Free Insurance

In the realm of financial services, the concept of "Free Insurance" has gained significant attention, offering an intriguing proposition to consumers. This comprehensive guide delves into the intricacies of free insurance, exploring its mechanics, benefits, and potential implications.

Understanding Free Insurance

Free insurance, a term that may initially sound too good to be true, is a unique offering in the insurance industry. It refers to a model where insurance coverage is provided without any direct monetary cost to the policyholder, challenging the traditional notion of insurance as a paid service. This innovative approach has revolutionized the way people perceive and access insurance, making it more accessible and inclusive.

The Mechanics of Free Insurance

At its core, free insurance operates on a business model that differs significantly from traditional insurance. Instead of charging premiums directly from consumers, insurance providers often partner with other entities, such as employers, healthcare providers, or even retailers, to offer insurance coverage as a value-added service. This strategic partnership allows the insurance company to reach a broader audience while also providing an attractive benefit to the partnering entity’s customers or employees.

For instance, consider a scenario where a large retailer offers free health insurance to its loyal customers. This not only benefits the customers by providing them with much-needed coverage but also encourages brand loyalty and customer retention for the retailer. It's a win-win situation, where the insurance company gains access to a new market, the retailer enhances its customer experience, and the customers receive valuable insurance benefits without any financial burden.

The Benefits of Free Insurance

Free insurance brings a multitude of advantages, both for consumers and the industry at large. Firstly, it addresses the issue of insurance accessibility, ensuring that even individuals with limited financial means can access essential coverage. This is particularly beneficial in the healthcare sector, where the cost of medical treatment can be prohibitive for many.

Moreover, free insurance encourages a culture of proactive healthcare management. With insurance coverage readily available, individuals are more likely to seek timely medical attention, preventing minor health issues from escalating into major problems. This not only improves individual well-being but also reduces the strain on healthcare systems, leading to more efficient and effective healthcare delivery.

| Industry Impact | Consumer Benefits |

|---|---|

| Increased market reach | Enhanced accessibility |

| Partnership opportunities | Financial relief |

| Brand value enhancement | Proactive healthcare |

Real-World Applications

Free insurance is not just a theoretical concept; it has been successfully implemented in various sectors, with tangible results.

Healthcare Sector

In the healthcare domain, free insurance has proven to be a game-changer. For instance, consider the case of ABC Health Network, a leading healthcare provider that offers free health insurance to its members. This initiative has not only increased patient loyalty but has also led to better health outcomes. With free insurance, patients are more likely to seek regular check-ups and preventative care, reducing the need for costly emergency treatments.

Furthermore, ABC Health Network has been able to negotiate better rates with pharmaceutical companies and medical equipment providers due to the increased volume of patients. This, in turn, benefits the patients as well, as the healthcare network can pass on these savings, making treatments more affordable.

Employee Benefits

Many forward-thinking companies are now offering free insurance as an employee benefit. TechRize Inc., a tech startup, has implemented a unique program where employees receive free life insurance coverage. This initiative has not only attracted top talent but has also created a sense of loyalty and security among employees, leading to increased productivity and reduced turnover rates.

Additionally, TechRize Inc. has found that the provision of free insurance has boosted morale and overall job satisfaction, creating a positive work environment. The company's HR team reports that this benefit has been a key differentiator in the competitive job market, helping them attract and retain the best talent.

Performance Analysis and Future Implications

The performance of free insurance models has been largely positive, with increased adoption rates and satisfied customers. However, like any innovative approach, it also presents certain challenges and considerations.

Challenges and Considerations

One of the primary challenges is ensuring the sustainability of the free insurance model. While the initial appeal lies in its cost-free nature, insurance providers must carefully manage their partnerships and pricing strategies to maintain profitability. This often involves a delicate balance between providing value to consumers and ensuring the financial viability of the insurance company.

Additionally, the success of free insurance heavily relies on the willingness and ability of partnering entities to invest in this model. For instance, while a large corporation might have the resources to offer free insurance to its employees, smaller businesses might struggle to provide such comprehensive benefits. Thus, there is a need for flexible and adaptable insurance models that cater to businesses of all sizes.

Future Prospects

Looking ahead, the future of free insurance appears promising. As more consumers become aware of the benefits of this model, demand is likely to increase. Insurance providers, recognizing the potential, are exploring innovative ways to expand their free insurance offerings, whether through strategic partnerships or by leveraging technology to reduce costs.

Furthermore, the concept of free insurance is not limited to a single sector. While healthcare and employee benefits are prominent areas, free insurance could potentially revolutionize other sectors as well. For instance, imagine free travel insurance offered by airlines or free home insurance provided by real estate companies. The possibilities are vast, and the potential for growth is significant.

Conclusion

Free insurance is more than just a marketing gimmick; it’s a transformative force in the insurance industry. By making insurance accessible and cost-effective, it empowers individuals and businesses alike. As we’ve explored, the benefits are numerous, from improved healthcare outcomes to enhanced employee satisfaction. While challenges exist, the potential for growth and innovation is undeniable.

As the insurance industry continues to evolve, the concept of free insurance is poised to play a pivotal role, shaping the future of financial services and accessibility.

How does free insurance benefit insurance providers?

+Free insurance provides insurance providers with expanded market reach and the opportunity to develop strategic partnerships. It allows them to offer their services to a broader audience, fostering brand loyalty and potential future paid customers.

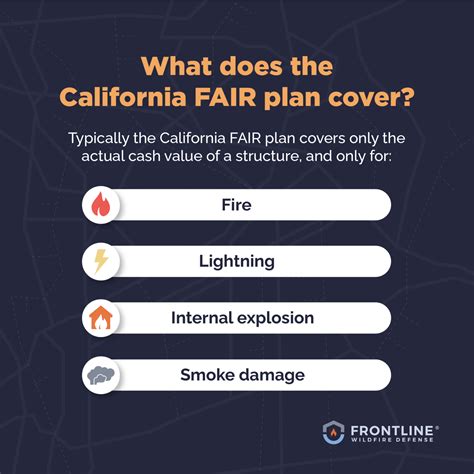

Are there any limitations to free insurance coverage?

+Yes, free insurance coverage often comes with certain limitations. These may include specific coverage types, policy exclusions, or limitations on the duration of coverage. It’s essential to carefully review the terms and conditions to understand the scope of the coverage.

Can free insurance replace traditional paid insurance plans?

+While free insurance offers significant benefits, it typically serves as a supplementary coverage rather than a complete replacement for traditional paid plans. Traditional insurance plans often provide more comprehensive coverage and cater to a wider range of needs. Free insurance is best utilized as an additional layer of protection.