California Fair Insurance

The insurance landscape in California is an intricate web, with numerous policies, providers, and regulations that shape the way residents protect their assets and mitigate risks. This comprehensive guide aims to delve into the world of California Fair Insurance, exploring its intricacies, benefits, and the unique challenges it presents. By understanding the nuances of this system, residents can make informed decisions to safeguard their properties and ensure compliance with state regulations.

Understanding California Fair Insurance

California Fair Insurance, often referred to as fair access insurance, is a unique concept designed to ensure that all eligible residents have access to property insurance, especially in high-risk areas. This system is a response to the challenges posed by traditional insurance markets, where coverage can be limited or prohibitively expensive for those in disaster-prone regions.

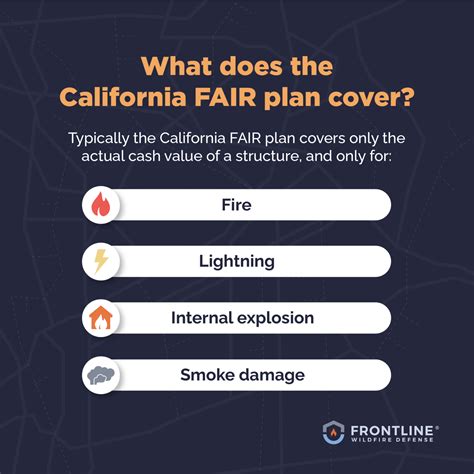

The cornerstone of California Fair Insurance is the California FAIR Plan, a state-mandated program that provides a basic level of property insurance to those who are unable to secure coverage through the voluntary market. This plan, administered by a consortium of insurance companies, plays a critical role in ensuring the availability of insurance, particularly for those living in wildfire-prone or coastal areas.

Eligibility and Coverage

Eligibility for the California FAIR Plan is not based solely on the risk profile of the property but also on the inability of the applicant to obtain insurance through regular channels. This means that individuals who have been declined coverage by at least two insurance companies may be eligible for the FAIR Plan. The plan offers coverage for both homeowners and renters, providing protection against losses from perils such as fire, windstorm, and vandalism.

However, it's important to note that the FAIR Plan is not a comprehensive insurance solution. It provides a basic level of coverage, often with lower policy limits and exclusions for certain perils. For instance, it may not cover damage from earthquakes or floods, which are considered high-risk perils and often require separate insurance policies.

| Coverage Type | Key Perils Covered |

|---|---|

| California FAIR Plan | Fire, Windstorm, Vandalism |

| Earthquake Insurance | Earthquakes |

| Flood Insurance | Floods |

The Role of California’s Insurance Commissioner

California’s Insurance Commissioner plays a pivotal role in overseeing the insurance industry within the state. This office is responsible for enforcing insurance laws, regulating insurance companies, and ensuring that consumers have access to fair and affordable insurance options.

Key Responsibilities and Initiatives

The Insurance Commissioner’s office has several key functions that directly impact the California Fair Insurance landscape. They include:

- Market Conduct Examinations: Regular audits of insurance companies to ensure compliance with state laws and regulations.

- Consumer Protection: Providing resources and education to help consumers understand their rights and make informed insurance decisions.

- Rate Regulation: Approving or denying insurance rate changes to ensure fairness and prevent excessive profits.

- Catastrophe Preparedness: Developing strategies to enhance insurance coverage and recovery efforts in disaster-prone areas.

For instance, the Insurance Commissioner's office has implemented initiatives to encourage insurance companies to provide coverage in high-risk areas, ensuring that more residents can access the protection they need. This includes offering incentives for insurers to write policies in wildfire-prone regions, a critical step towards mitigating the impact of natural disasters on homeowners.

How to File a Complaint

In the event that consumers feel they have been treated unfairly or experience issues with their insurance coverage, the Insurance Commissioner’s office provides a process for filing complaints. This can be done online through the California Department of Insurance website. The office investigates these complaints, taking action to protect consumers’ rights and ensure fair practices within the insurance industry.

California’s Wildfire and Earthquake Risks

California is renowned for its natural beauty, but this comes with significant risks, notably from wildfires and earthquakes. These natural disasters pose unique challenges to the insurance industry and property owners alike.

Wildfire Insurance Challenges

Wildfires are a recurring threat in California, with devastating impacts on communities and property. The insurance industry faces challenges in providing coverage for these events due to the unpredictability and severity of wildfires. Insurance companies often set limits on wildfire coverage or exclude it entirely from standard policies, leaving homeowners vulnerable.

To address this, California has implemented measures to encourage insurers to provide wildfire coverage. However, the cost of this coverage can be high, especially for those in high-risk areas. The California FAIR Plan, as mentioned earlier, steps in to provide basic coverage for those who cannot obtain it elsewhere, offering a crucial safety net for at-risk residents.

Earthquake Insurance Considerations

California’s vulnerability to earthquakes is another significant concern. Unlike wildfires, earthquakes can affect a wide area simultaneously, leading to extensive damage. Standard homeowners’ insurance policies typically do not cover earthquake damage, necessitating the purchase of separate policies.

The California Earthquake Authority (CEA) is a state-mandated entity that provides earthquake insurance to California residents. The CEA works to ensure that earthquake insurance is available and affordable, playing a critical role in protecting homeowners from this unique natural hazard.

