Cancel My Progressive Insurance

Understanding Progressive Insurance and Cancellation Process

Progressive Insurance is a well-known provider of auto insurance, offering a range of policies to suit various needs. However, there may be instances where you need to cancel your insurance coverage with the company. This article will guide you through the process of canceling your Progressive Insurance policy, ensuring a smooth and informed experience.

The Progressive Cancellation Policy

Progressive Insurance understands that circumstances can change, and as such, they provide a straightforward cancellation process. While they aim to retain customers, they respect the decision to cancel and strive to make the process as hassle-free as possible. Here’s what you need to know about canceling your Progressive Insurance policy.

Steps to Cancel Progressive Insurance

-

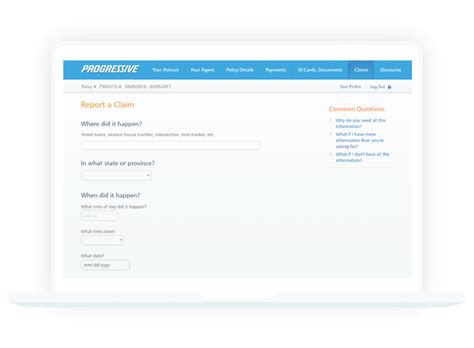

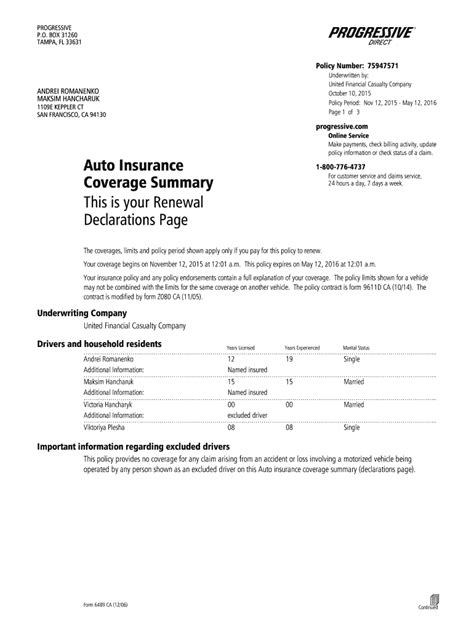

Contact Progressive: The first step is to reach out to Progressive’s customer service team. You can do this by calling their toll-free number, which is typically available 24⁄7. Alternatively, you can initiate a live chat on their website or send an email outlining your request. Ensure you have your policy number and relevant details handy to expedite the process.

-

Provide Reason for Cancellation: Progressive values customer feedback and may ask for the reason behind your decision to cancel. While it’s not mandatory to provide a detailed explanation, being honest and transparent can help improve their services. They may offer alternatives or adjustments to better meet your needs.

-

Request Confirmation: Once you’ve communicated your intention to cancel, request a written confirmation from Progressive. This can be in the form of an email or a physical letter, ensuring you have a record of the cancellation. The confirmation should include the effective date of cancellation and any relevant details.

-

Return Unwanted Items: If you have any physical items, such as a telemetry device or mobile app tracking device, associated with your policy, Progressive may request their return. Follow the instructions provided to return these items safely and securely.

-

Review Final Billing: Progressive will provide you with a final billing statement, detailing any refunds or outstanding amounts. Ensure you review this statement carefully to understand the financial implications of canceling your policy. If there are any discrepancies, contact Progressive promptly to resolve them.

| Step | Action |

|---|---|

| 1 | Contact Progressive |

| 2 | Provide Reason for Cancellation |

| 3 | Request Confirmation |

| 4 | Return Unwanted Items |

| 5 | Review Final Billing |

Reasons for Canceling Progressive Insurance

There are several reasons why you might choose to cancel your Progressive Insurance policy. Understanding these reasons can help you make an informed decision and potentially avoid cancellation if an alternative solution is available.

Changing Circumstances

Life events such as moving to a new location, purchasing a new vehicle, or experiencing a change in financial situation can impact your insurance needs. Progressive offers flexible policies, and discussing these changes with their customer service team might lead to adjustments that better suit your current circumstances.

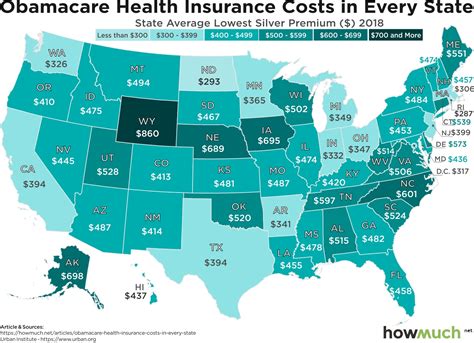

Cost Considerations

Insurance costs can be a significant factor in deciding to cancel. If you find that Progressive’s premiums are no longer within your budget, it’s worth exploring alternative insurance providers or discussing potential discounts with Progressive. They may be able to offer cost-saving options or provide guidance on managing your insurance expenses.

Coverage Needs

As your life evolves, your insurance coverage requirements may change. If you feel that Progressive’s policy no longer aligns with your needs, whether it’s due to additional coverage requirements, changes in driving habits, or other personal circumstances, it’s important to assess whether canceling and seeking alternative coverage is the best course of action.

Potential Implications and Alternatives

Canceling your Progressive Insurance policy can have financial and coverage implications. It’s crucial to carefully consider these aspects before making a decision. Additionally, exploring alternatives can help you make an informed choice.

Financial Implications

When canceling your policy, you may be eligible for a partial refund of any prepaid premiums. Progressive will calculate this refund based on the remaining term of your policy. Keep in mind that any outstanding amounts, such as deductibles or unpaid premiums, will need to be settled.

Coverage Gaps

Canceling your insurance policy can leave you with a coverage gap, which means you won’t be protected in the event of an accident or other insured incidents. It’s essential to have an alternative insurance plan in place before canceling to ensure continuous coverage. Progressive may be able to provide guidance on bridging this gap.

Exploring Alternatives

Before canceling your Progressive Insurance policy, consider exploring alternative options. This could involve comparing quotes from other insurance providers to find a policy that better suits your needs and budget. Progressive’s customer service team might also be able to offer suggestions or adjustments to address your concerns.

Conclusion: A Thoughtful Decision

Canceling your Progressive Insurance policy is a significant decision that should be made thoughtfully. By understanding the cancellation process, reasons for cancellation, and potential implications, you can navigate this process with confidence. Remember, Progressive values customer feedback and is dedicated to providing excellent service, so don’t hesitate to reach out and discuss your concerns.

Can I cancel my Progressive Insurance policy online?

+While Progressive offers various online services, canceling your policy typically requires a phone call or email communication with their customer service team. This ensures a more personalized and efficient cancellation process.

What happens if I cancel my policy mid-term?

+If you cancel your policy mid-term, Progressive will calculate a refund based on the remaining term of your policy. Any outstanding amounts, such as deductibles or unpaid premiums, will need to be settled. They will provide you with a final billing statement detailing these amounts.

Can I get a refund if I’ve had an accident while insured with Progressive?

+Yes, you may be eligible for a refund if you cancel your policy, even if you’ve had an accident while insured. However, the refund amount may be reduced to cover the cost of any claims made during your policy term. Progressive will provide a clear breakdown of the refund calculation.