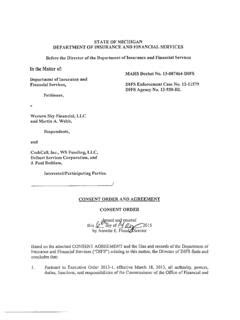

How Much Does Full Coverage Car Insurance Cost

Understanding the cost of full coverage car insurance is essential for any vehicle owner. This comprehensive insurance policy provides extensive protection, covering a range of potential risks and damages. The cost of full coverage insurance varies significantly based on several key factors, and it's important to delve into these details to make informed decisions about your automotive insurance needs.

The Basics of Full Coverage Car Insurance

Full coverage car insurance, also known as comprehensive insurance, is a policy that goes beyond the basic liability coverage. It includes both collision coverage and comprehensive coverage, offering protection against a wide array of incidents and potential damages. Collision coverage typically covers damage to your vehicle resulting from an accident, regardless of fault. On the other hand, comprehensive coverage protects against damages caused by non-collision events, such as theft, vandalism, weather-related incidents, and collisions with animals.

This comprehensive policy ensures that vehicle owners have peace of mind, knowing they are protected against a broad range of unforeseen events. However, the cost of this coverage can be a significant consideration when choosing an insurance plan.

Factors Influencing Full Coverage Insurance Costs

The cost of full coverage car insurance is influenced by a multitude of factors, each playing a crucial role in determining the final premium. These factors include the vehicle’s make and model, the driver’s age and driving history, the location of the vehicle, and the specific coverage limits and deductibles chosen. Understanding how these factors impact insurance costs is essential for making informed decisions.

Vehicle Characteristics

The make and model of your vehicle significantly affect the cost of full coverage insurance. Insurers consider factors such as the vehicle’s safety ratings, its repair and maintenance costs, and its overall popularity and demand in the market. Vehicles that are expensive to repair or those with a higher risk of theft or damage may incur higher insurance premiums.

For instance, luxury vehicles and sports cars often have higher insurance costs due to their expensive parts and higher risk of theft. In contrast, vehicles with excellent safety ratings and lower repair costs may be more affordable to insure.

Driver Profile

The driver’s profile is another critical factor in determining insurance costs. Younger drivers, especially those under 25, often face higher premiums due to their lack of driving experience and higher statistical risk of accidents. On the other hand, mature drivers with a clean driving record and a long history of safe driving may benefit from lower insurance rates.

Additionally, drivers with a history of accidents or traffic violations may see higher insurance costs, as they are considered higher risk by insurance providers. Maintaining a clean driving record can significantly impact the affordability of full coverage insurance.

Location and Usage

The location where the vehicle is primarily driven and parked also affects insurance costs. Areas with a higher incidence of accidents, thefts, or natural disasters may have higher insurance premiums. Similarly, the purpose of the vehicle’s usage, such as personal or commercial use, can influence insurance rates.

For instance, vehicles used for business purposes or those driven in high-risk areas may face higher insurance costs. Understanding the specific risks associated with your location and usage can help you anticipate potential insurance costs.

Coverage Limits and Deductibles

The chosen coverage limits and deductibles also play a significant role in determining the cost of full coverage insurance. Higher coverage limits typically result in higher premiums, as they provide more extensive protection. Conversely, selecting a higher deductible can lower your premium, as it reduces the insurer’s potential payout in the event of a claim.

It's essential to strike a balance between coverage limits and deductibles to ensure adequate protection without incurring excessive costs. Consulting with an insurance professional can help you make informed choices based on your specific needs and budget.

Average Costs and Variations

The average cost of full coverage car insurance varies significantly across different states and regions. According to recent data, the national average for full coverage insurance ranges from approximately 1,000 to 2,000 per year. However, this average can vary widely based on the factors mentioned earlier.

For example, in states with a high incidence of accidents or theft, such as California or Texas, full coverage insurance may cost significantly more than the national average. Conversely, states with lower risk profiles may offer more affordable insurance rates.

It's important to note that these averages are just estimates, and the actual cost of full coverage insurance can vary greatly from one individual to another. Factors such as the specific make and model of your vehicle, your driving history, and the coverage limits you choose can lead to substantial variations in insurance costs.

Tips for Lowering Full Coverage Insurance Costs

While full coverage car insurance provides extensive protection, it’s understandable that many vehicle owners seek ways to reduce their insurance costs. Here are some strategies to consider:

- Compare Quotes: Obtain quotes from multiple insurance providers to compare costs and coverage options. This allows you to find the best value for your insurance needs.

- Maintain a Clean Driving Record: A clean driving record can significantly impact your insurance costs. Avoid accidents and traffic violations to keep your insurance premiums as low as possible.

- Choose a Higher Deductible: Selecting a higher deductible can reduce your insurance premium. However, ensure that the chosen deductible is an amount you can comfortably afford in the event of a claim.

- Bundle Policies: Consider bundling your auto insurance with other policies, such as homeowners or renters insurance. Many insurance providers offer discounts for bundling multiple policies, potentially saving you money.

- Review Coverage Limits: Regularly review your coverage limits to ensure they align with your current needs and budget. Adjusting coverage limits can impact your premium, allowing you to customize your insurance to your specific requirements.

It's important to note that while these strategies can help reduce insurance costs, they should be balanced with the need for adequate coverage. Consulting with an insurance professional can provide valuable insights to help you make informed decisions about your full coverage car insurance.

The Future of Full Coverage Insurance

The automotive insurance industry is continually evolving, and full coverage insurance is no exception. As technology advances, insurers are exploring new ways to assess risk and offer more personalized insurance policies. Telematics, for instance, allows insurers to track driving behavior and offer tailored insurance rates based on real-time data.

Additionally, the rise of electric vehicles and autonomous driving technologies is expected to impact insurance costs in the future. As these technologies become more prevalent, insurers may need to adjust their risk assessments and pricing structures accordingly.

Staying informed about these industry developments can help vehicle owners anticipate potential changes in insurance costs and make proactive decisions about their coverage.

Conclusion

Understanding the cost of full coverage car insurance is crucial for vehicle owners seeking comprehensive protection. By considering factors such as vehicle characteristics, driver profile, location, and coverage limits, individuals can make informed decisions about their insurance needs. While full coverage insurance offers extensive protection, there are strategies to mitigate costs, ensuring vehicle owners can find the right balance between coverage and affordability.

As the automotive insurance industry continues to evolve, staying abreast of industry trends and advancements can help vehicle owners navigate the changing landscape of insurance costs. With the right knowledge and strategies, individuals can make confident choices about their full coverage car insurance, ensuring they are adequately protected while managing their financial responsibilities.

What is the difference between full coverage and liability-only car insurance?

+Full coverage insurance includes both collision and comprehensive coverage, protecting against a wide range of damages and incidents. Liability-only insurance, on the other hand, provides coverage only for damages you cause to others’ property or injuries you cause to others. It does not cover damage to your own vehicle.

How can I lower my full coverage insurance costs without compromising protection?

+You can explore options such as choosing a higher deductible, maintaining a clean driving record, and bundling policies to potentially lower your insurance costs. However, it’s important to strike a balance and ensure you still have adequate coverage for your needs.

Are there any discounts available for full coverage car insurance?

+Yes, many insurance providers offer discounts for full coverage insurance. These may include discounts for safe driving, multi-policy bundling, loyalty, or even certain vehicle safety features. It’s worth inquiring about potential discounts when obtaining insurance quotes.