Insurance Considerations for California Renters

Renters in California face unique insurance challenges, often overlooked by those outside the industry. Understanding these challenges is crucial for renters to ensure they have adequate protection for their belongings and liabilities.

Renters’ Insurance Overview

Renters’ insurance is a type of property insurance that provides coverage for personal belongings and liability protection. It is particularly important for renters as it covers losses that may not be covered by a landlord’s insurance policy. Renters’ insurance can protect against fire, theft, and water damage, among other perils.

In California, the need for renters' insurance is especially high due to the state's susceptibility to natural disasters. Renters should be aware that their landlord's insurance typically covers the building structure but not their personal possessions. In the event of a disaster, such as a wildfire or earthquake, renters' insurance can provide critical financial protection.

Key Considerations for Renters

When choosing renters’ insurance, it’s essential to consider the following:

- Coverage Limits: Ensure the policy provides adequate coverage for your belongings. Consider the replacement cost of your items, especially if you have valuable possessions.

- Liability Coverage: This protects you if someone is injured in your rented property or if you accidentally damage someone else's property.

- Additional Living Expenses: Some policies cover the cost of temporary housing if your rented property becomes uninhabitable due to a covered loss.

- Discounts: Many insurers offer discounts for bundling renters' insurance with other policies, such as auto insurance.

Navigating Auto Insurance in California

Auto insurance is a mandatory requirement for all vehicle owners in California. The state has specific laws and regulations that govern auto insurance, ensuring that drivers have the necessary coverage to protect themselves and others on the road.

California’s Auto Insurance Laws

California law requires all drivers to carry a minimum level of auto insurance, known as liability insurance. This insurance covers the costs of bodily injury and property damage that you may cause to others in an accident. The minimum liability limits in California are 15,000 for bodily injury to one person, 30,000 for bodily injury to multiple people, and $5,000 for property damage.

In addition to liability insurance, California law also requires drivers to carry uninsured and underinsured motorist coverage. This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the costs of the accident.

Factors Affecting Auto Insurance Rates

Several factors influence the cost of auto insurance in California. These include:

- Vehicle Type: The make, model, and year of your vehicle can impact your insurance rates. Sports cars and luxury vehicles often have higher premiums due to their increased repair costs and higher risk of theft.

- Driving Record: A clean driving record can lead to lower insurance rates. On the other hand, a history of accidents or traffic violations may result in higher premiums.

- Location: The area where you live and park your vehicle can affect your rates. High-crime areas or regions with a high incidence of accidents may have higher insurance costs.

- Age and Gender: Younger drivers and males tend to have higher insurance rates due to their higher risk profiles.

- Usage: The frequency and purpose of your vehicle's use can impact your rates. High-mileage vehicles or those used for business purposes may have higher premiums.

Conclusion: Embracing California’s Fair Insurance Landscape

California’s insurance landscape is complex, driven by the state’s unique challenges, from natural disasters to a diverse population. The California Fair Insurance system, with its focus on accessibility and consumer protection, is a testament to the state’s commitment to ensuring all residents have the protection they need.

From the California FAIR Plan's role in providing basic coverage to the initiatives of the Insurance Commissioner's office, the state actively works to balance the needs of consumers and the realities of the insurance market. Renters and homeowners alike must understand these intricacies to make informed decisions about their insurance coverage.

Whether it's navigating the complexities of auto insurance, understanding the importance of renters' insurance, or ensuring adequate coverage for natural disasters, California residents have a wealth of resources and support systems in place. By staying informed and proactive, Californians can embrace the challenges and benefits of the state's fair insurance landscape.

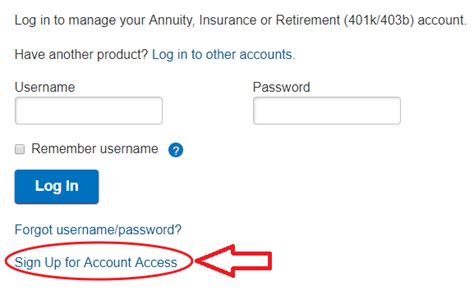

What is the California FAIR Plan, and who is it for?

+

The California FAIR Plan is a state-mandated program that provides basic property insurance to those who are unable to obtain coverage through the voluntary market. It is intended for individuals who have been declined insurance by at least two insurance companies and need a safety net for their property coverage.

How does the Insurance Commissioner’s office protect consumer rights in California?

+

The Insurance Commissioner’s office protects consumer rights through various initiatives, including market conduct examinations, consumer education, and rate regulation. They also investigate complaints filed by consumers, ensuring fair practices within the insurance industry.

What are the key considerations for renters when choosing insurance coverage in California?

+

Renters in California should consider coverage limits, liability protection, additional living expenses, and potential discounts when choosing insurance. Renters’ insurance provides crucial protection for personal belongings and liabilities, especially in a state prone to natural disasters.

How do auto insurance rates vary based on different factors in California?

+

Auto insurance rates in California can vary based on vehicle type, driving record, location, age and gender, and usage. For instance, sports cars and luxury vehicles may have higher premiums due to their increased repair costs, while high-mileage vehicles or those used for business purposes may also see higher rates.