Average Car Insurance

Navigating the world of car insurance can be a complex journey, with various factors influencing the cost of coverage. The average car insurance premium is a key indicator for many drivers, offering a glimpse into the financial commitments they might expect. This article aims to provide an in-depth analysis of average car insurance rates, exploring the factors that influence them, regional variations, and strategies to find the best value for your specific needs.

Understanding the Average Car Insurance Premium

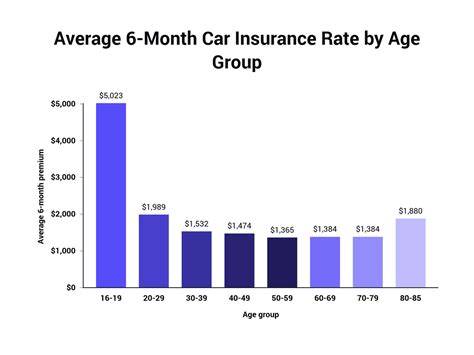

The average car insurance premium serves as a benchmark for drivers, offering a general idea of the cost they can anticipate for their vehicle’s coverage. However, it’s important to note that this average is a broad estimate and can vary significantly based on numerous individual and regional factors. These factors can include the driver’s age, driving record, the type of vehicle, and the coverage limits chosen.

For instance, consider the case of a 25-year-old driver with a clean driving record and a standard sedan in a metropolitan area. This driver might expect an average premium of approximately $1,200 annually, based on national averages. However, if this driver has a history of accidents or resides in a high-risk area, their premium could easily exceed $2,000 or more.

Factors Influencing Car Insurance Premiums

Car insurance premiums are influenced by a multitude of factors, each playing a role in determining the cost of coverage. These factors can be broadly categorized into individual factors and regional factors.

- Individual Factors: These are attributes specific to the driver and their vehicle. This includes the driver's age, gender, driving record, credit score, and the type and value of the vehicle being insured. For example, younger drivers are often considered higher risk and can expect higher premiums, while a clean driving record and a good credit score can lead to lower rates.

- Regional Factors: These are attributes related to the geographical location of the driver. This includes the state or city they reside in, the crime rate in the area, the frequency of natural disasters, and even the average cost of repairs in that region. For instance, states with higher populations or a history of frequent accidents or thefts often have higher average premiums.

Additionally, the type of coverage and the chosen deductible can significantly impact the premium. Comprehensive and collision coverage, while offering more protection, generally result in higher premiums. Conversely, a higher deductible can lower the premium but increases the out-of-pocket expenses in the event of a claim.

