effective options that may have become available.

Can I switch health insurance plans mid-year if I find a better deal?

+

In most cases, switching health insurance plans mid-year is possible, but it often requires a qualifying event, such as a change in family status (e.g., marriage, birth, adoption) or employment status. It’s important to check with your current insurer and the new plan provider to understand the specific requirements and timelines for switching plans.

What are some common mistakes people make when choosing health insurance for their family?

+

Some common mistakes include choosing a plan solely based on the lowest premium, failing to consider the network of providers, and not understanding the plan’s coverage limitations. It’s crucial to read the fine print, understand the plan’s exclusions and limitations, and ensure the plan’s network of providers includes your preferred doctors and hospitals.