| Coverage Type | Average Premium Impact |

|---|---|

| Liability Only | Lowest |

| Liability + Collision | Moderate Increase |

| Full Coverage (Liability + Collision + Comprehensive) | Highest Increase |

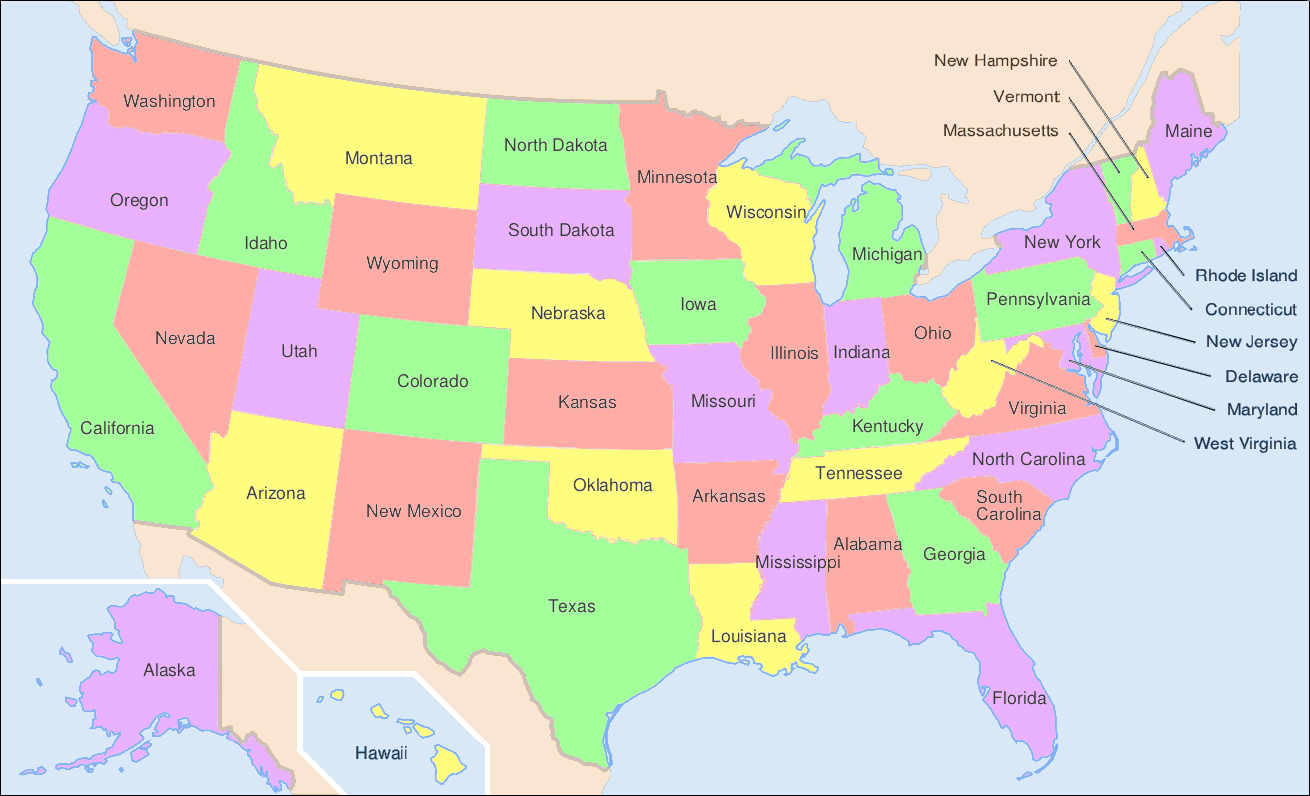

Regional Variations in Car Insurance Premiums

Car insurance premiums can vary significantly across different regions, influenced by a combination of regional factors and insurance provider practices. This regional disparity is often a reflection of the unique risks and costs associated with each area.

State-by-State Differences

Each state in the US has its own set of laws and regulations governing car insurance, which can lead to significant variations in premiums. For example, states with no-fault insurance laws, like Michigan and Florida, often have higher average premiums due to the unique coverage requirements. On the other hand, states with traditional tort systems, like Texas and California, generally have lower average premiums.

| State | Average Annual Premium |

|---|---|

| Michigan | $2,500 |

| Florida | $2,000 |

| Texas | $1,500 |

| California | $1,300 |

Urban vs. Rural Areas

The distinction between urban and rural areas also plays a significant role in car insurance premiums. Urban areas, with their higher populations and increased traffic, often have higher rates of accidents and thefts, leading to higher average premiums. In contrast, rural areas, with their lower population density and reduced traffic, generally have lower premiums.

For instance, a driver in a major city like New York or Los Angeles might pay an average premium of $1,800 annually, while a driver in a rural area might pay as little as $1,000 for the same coverage.

Strategies for Finding the Best Car Insurance Deal

Finding the best car insurance deal involves more than just comparing premiums. It requires a comprehensive evaluation of your specific needs, the coverage options available, and the reputation and financial stability of the insurance provider.

Assessing Your Coverage Needs

Start by evaluating your coverage needs. Consider the value of your vehicle, your personal assets, and your ability to cover potential out-of-pocket expenses. For most drivers, a comprehensive policy that includes liability, collision, and comprehensive coverage is the best option. However, if you have an older vehicle with a low market value, you might consider a liability-only policy to save on premiums.

Comparing Quotes from Multiple Providers

Obtain quotes from multiple insurance providers to compare rates and coverage options. Online quote tools can be a convenient way to get a quick overview of different providers’ offerings. However, it’s essential to follow up with direct conversations with insurance agents to get a clearer picture of the coverage and any potential discounts you might qualify for.

Exploring Discount Opportunities

Insurance providers offer a variety of discounts that can significantly reduce your premium. These discounts can include safe driver discounts, multi-policy discounts (bundling car insurance with home or renters insurance), good student discounts, and loyalty discounts for long-term customers. Additionally, some providers offer discounts for vehicles equipped with safety features or for drivers who maintain a good credit score.

For instance, a safe driver with a good credit score might qualify for discounts totaling 20% or more off their premium, depending on the insurance provider.

Understanding Provider Reputation and Financial Stability

While price is a significant factor, it’s not the only consideration when choosing a car insurance provider. The reputation and financial stability of the provider are equally important. Look for providers with a solid track record of customer satisfaction and financial stability, as this can ensure smooth claims processes and long-term peace of mind.

Conclusion: Making Informed Decisions

Understanding the average car insurance premium is a crucial step towards making informed decisions about your coverage. While it provides a useful benchmark, it’s essential to remember that your individual circumstances will play a significant role in determining your actual premium. By assessing your needs, comparing quotes, exploring discounts, and considering the reputation and financial stability of providers, you can find the best car insurance deal that suits your unique situation.

Stay informed, and happy driving!

What is the average cost of car insurance per month?

+The average cost of car insurance per month can vary significantly based on numerous factors. However, based on national averages, you can expect to pay anywhere from 80 to 200 per month for basic liability coverage, and up to $300 or more for full coverage.

How do I lower my car insurance premiums?

+There are several strategies to lower your car insurance premiums. These include maintaining a clean driving record, improving your credit score, increasing your deductible, exploring discounts, and shopping around for the best rates.

Are there any states with particularly low or high average car insurance premiums?

+Yes, certain states have significantly lower or higher average car insurance premiums due to unique regional factors and insurance laws. For instance, states like Maine and Ohio often have lower average premiums, while states like Michigan and Florida tend to have higher average premiums.